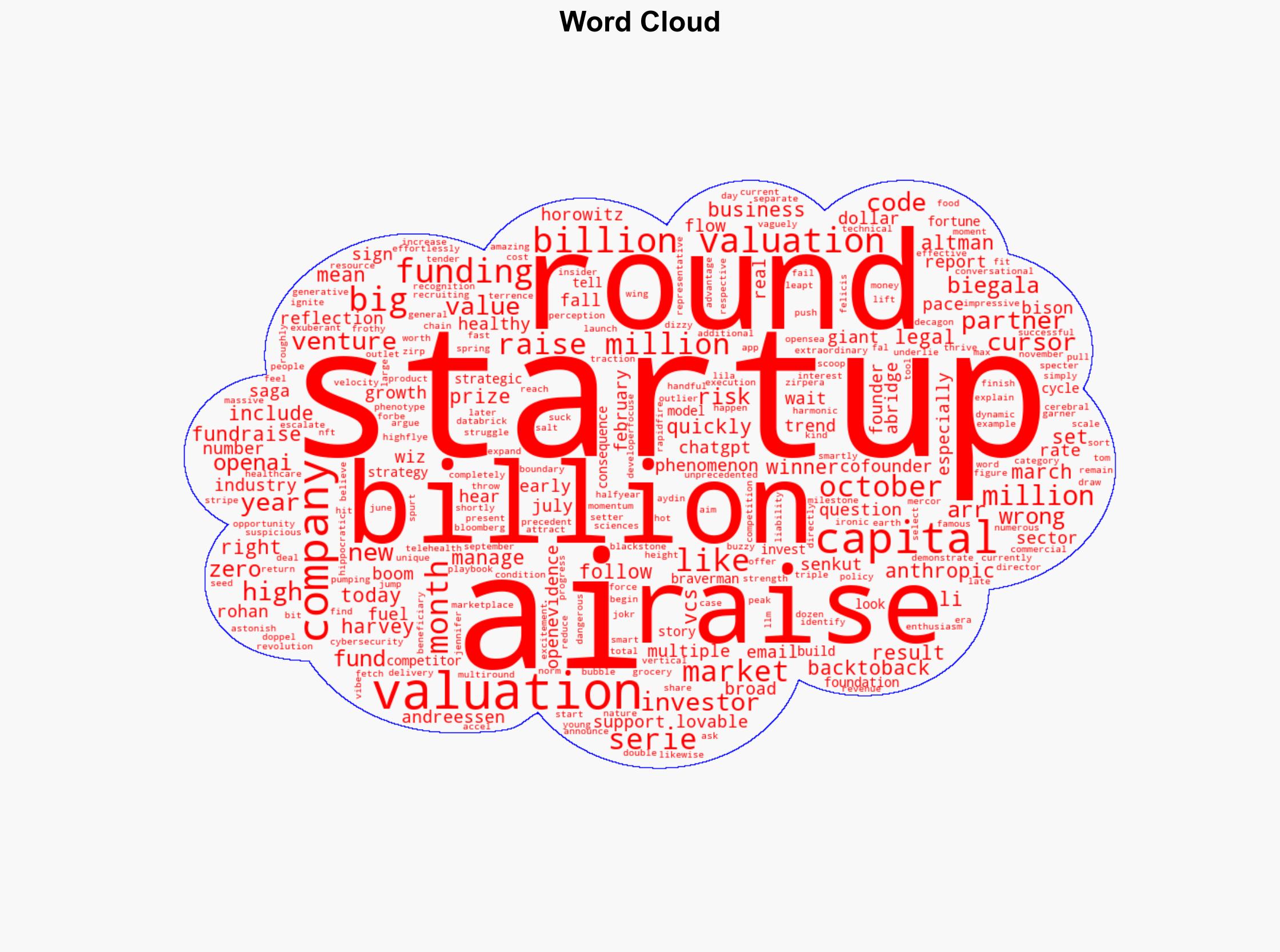

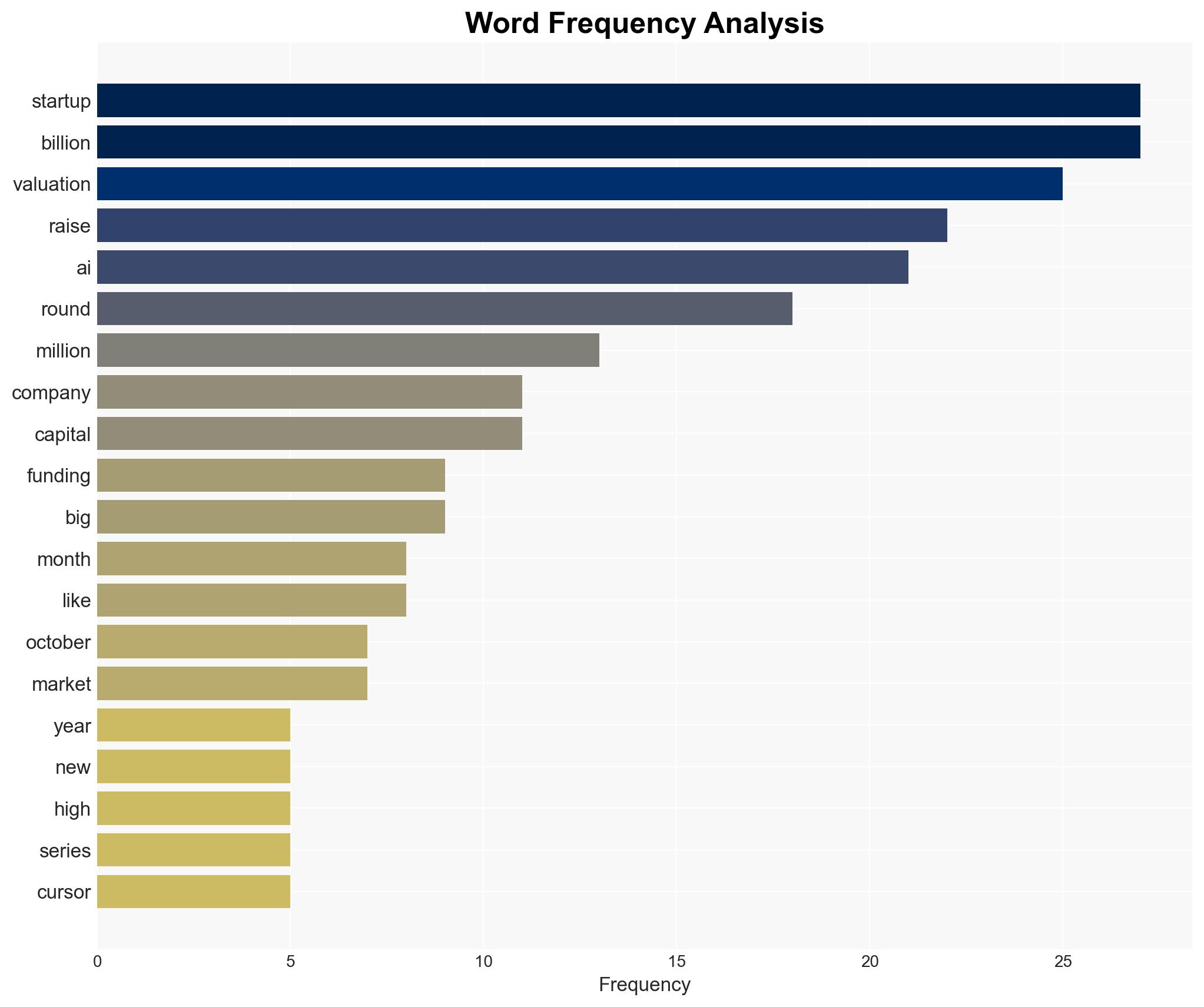

AI startup valuations surge dramatically as rapid funding rounds lead to unprecedented growth.

Published on: 2025-11-29

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: AI startup valuations are doubling and tripling within months as back-to-back funding rounds fuel a stunning growth spurt

