US Delay on Iran Military Action Triggers Significant Drop in Oil Prices

Published on: 2026-01-15

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Oil Falls Sharply as US Pauses Iran Action

1. BLUF (Bottom Line Up Front)

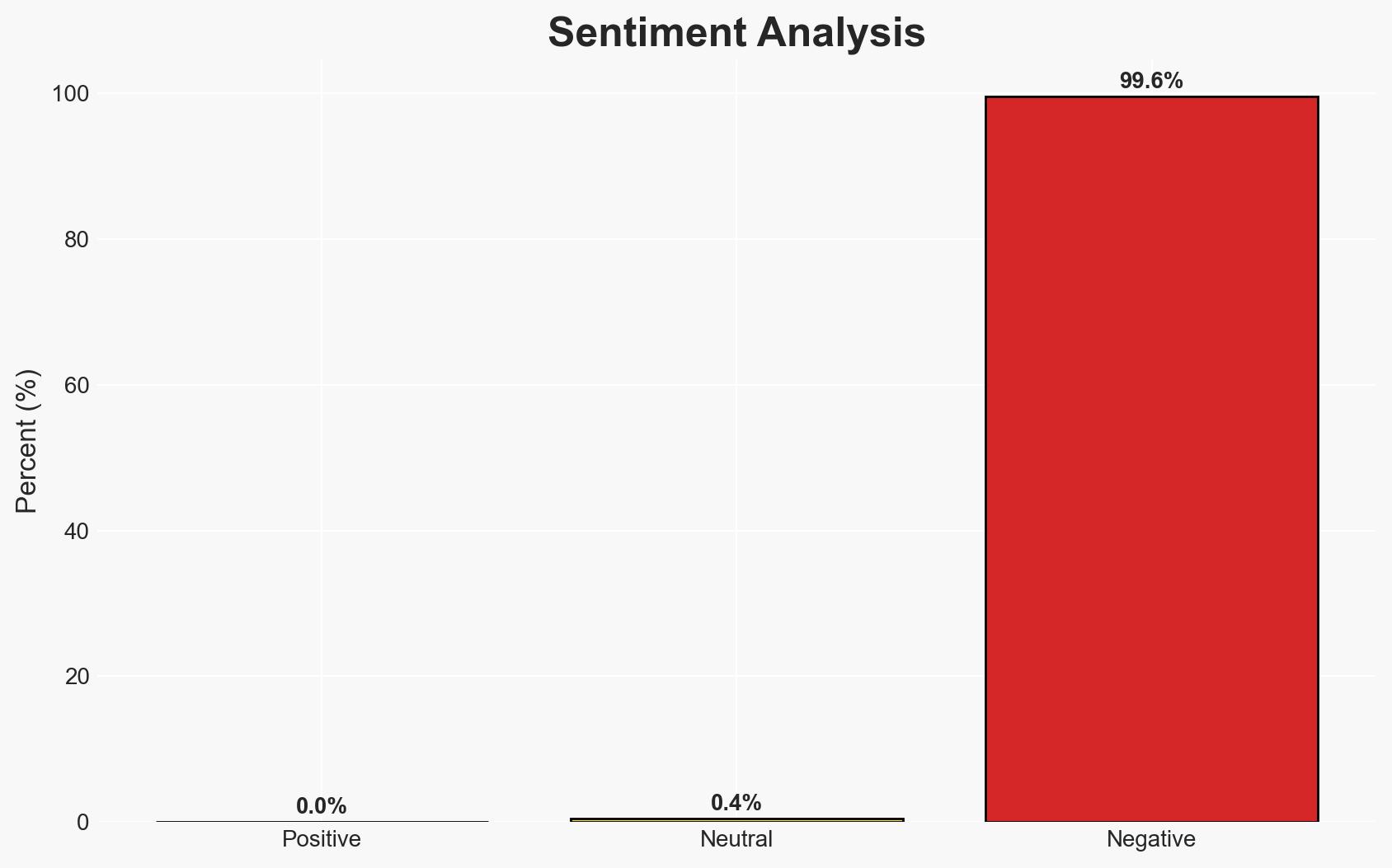

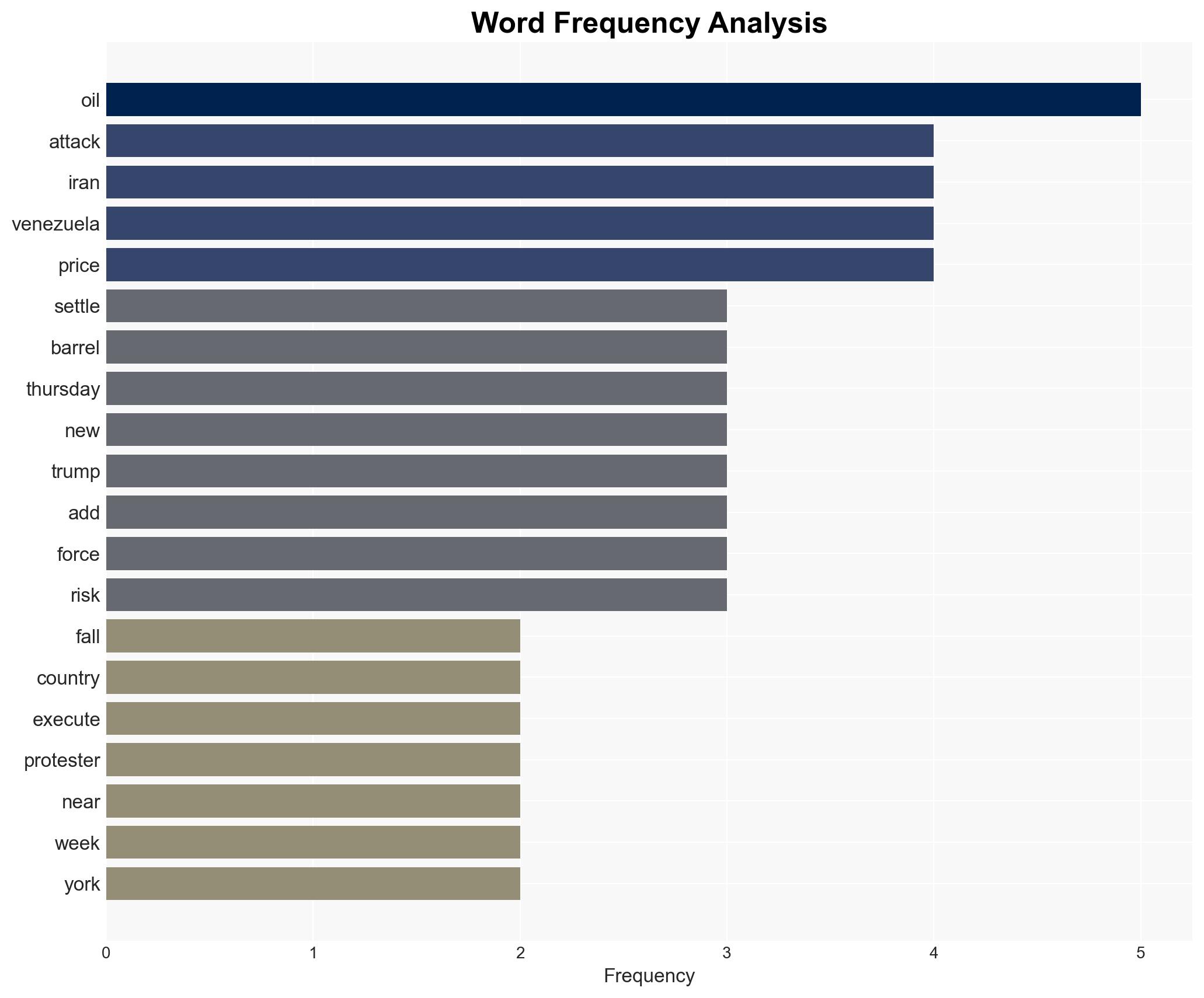

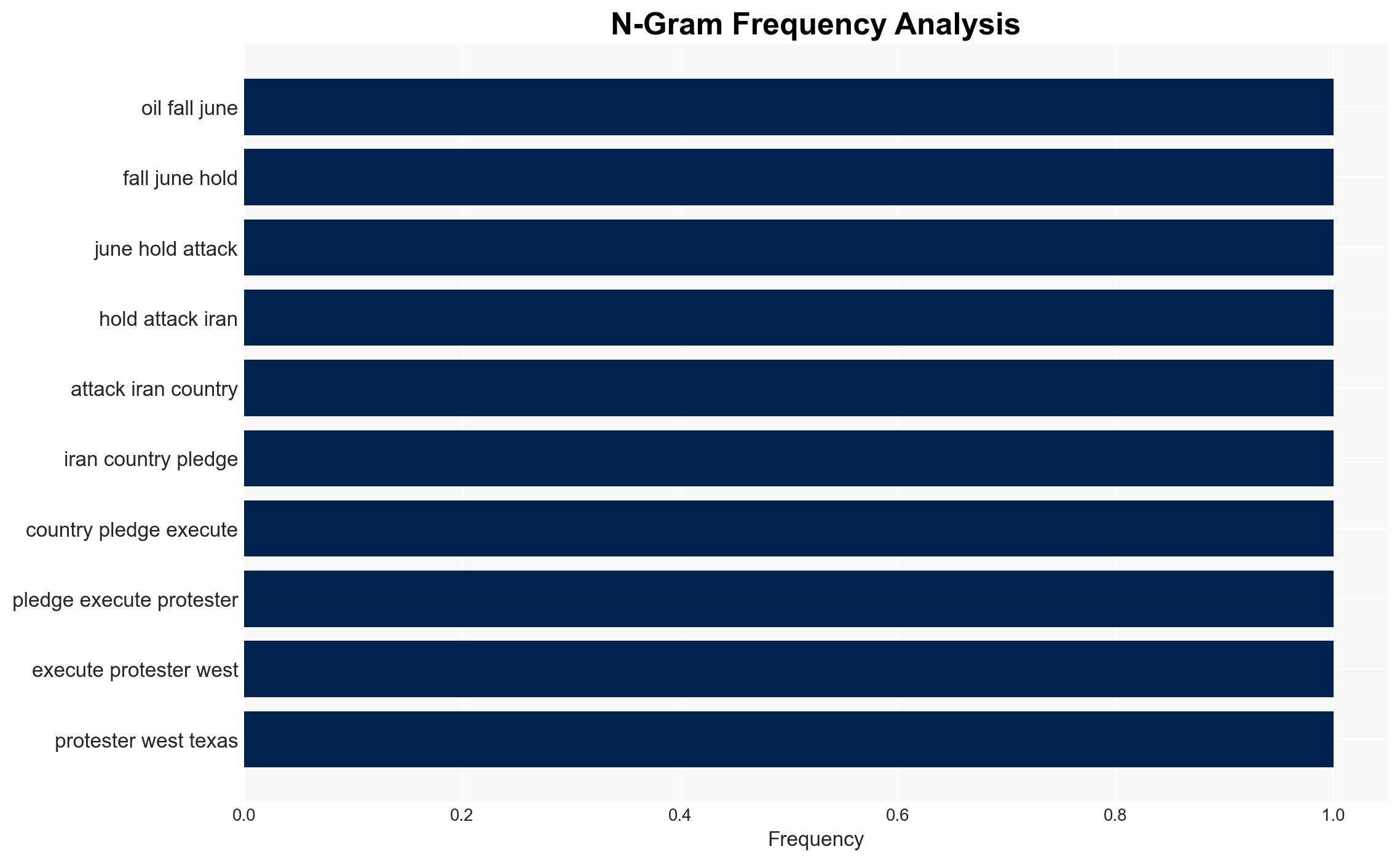

The recent decision by the US to delay military action against Iran has led to a significant drop in oil prices, reflecting reduced geopolitical tensions. This development affects global oil markets and regional stability, with moderate confidence in the assessment that the US is prioritizing diplomatic and economic measures over immediate military intervention.

