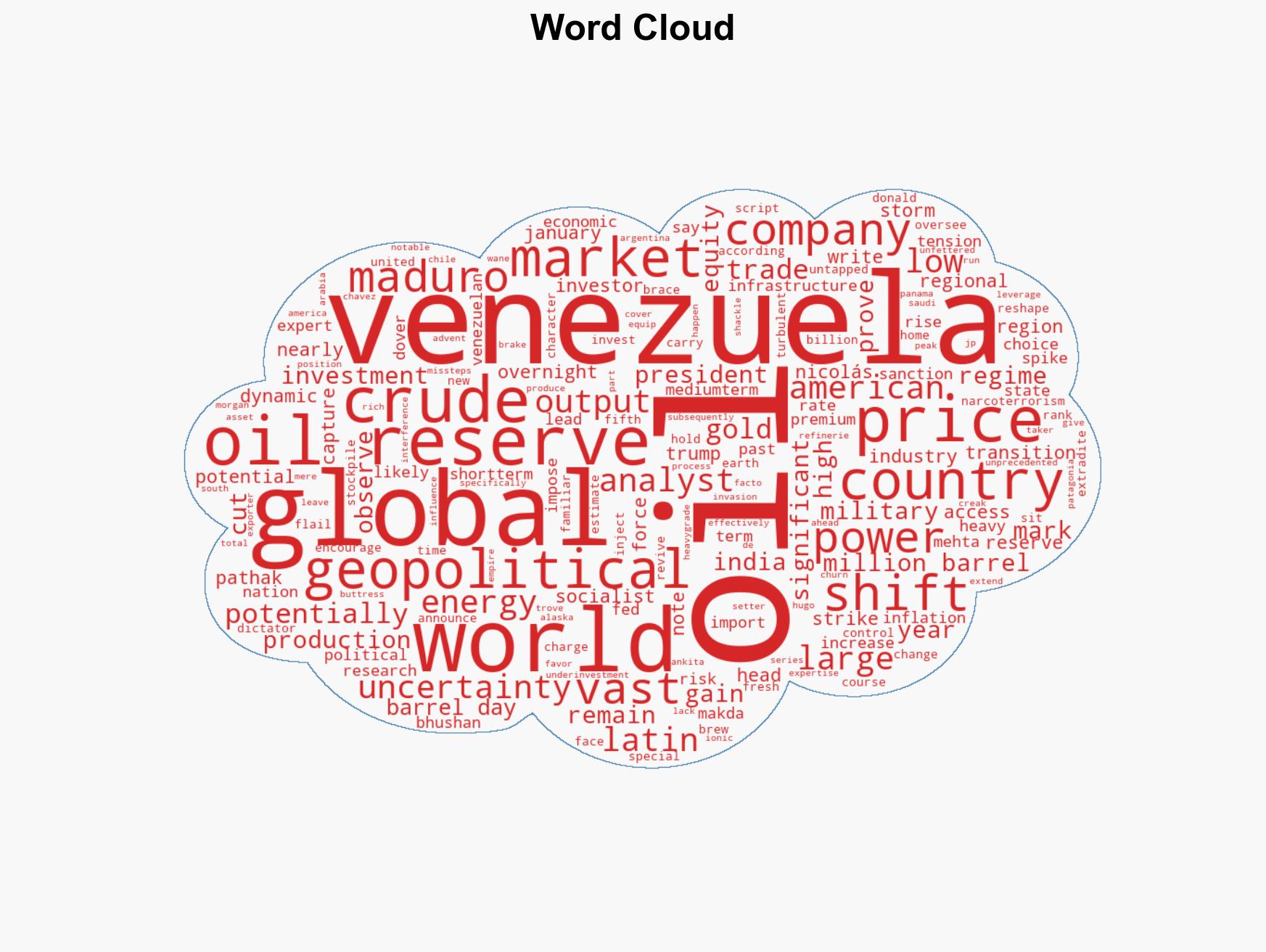

Trump’s Venezuela Intervention: Implications for Oil Markets, Inflation, and Emerging Economies

