Oil prices dip as market reacts to ongoing Russia-Ukraine conflict and precious metals decline

Published on: 2025-12-30

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Oil prices retreat slightly investors wary of Russia-Ukraine tensions

1. BLUF (Bottom Line Up Front)

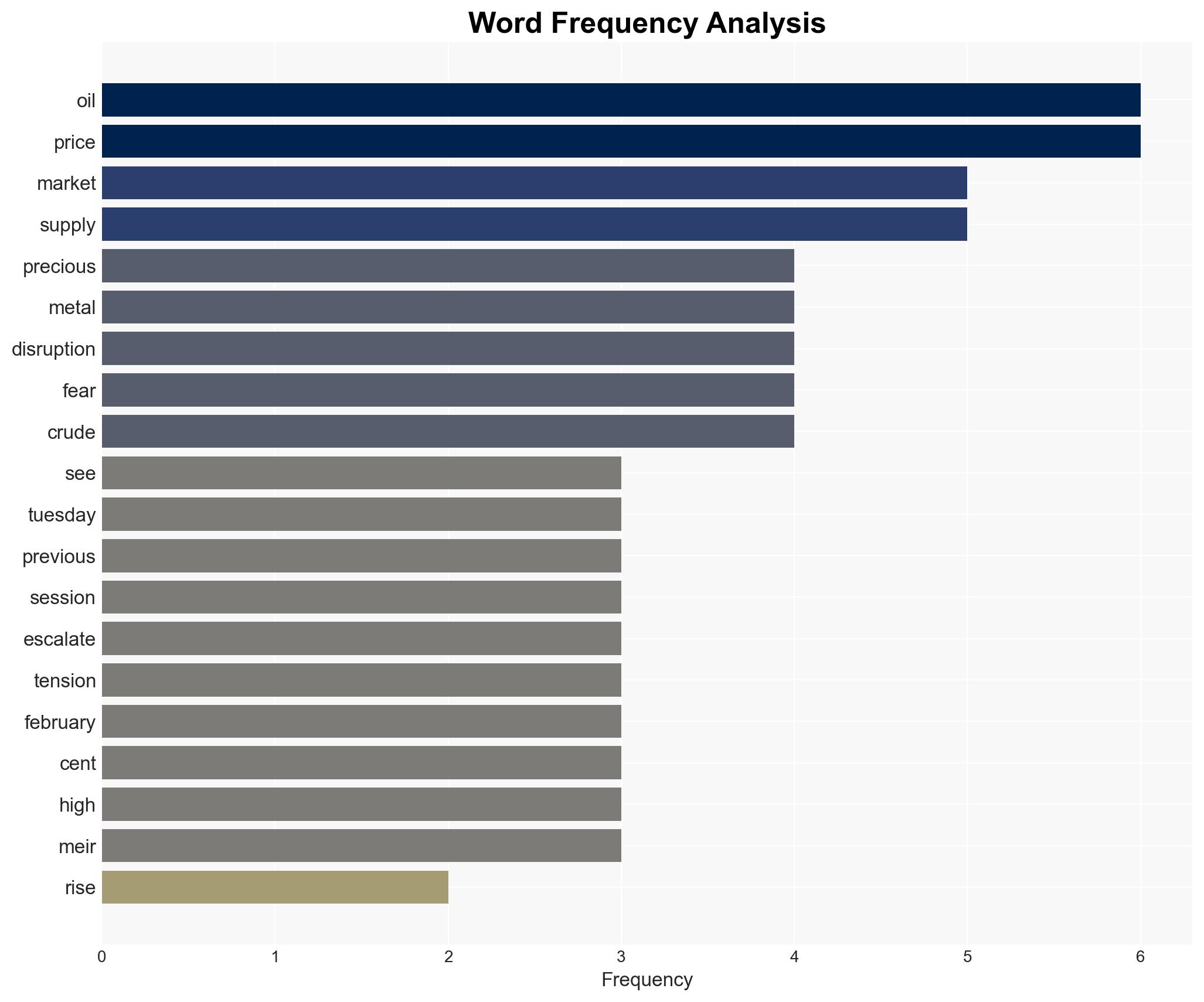

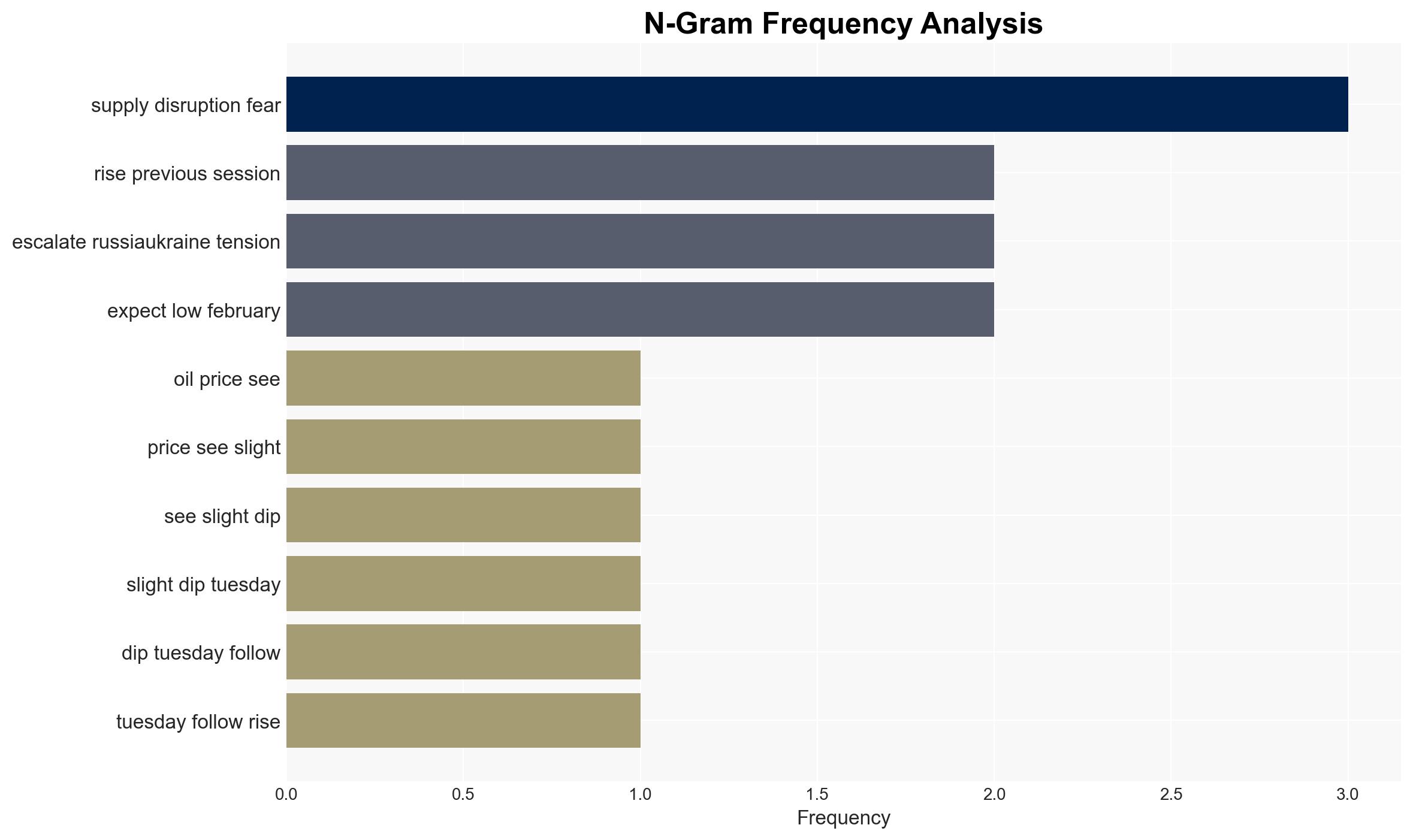

Oil prices have slightly retreated due to a combination of geopolitical tensions between Russia and Ukraine and market reactions to precious metals’ price corrections. The most likely hypothesis is that these tensions will continue to create volatility in oil markets, affecting global economic stability. Overall confidence in this assessment is moderate.

2. Competing Hypotheses

- Hypothesis A: The slight retreat in oil prices is primarily due to market corrections in precious metals, with geopolitical tensions playing a secondary role. Supporting evidence includes the direct correlation between precious metals’ decline and oil price adjustments. Key uncertainties include the future trajectory of precious metals and their influence on oil.

- Hypothesis B: The primary driver of oil price fluctuations is the escalating geopolitical tensions between Russia and Ukraine, with market corrections in precious metals being a secondary factor. Supporting evidence includes Russia’s accusations against Ukraine and the subsequent market reactions. Contradicting evidence includes the lack of immediate supply disruptions.

- Assessment: Hypothesis B is currently better supported due to the geopolitical context and historical precedence of such tensions affecting oil markets. Key indicators that could shift this judgment include changes in diplomatic relations or significant market movements in other commodities.

3. Key Assumptions and Red Flags

- Assumptions: Oil markets are sensitive to geopolitical tensions; precious metals’ market movements influence oil prices; Saudi Arabia’s pricing strategies will continue to impact Asian markets.

- Information Gaps: Detailed insights into Russia-Ukraine diplomatic engagements and potential undisclosed agreements affecting oil supply.

