US Access to Venezuelan Oil Could Diminish Canada’s Bargaining Power in Trade Negotiations

Published on: 2026-01-10

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: The US wants Venezuelan oil Does that undercut Canada’s leverage in trade talks

1. BLUF (Bottom Line Up Front)

The United States’ potential access to Venezuelan oil reserves could diminish Canada’s leverage in trade negotiations, particularly concerning energy exports. However, significant infrastructure challenges in Venezuela may delay any immediate impact. The situation requires close monitoring, with moderate confidence in the assessment that Canada’s position remains relatively stable in the short term.

2. Competing Hypotheses

- Hypothesis A: The U.S. access to Venezuelan oil significantly weakens Canada’s trade leverage. Supporting evidence includes the U.S. government’s push for oil companies to invest in Venezuela and public statements downplaying the need for Canadian oil. Contradicting evidence includes the deteriorated state of Venezuela’s oil infrastructure, which poses a barrier to rapid exploitation.

- Hypothesis B: Canada’s trade leverage remains largely unaffected in the short term due to Venezuela’s infrastructural challenges and Canada’s competitive oil product. Supporting evidence includes expert opinions on the risks of investing in Venezuela and Canada’s diversified energy market strategy. Contradicting evidence involves potential U.S. policy shifts to prioritize Venezuelan oil.

- Assessment: Hypothesis B is currently better supported due to the immediate infrastructural and investment barriers in Venezuela. Key indicators that could shift this judgment include rapid U.S. investment in Venezuelan infrastructure or significant policy changes in U.S.-Canada trade relations.

3. Key Assumptions and Red Flags

- Assumptions: The U.S. will face significant delays in ramping up Venezuelan oil production; Canadian oil remains competitive in price and quality; U.S.-Canada trade relations are stable in the near term.

- Information Gaps: Detailed timelines for U.S. investment in Venezuelan oil infrastructure; specific U.S. policy changes regarding Canadian trade.

- Bias & Deception Risks: Potential bias in public statements from U.S. officials aiming to influence trade negotiations; risk of overestimating U.S. capability to quickly exploit Venezuelan oil.

4. Implications and Strategic Risks

The U.S. interest in Venezuelan oil could alter North American energy dynamics, with potential long-term impacts on trade and economic stability. The situation may evolve with geopolitical shifts and infrastructure developments.

- Political / Geopolitical: Possible strain on U.S.-Canada relations; increased U.S. influence in Latin America.

