Gold and Silver Prices Surge Amid Global Demand; Current Rates in Major Indian Cities on January 29

Published on: 2026-01-29

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Gold Silver Price Today Jan 29 – Check Prices In Mumbai Delhi Chennai

1. BLUF (Bottom Line Up Front)

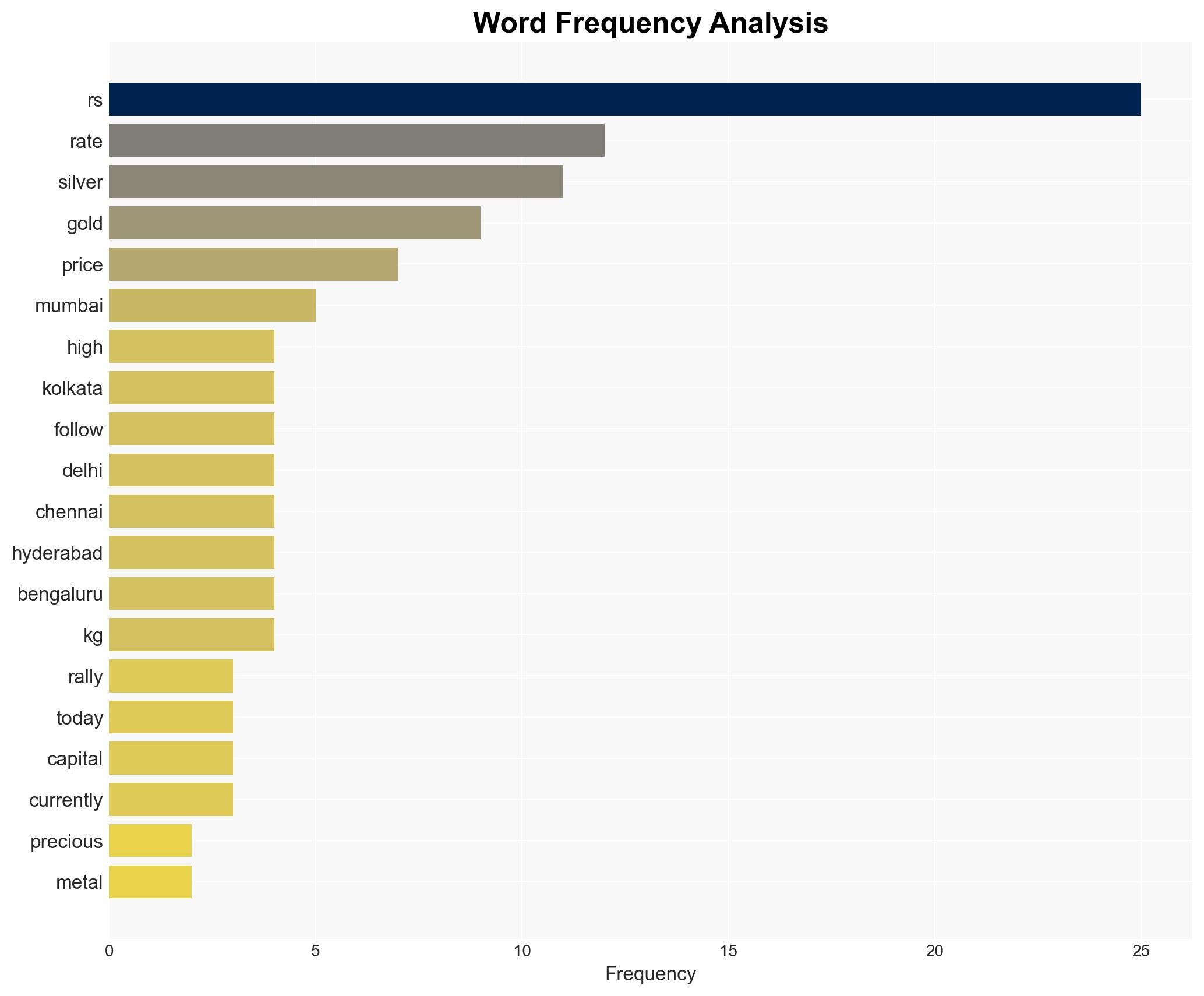

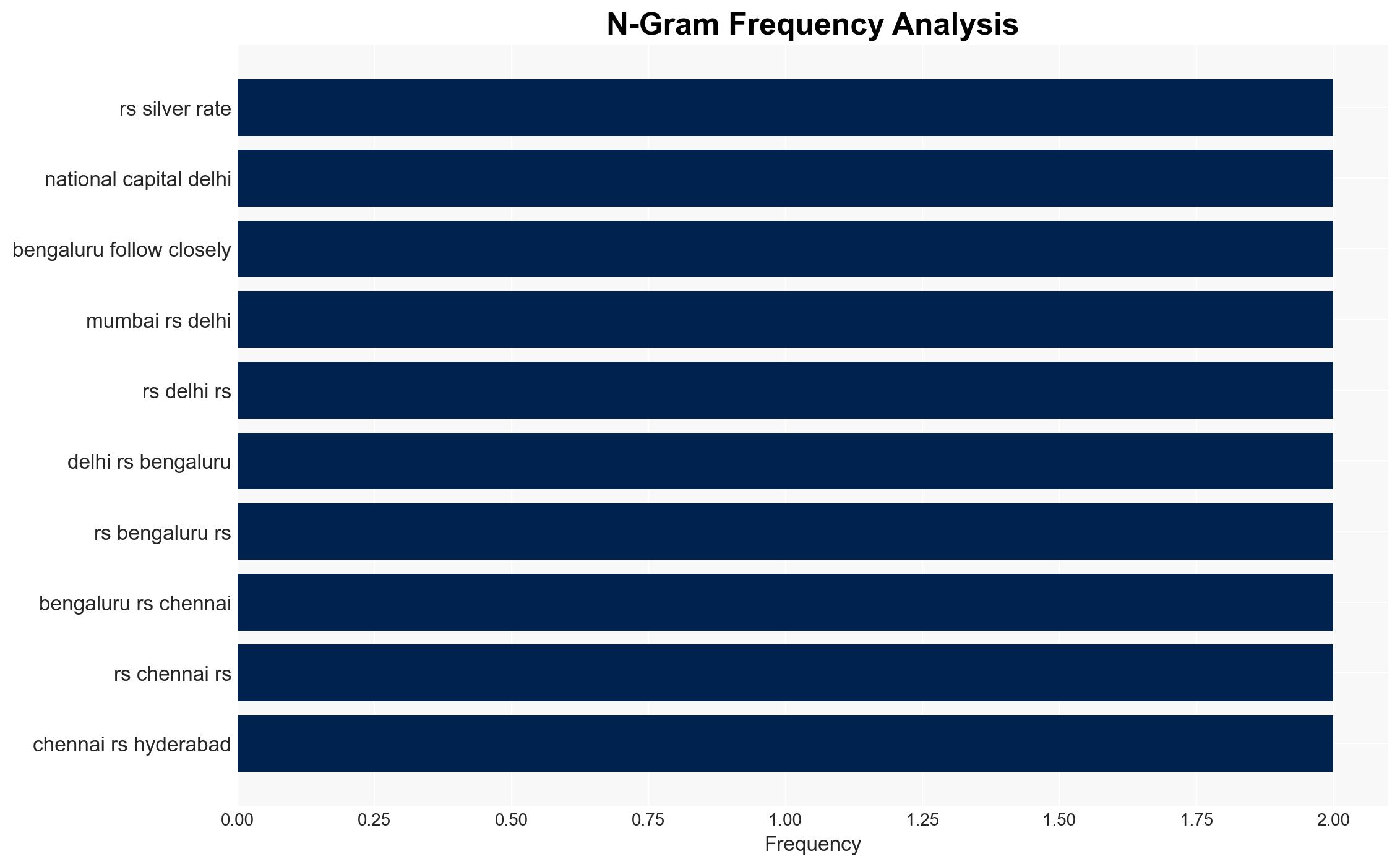

The surge in gold and silver prices is primarily driven by geopolitical tensions and trade uncertainties, with a weak US dollar further amplifying the trend. This affects global markets and local economies, particularly in India, where regional price disparities are evident. Overall, this assessment is made with moderate confidence due to the complexity of the factors involved and potential for rapid change.

2. Competing Hypotheses

- Hypothesis A: The increase in gold and silver prices is primarily due to geopolitical tensions and trade uncertainties. Supporting evidence includes the weak US dollar and increased demand for safe-haven assets. However, the specific geopolitical events driving this trend are not detailed, presenting a key uncertainty.

- Hypothesis B: The price surge is driven by speculative market behavior and investor sentiment rather than fundamental geopolitical or economic factors. This is supported by the rapid price increases and the role of silver in emerging technologies, which may attract speculative investment. Contradicting evidence includes the reported influence of geopolitical tensions.

- Assessment: Hypothesis A is currently better supported due to the explicit mention of geopolitical tensions and trade uncertainties as catalysts. Future shifts could occur if new geopolitical developments arise or if speculative behavior becomes more evident.

3. Key Assumptions and Red Flags

- Assumptions: The geopolitical tensions mentioned are significant enough to impact global markets; the weak US dollar will continue to influence precious metal prices; regional price variations in India reflect broader market trends.

- Information Gaps: Specific geopolitical events or trade issues driving the price increases are not detailed; the role of speculative investments in the current price trends is unclear.

