Illicit Cryptocurrency Transactions Reached $154 Billion in 2025 Amid Sanctions Evasion by Nation-States

Published on: 2026-01-09

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

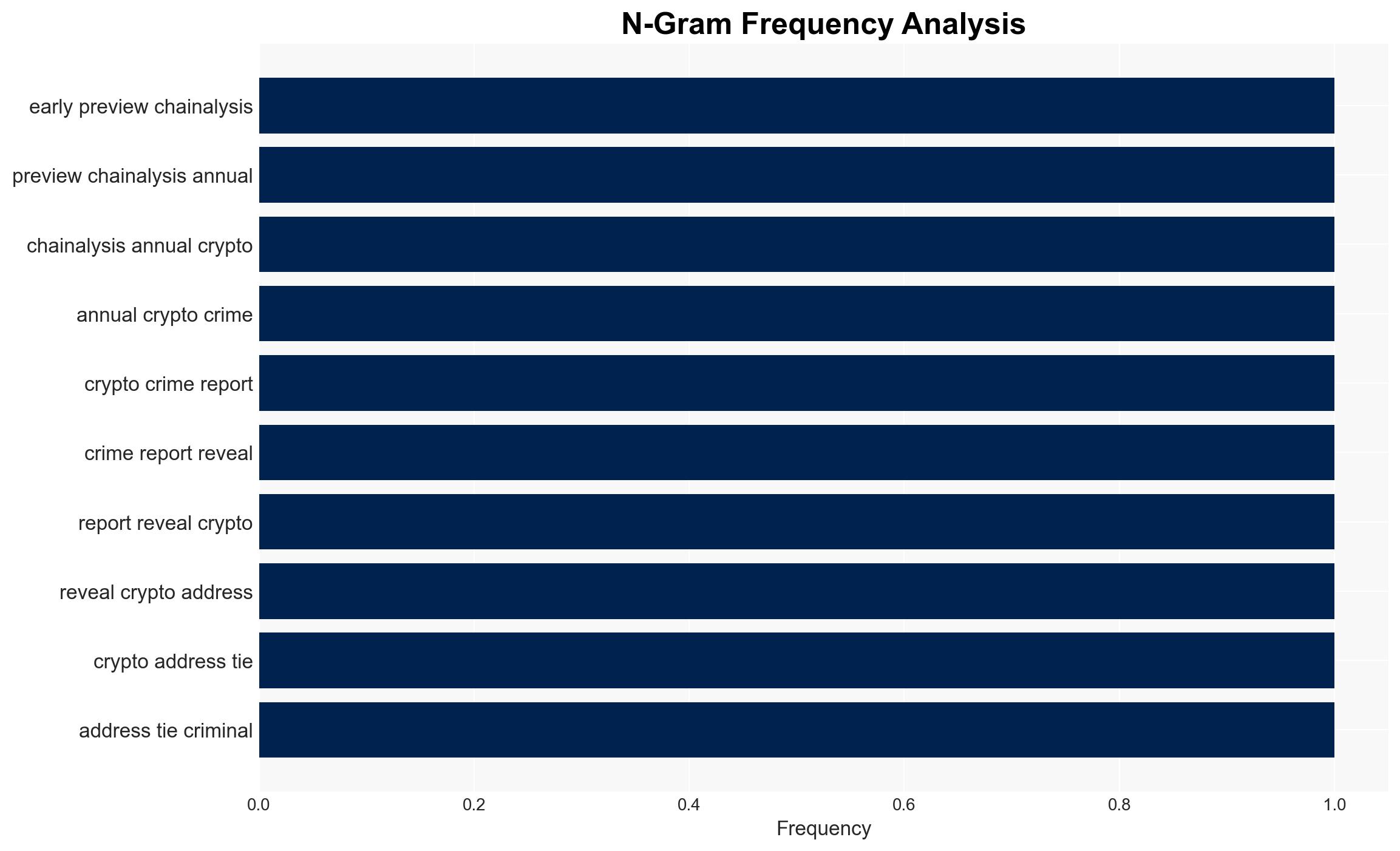

Intelligence Report: Illicit Crypto Flows Climbed to 154 Billion in 2025 as Nation States Evade Sanctions Report Finds

