Binance CEO Faces $1 Billion Lawsuit Over Alleged Financial Ties to October Terror Attack

Published on: 2025-11-26

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

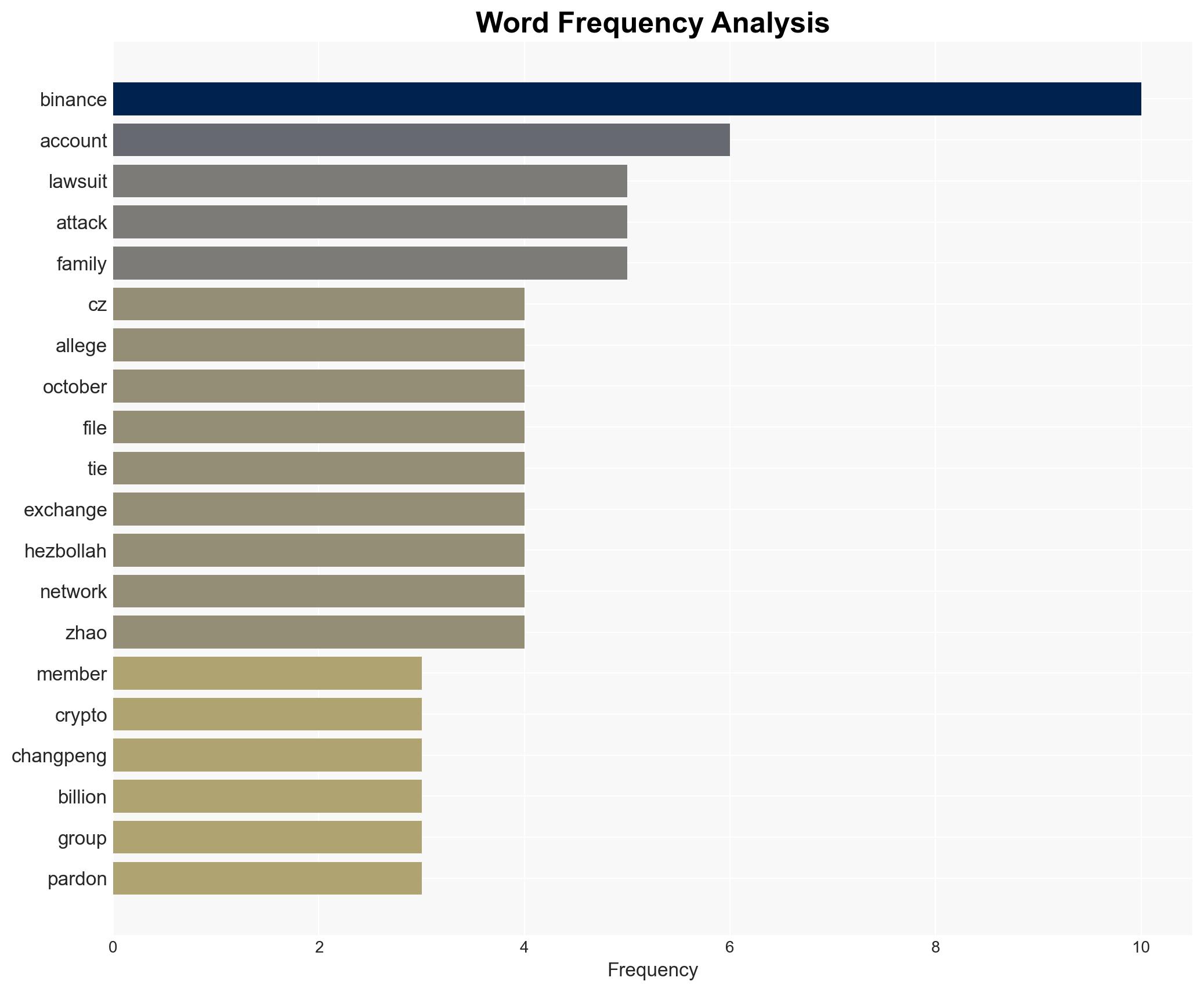

Intelligence Report: Binance CZ Hit with $1B Lawsuit Alleging Financial Links to 7 October Attack

