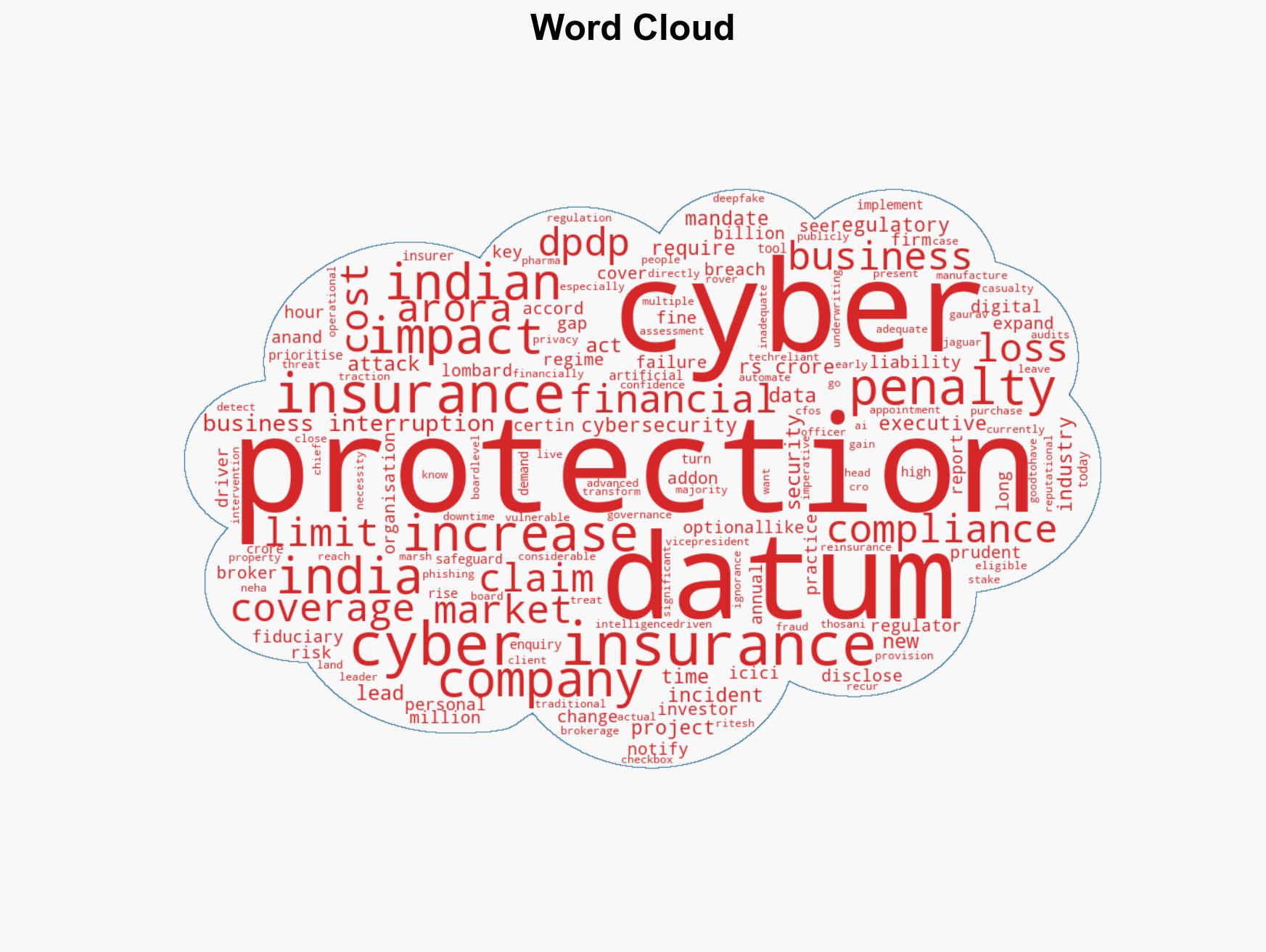

Surge in Cyber Insurance Demand Follows India’s New Data Protection Regulations

Published on: 2025-12-03

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: New data law spurs huge spike in cyber insurance demand

