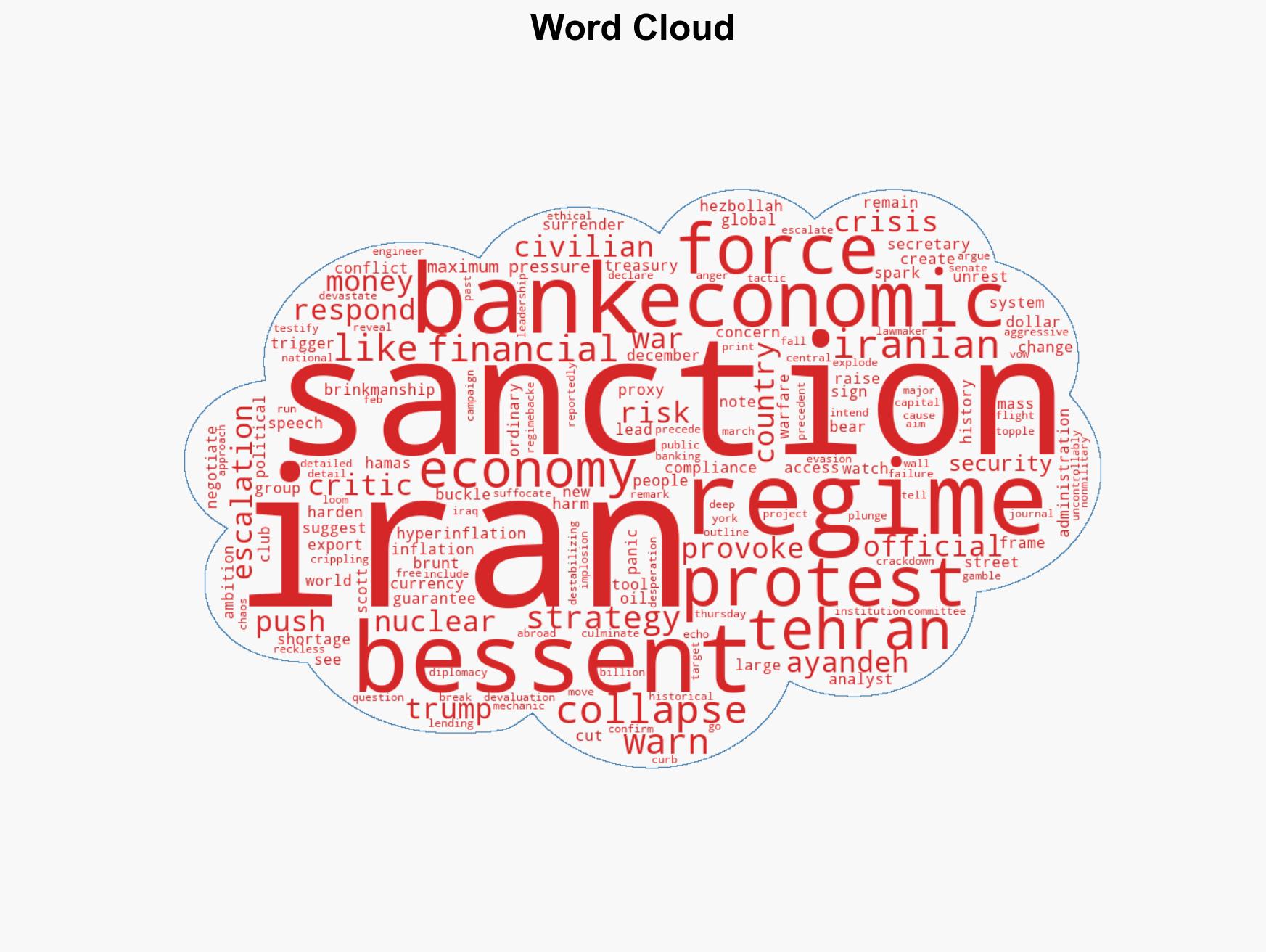

US Sanctions Devastate Iran’s Economy, Fuel Protests, and Heighten Risks of Escalation and Regime Resilience

Published on: 2026-02-10

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Maximum pressure backfires US sanctions crush Irans economy fuel protests but at what cost