1. BLUF (Bottom Line Up Front)

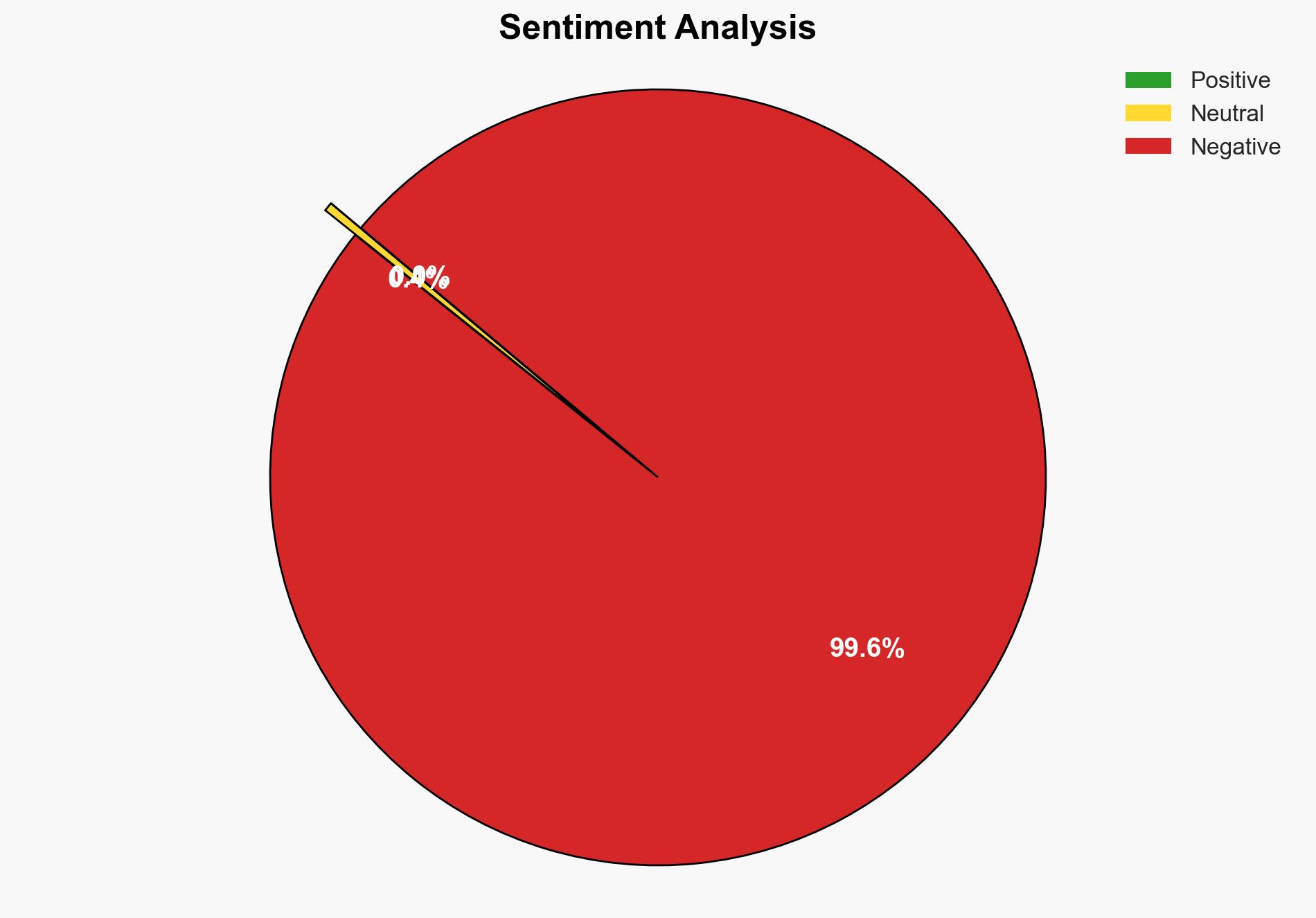

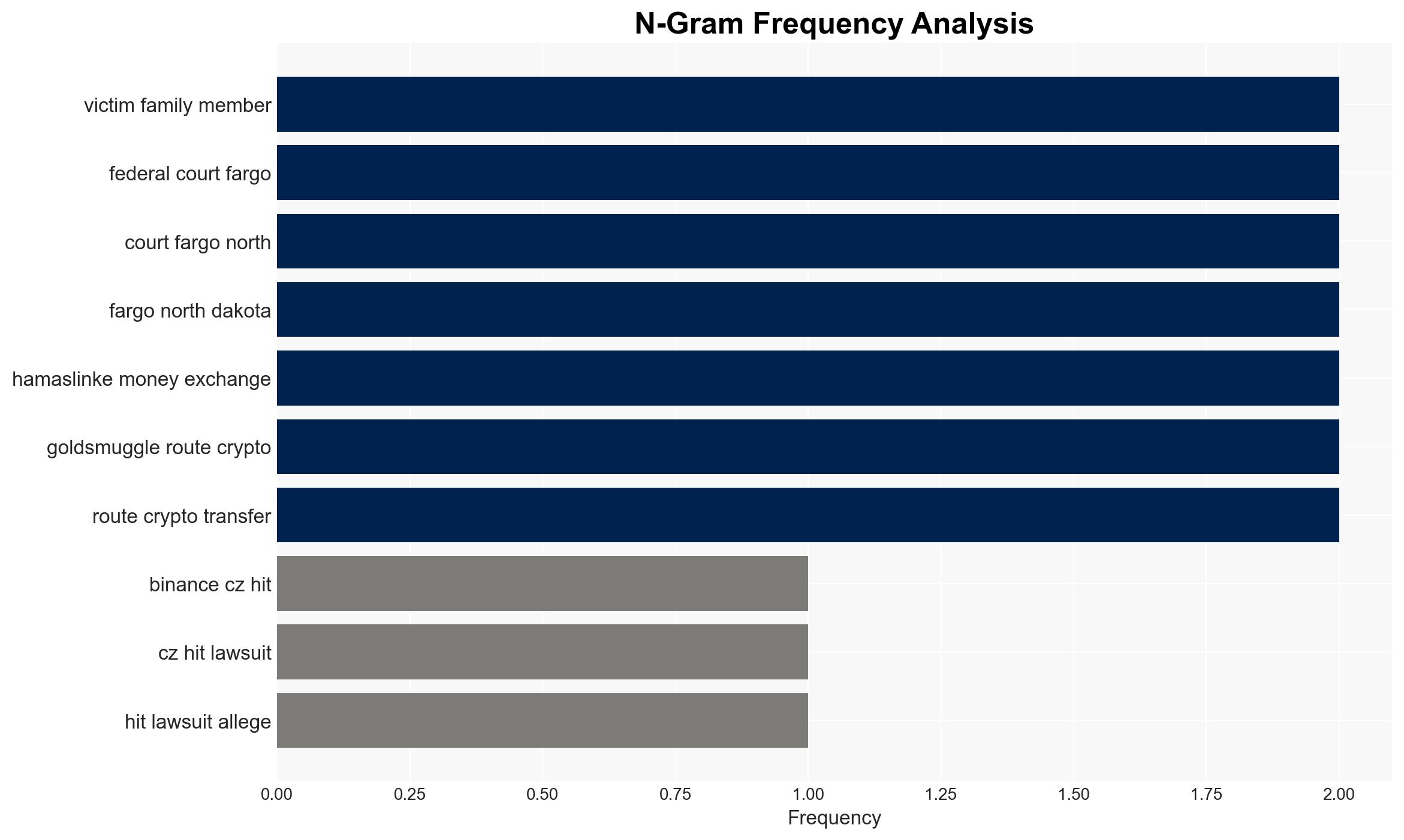

The most supported hypothesis is that Binance, under the leadership of Changpeng Zhao, inadvertently facilitated financial transactions linked to terrorist groups due to inadequate compliance measures. Confidence level: Moderate. Recommended actions include conducting a thorough investigation into Binance’s compliance practices and enhancing international cooperation to monitor cryptocurrency transactions.

2. Competing Hypotheses

Hypothesis 1: Binance, led by Changpeng Zhao, knowingly facilitated financial transactions for terrorist groups, as alleged in the lawsuit. This hypothesis is supported by the detailed accounts of transactions linked to militant networks and the involvement of senior executives.

Hypothesis 2: Binance’s involvement is unintentional, resulting from inadequate compliance and oversight mechanisms, leading to exploitation by terrorist groups. This hypothesis is supported by Binance’s previous admissions of compliance failures and the complexity of monitoring cryptocurrency transactions.

The second hypothesis is more likely due to the historical context of compliance issues in cryptocurrency exchanges and the absence of direct evidence proving intentional facilitation by Binance executives.

3. Key Assumptions and Red Flags

Assumptions: The lawsuit’s claims are based on verifiable evidence; cryptocurrency transactions can be effectively traced to specific entities.

Red Flags: The timing of the lawsuit following a presidential pardon for Zhao raises questions about potential political motivations. The involvement of high-profile legal figures may indicate an attempt to leverage public opinion.

Deception Indicators: The lack of direct evidence linking Binance executives to intentional misconduct suggests potential exaggeration of claims for legal leverage.

4. Implications and Strategic Risks

The lawsuit could lead to increased regulatory scrutiny on cryptocurrency exchanges, potentially affecting global financial markets. There is a risk of political tensions if the lawsuit is perceived as targeting a major Chinese company. Cybersecurity risks may increase as exchanges enhance monitoring, potentially leading to retaliatory cyberattacks by affected groups.

5. Recommendations and Outlook

- Conduct an independent audit of Binance’s compliance practices to identify vulnerabilities and recommend improvements.

- Enhance international cooperation to develop standardized regulations for cryptocurrency transactions.

- Best-case scenario: Binance strengthens its compliance measures, reducing the risk of future exploitation by terrorist groups.