2. Competing Hypotheses

- Hypothesis A: The US is genuinely seeking a diplomatic resolution with Iran, leveraging sanctions and diplomatic pressure to achieve compliance without military conflict. This is supported by the US Treasury’s sanctions and public statements indicating a preference for non-military measures. However, uncertainties remain about Iran’s long-term compliance and the potential for internal unrest to escalate.

- Hypothesis B: The US is using the threat of military action as a strategic deterrent while preparing for potential future conflict. The postponement may be temporary, influenced by Israel’s request and internal US considerations. Contradicting evidence includes the immediate de-escalation in rhetoric and the imposition of sanctions as a substitute for military action.

- Assessment: Hypothesis A is currently better supported due to the immediate actions taken by the US, such as sanctions and public statements emphasizing non-military consequences. Key indicators that could shift this judgment include changes in Iran’s domestic policy or renewed aggressive actions by Iran in the region.

3. Key Assumptions and Red Flags

- Assumptions: The US is committed to avoiding military conflict with Iran; Iran will respond to economic and diplomatic pressures; Israel’s influence on US policy is significant but not overriding.

- Information Gaps: Detailed intelligence on Iran’s internal political dynamics and decision-making processes; clarity on US-Israel strategic discussions and agreements.

- Bias & Deception Risks: Potential confirmation bias in interpreting US and Iranian public statements; risk of Iranian deception regarding protester executions to delay US action.

4. Implications and Strategic Risks

The US decision to pause military action against Iran could stabilize oil markets in the short term but leaves open the potential for future volatility. This development interacts with broader regional dynamics, including US-Iran relations and OPEC’s stability.

- Political / Geopolitical: Potential for improved US-Iran relations if diplomatic efforts succeed, but risk of escalation remains if Iran resumes aggressive actions.

- Security / Counter-Terrorism: Reduced immediate threat of military conflict, but ongoing risk of proxy conflicts and terrorism in the region.

- Cyber / Information Space: Potential for increased cyber operations by Iran as a form of asymmetric retaliation against US sanctions.

- Economic / Social: Short-term stabilization of oil prices, but economic sanctions may exacerbate internal unrest in Iran, affecting social cohesion.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Monitor Iranian compliance with protester execution pledges; enhance intelligence collection on Iran’s internal political dynamics.

- Medium-Term Posture (1–12 months): Strengthen diplomatic channels with regional allies; prepare contingency plans for potential escalation scenarios.

- Scenario Outlook:

- Best: Diplomatic resolution leads to reduced tensions and stable oil markets.

- Worst: Breakdown in negotiations results in renewed military conflict and oil market volatility.

- Most-Likely: Continued diplomatic engagement with periodic tensions affecting oil prices.

6. Key Individuals and Entities

- US President Donald Trump

- Israel’s Prime Minister Benjamin Netanyahu

- White House Press Secretary Karoline Leavitt

- Iran’s Secretary of the Supreme National Security Council (sanctioned)

