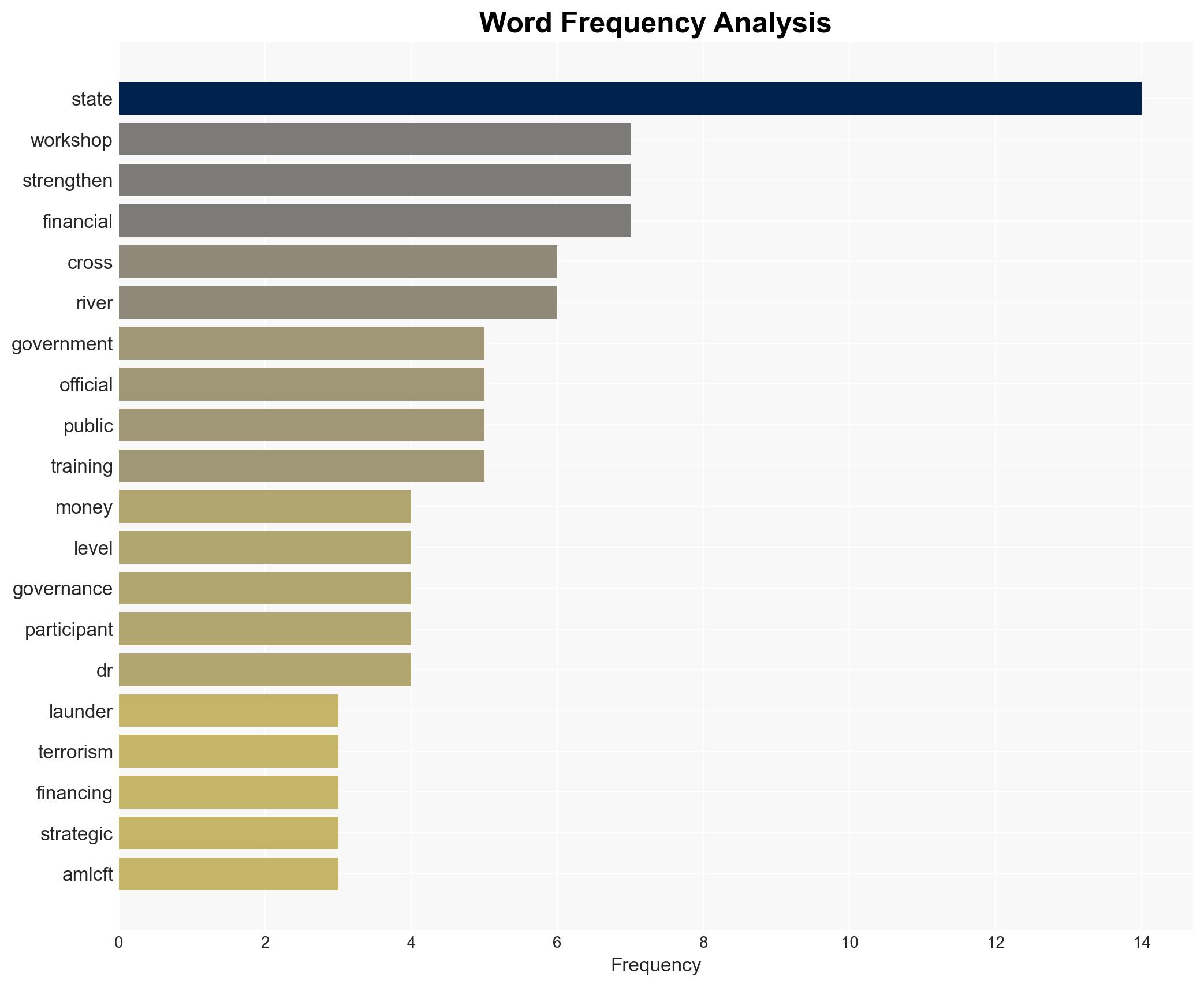

Cross River State Launches Workshop to Combat Money Laundering and Terrorism Financing Among Officials