1. BLUF (Bottom Line Up Front)

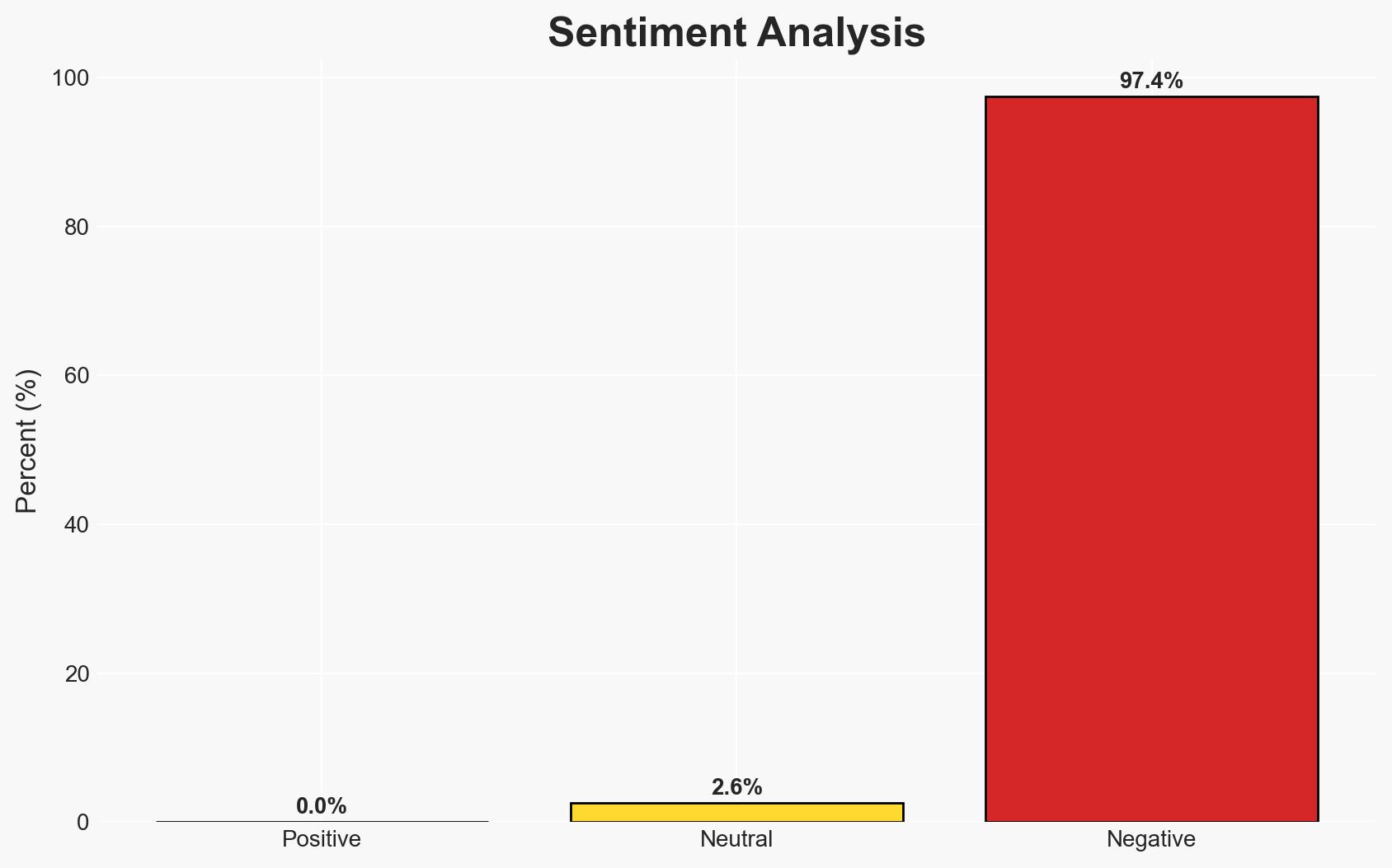

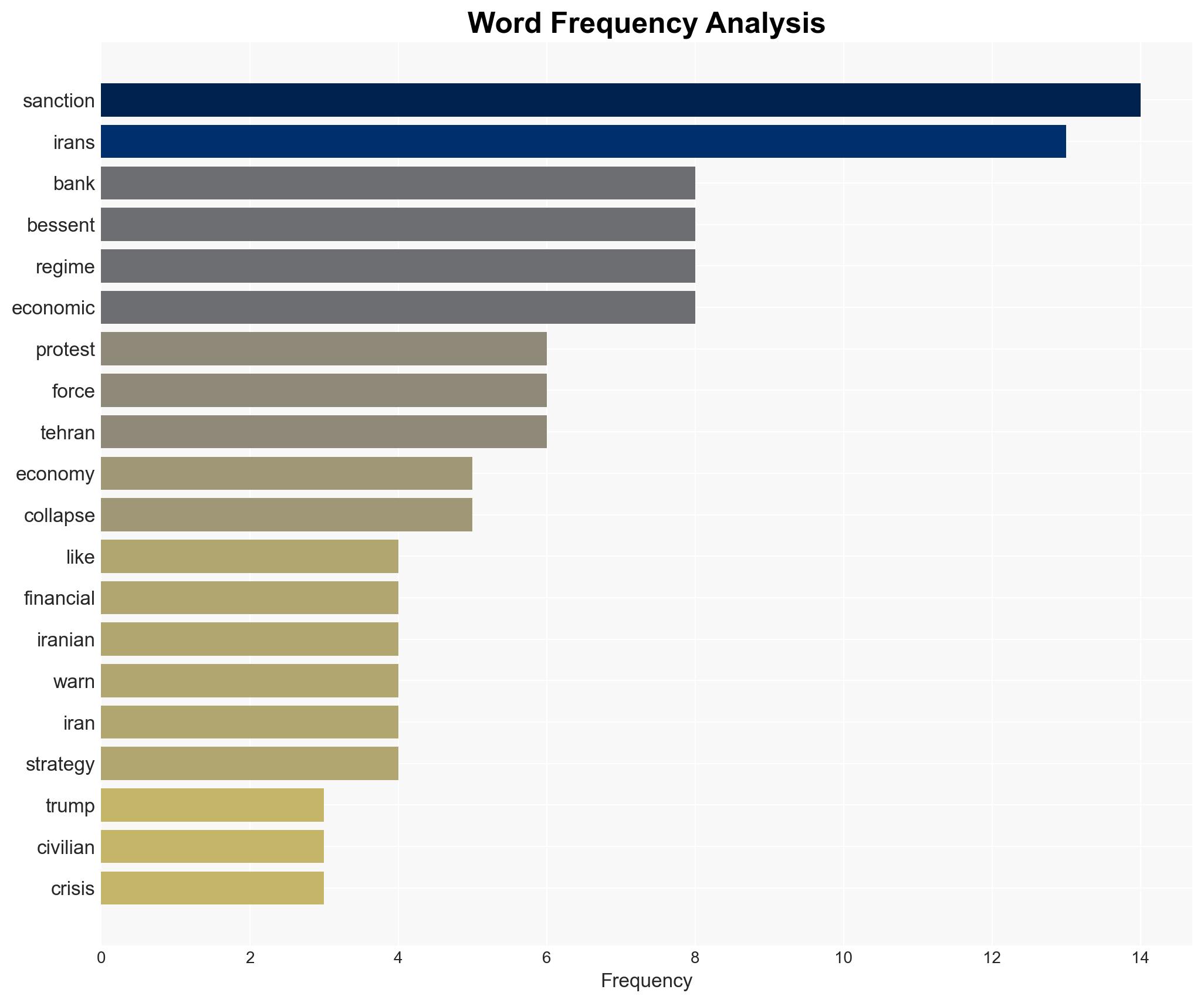

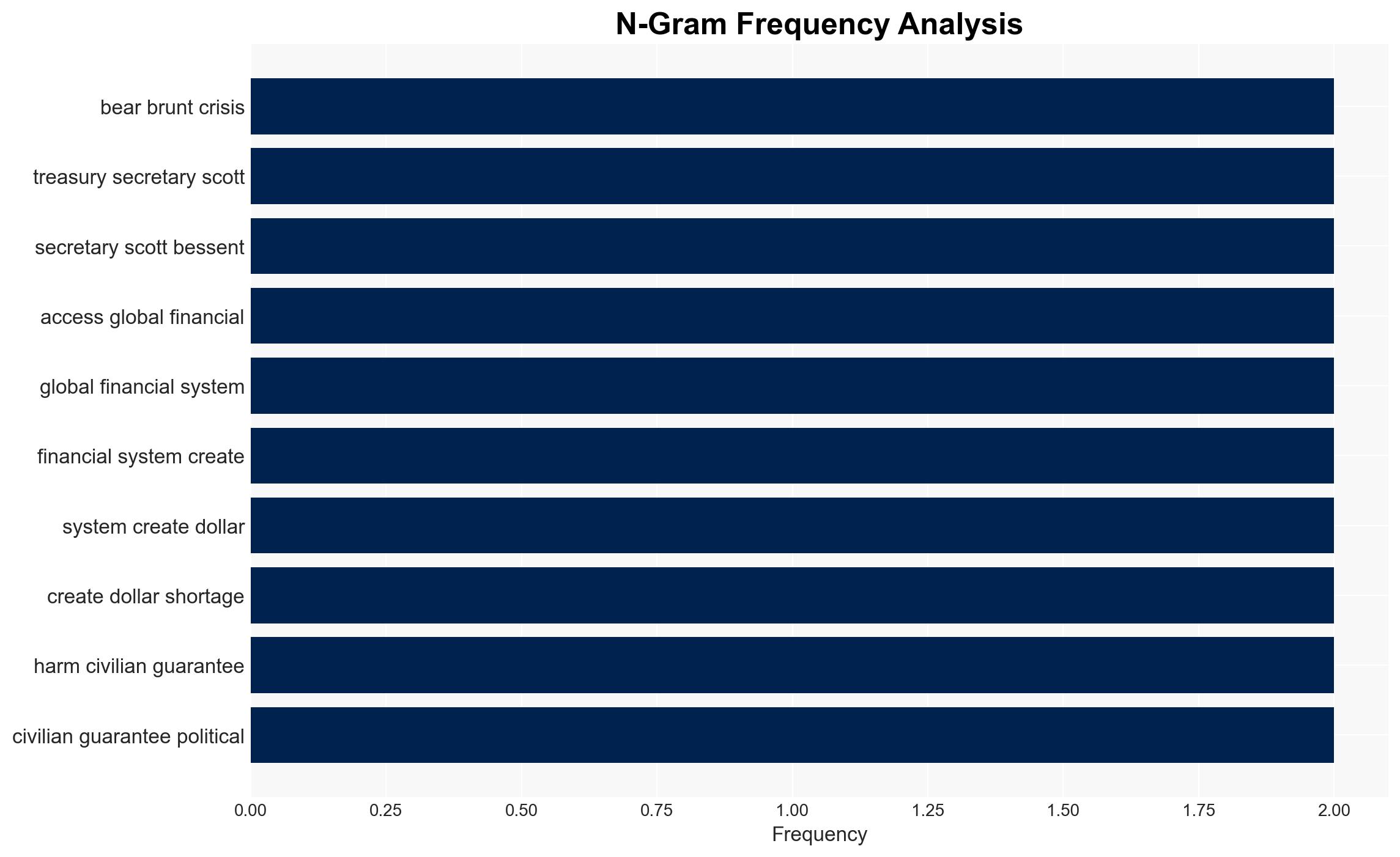

The U.S. “maximum pressure” sanctions have severely impacted Iran’s economy, leading to hyperinflation, bank collapses, and widespread protests. While the strategy aims to force Iran into nuclear compliance, it risks provoking further escalation. The current evidence supports the hypothesis that sanctions are more likely to harden Iran’s stance rather than compel negotiation. Overall confidence in this assessment is moderate.

2. Competing Hypotheses

- Hypothesis A: Sanctions will force Iran to negotiate on its nuclear program. Supporting evidence includes the severe economic impact on Iran, such as hyperinflation and bank failures, which could pressure the regime to seek relief. However, historical precedent suggests sanctions often lead to entrenchment rather than compliance.