Published on: 2026-01-12

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

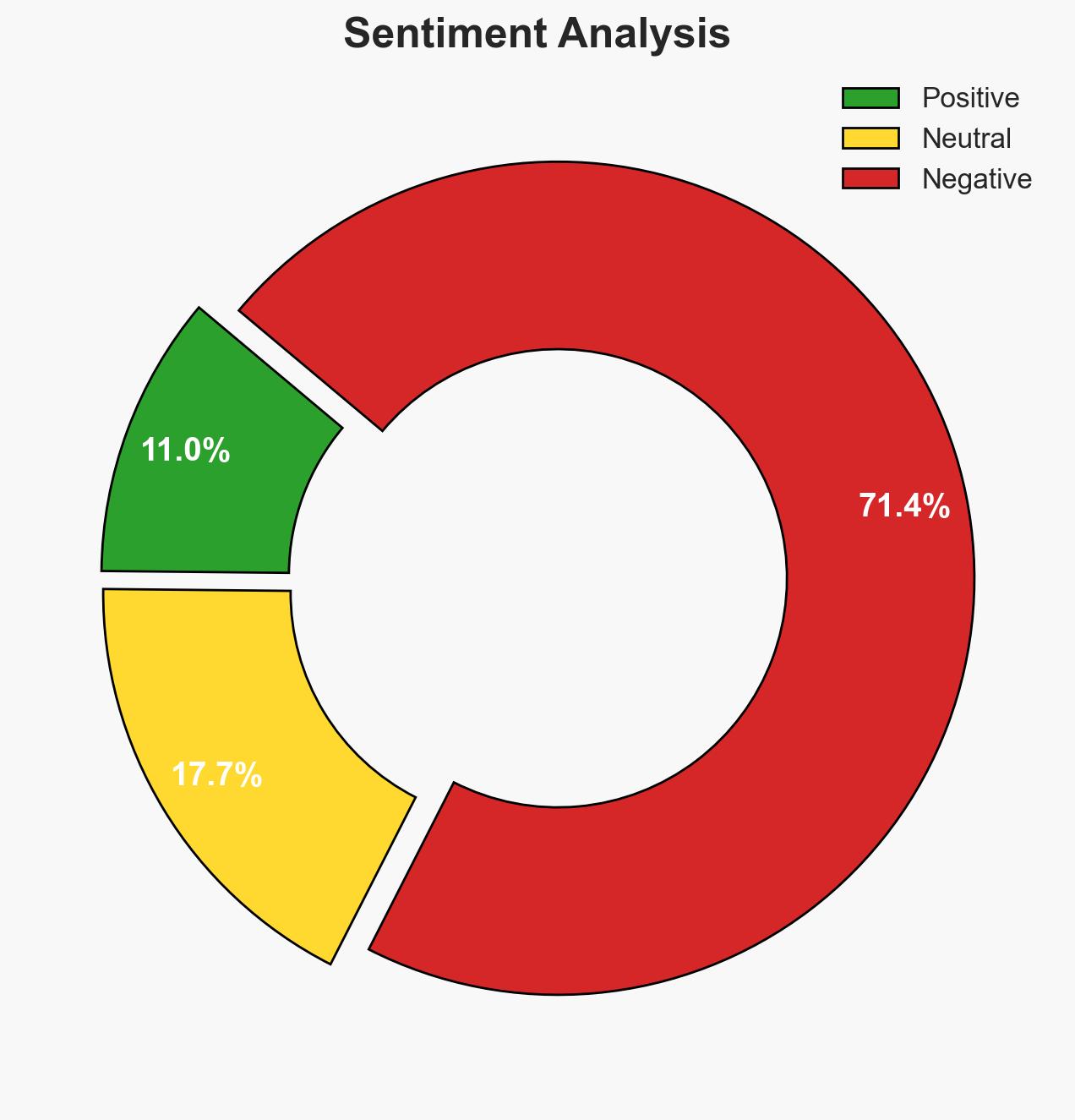

Intelligence Report: Beyond Venezuela How Donald Trumps oil power play could reshape inflation interest rates and emerging market returns