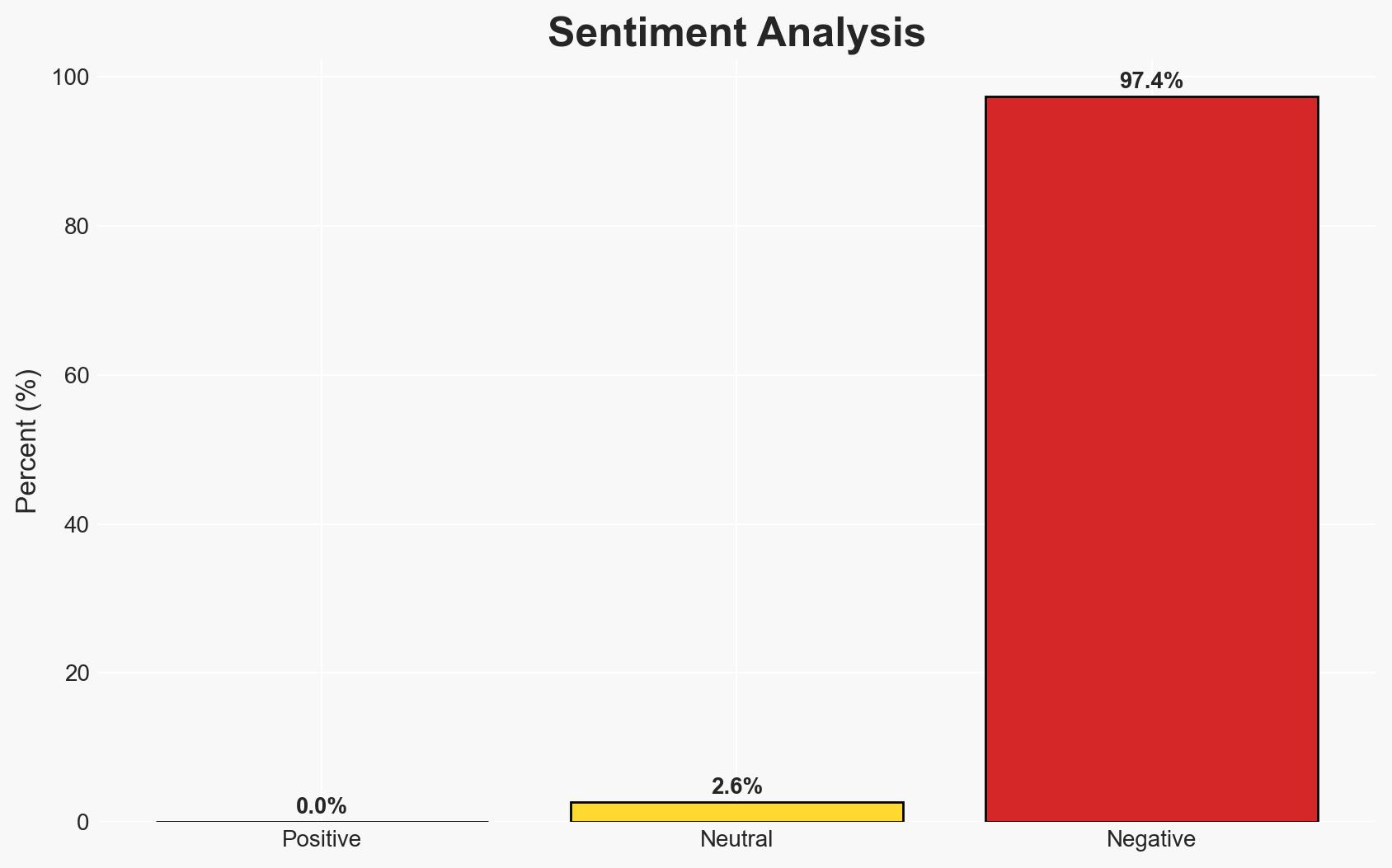

- Bias & Deception Risks: Potential bias in attributing price increases solely to geopolitical factors without considering speculative market behavior; reliance on a single analyst’s perspective could introduce confirmation bias.

4. Implications and Strategic Risks

The ongoing rise in precious metal prices could lead to increased economic volatility and influence monetary policy decisions. Over time, this trend could interact with broader economic and geopolitical dynamics, potentially exacerbating existing tensions or creating new ones.

- Political / Geopolitical: Heightened geopolitical tensions could lead to further economic instability and impact international relations.

- Security / Counter-Terrorism: Increased economic volatility may affect national security budgets and priorities.

- Cyber / Information Space: Potential for misinformation campaigns exploiting economic uncertainties to destabilize markets.

