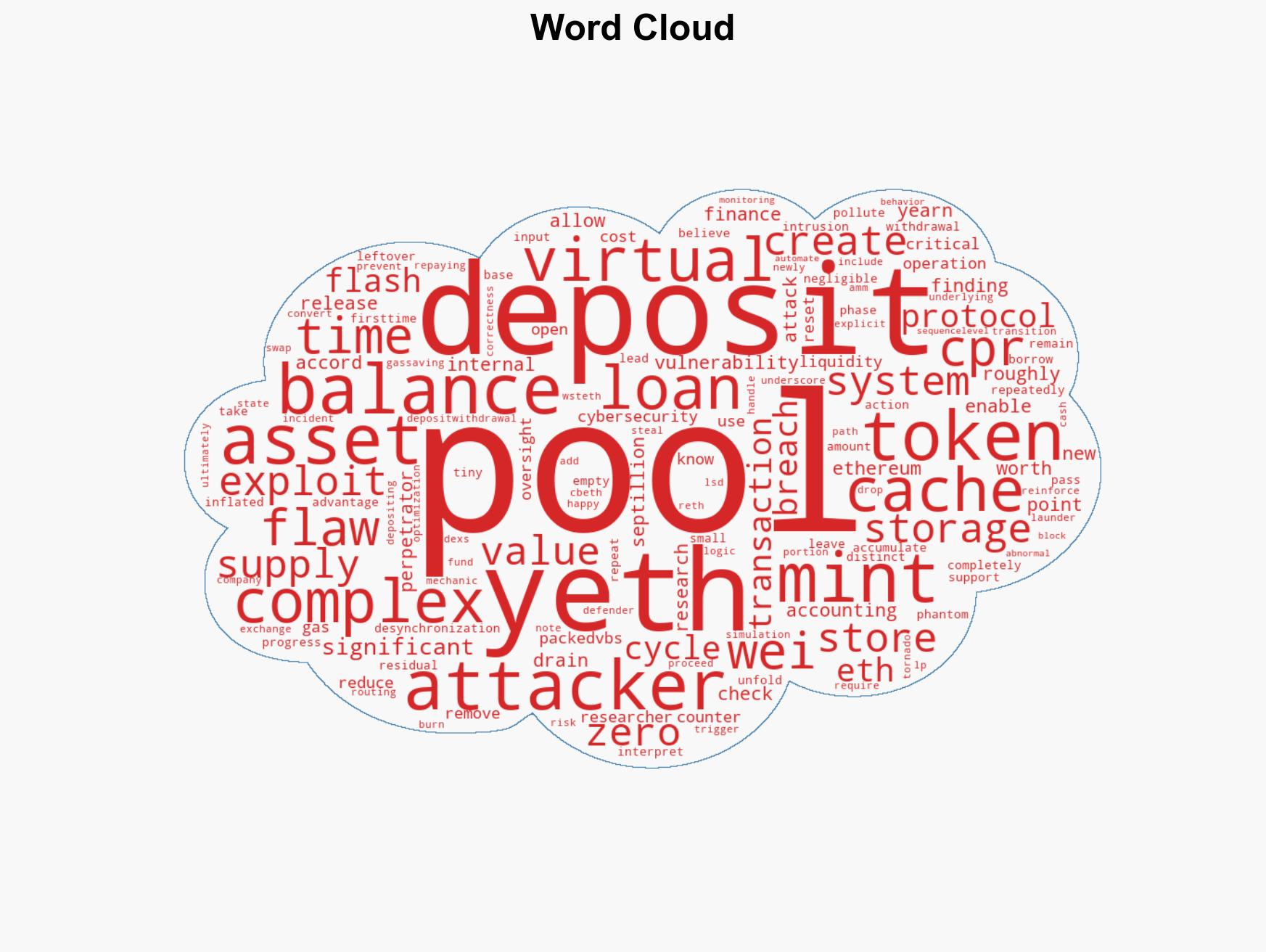

Yearn Finance’s yETH Pool Vulnerability Leads to $9 Million Asset Drain

Published on: 2025-12-03

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Yearn Finance yETH Pool Hit by 9M Exploit