- John Evans, Analyst at brokerage PVM

- A.P. Moller-Maersk A/S

7. Thematic Tags

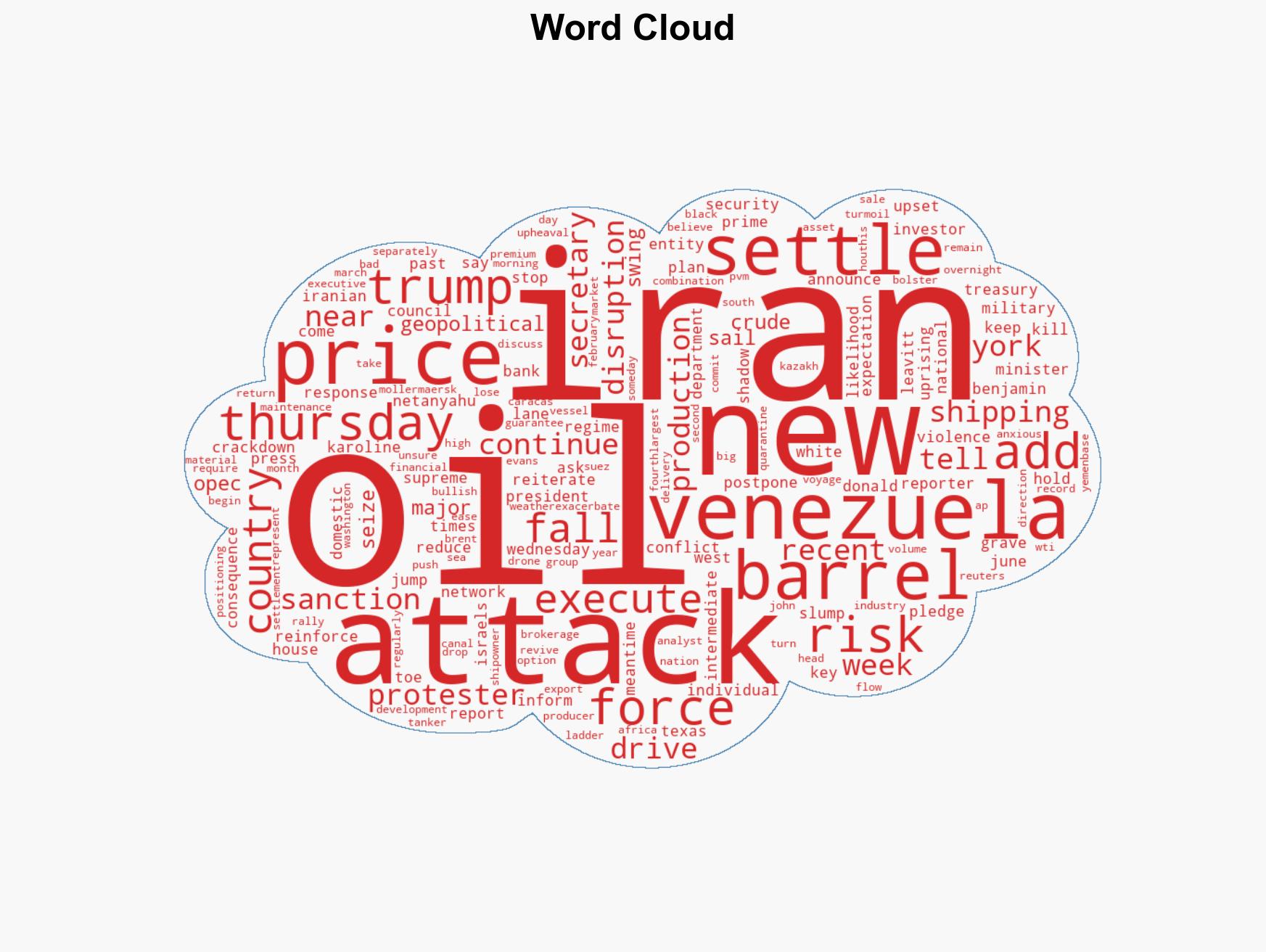

regional conflicts, oil markets, US-Iran relations, sanctions, geopolitical risk, OPEC stability, military strategy, economic sanctions

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Regional Conflicts Briefs ·

Daily Summary ·

Support us