Binance Faces Lawsuit by Hamas Victims Under Anti-Terrorism Law

Published on: 2025-11-25

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

With a moderate confidence level, the most supported hypothesis is that Binance Holdings Ltd. inadvertently facilitated transactions linked to terrorist organizations due to insufficient compliance measures. Strategic recommendations include enhancing regulatory compliance and monitoring systems to prevent similar incidents.

2. Competing Hypotheses

Hypothesis 1: Binance knowingly facilitated transactions for Hamas and other terrorist organizations, prioritizing profit over compliance with anti-terrorism laws.

Hypothesis 2: Binance inadvertently facilitated these transactions due to inadequate compliance and monitoring systems, rather than intentional malfeasance.

Assessment: Hypothesis 2 is more likely given the lack of specific evidence directly linking Binance’s leadership to intentional support of terrorist activities. The company’s prior acknowledgment of compliance failures and efforts to restructure suggest negligence rather than intentional facilitation.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that Binance’s compliance measures were insufficient to detect and prevent illicit transactions. It is also assumed that the legal framework and enforcement mechanisms were not robust enough to deter such activities.

Red Flags: The timing of the lawsuit and its public disclosure could indicate potential bias or strategic legal positioning. The lack of detailed evidence linking specific transactions to terrorist activities raises questions about the strength of the allegations.

4. Implications and Strategic Risks

The lawsuit against Binance could lead to increased regulatory scrutiny and stricter compliance requirements for cryptocurrency platforms globally. This may result in heightened operational costs and potential reputational damage for Binance. There is also a risk of geopolitical tensions if the case is perceived as targeting specific nations or groups.

5. Recommendations and Outlook

- Enhance compliance systems and implement advanced monitoring technologies to detect and prevent illicit transactions.

- Engage with regulatory bodies to align on compliance standards and demonstrate commitment to preventing terrorist financing.

- Best-case scenario: Binance successfully strengthens its compliance framework, regains trust, and avoids significant legal penalties.

- Worst-case scenario: Binance faces severe legal and financial repercussions, leading to loss of market position and investor confidence.

- Most-likely scenario: Binance incurs moderate penalties and implements necessary compliance improvements, maintaining its market presence.

