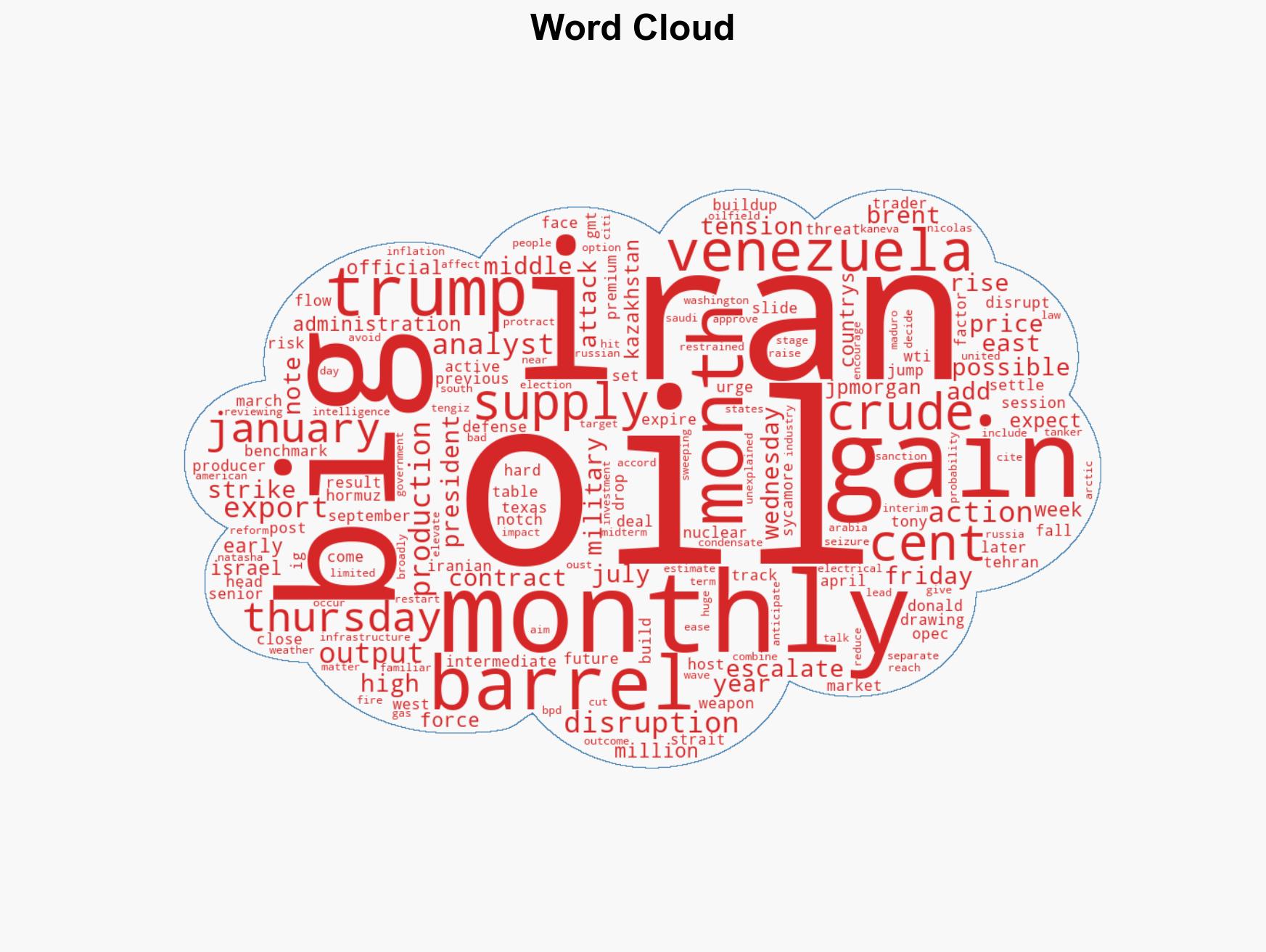

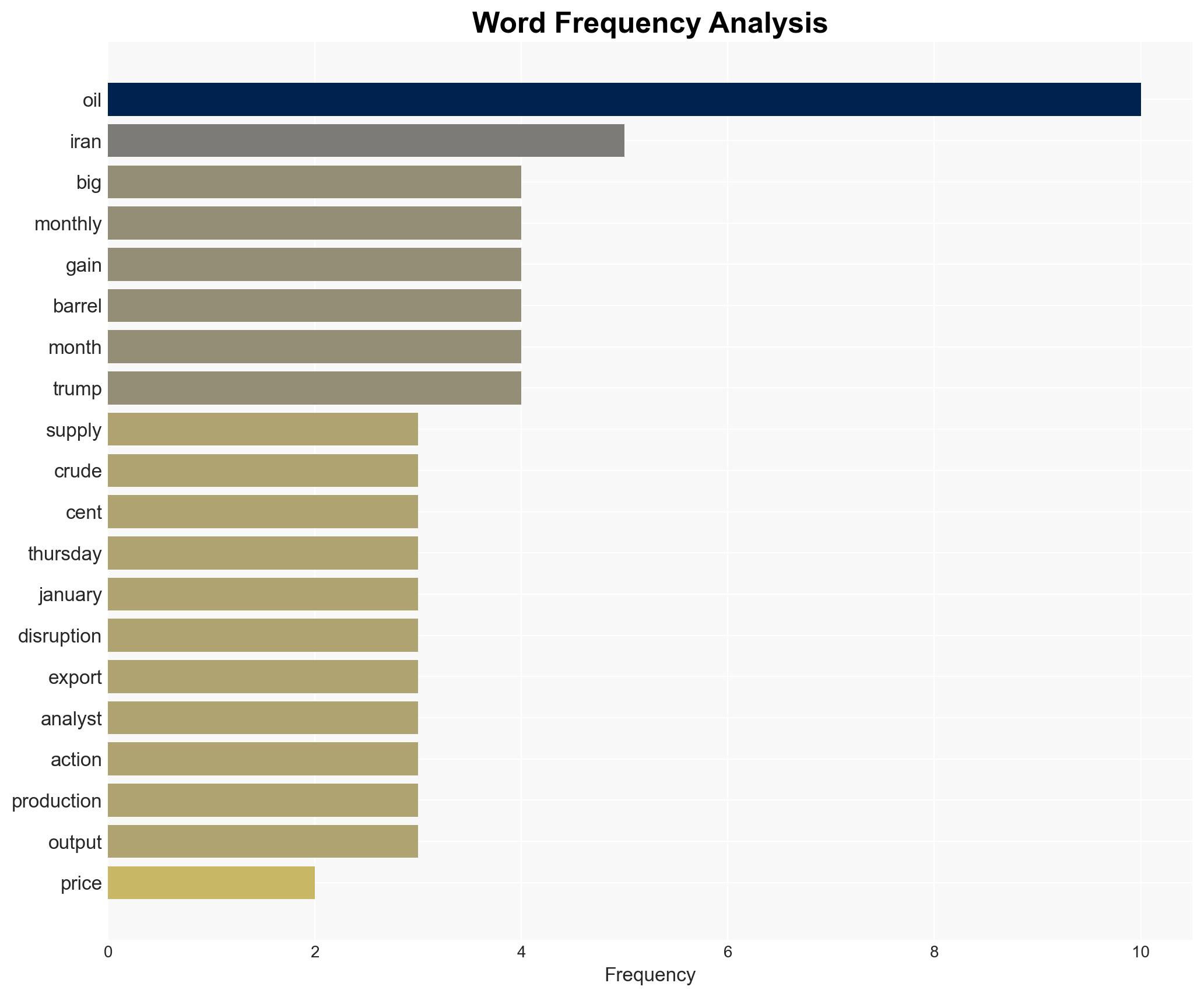

Oil prices near multi-month peaks amid rising Middle East tensions and potential U.S. action against Iran

Published on: 2026-01-30

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Oil hovers near multi-month highs as Trump considers Iran strike