Published on: 2026-01-23

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: CRiver trains officials in anti-money laundering terrorism financing

1. BLUF (Bottom Line Up Front)

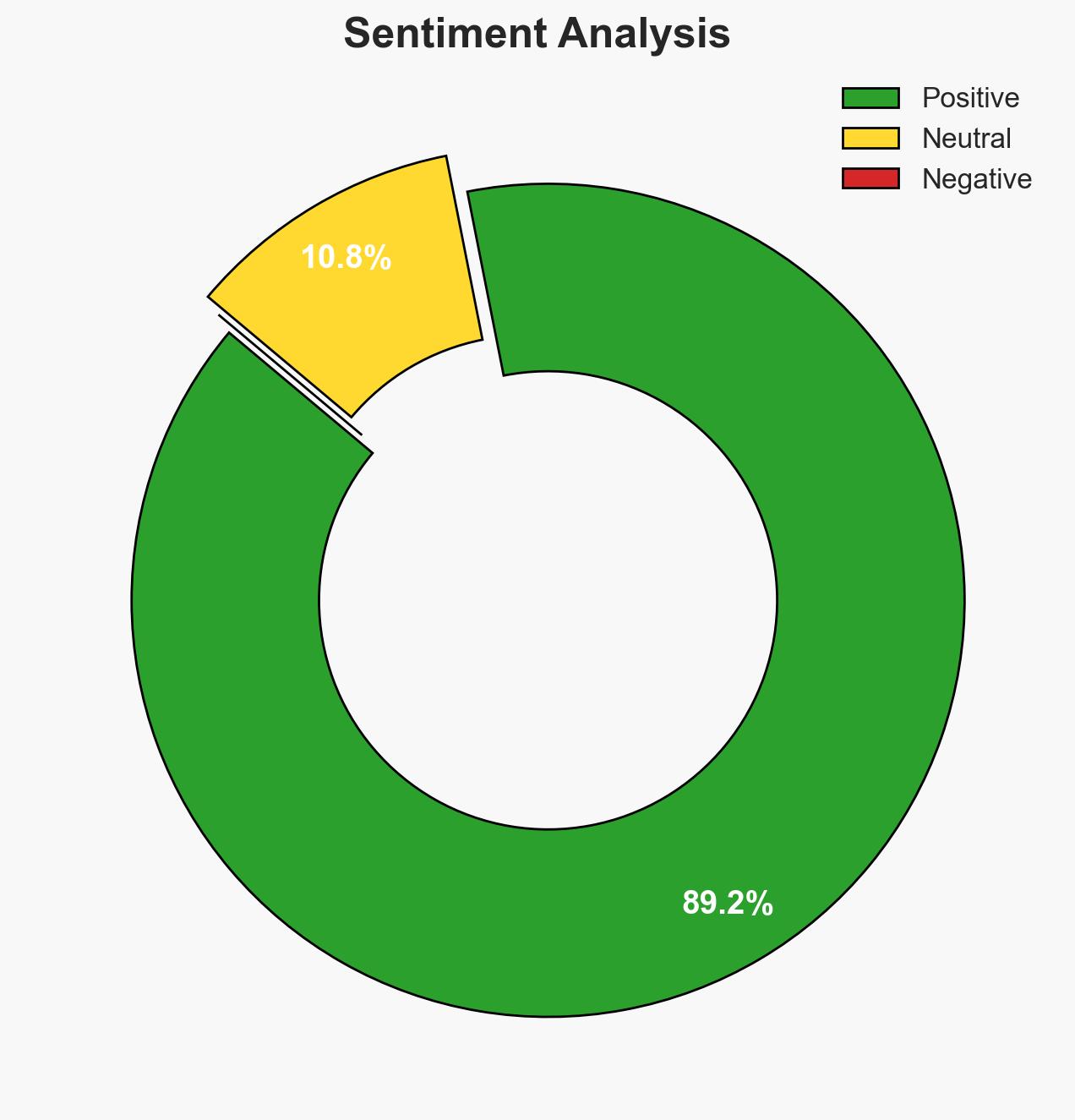

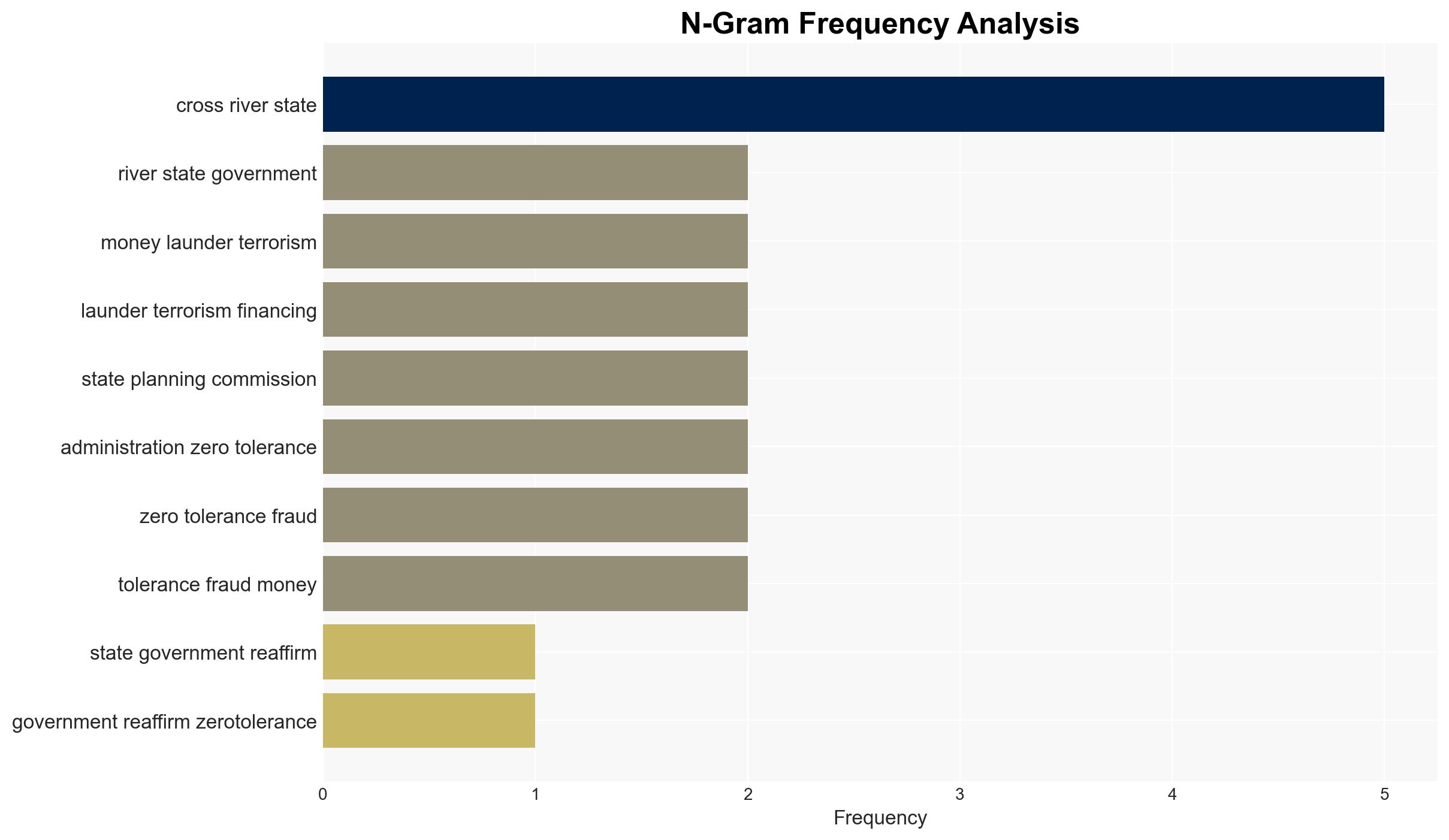

The Cross River State Government’s recent AML/CFT workshop for senior officials is a strategic move to enhance financial governance and counter financial crimes. The initiative is likely to improve compliance with national and international standards, though its long-term effectiveness depends on sustained implementation and monitoring. This assessment is made with moderate confidence.

2. Competing Hypotheses

- Hypothesis A: The workshop is a genuine effort by the Cross River State Government to strengthen financial governance and counter financial crimes. Supporting evidence includes the involvement of high-level officials and the strategic focus on AML/CFT. However, the effectiveness of such initiatives is uncertain without ongoing commitment and monitoring.