1. BLUF (Bottom Line Up Front)

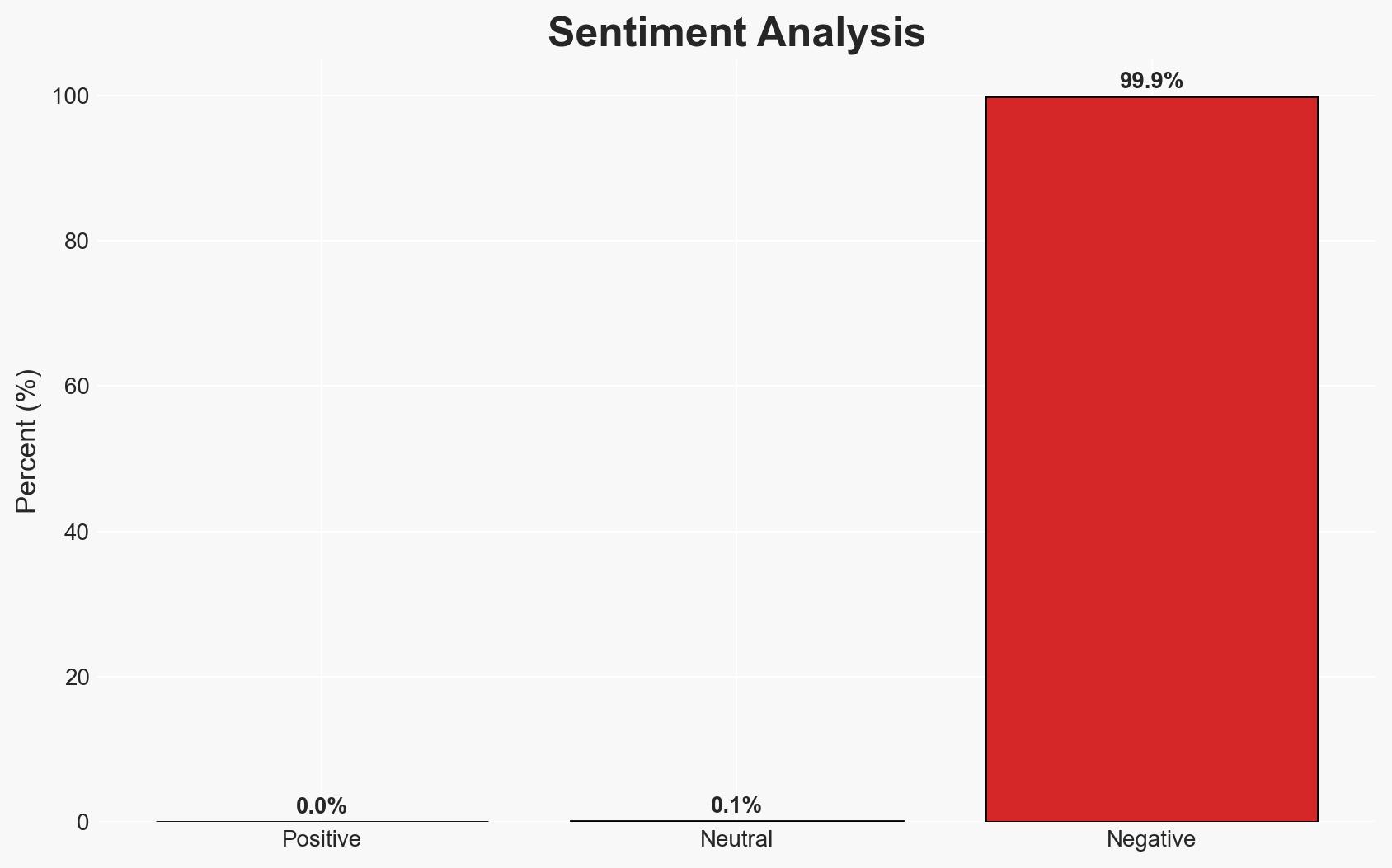

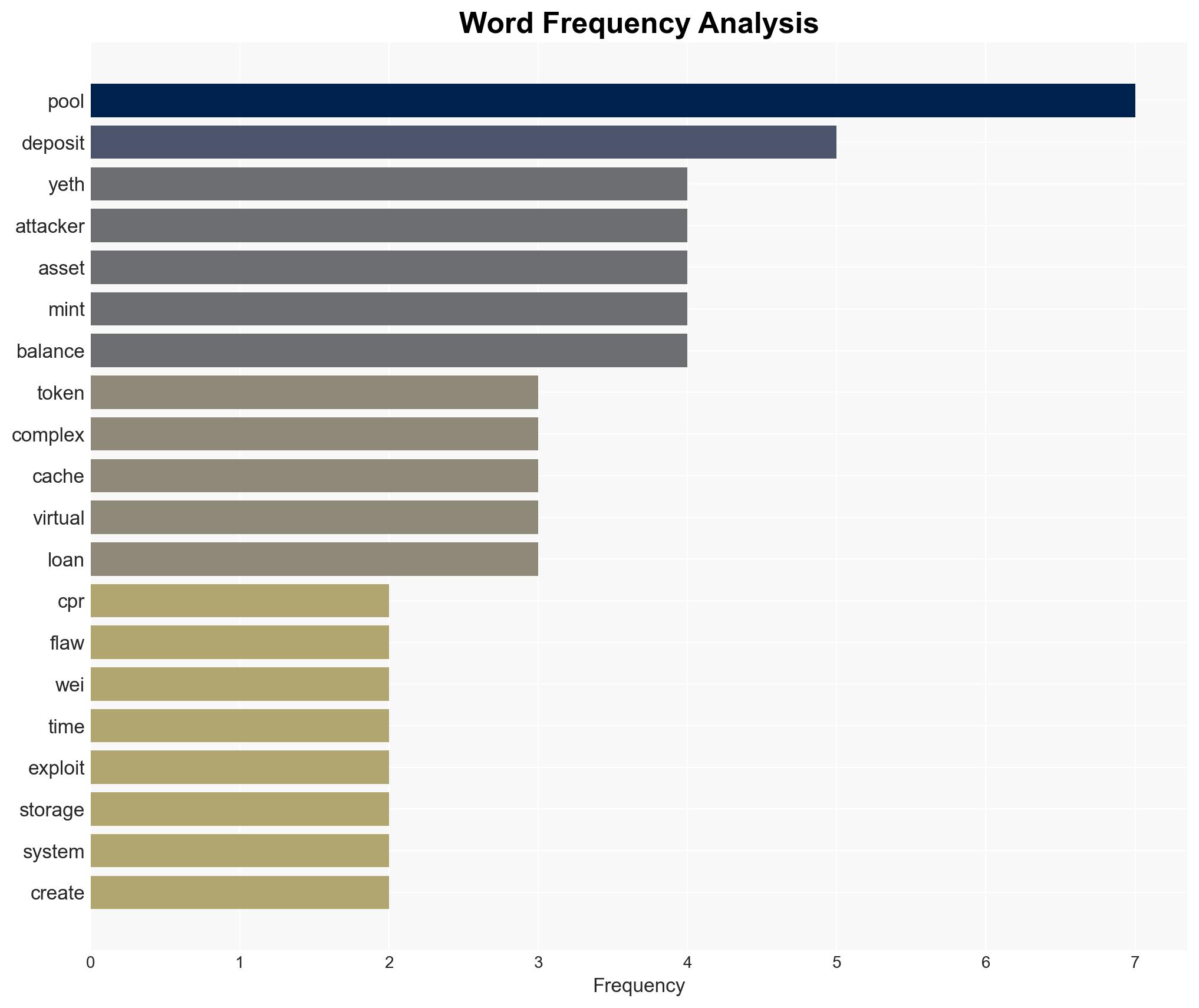

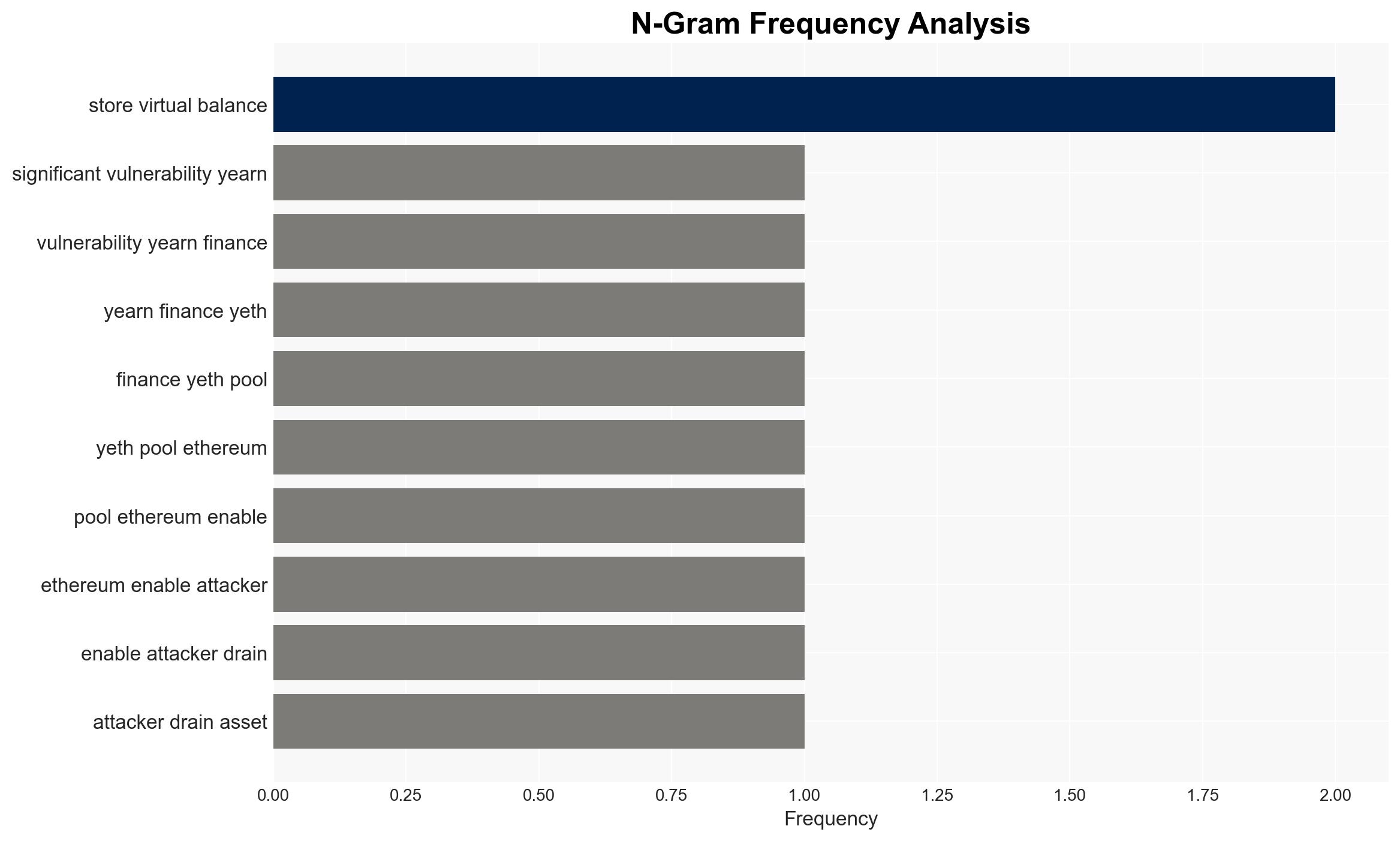

The Yearn Finance yETH pool on Ethereum was exploited, resulting in a $9 million loss due to a vulnerability in its accounting system. This incident highlights significant risks associated with complex automated market maker (AMM) mechanics and gas-saving optimizations. The most likely hypothesis is that the exploit was conducted by a sophisticated attacker leveraging flash loans and system desynchronization. Overall confidence in this assessment is moderate.

2. Competing Hypotheses

- Hypothesis A: The exploit was executed by a sophisticated attacker who identified and exploited a vulnerability in the yETH pool’s accounting system. Supporting evidence includes the complex nature of the attack, involving multiple phases and the use of flash loans. Key uncertainty remains regarding the attacker’s identity and potential insider knowledge.

- Hypothesis B: The exploit was an opportunistic attack by a less sophisticated actor who stumbled upon the vulnerability. This is less supported due to the complexity and precision required in executing the attack phases.