- Worst-case scenario: The lawsuit leads to significant financial penalties and operational disruptions for Binance, affecting the broader cryptocurrency market.

- Most-likely scenario: Binance implements compliance improvements, facing moderate financial and reputational impacts while continuing operations.

6. Key Individuals and Entities

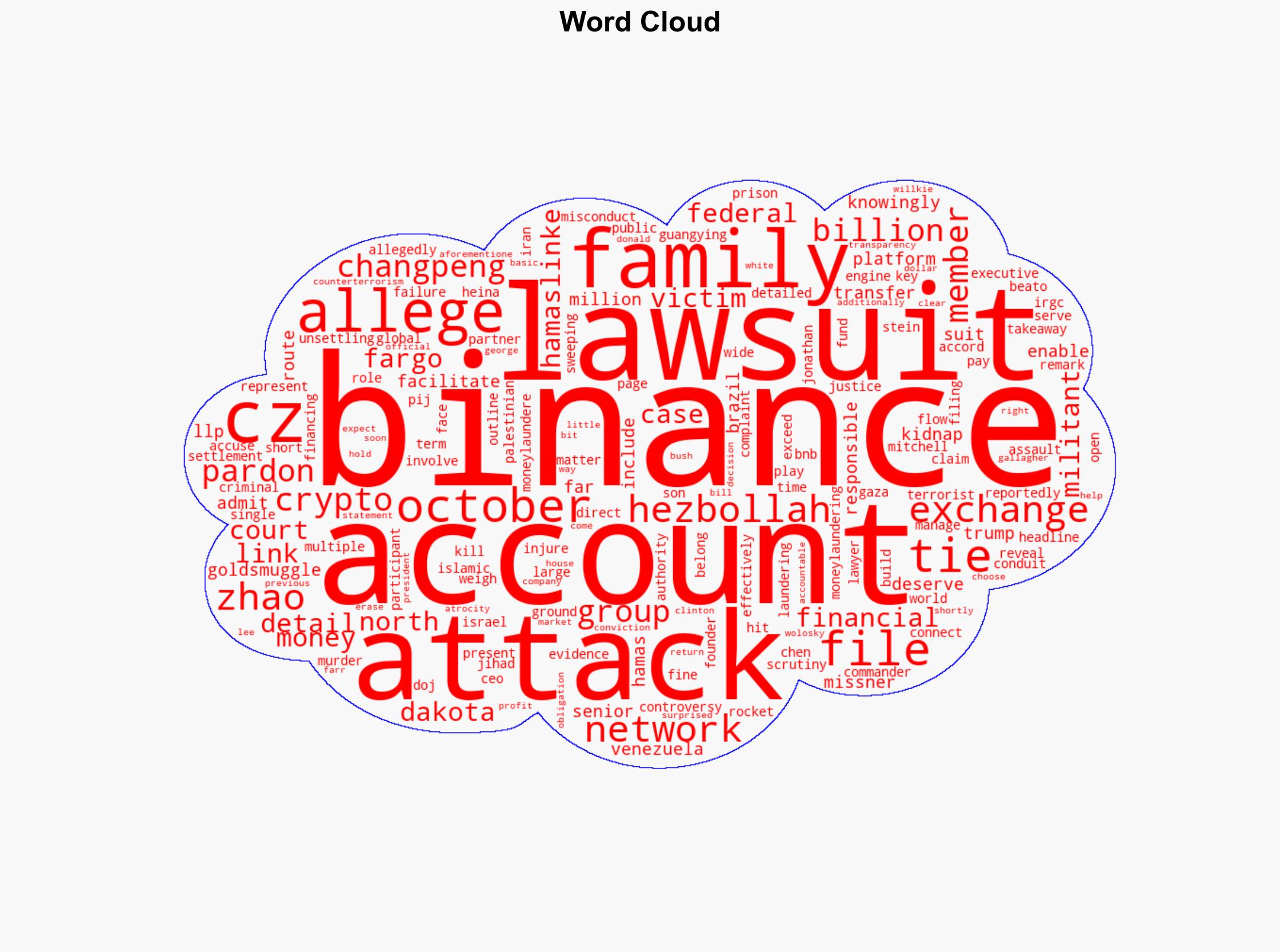

Changpeng Zhao (CZ), Guangying Heina Chen, Jonathan Missner, Lee Wolosky.

7. Thematic Tags

Structured Analytic Techniques Applied

- ACH 2.0: Reconstruct likely threat actor intentions via hypothesis testing and structured refutation.

- Indicators Development: Track radicalization signals and propaganda patterns to anticipate operational planning.

- Narrative Pattern Analysis: Analyze spread/adaptation of ideological narratives for recruitment/incitement signals.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Counter-Terrorism Briefs ·

Daily Summary ·

Support us