1. BLUF (Bottom Line Up Front)

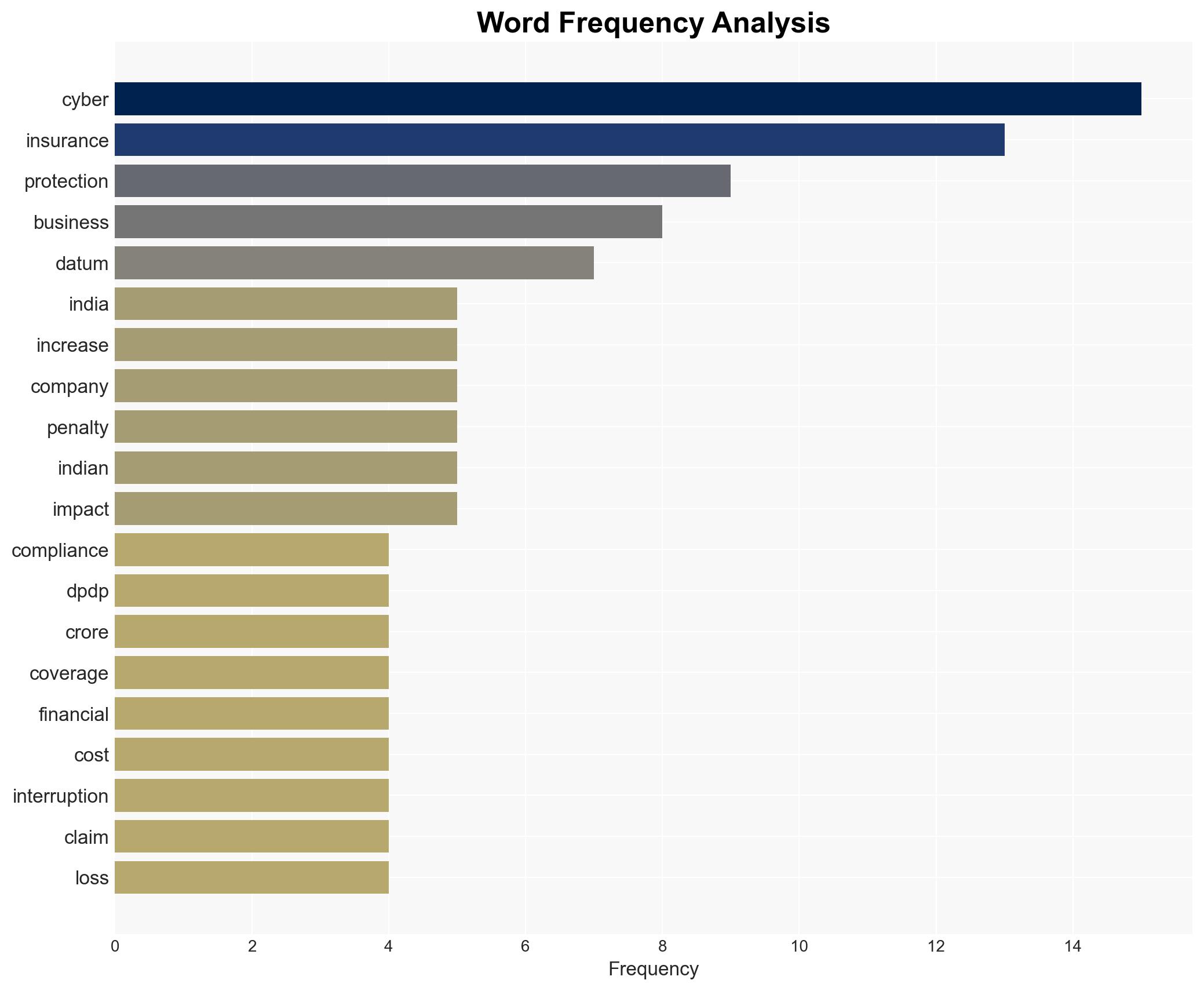

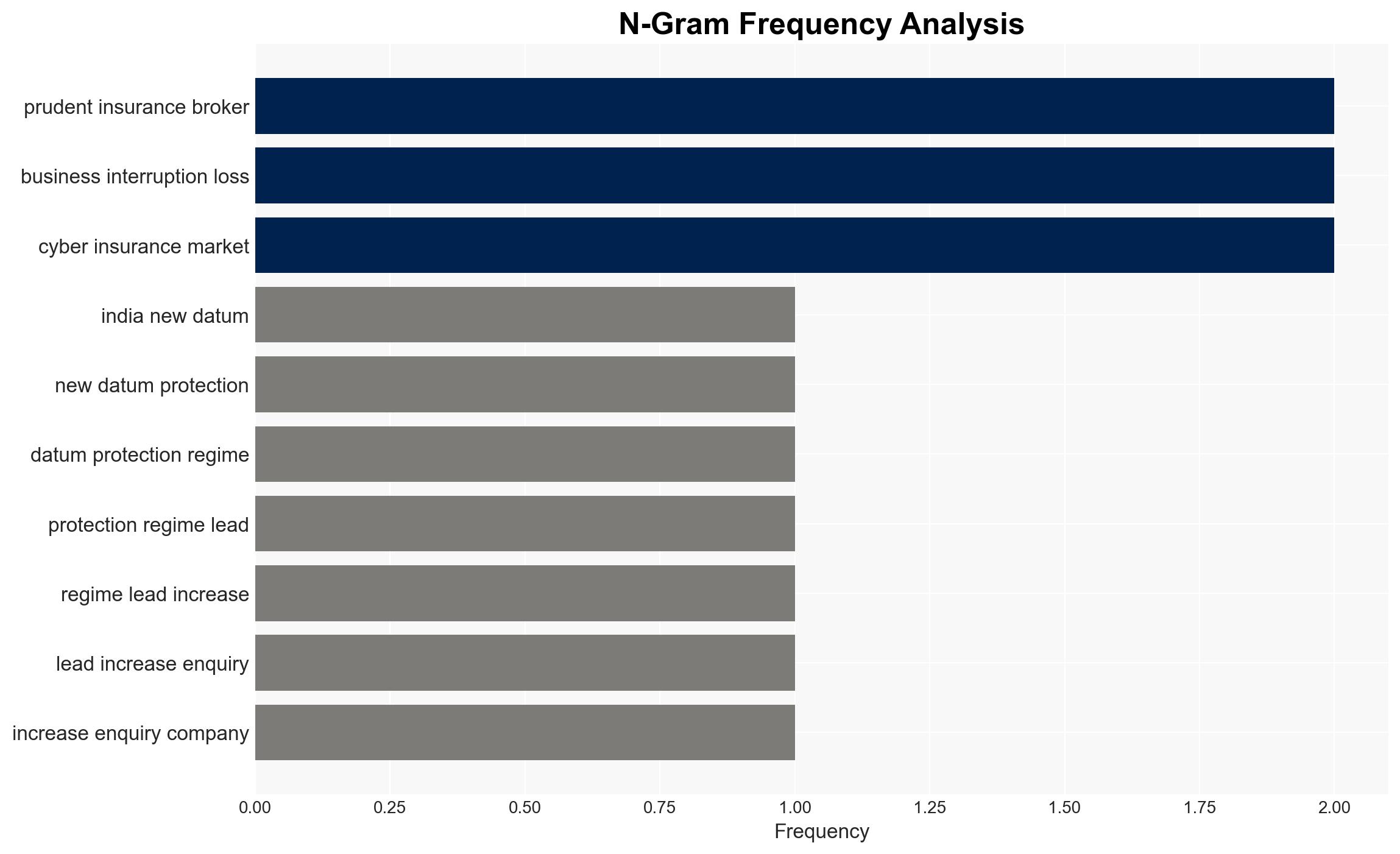

The introduction of India’s Digital Personal Data Protection (DPDP) Act has significantly increased demand for cyber insurance, transforming it from an optional to a necessary business expense. This shift is primarily driven by the heightened financial liabilities and compliance requirements imposed by the Act. The most likely hypothesis is that this trend will continue as businesses seek to mitigate financial risks associated with data breaches. Overall confidence in this assessment is moderate due to existing information gaps and potential biases in reported data.

2. Competing Hypotheses

- Hypothesis A: The spike in cyber insurance demand is primarily driven by the DPDP Act’s stringent penalties and compliance requirements. Supporting evidence includes the reported increase in demand and the financial penalties outlined in the Act. Key uncertainties involve the actual compliance levels and the effectiveness of enforcement mechanisms.

- Hypothesis B: The increase in demand is largely due to a broader recognition of cyber threats, independent of the DPDP Act. This is supported by the rise in AI-driven attacks and the general trend towards digitalization. Contradicting evidence includes the timing of the demand spike coinciding with the Act’s implementation.

- Assessment: Hypothesis A is currently better supported due to the direct correlation between the DPDP Act’s introduction and the reported increase in insurance demand. Indicators such as changes in enforcement practices or shifts in the cyber threat landscape could alter this assessment.

3. Key Assumptions and Red Flags

- Assumptions: Businesses will continue to prioritize compliance; the DPDP Act will be enforced effectively; cyber insurance will remain a viable risk mitigation tool; AI-driven cyber threats will persist.

- Information Gaps: Detailed data on the actual uptake of cyber insurance across sectors; enforcement statistics of the DPDP Act; comprehensive impact assessments of AI-driven attacks.