1. BLUF (Bottom Line Up Front)

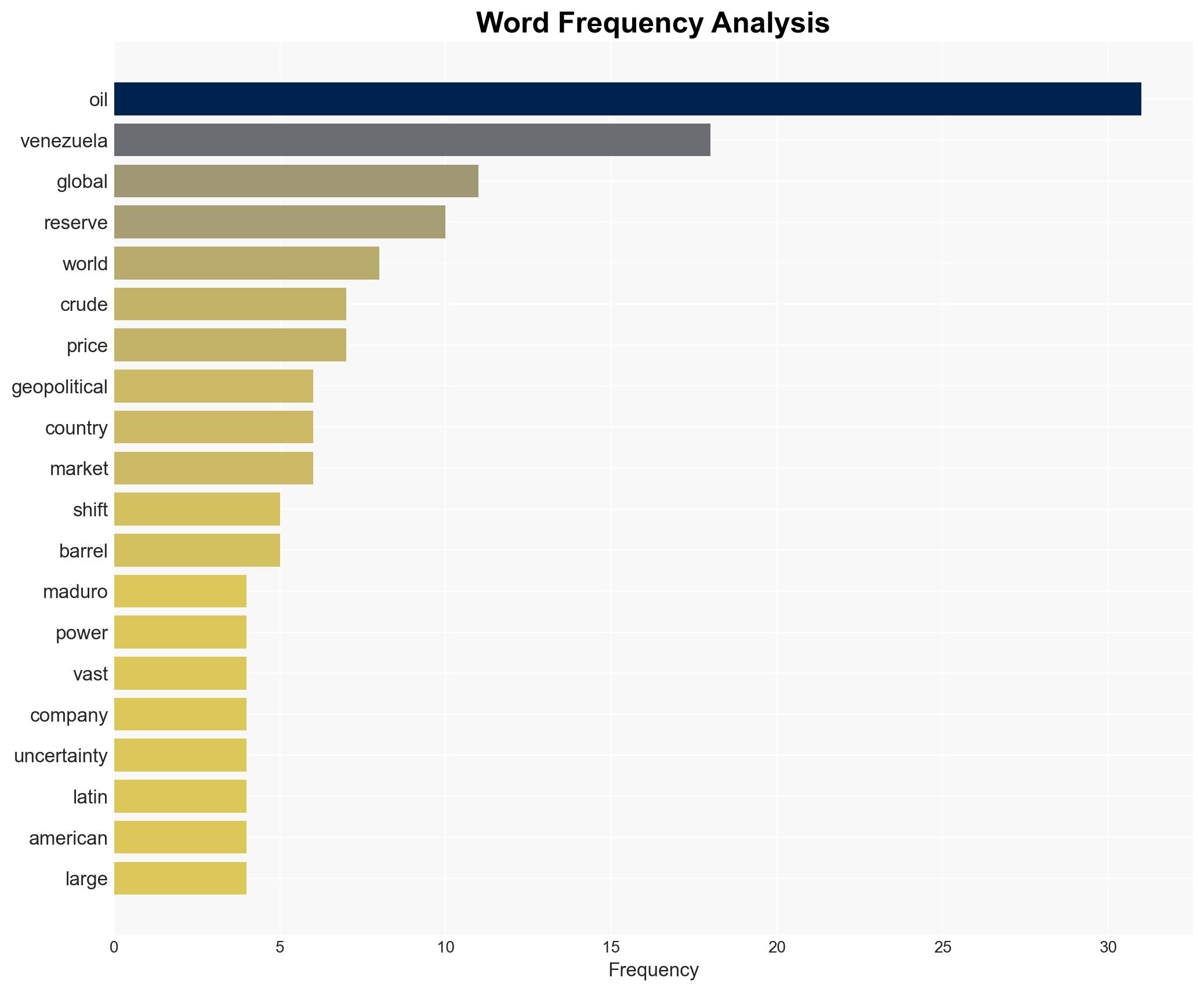

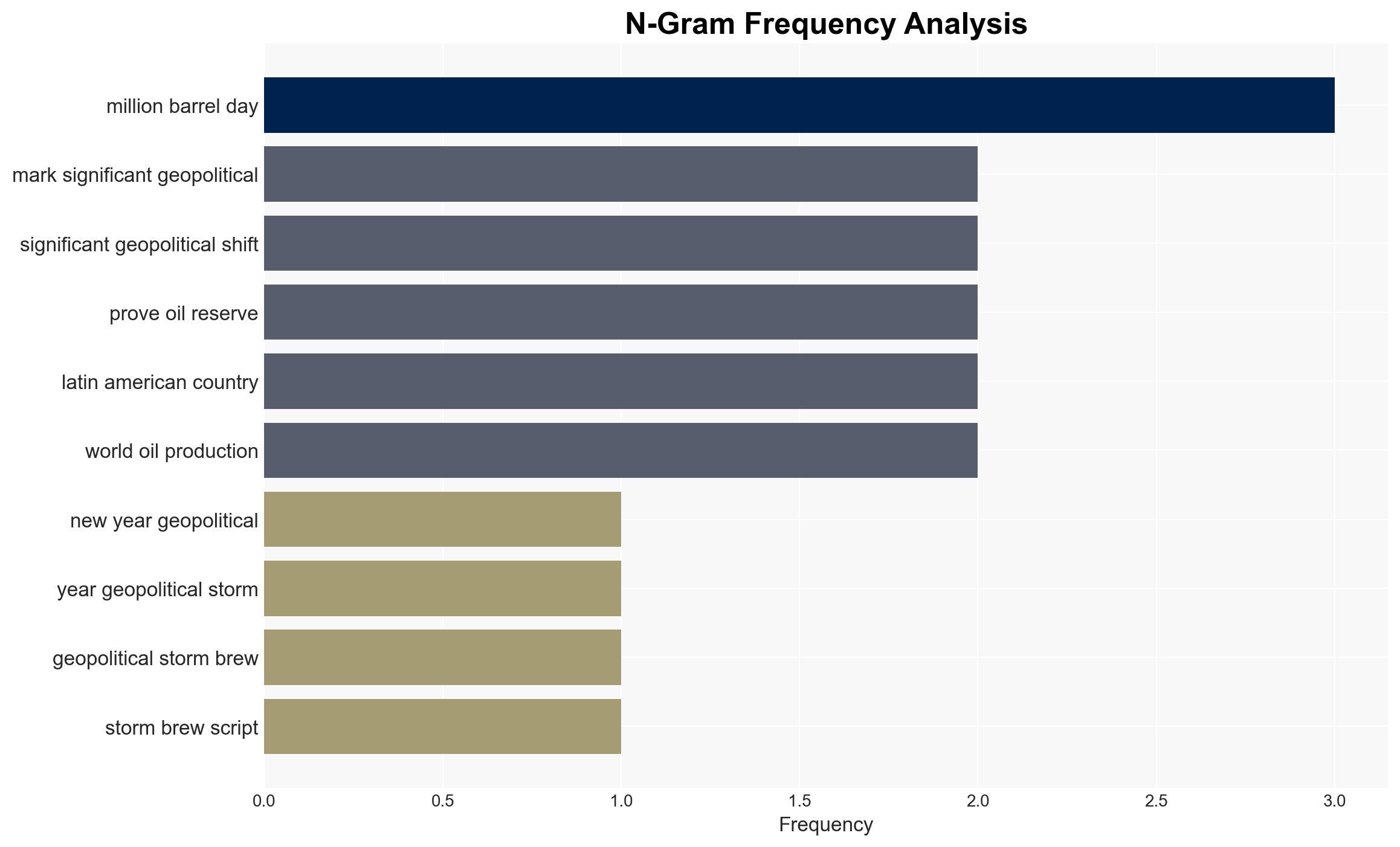

The US intervention in Venezuela, marked by the capture of President Nicolás Maduro, is poised to significantly alter global oil dynamics and geopolitical alignments. This development could enhance US influence over global oil markets and reshape economic and political landscapes, particularly in Latin America. The overall confidence level in this assessment is moderate, given the incomplete information and potential for rapid changes in the situation.

2. Competing Hypotheses

- Hypothesis A: The US intervention will lead to a successful transition of power in Venezuela, stabilizing the region and boosting US economic interests through control of Venezuelan oil reserves. This is supported by the US’s strategic interest in stabilizing its influence in Latin America and leveraging Venezuela’s oil reserves. However, uncertainties include potential resistance from local factions and international backlash.

- Hypothesis B: The intervention may lead to prolonged instability in Venezuela, with resistance from local actors and potential international condemnation, hindering US efforts to control the oil reserves. This hypothesis is supported by historical challenges in regime change operations and the complexity of Venezuelan internal politics.