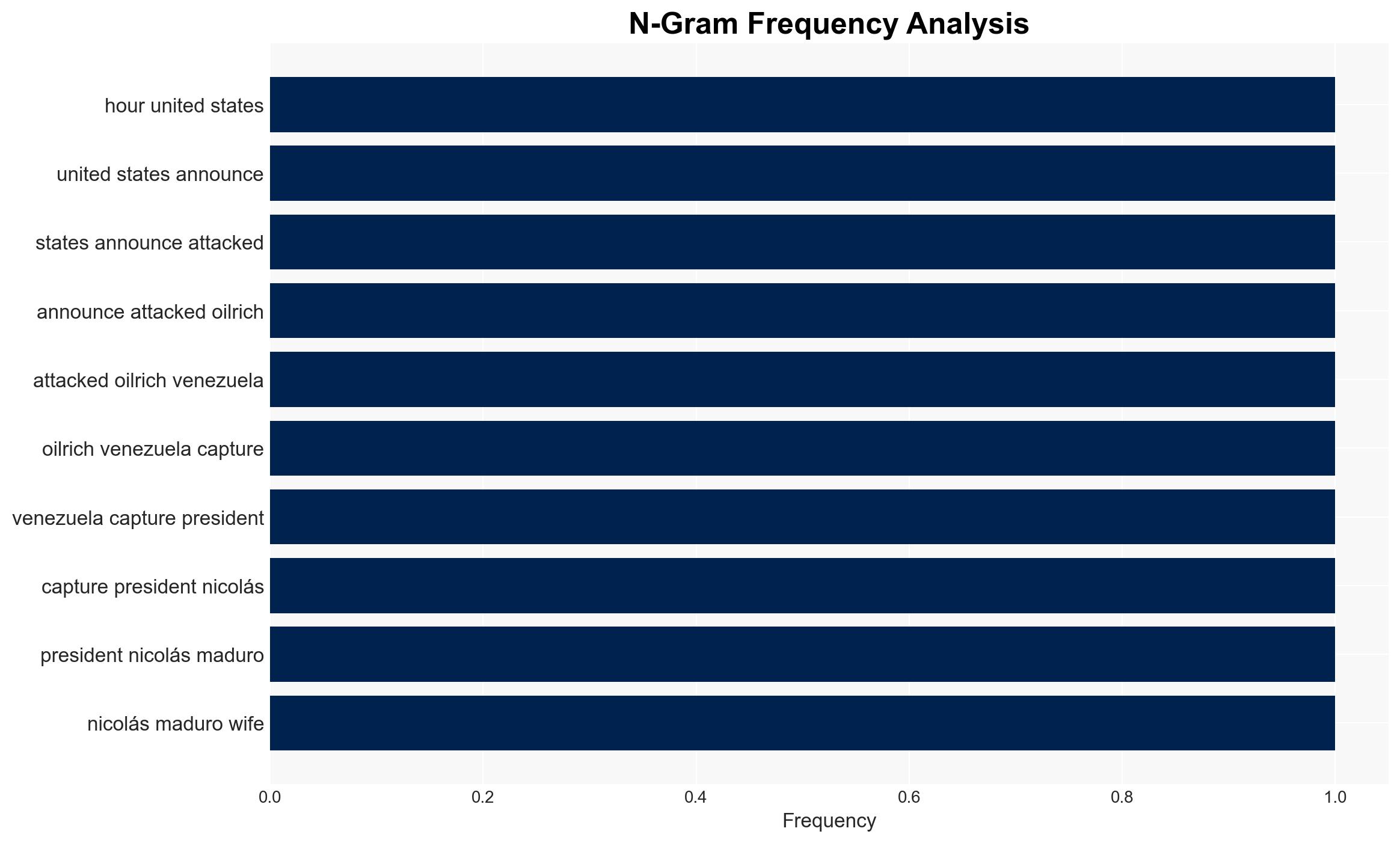

- Security / Counter-Terrorism: Heightened regional instability if Venezuelan internal conflict escalates.

- Cyber / Information Space: Potential for increased cyber operations targeting energy infrastructure and trade negotiations.

- Economic / Social: Fluctuations in oil prices affecting Canadian economy; potential social unrest in Venezuela due to foreign intervention.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Monitor U.S. policy announcements and investment activities in Venezuela; engage in diplomatic channels to reaffirm Canada-U.S. trade commitments.

- Medium-Term Posture (1–12 months): Strengthen Canadian energy market diversification; develop contingency plans for potential trade disruptions.

- Scenario Outlook: Best: U.S. delays in Venezuela lead to stable Canada-U.S. trade; Worst: Rapid U.S. investment undermines Canadian oil exports; Most-Likely: Gradual shifts with limited immediate impact, monitored through investment and policy indicators.