- Economic / Social: Rising precious metal prices could impact consumer spending and savings behavior, influencing broader economic stability.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Monitor geopolitical developments closely; assess the impact of price changes on local economies and adjust monetary policies accordingly.

- Medium-Term Posture (1–12 months): Develop resilience measures to mitigate economic volatility; strengthen international partnerships to address trade uncertainties.

- Scenario Outlook:

- Best: Geopolitical tensions ease, stabilizing prices.

- Worst: Escalation of tensions leads to further economic instability.

- Most-Likely: Prices remain volatile, influenced by ongoing geopolitical and economic factors.

6. Key Individuals and Entities

- Saumil Gandhi, Senior Analyst – Commodities at HDFC Securities

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

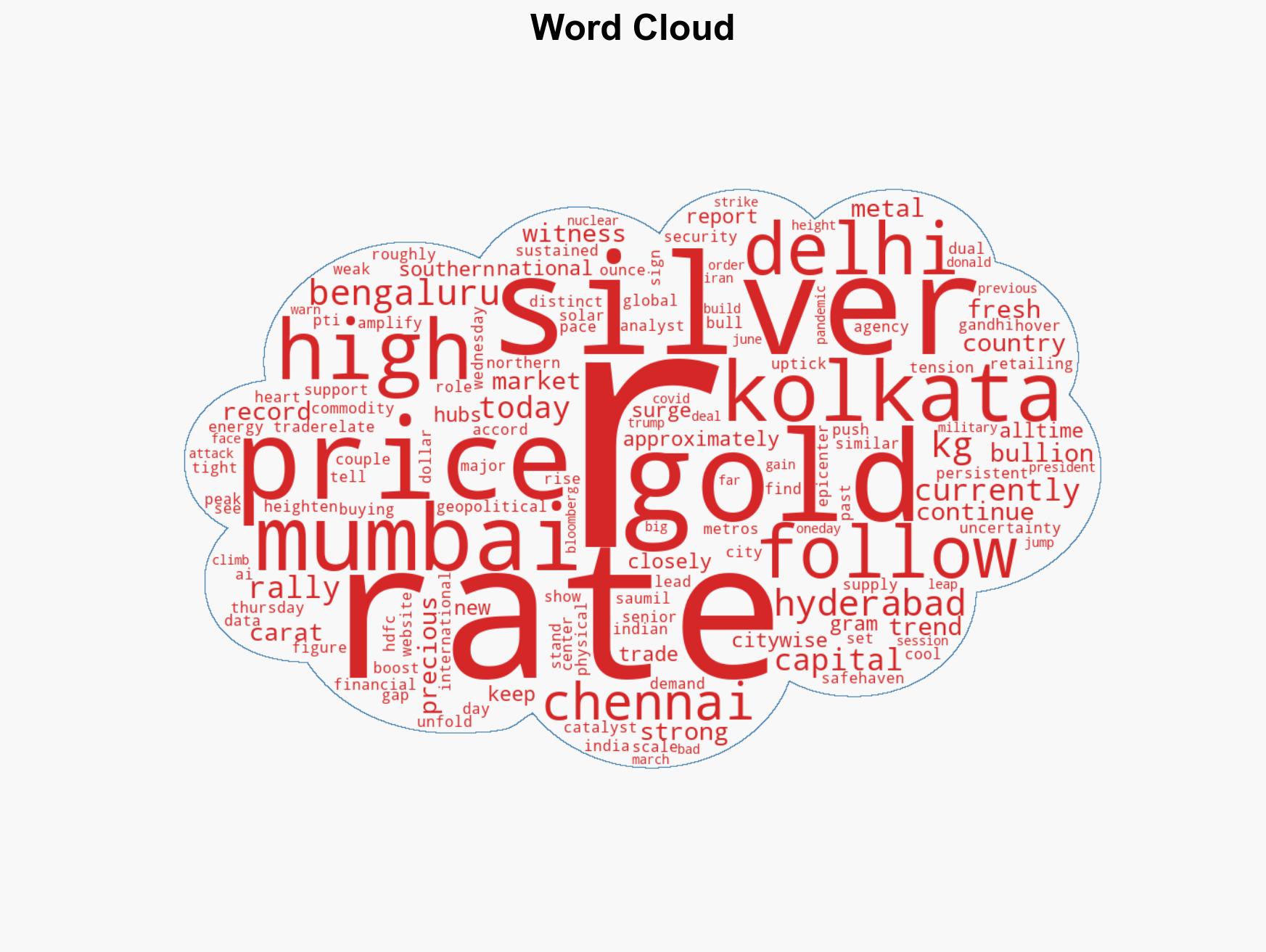

regional conflicts, geopolitical tensions, trade uncertainties, precious metals, economic volatility, safe-haven assets, speculative investment, regional price disparities

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Conflicts Briefs ·

Daily Summary ·

Support us