- Assessment: Hypothesis A is currently better supported due to the immediate strategic gains for the US and the alignment of US refineries with Venezuelan crude. Key indicators that could shift this judgment include the emergence of significant local resistance or international diplomatic pressures against the US actions.

3. Key Assumptions and Red Flags

- Assumptions: The US will maintain political will and resources to manage Venezuela’s transition; Venezuelan oil infrastructure can be revitalized with US investment; local resistance will be manageable.

- Information Gaps: Details on the extent of local support or opposition to the US intervention; specific plans for the transition of power; international reactions from key global players.

- Bias & Deception Risks: Potential US source bias in reporting success and strategic benefits; risk of underestimating local resistance due to cognitive biases favoring intervention outcomes.

4. Implications and Strategic Risks

This development could lead to shifts in global energy markets, affecting oil prices and economic stability in oil-dependent regions. The geopolitical landscape in Latin America may realign, with potential ripple effects on US relations with other regional powers.

- Political / Geopolitical: Potential for increased US influence in Latin America; risk of strained relations with countries opposing the intervention.

- Security / Counter-Terrorism: Possible rise in local insurgency or terrorism as a reaction to foreign intervention.

- Cyber / Information Space: Likely increase in cyber operations targeting US interests in Venezuela; potential misinformation campaigns.

