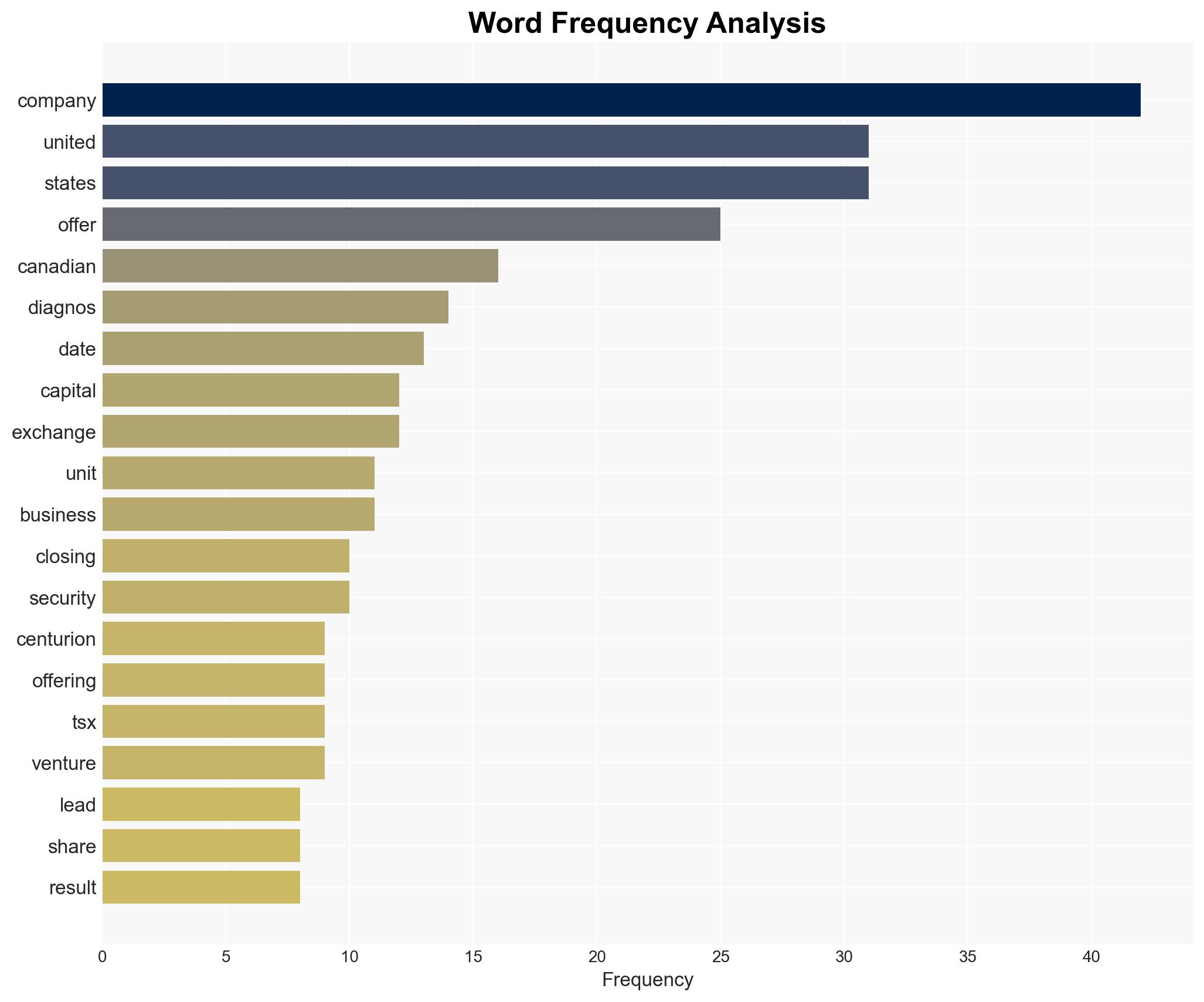

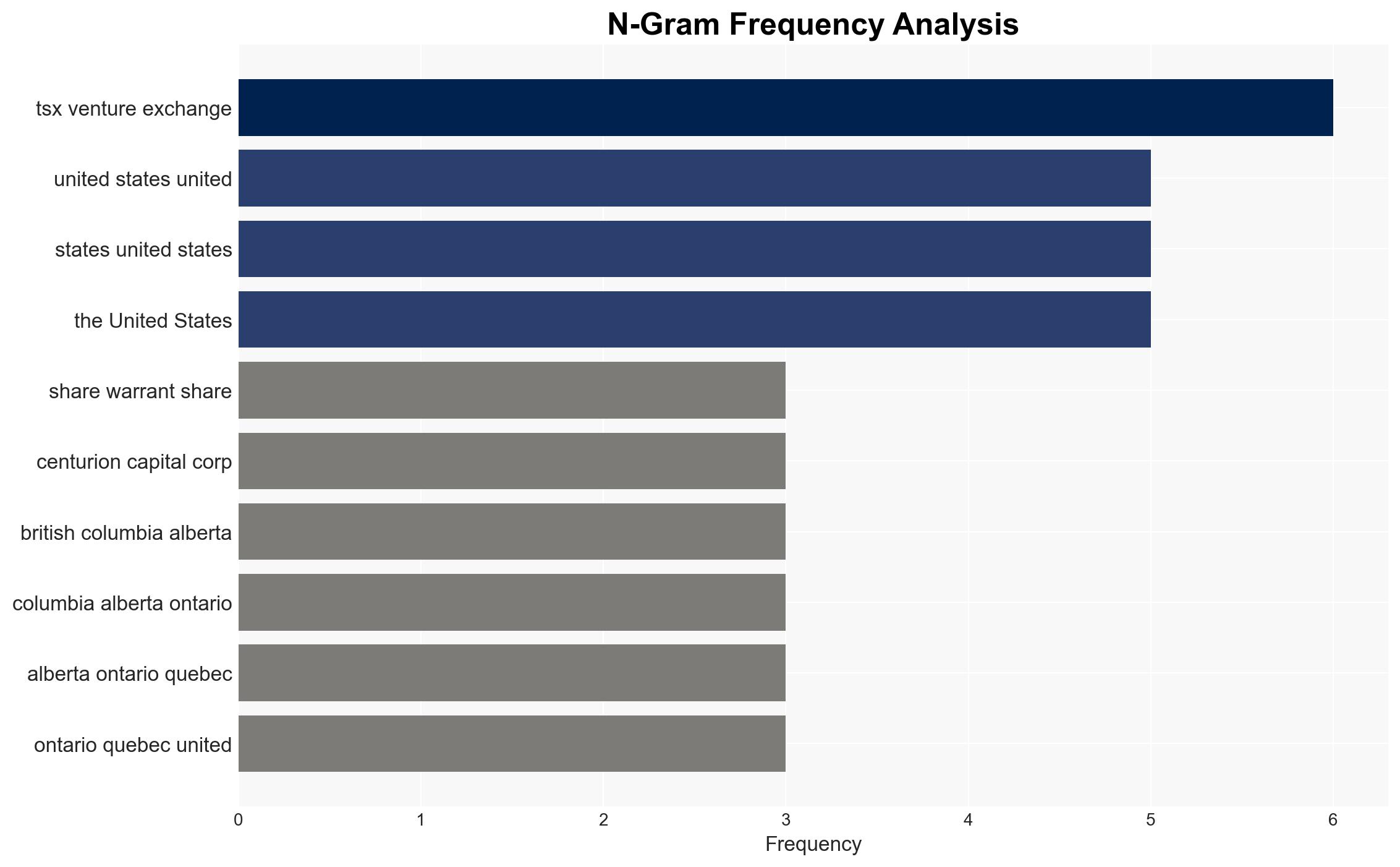

Diagnos Announces Upsize of Previously Announced Brokered Private Placement to 365M Led by Centurion One Capital

Published on: 2025-11-25

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Diagnos’ Upsized Brokered Private Placement

1. BLUF (Bottom Line Up Front)

Diagnos has announced an upsized brokered private placement led by Centurion One Capital, indicating strong investor demand. The most supported hypothesis is that this move is primarily driven by Diagnos’ strategic intent to accelerate growth and expand its market presence. Confidence level: Moderate. Recommended action: Monitor Diagnos’ financial health and strategic partnerships to assess potential impacts on the healthcare AI sector.

2. Competing Hypotheses

Hypothesis 1: Diagnos is leveraging strong investor demand to accelerate its growth and market expansion, particularly in AI-driven healthcare solutions. This is supported by the upsizing of the private placement and the involvement of Centurion One Capital, suggesting confidence in Diagnos’ business model.

Hypothesis 2: Diagnos is facing financial pressures and is using the upsized private placement as a means to stabilize its financial position. This could be inferred from the need to amend terms and increase the offering size, potentially indicating underlying financial challenges.

Hypothesis 1 is more likely due to the proactive nature of the announcement and the strategic involvement of a leading capital firm, which suggests a growth-oriented motive rather than a reactive financial stabilization effort.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that the strong investor demand is genuine and not artificially inflated. It is also assumed that Diagnos’ strategic goals align with the capital raised.

