Brunswick Corporation Increases Cash Tender Offer for 5100 Senior Notes Due 2052 Following Early Results

Published on: 2025-11-26

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Brunswick Corporation Announces Early Results and Increase of Cash Tender Offer of Outstanding 5100 Senior Notes due 2052

1. BLUF (Bottom Line Up Front)

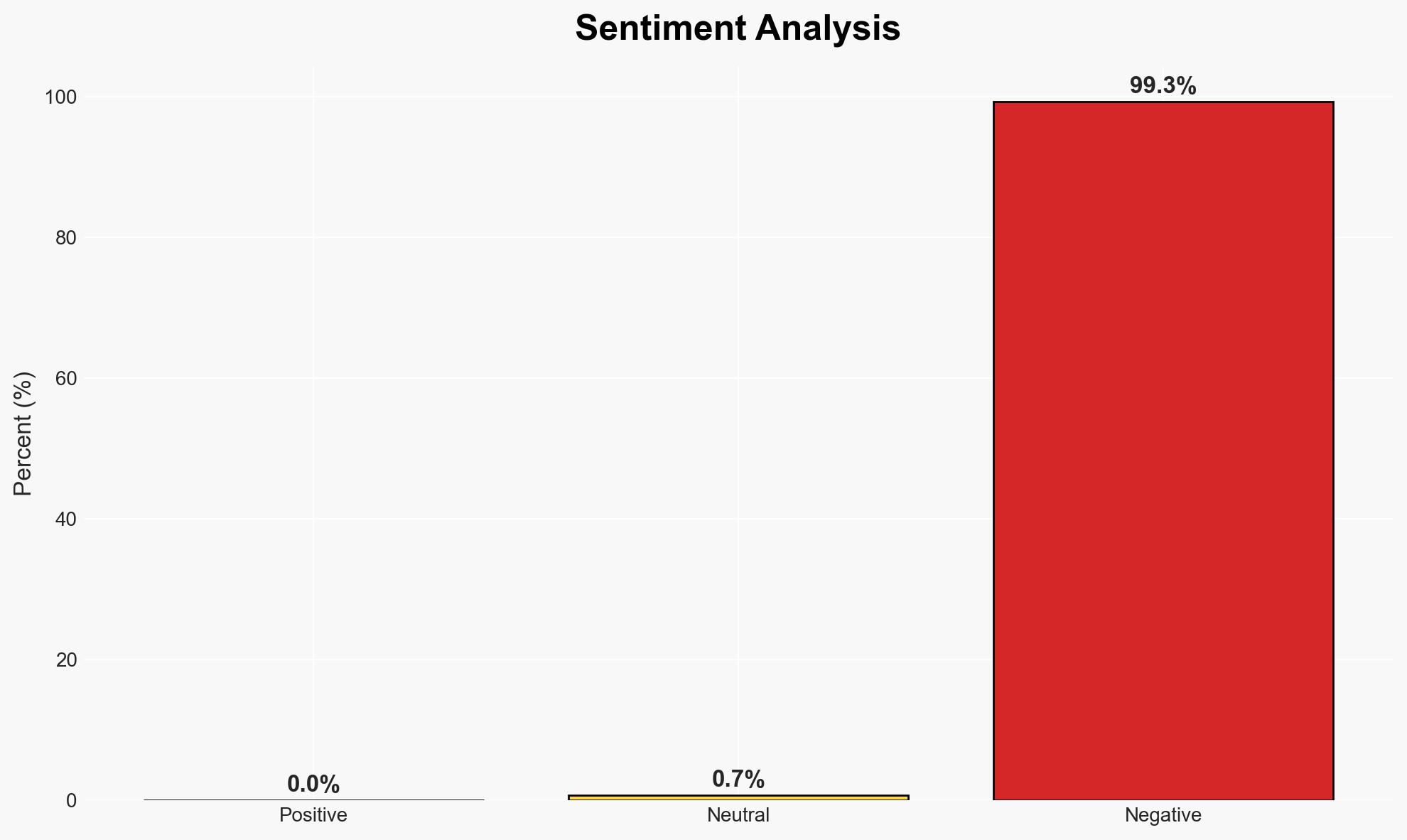

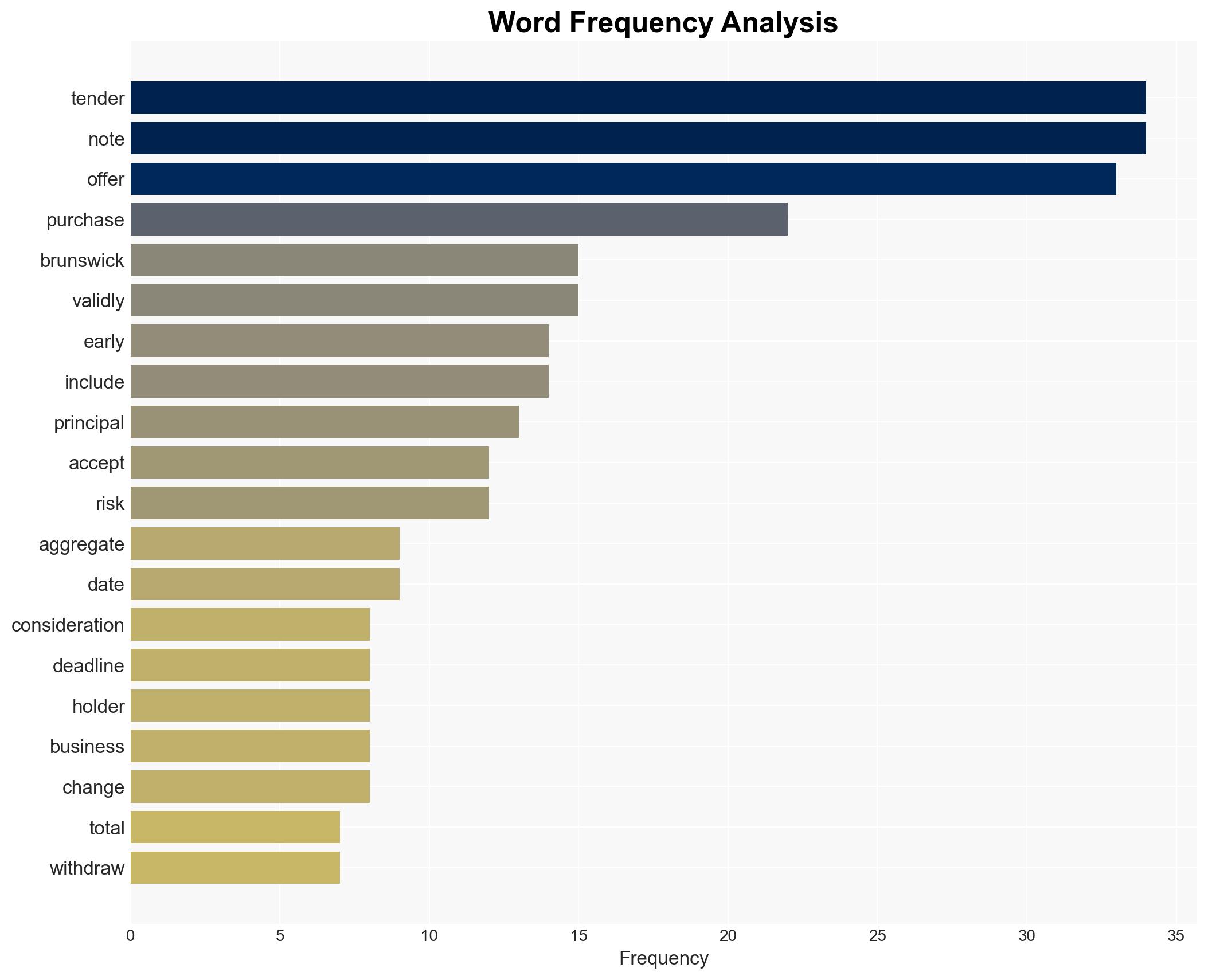

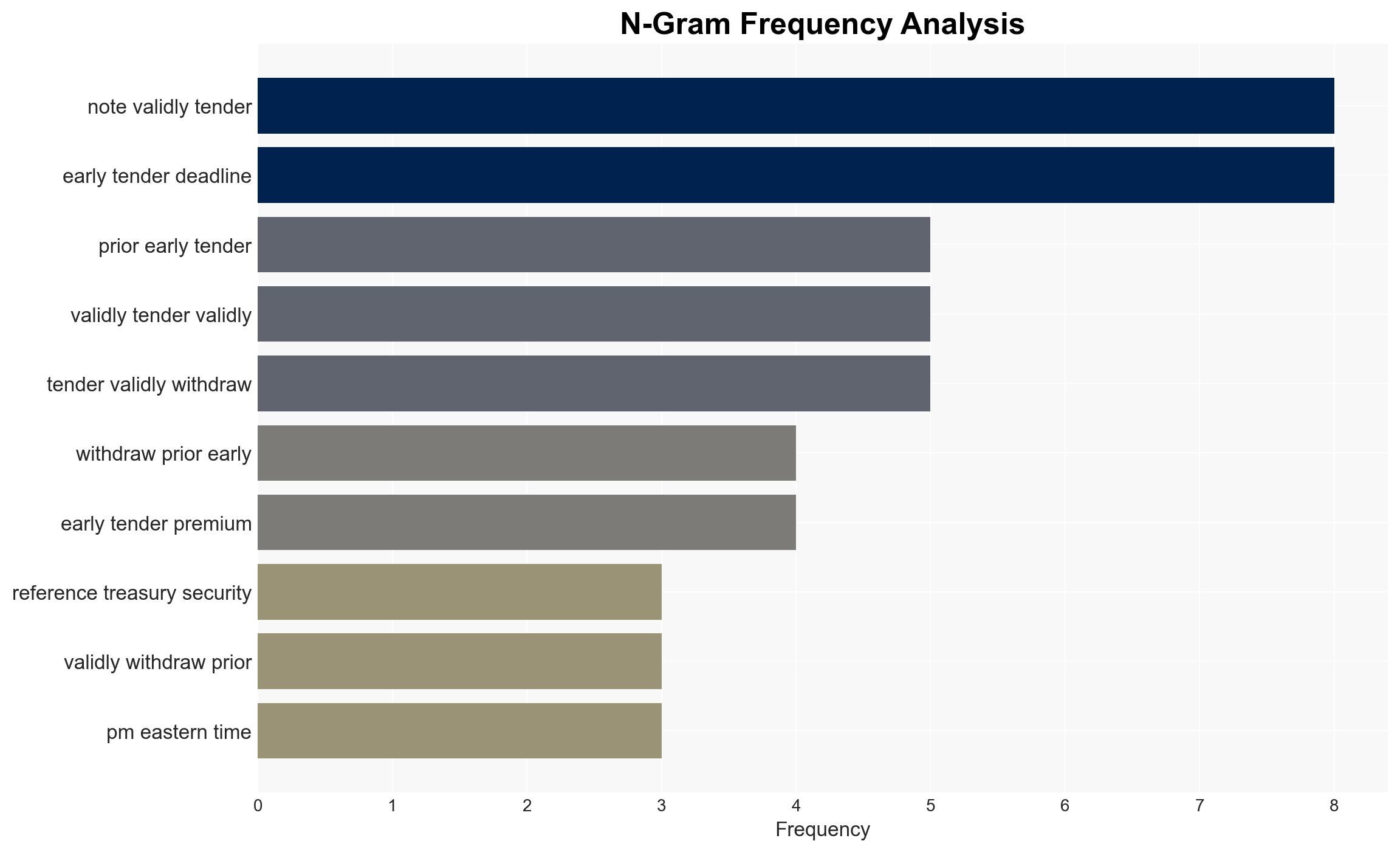

Brunswick Corporation has announced early results and an increase in its cash tender offer for its outstanding 5100 Senior Notes due 2052. This financial maneuver aims to manage debt and optimize capital structure. The most likely hypothesis is that Brunswick is responding to favorable market conditions to improve its financial standing. The primary stakeholders affected include Brunswick’s investors and financial markets. Overall confidence in this assessment is moderate, given the limited context.

2. Competing Hypotheses

- Hypothesis A: Brunswick Corporation is increasing its tender offer due to favorable market conditions, allowing it to manage its debt more effectively. This is supported by the increase in the tender cap and the early tender premium, suggesting a strategic financial move.

- Hypothesis B: The increase in the tender offer may be a reaction to internal financial pressures or external economic uncertainties, compelling Brunswick to secure its financial position. Contradicting evidence includes the lack of explicit mention of financial distress in the snippet.