6. Key Individuals and Entities

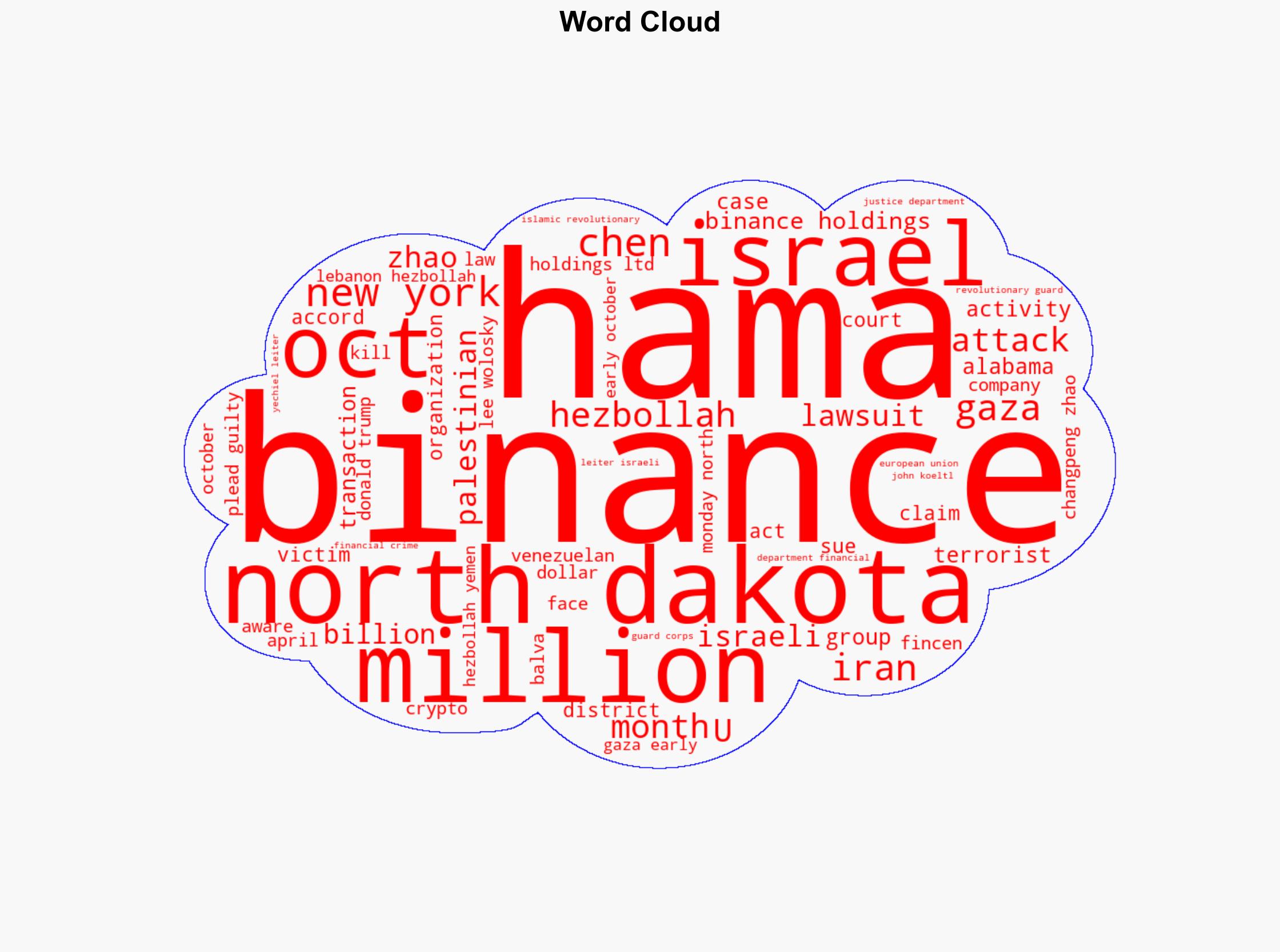

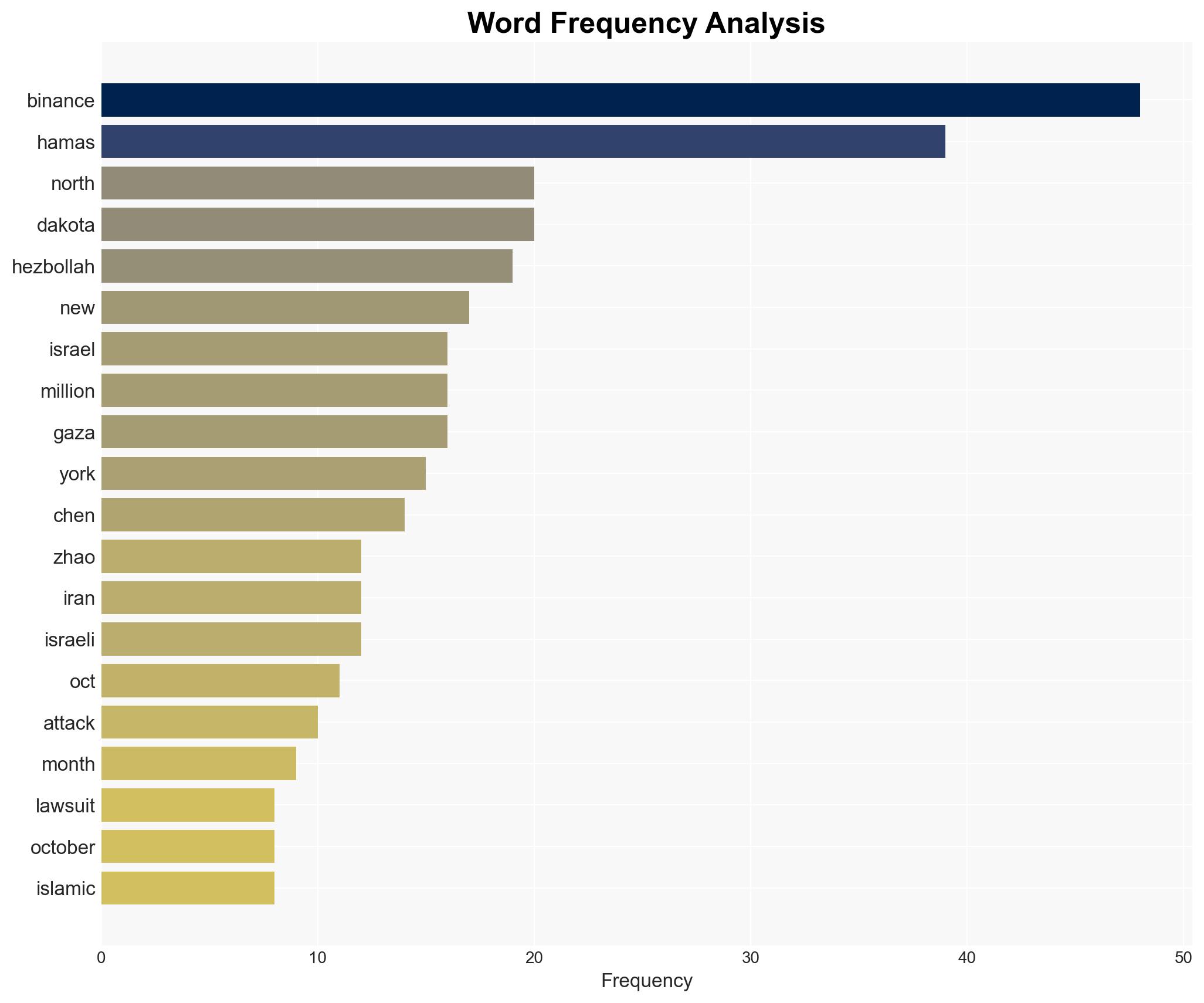

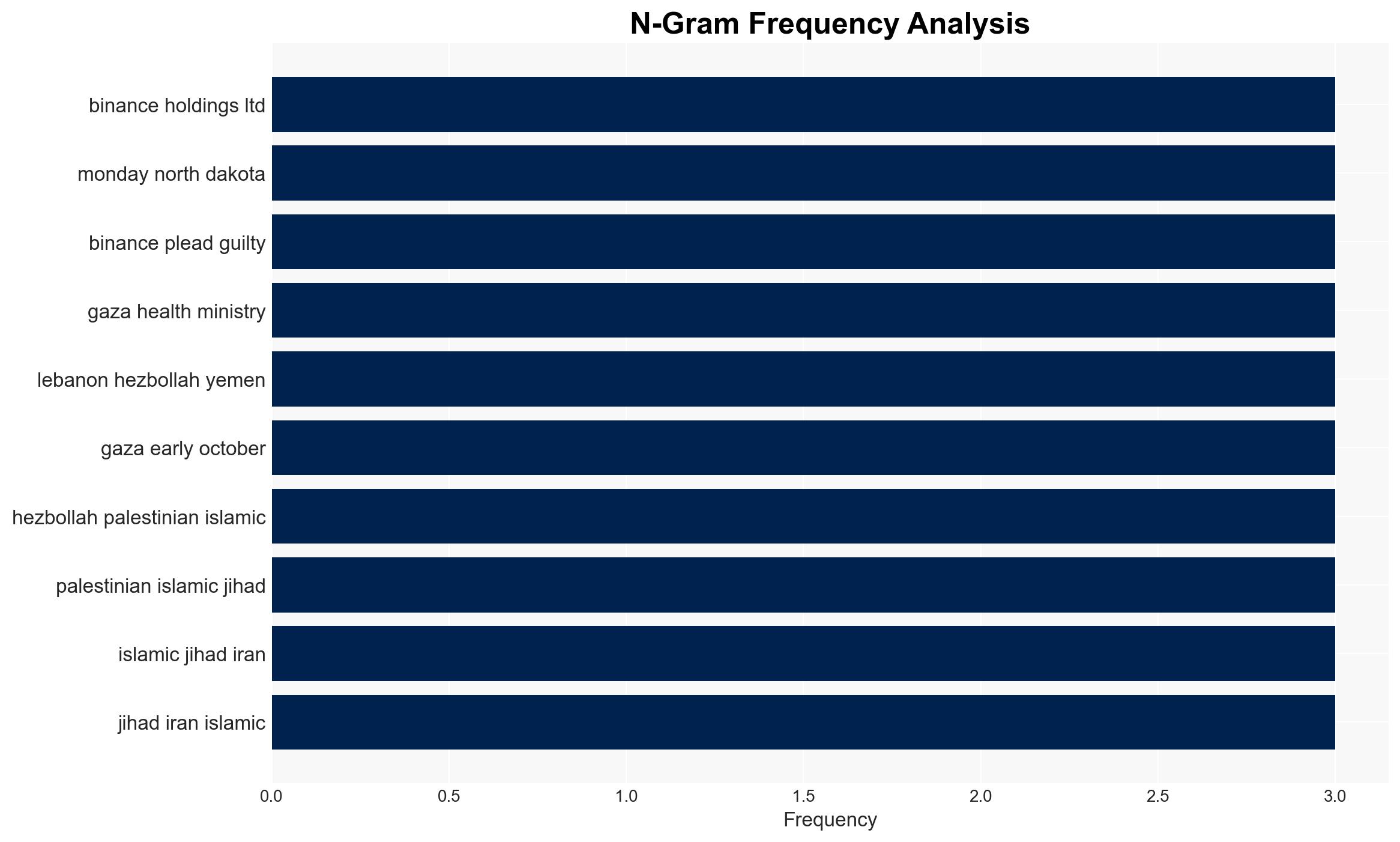

Changpeng Zhao (Binance Co-founder), Guangying Chen (Binance Executive), Lee Wolosky (Attorney for victims), Hamas, Hezbollah, and the U.S. Department of Justice.

7. Thematic Tags

Structured Analytic Techniques Applied

- ACH 2.0: Reconstruct likely threat actor intentions via hypothesis testing and structured refutation.

- Indicators Development: Track radicalization signals and propaganda patterns to anticipate operational planning.

- Narrative Pattern Analysis: Analyze spread/adaptation of ideological narratives for recruitment/incitement signals.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Counter-Terrorism Briefs ·

Daily Summary ·

Support us