Red Flags: The lack of detailed financial disclosures in the announcement could indicate potential financial instability. The involvement of insiders in the offering might suggest conflicts of interest or insider advantage.

4. Implications and Strategic Risks

The upsized private placement could lead to increased market competition in the AI healthcare sector, potentially driving innovation but also escalating competitive pressures. If financial instability is a factor, Diagnos might face challenges in sustaining operations, which could impact stakeholders and market confidence.

5. Recommendations and Outlook

- Monitor Diagnos’ financial disclosures and market performance for signs of financial instability.

- Engage with industry analysts to assess the impact of Diagnos’ expansion on the AI healthcare market.

- Best-case scenario: Diagnos successfully leverages the capital to expand its market presence and enhance its AI solutions, leading to increased market share.

- Worst-case scenario: Diagnos faces financial difficulties despite the capital infusion, leading to potential downsizing or restructuring.

- Most-likely scenario: Diagnos experiences moderate growth, using the capital to strengthen its market position and product offerings.

6. Key Individuals and Entities

Diagnos: The company involved in the private placement, focused on AI-driven healthcare solutions.

Centurion One Capital: The lead agent and sole bookrunner for the private placement, indicating strategic involvement in Diagnos’ growth.

7. Thematic Tags

Cybersecurity, Investment Strategy, AI Healthcare, Financial Stability, Market Expansion

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us