1. BLUF (Bottom Line Up Front)

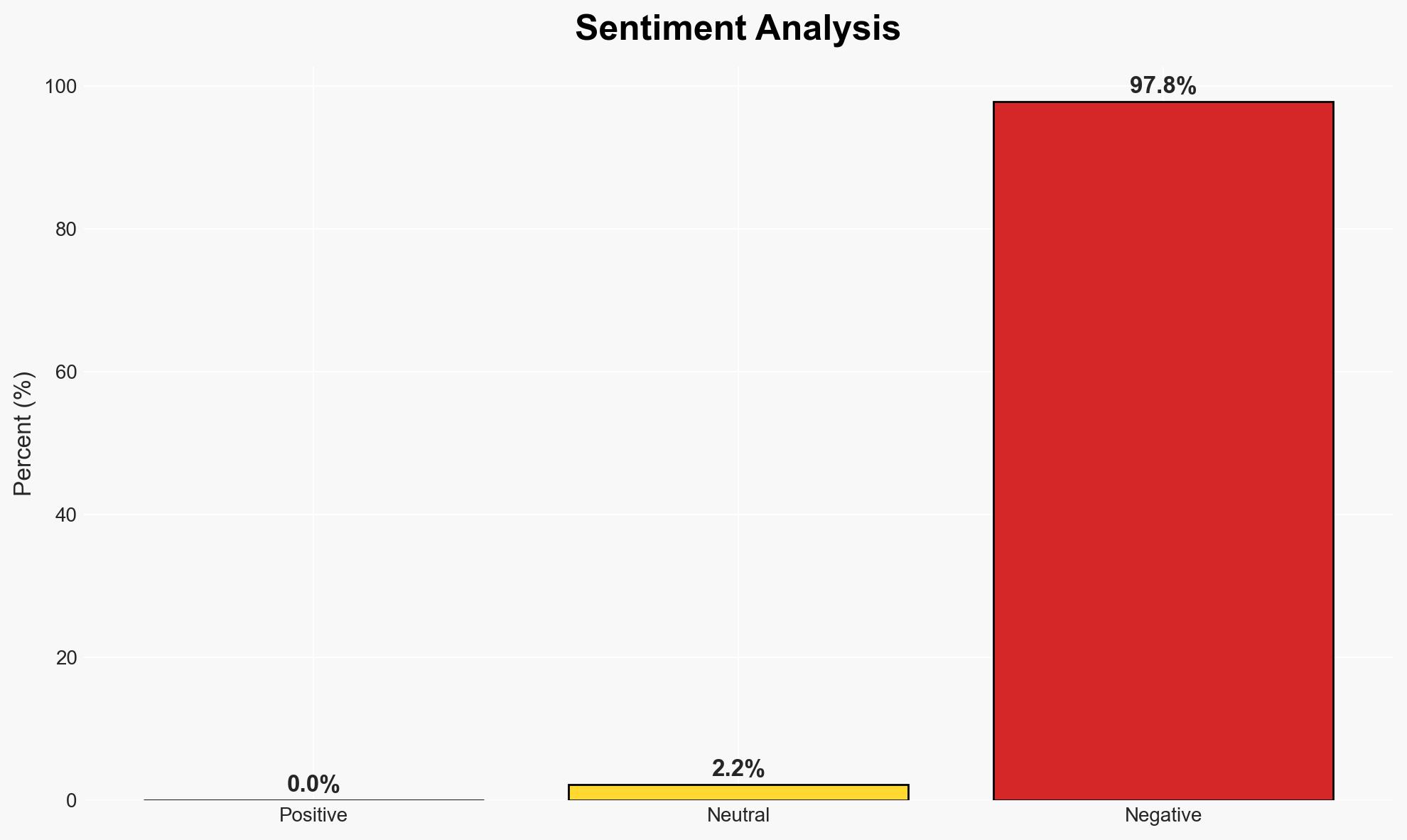

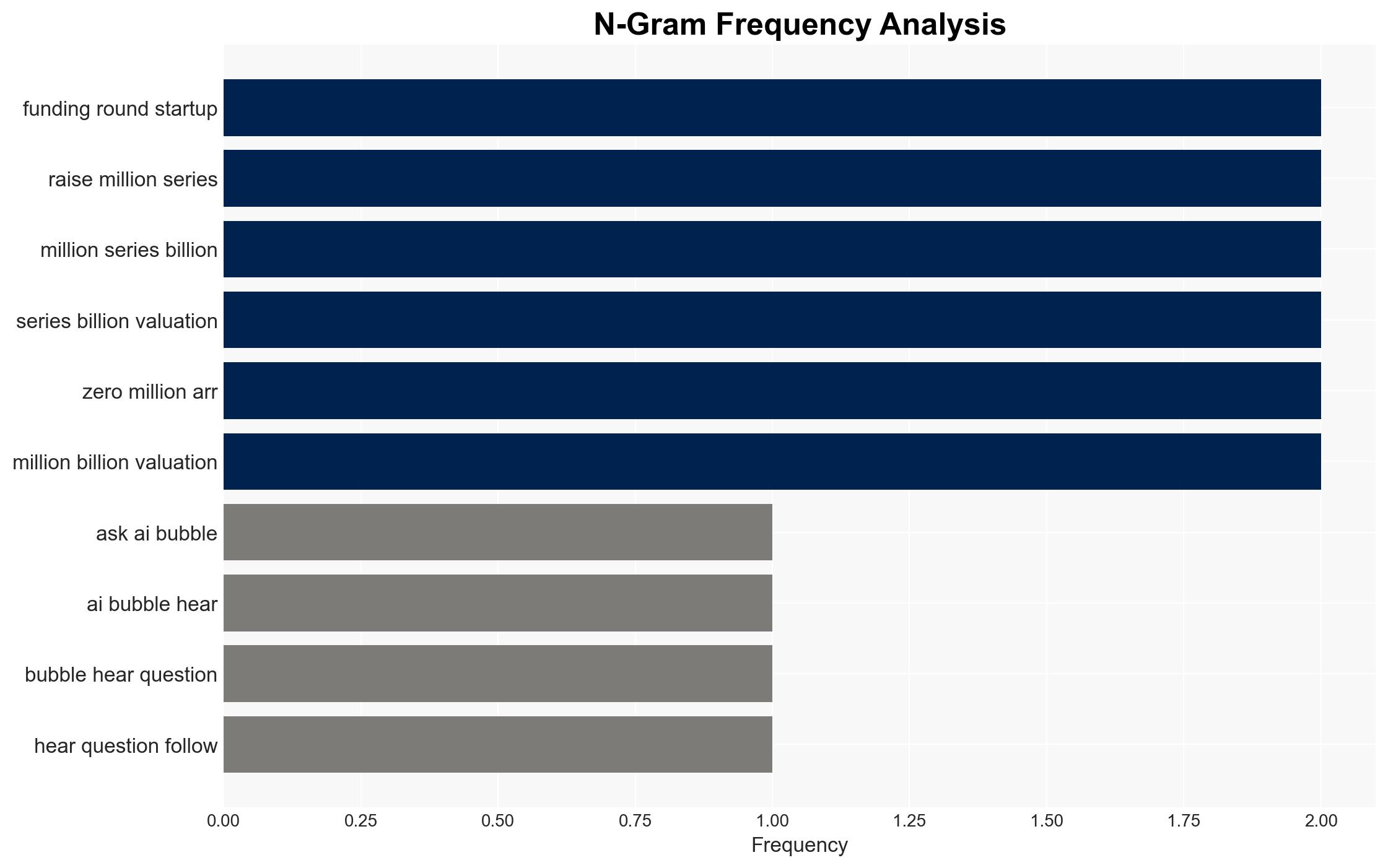

The rapid increase in AI startup valuations, driven by successive funding rounds, suggests a highly speculative market environment. This trend primarily affects investors and the tech sector, with potential broader economic implications. Current analysis supports the hypothesis that this growth is fueled by speculative investment rather than sustainable business models. Overall confidence in this judgment is moderate.

2. Competing Hypotheses

- Hypothesis A: The surge in AI startup valuations is primarily driven by genuine advancements in AI technology and corresponding business opportunities. Evidence includes reported technical and commercial milestones achieved by startups. However, the lack of detailed performance metrics and the rapid pace of valuation increases raise uncertainties about the sustainability of these valuations.

- Hypothesis B: The valuation increases are largely speculative, driven by investor enthusiasm and favorable market conditions, rather than intrinsic business value. This is supported by the rapid and substantial valuation jumps without corresponding revenue growth or market penetration evidence. The historical precedent of similar speculative bubbles in tech sectors supports this view.

- Assessment: Hypothesis B is currently better supported due to the lack of concrete evidence of sustainable business models and the historical context of speculative bubbles. Key indicators that could shift this judgment include verifiable revenue growth and market expansion by these startups.

3. Key Assumptions and Red Flags

- Assumptions: The current market conditions remain stable; AI startups have not yet reached their full market potential; investor behavior is primarily speculative.

- Information Gaps: Detailed financial performance data of the startups; specific technological advancements achieved; investor profiles and motivations.