1. BLUF (Bottom Line Up Front)

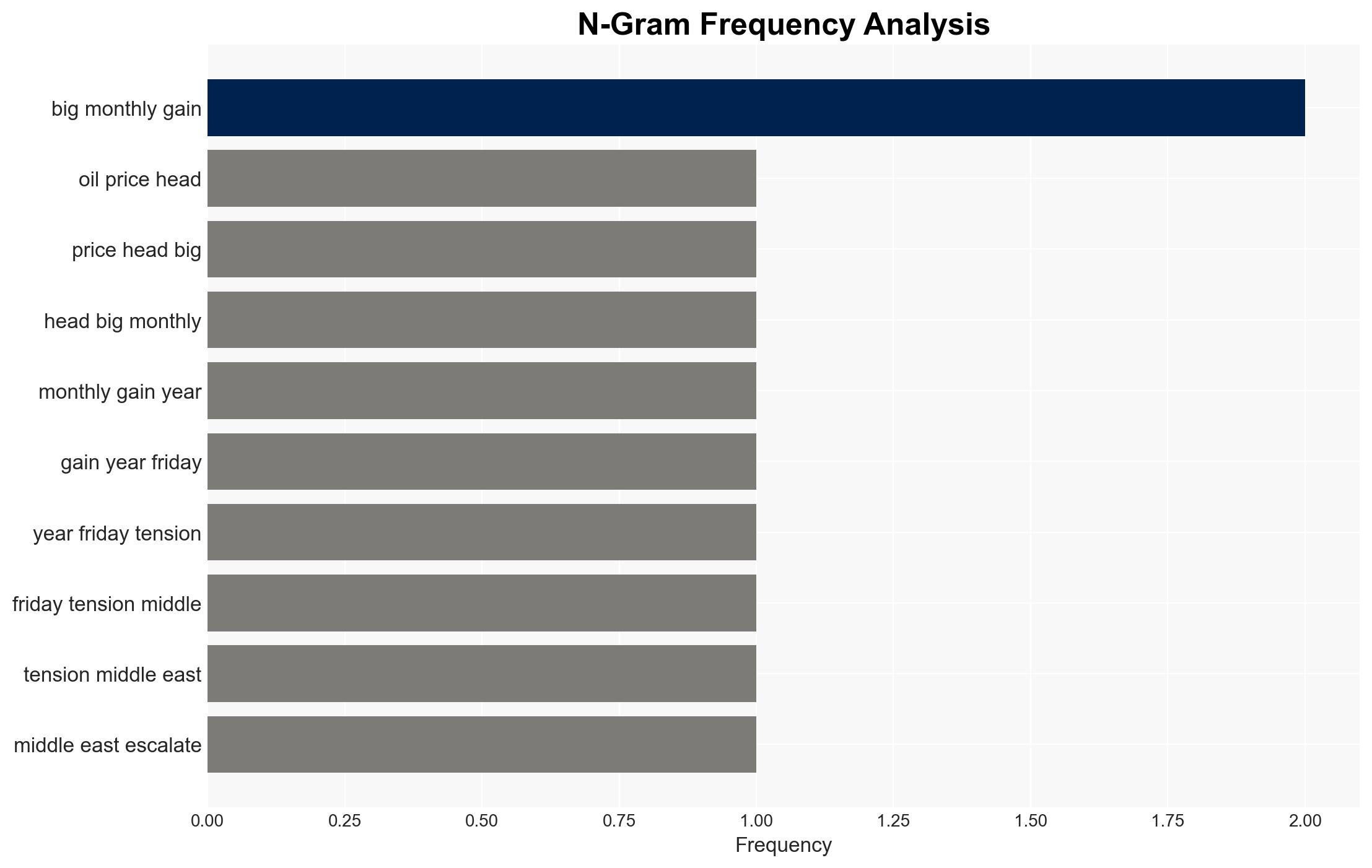

Oil prices are experiencing significant volatility due to heightened tensions between the U.S. and Iran, with potential military actions posing a risk to global oil supply stability. The most likely hypothesis is that the U.S. will engage in limited military actions that avoid major disruptions to oil infrastructure, with moderate confidence in this assessment. Key stakeholders include OPEC nations, global oil markets, and geopolitical actors in the Middle East.

2. Competing Hypotheses

- Hypothesis A: The U.S. will conduct limited military strikes on Iran, avoiding significant disruption to oil infrastructure. This is supported by current U.S. diplomatic engagements with Israel and Saudi Arabia and the strategic importance of maintaining oil flow stability. However, uncertainty remains regarding Iran’s potential retaliatory actions.

- Hypothesis B: The U.S. will escalate to broader military conflict with Iran, leading to significant disruptions in oil supply. This is less supported due to the potential economic and political costs, particularly in an election year, and the current U.S. administration’s focus on targeted actions.

- Assessment: Hypothesis A is currently best supported due to diplomatic efforts and economic considerations. Key indicators that could shift this judgment include changes in Iran’s military posture or unexpected regional alliances.

3. Key Assumptions and Red Flags

- Assumptions: The U.S. aims to avoid major oil supply disruptions; Iran will retaliate proportionally; diplomatic channels remain open.

- Information Gaps: Specific details on U.S. military plans and Iran’s strategic intentions are lacking.