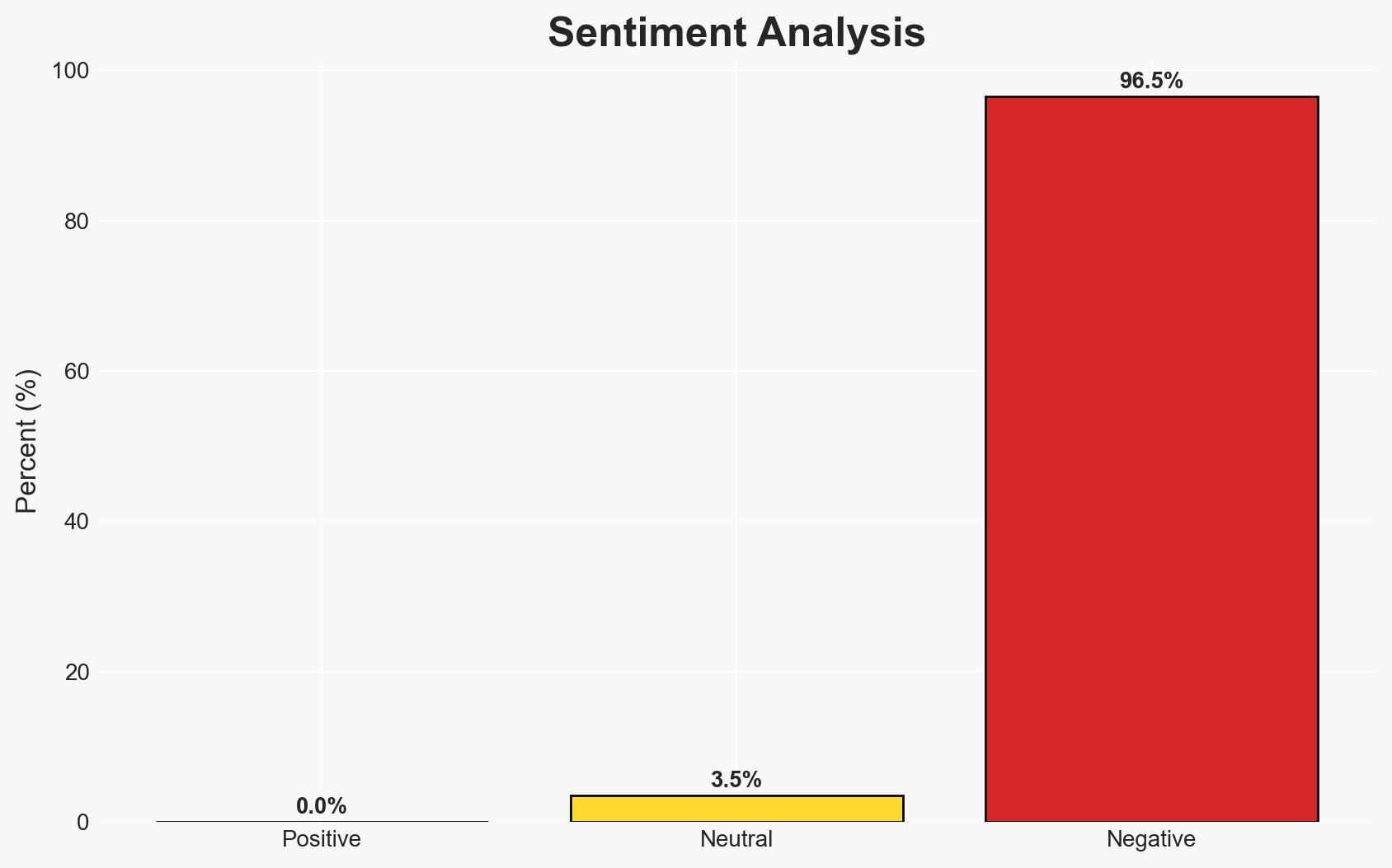

- Bias & Deception Risks: Potential bias from insurance industry sources highlighting demand increases; underreporting of cyber incidents due to reputational concerns; possible exaggeration of AI threat levels.

4. Implications and Strategic Risks

This development could lead to increased financial stability for businesses that adopt cyber insurance, but also higher operational costs. Over time, it may drive improvements in cybersecurity practices and influence global data protection standards.

- Political / Geopolitical: Potential for increased regulatory scrutiny and international alignment on data protection laws.

- Security / Counter-Terrorism: Enhanced cybersecurity measures could reduce vulnerabilities, but also increase the complexity of threat landscapes.

- Cyber / Information Space: Greater emphasis on cyber insurance may lead to innovations in coverage and risk assessment models.

- Economic / Social: Increased costs for businesses could impact economic growth, particularly for small to medium enterprises.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Monitor enforcement of the DPDP Act; engage with industry stakeholders to assess compliance challenges; evaluate current cyber insurance offerings.

- Medium-Term Posture (1–12 months): Develop partnerships with cybersecurity firms; invest in employee training on data protection; enhance incident response capabilities.

- Scenario Outlook:

- Best: Effective compliance leads to reduced cyber incidents and improved business resilience.

- Worst: Inadequate enforcement and rising cyber threats result in significant financial losses.

- Most-Likely: Gradual improvement in compliance and cybersecurity practices, with ongoing adjustments to insurance models.

6. Key Individuals and Entities

- Neha Anand, Vice-President and Head of Cyber at Prudent Insurance Brokers

- Ritesh Thosani, Cyber Practice Leader at Marsh India

- Gaurav Arora, Chief of Reinsurance, Underwriting & Claims at ICICI Lombard

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

Cybersecurity, cyber insurance, data protection, regulatory compliance, AI-driven attacks, financial risk, India

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us