- Bias & Deception Risks: Potential cognitive bias towards optimism in tech investments; source bias from startup promotional materials; possible manipulation of valuation data.

4. Implications and Strategic Risks

The rapid valuation increases in AI startups could lead to significant market corrections if speculative investments are not supported by real business growth. This could affect investor confidence and broader economic stability.

- Political / Geopolitical: Potential for increased regulatory scrutiny on tech investments and cross-border capital flows.

- Security / Counter-Terrorism: Minimal direct impact, but potential for increased cyber vulnerabilities as startups rapidly scale operations.

- Cyber / Information Space: Increased focus on AI capabilities could lead to heightened cyber espionage activities targeting these startups.

- Economic / Social: Potential for economic disruption if a market correction occurs, impacting employment and investment in the tech sector.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Monitor key financial indicators of major AI startups; assess investor profiles and motivations; increase scrutiny on valuation data.

- Medium-Term Posture (1–12 months): Develop resilience measures for potential market corrections; foster partnerships with stable tech entities; enhance regulatory frameworks for tech investments.

- Scenario Outlook:

- Best Case: Sustainable growth in AI startups with robust business models, supported by genuine technological advancements.

- Worst Case: Market correction leading to significant financial losses and reduced investor confidence.

- Most Likely: Continued speculative investment with periodic corrections, leading to a more cautious investment climate.

6. Key Individuals and Entities

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

Cybersecurity, AI startups, speculative investment, market valuation, tech sector growth, economic stability, regulatory scrutiny, cyber vulnerabilities

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us