- Hypothesis B: The workshop serves primarily as a public relations exercise to project an image of good governance without substantial follow-through. This hypothesis is supported by the potential for limited actual enforcement and the historical challenges in sustaining anti-corruption measures. Contradicting evidence includes the detailed program and high-level endorsements.

- Assessment: Hypothesis A is currently better supported due to the structured approach and involvement of key stakeholders. Indicators such as follow-up actions and policy changes could shift this judgment.

3. Key Assumptions and Red Flags

- Assumptions: The state government has the political will to enforce AML/CFT measures; the workshop content is comprehensive and actionable; participants will apply the training effectively.

- Information Gaps: Details on the workshop’s curriculum and metrics for success; follow-up mechanisms to ensure implementation; historical data on previous similar initiatives.

- Bias & Deception Risks: Potential for confirmation bias if relying solely on official statements; risk of source bias from state-controlled narratives; possibility of deceptive practices to mask non-compliance.

4. Implications and Strategic Risks

This development could enhance the state’s financial governance framework if sustained, but risks remain if it lacks follow-through. The initiative may influence broader governance and anti-corruption efforts in Nigeria.

- Political / Geopolitical: Could enhance the state’s reputation and influence within Nigeria, potentially attracting more investment.

- Security / Counter-Terrorism: Improved financial governance may reduce funding channels for terrorism, enhancing regional security.

- Cyber / Information Space: Increased focus on AML/CFT could lead to enhanced cybersecurity measures, though specific impacts are unclear.

- Economic / Social: Strengthened financial systems could improve economic stability and public trust, though social impacts depend on visible enforcement outcomes.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Monitor the implementation of workshop outcomes; engage with participants for feedback; assess initial compliance improvements.

- Medium-Term Posture (1–12 months): Develop partnerships with national and international AML/CFT bodies; invest in capacity-building and technology for sustained enforcement.

- Scenario Outlook: Best: Effective implementation leads to reduced financial crimes. Worst: Initiative fails due to lack of follow-through. Most-Likely: Incremental improvements with ongoing challenges in enforcement.