- Assessment: Hypothesis A is currently better supported due to the structured nature of the tender offer and the absence of indicators of financial distress. Key indicators that could shift this judgment include sudden changes in market conditions or disclosures of financial instability.

3. Key Assumptions and Red Flags

- Assumptions: The market conditions are favorable for Brunswick’s financial strategy; Brunswick’s financial health is stable; the tender offer is part of a long-term financial strategy; investors will respond positively to the offer; regulatory conditions remain unchanged.

- Information Gaps: Detailed financial statements of Brunswick; specific market conditions influencing the decision; investor sentiment and response data; potential regulatory impacts.

- Bias & Deception Risks: Potential bias in interpreting financial maneuvers as solely strategic without considering possible underlying financial distress; limited source information may omit critical context.

4. Implications and Strategic Risks

This development could lead to improved financial stability for Brunswick, influencing investor confidence and market perception. Over time, it may affect Brunswick’s credit rating and borrowing costs.

- Political / Geopolitical: Minimal direct implications unless linked to broader economic policies or international financial markets.

- Security / Counter-Terrorism: No immediate implications identified in the security domain.

- Cyber / Information Space: Potential for increased scrutiny of Brunswick’s digital communications and financial disclosures.

- Economic / Social: Positive economic implications for Brunswick, potentially affecting investor portfolios and market dynamics.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Monitor Brunswick’s financial disclosures and market reactions; assess investor sentiment through financial news and analysis.

- Medium-Term Posture (1–12 months): Develop resilience measures to mitigate potential market volatility; consider partnerships to enhance financial strategy.

- Scenario Outlook:

- Best: Successful tender offer leading to improved financial metrics and investor confidence.

- Worst: Market conditions deteriorate, leading to financial strain and negative investor sentiment.

- Most-Likely: Brunswick stabilizes its financial position, maintaining market confidence.

6. Key Individuals and Entities

- Brunswick Corporation

- Investors in Brunswick’s Senior Notes

- Financial markets and regulatory bodies

- DF King (Tender Agent)

7. Thematic Tags

Cybersecurity, This brief is tagged under: national security threats; cybersecurity; counter-terrorism; regional focus; financial markets; corporate finance; investor relations; economic stability

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us