- Assessment: Hypothesis A is currently better supported due to the intricate nature of the exploit, which suggests planning and technical expertise. Indicators that could shift this judgment include evidence of insider involvement or simpler attack vectors being identified.

3. Key Assumptions and Red Flags

- Assumptions: The attacker had prior knowledge of the vulnerability; the yETH pool’s cached storage system was inadequately monitored; the exploit required significant technical expertise.

- Information Gaps: The identity of the attacker and any potential insider involvement; the full extent of the exploit’s impact on other systems.

- Bias & Deception Risks: Potential bias in attributing the attack to a sophisticated actor without concrete evidence; risk of deception if the attacker disseminates false information to mislead investigators.

4. Implications and Strategic Risks

This exploit could lead to increased scrutiny and regulatory pressure on decentralized finance (DeFi) platforms, potentially affecting their operational models and user trust.

- Political / Geopolitical: Potential for increased regulatory actions against DeFi platforms, impacting international financial technology policies.

- Security / Counter-Terrorism: Heightened risk of similar exploits being used for funding illicit activities, necessitating enhanced monitoring.

- Cyber / Information Space: Increased focus on cybersecurity measures within DeFi, potentially driving innovation in security protocols.

- Economic / Social: Loss of user confidence in DeFi platforms could lead to reduced investment and participation, impacting the broader cryptocurrency market.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Implement enhanced monitoring and transaction simulation tools; conduct a comprehensive audit of similar systems to identify vulnerabilities.

- Medium-Term Posture (1–12 months): Develop partnerships with cybersecurity firms for ongoing threat assessments; invest in user education on security best practices.

- Scenario Outlook:

- Best: Rapid implementation of security measures restores confidence in DeFi platforms.

- Worst: Continued exploits lead to significant financial losses and regulatory crackdowns.

- Most-Likely: Incremental improvements in security and regulatory frameworks stabilize the DeFi environment.

6. Key Individuals and Entities

- Yearn Finance

- Check Point Research

- Tornado Cash

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

Cybersecurity, DeFi, blockchain, financial crime, Ethereum, vulnerability exploitation, cryptocurrency

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us