1. BLUF (Bottom Line Up Front)

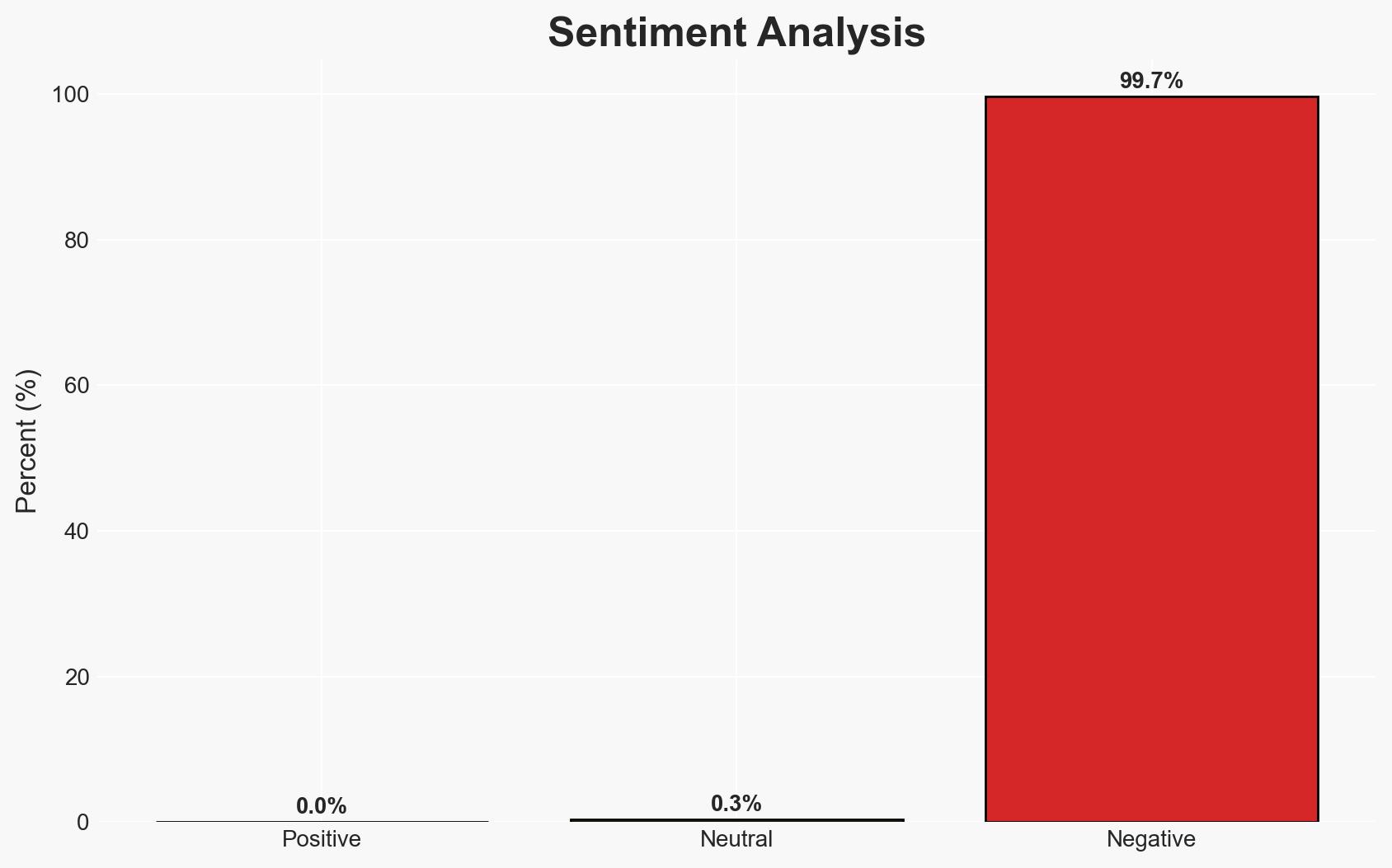

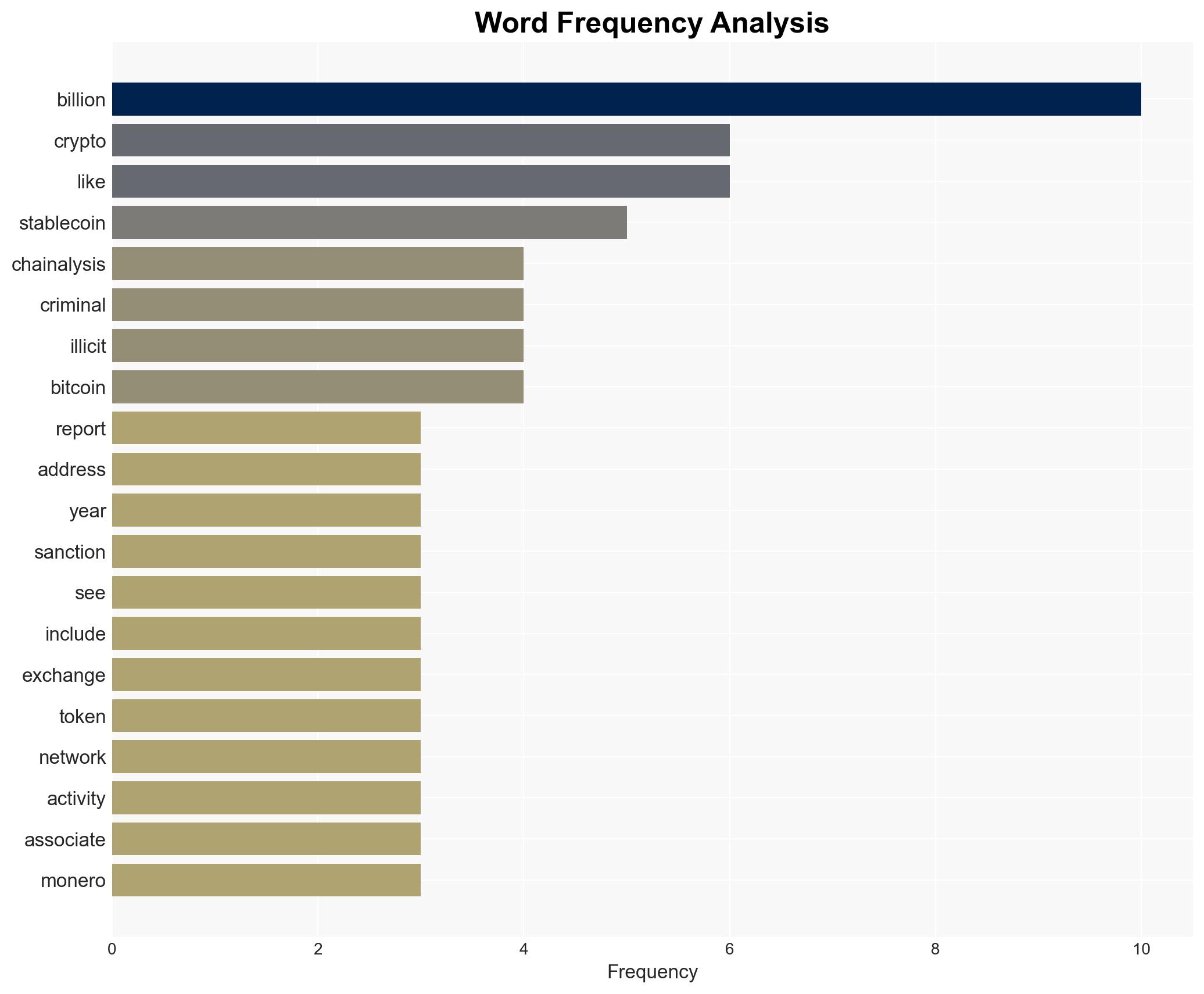

Illicit cryptocurrency flows reached $154 billion in 2025, driven largely by nation-state actors evading sanctions. This trend highlights the increasing geopolitical relevance of cryptocurrencies. The most likely hypothesis is that nation-states will continue to leverage crypto to bypass financial restrictions, posing a significant challenge to global financial security. Overall confidence in this assessment is moderate.

2. Competing Hypotheses

- Hypothesis A: Nation-states are primarily using cryptocurrencies to evade sanctions, as evidenced by the significant increase in illicit flows and specific examples of North Korea, Russia, and Iran. However, the full extent of these operations remains uncertain due to potential undiscovered activities.

- Hypothesis B: The surge in illicit crypto flows is driven more by non-state actors and organized crime exploiting regulatory gaps, with nation-states playing a secondary role. This is contradicted by the specific state-linked activities reported.

- Assessment: Hypothesis A is currently better supported due to the documented involvement of nation-states in large-scale operations. Indicators such as increased regulatory scrutiny or international cooperation could shift this judgment.

3. Key Assumptions and Red Flags

- Assumptions: The reported figures accurately reflect illicit activity; nation-states have the capability and intent to use crypto for sanctions evasion; regulatory environments remain insufficiently robust.

- Information Gaps: Detailed breakdowns of specific transactions, the role of decentralized exchanges, and the effectiveness of current countermeasures.

- Bias & Deception Risks: Potential bias in data collection methods; manipulation of crypto flows to mislead analysts on the true scale of nation-state involvement.

4. Implications and Strategic Risks

The continued use of cryptocurrencies by nation-states for sanctions evasion could undermine international financial systems and regulatory frameworks, potentially leading to increased geopolitical tensions.

- Political / Geopolitical: Escalation of sanctions and countermeasures, potential diplomatic conflicts over regulatory approaches.

- Security / Counter-Terrorism: Enhanced capabilities for terrorist financing and organized crime, complicating law enforcement efforts.

- Cyber / Information Space: Increased cyber operations targeting crypto exchanges and wallets, potential for misinformation campaigns.

- Economic / Social: Destabilization of financial markets, erosion of trust in digital currencies, potential social unrest due to economic impacts.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Strengthen monitoring of crypto transactions, enhance international cooperation on regulatory frameworks, and increase intelligence sharing.

- Medium-Term Posture (1–12 months): Develop resilience measures for financial institutions, foster partnerships with tech firms for compliance solutions, and invest in capability development for crypto-tracking technologies.