- Economic / Social: Short-term economic instability in Venezuela; potential long-term economic benefits if oil production is revitalized.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Monitor local reactions and international diplomatic responses; assess the condition of Venezuelan oil infrastructure.

- Medium-Term Posture (1–12 months): Develop partnerships with regional allies to support stabilization efforts; invest in infrastructure and capacity-building in Venezuela.

- Scenario Outlook:

- Best: Successful transition and revitalization of the oil industry, enhancing US economic interests.

- Worst: Prolonged conflict and instability, leading to a humanitarian crisis and international condemnation.

- Most-Likely: Gradual stabilization with intermittent resistance, requiring sustained US engagement.

6. Key Individuals and Entities

- Nicolás Maduro – Captured Venezuelan President

- Donald Trump – US President

- US Special Forces – Involved in the capture operation

- JP Morgan – Provided analysis on oil market impact

- Ankita Pathak – Head of Global Investments, Ionic Asset

- Swarnendu Bhushan – Research Analyst, PL Capital

7. Thematic Tags

regional conflicts, geopolitics, oil markets, US foreign policy, Latin America, regime change, economic impact, energy security

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

- Narrative Pattern Analysis: Deconstruct and track propaganda or influence narratives.

Explore more:

Regional Conflicts Briefs ·

Daily Summary ·

Support us