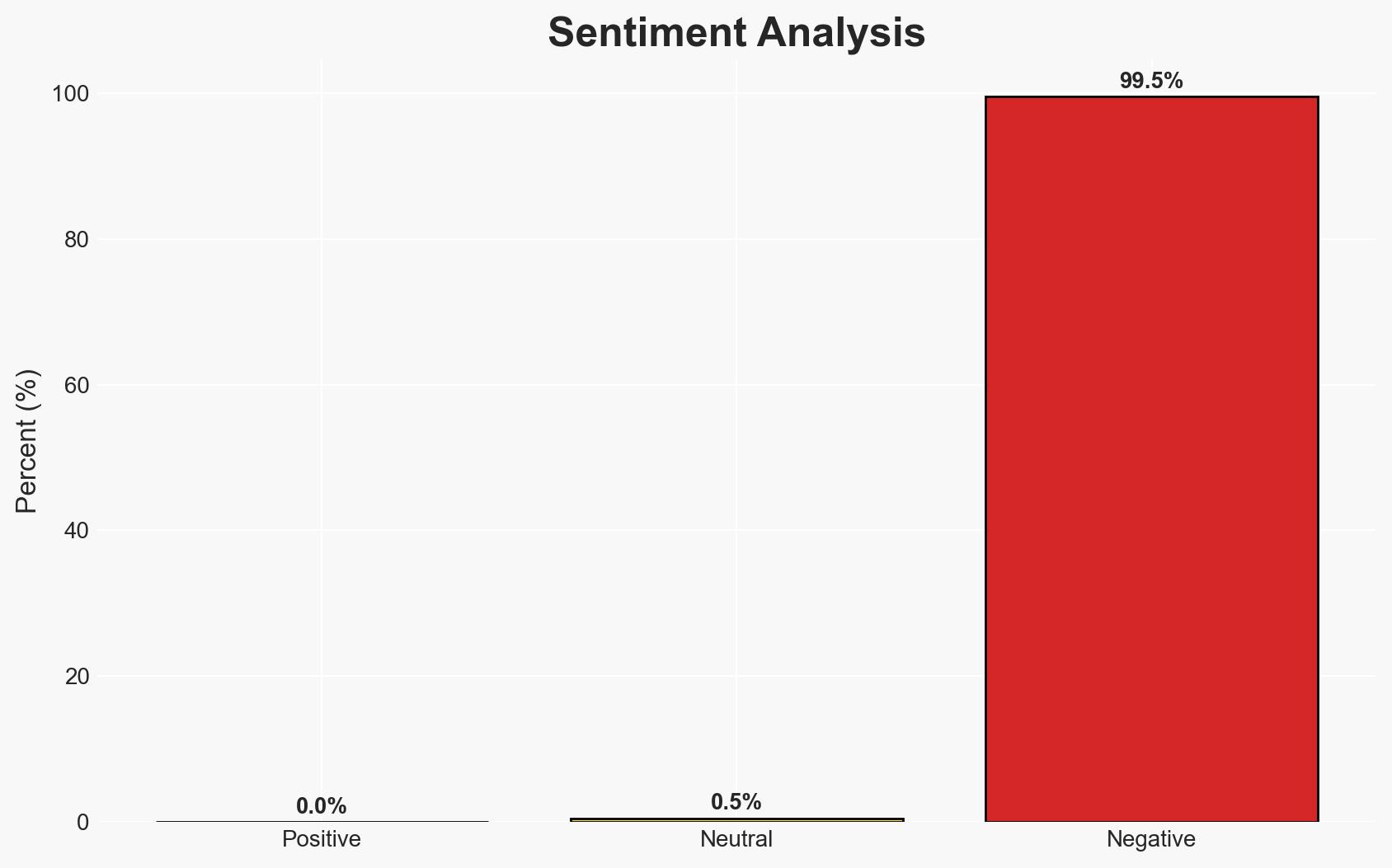

- Bias & Deception Risks: Potential bias in market analysis due to reliance on commodity correlations; risk of misinformation from conflicting geopolitical narratives.

4. Implications and Strategic Risks

Continued geopolitical tensions could exacerbate market volatility, influencing global economic conditions and energy security. The situation may evolve with broader geopolitical shifts and market responses.

- Political / Geopolitical: Escalation between Russia and Ukraine could lead to broader regional instability and impact global diplomatic relations.

- Security / Counter-Terrorism: Increased tensions may heighten security risks in Eastern Europe, affecting counter-terrorism operations.

- Cyber / Information Space: Potential for increased cyber operations targeting critical infrastructure and information warfare tactics.

- Economic / Social: Prolonged volatility in oil prices could strain economies dependent on energy imports and exports, affecting social stability.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Enhance monitoring of geopolitical developments and market reactions; engage in diplomatic efforts to de-escalate tensions.