6. Key Individuals and Entities

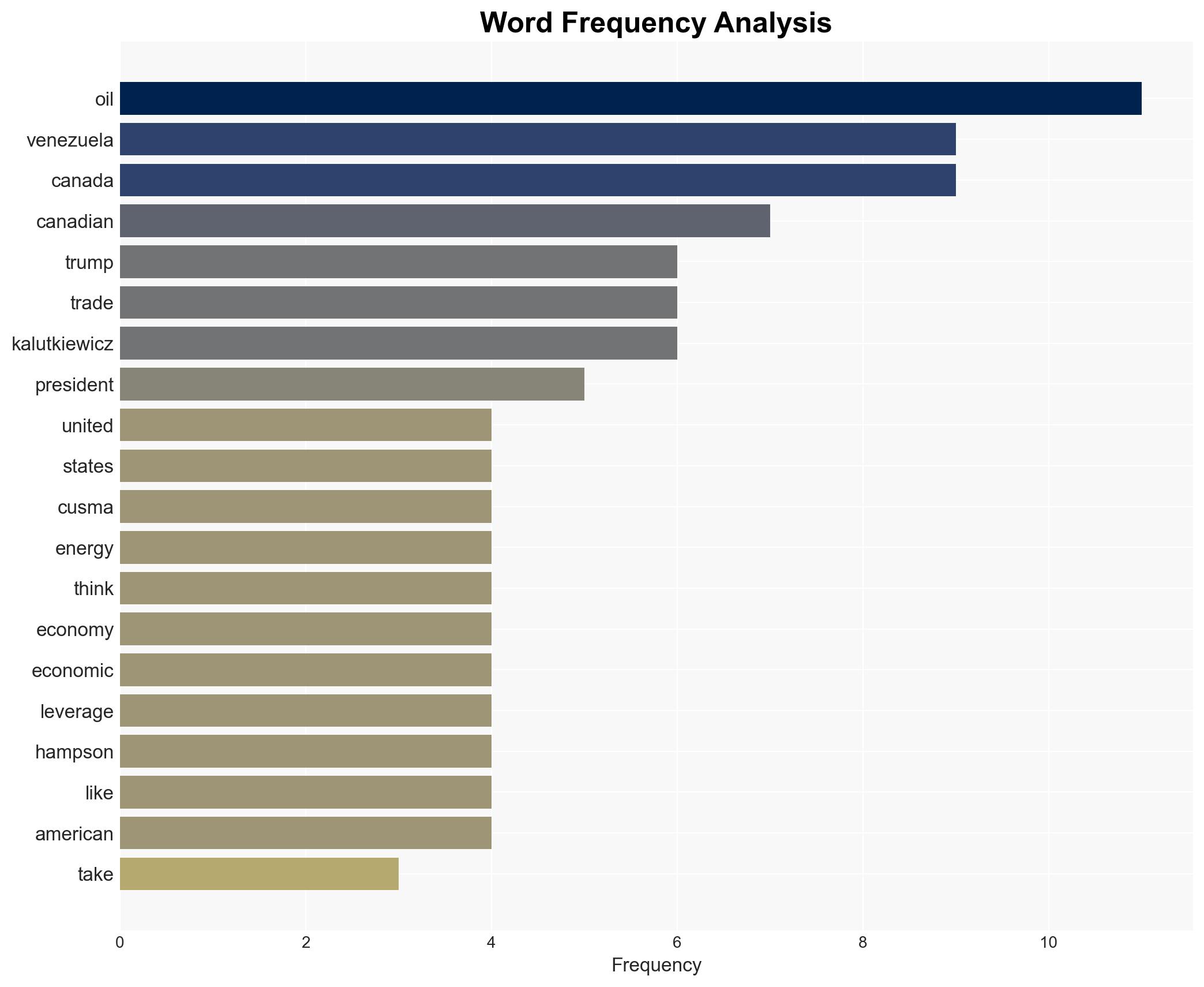

- Nicolás Maduro, Katie Miller, Stephen Miller, RJ Johnston, Mark Carney, Kate Kalutkiewicz

7. Thematic Tags

national security threats, energy trade, U.S.-Canada relations, Venezuelan oil, infrastructure challenges, geopolitical dynamics

Structured Analytic Techniques Applied

- Cognitive Bias Stress Test: Expose and correct potential biases in assessments through red-teaming and structured challenge.

- Bayesian Scenario Modeling: Use probabilistic forecasting for conflict trajectories or escalation likelihood.

- Network Influence Mapping: Map relationships between state and non-state actors for impact estimation.

Explore more:

National Security Threats Briefs ·

Daily Summary ·

Support us