- Scenario Outlook:

- Best: Enhanced global cooperation leads to effective regulation and reduction in illicit flows.

- Worst: Increased nation-state exploitation of crypto leads to significant geopolitical instability.

- Most-Likely: Continued use of crypto for sanctions evasion with incremental regulatory improvements.

6. Key Individuals and Entities

- North Korean hackers, Russian financial entities, Iranian networks, Chinese money laundering outfits, Circle, Tether

7. Thematic Tags

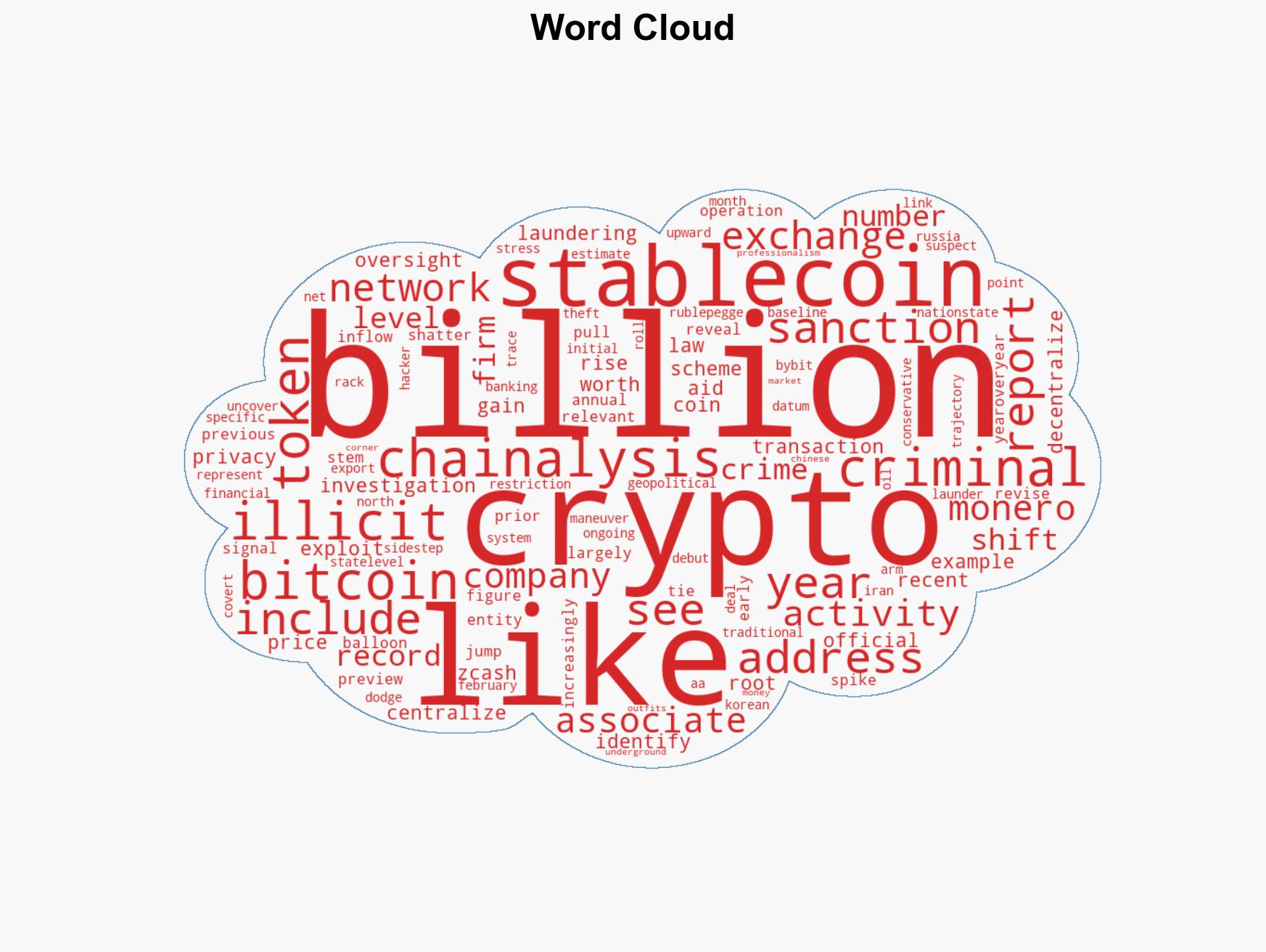

regional conflicts, cryptocurrency, sanctions evasion, nation-state actors, cybercrime, financial regulation, geopolitical tensions, illicit finance

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

- Network Influence Mapping: Map influence relationships to assess actor impact.

- Narrative Pattern Analysis: Deconstruct and track propaganda or influence narratives.

Explore more:

Regional Conflicts Briefs ·

Daily Summary ·

Support us