- Medium-Term Posture (1–12 months): Strengthen energy security measures and diversify energy sources; develop partnerships to mitigate economic impacts.

- Scenario Outlook: Best: Diplomatic resolution reduces tensions and stabilizes markets. Worst: Escalation leads to significant supply disruptions and economic downturn. Most-Likely: Continued volatility with periodic diplomatic engagements.

6. Key Individuals and Entities

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

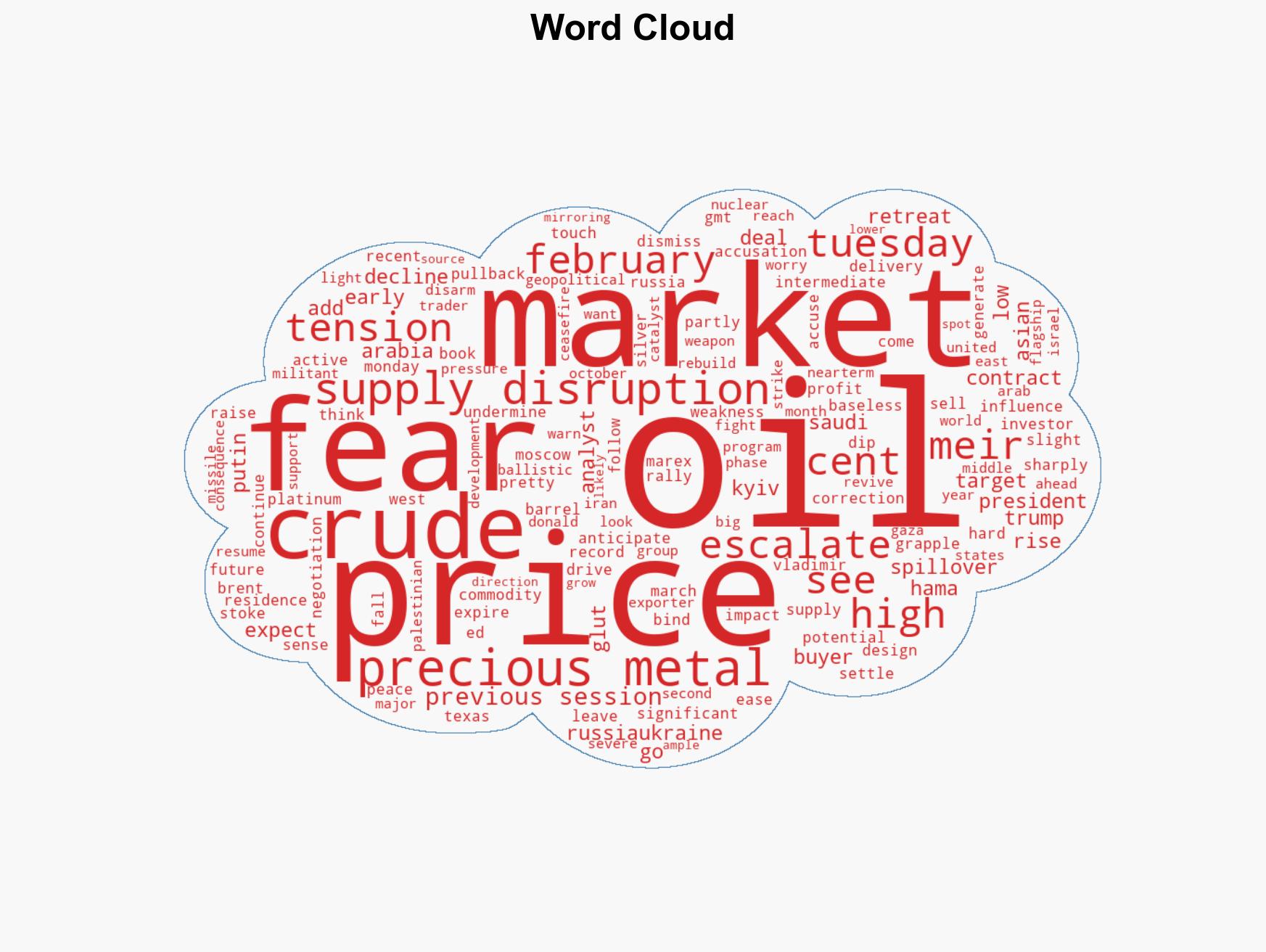

regional conflicts, geopolitical tensions, oil market volatility, Russia-Ukraine conflict, precious metals, energy security, economic stability, commodity markets

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

- Narrative Pattern Analysis: Deconstruct and track propaganda or influence narratives.

Explore more:

Regional Conflicts Briefs ·

Daily Summary ·

Support us