6. Key Individuals and Entities

- Governor Bassey Otu

- Deputy Governor Rt. Hon. Peter Odey

- Dr Bong Duke, Vice Chairman and CEO of the State Planning Commission

- Dr Ade Shonubi, Lead Facilitator

7. Thematic Tags

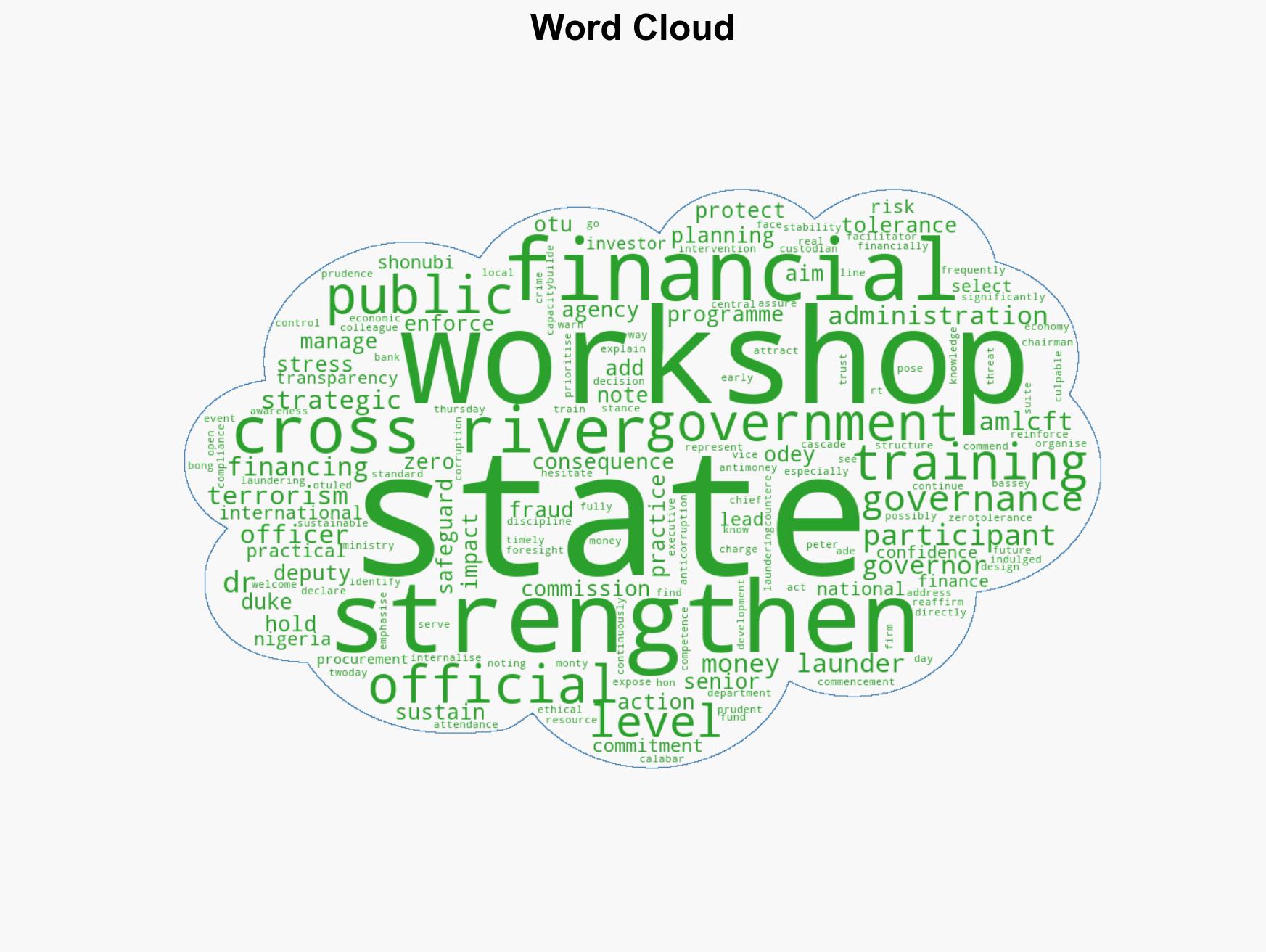

national security threats, anti-money laundering, counter-terrorism financing, governance, financial compliance, capacity building, Nigeria, public sector reform

Structured Analytic Techniques Applied

- Cognitive Bias Stress Test: Expose and correct potential biases in assessments through red-teaming and structured challenge.

- Bayesian Scenario Modeling: Use probabilistic forecasting for conflict trajectories or escalation likelihood.

- Network Influence Mapping: Map relationships between state and non-state actors for impact estimation.

Explore more:

National Security Threats Briefs ·

Daily Summary ·

Support us