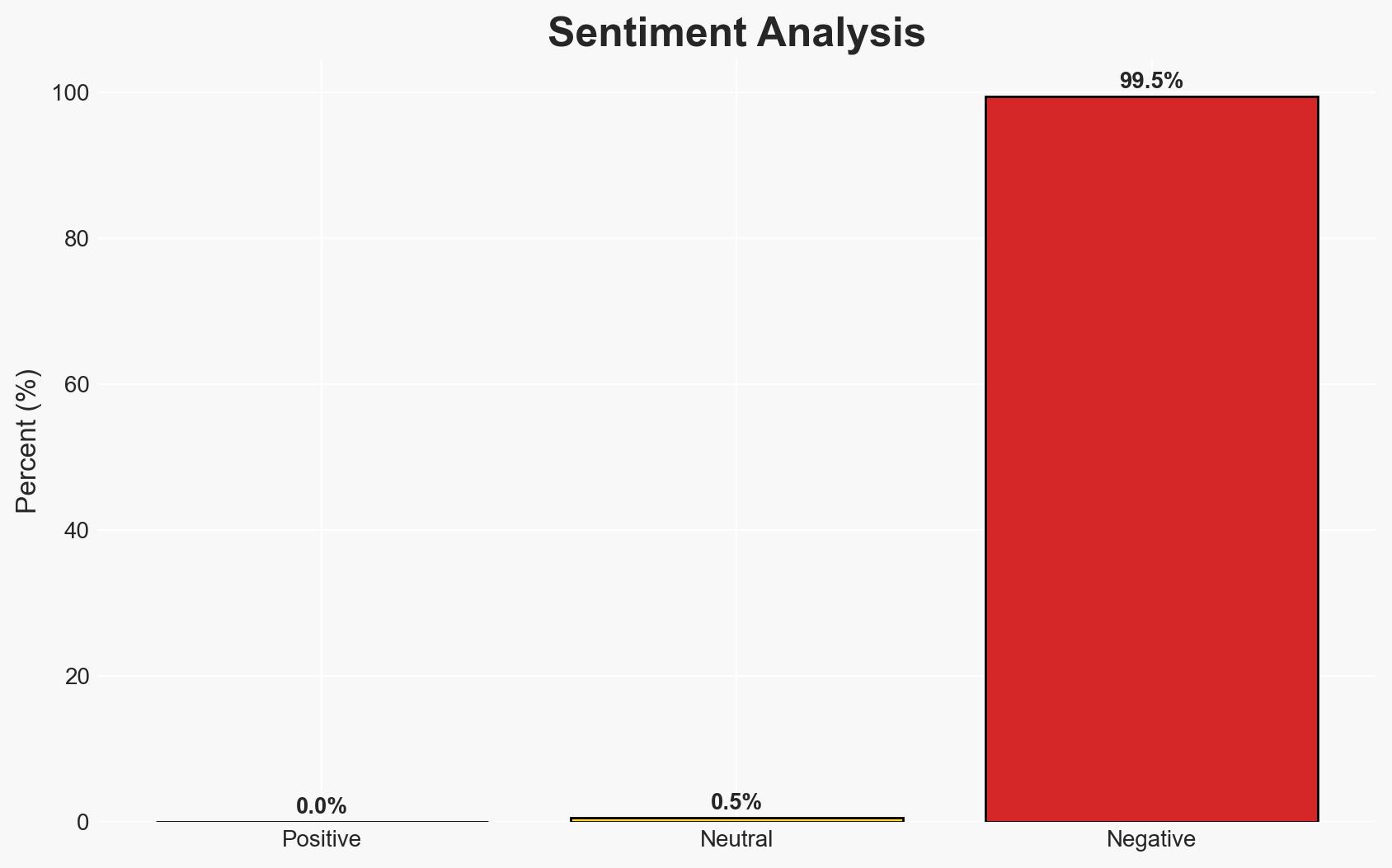

- Bias & Deception Risks: Potential for source bias from market analysts; risk of strategic deception by both U.S. and Iranian officials to influence public perception.

4. Implications and Strategic Risks

The situation could lead to increased geopolitical instability in the Middle East, affecting global oil markets and international relations.

- Political / Geopolitical: Potential for regional escalation involving U.S. allies and adversaries; impact on U.S. foreign policy credibility.

- Security / Counter-Terrorism: Increased threat of asymmetric retaliation by Iran or proxy groups against U.S. interests.

- Cyber / Information Space: Potential for cyber operations targeting critical infrastructure and information warfare to shape narratives.

- Economic / Social: Oil price volatility could impact global economic stability and domestic inflation rates.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Enhance monitoring of military movements and diplomatic communications; prepare contingency plans for oil supply disruptions.

- Medium-Term Posture (1–12 months): Strengthen alliances with regional partners; invest in alternative energy sources to reduce dependency on Middle Eastern oil.

- Scenario Outlook:

- Best: Diplomatic resolution reduces tensions, stabilizing oil markets.

- Worst: Full-scale conflict disrupts global oil supply, leading to economic recession.

- Most-Likely: Limited military engagement with temporary oil price spikes, followed by stabilization.

6. Key Individuals and Entities

- Donald Trump (U.S. President)

- Iranian Government (Leadership not specified)

- OPEC (Organization of the Petroleum Exporting Countries)

- IG Market Analyst (Tony Sycamore)

- JPMorgan Analysts (Led by Natasha Kaneva)

- Citi Analysts (Unnamed)

7. Thematic Tags

regional conflicts, oil prices, Middle East tensions, U.S.-Iran relations, military strategy, geopolitical risk, energy markets, economic impact

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Conflicts Briefs ·

Daily Summary ·

Support us