- Hypothesis B: Sanctions will lead to increased Iranian brinkmanship and regional destabilization. This is supported by Iran’s potential to escalate proxy conflicts and the regime’s historical resilience to external pressure. Contradicting evidence includes the possibility of internal dissent weakening the regime’s resolve.

- Assessment: Hypothesis B is currently better supported due to Iran’s history of using brinkmanship as a response to external pressure and the lack of evidence that economic hardship alone will lead to policy change. Key indicators that could shift this judgment include significant internal regime change or a shift in U.S. diplomatic strategy.

3. Key Assumptions and Red Flags

- Assumptions: The Iranian regime prioritizes nuclear ambitions over economic stability; U.S. sanctions will not be lifted without significant Iranian concessions; internal protests will not immediately topple the regime.

- Information Gaps: The extent of internal dissent within the Iranian government and military; the actual impact of sanctions on Iran’s nuclear capabilities; potential backchannel negotiations between the U.S. and Iran.

- Bias & Deception Risks: Potential U.S. policy bias towards viewing economic pressure as a primary tool for compliance; Iranian propaganda efforts to exaggerate or downplay the impact of sanctions.

4. Implications and Strategic Risks

The continuation of U.S. sanctions could lead to increased regional instability and further entrenchment of the Iranian regime’s hardline policies. The economic collapse may exacerbate social unrest, potentially leading to more severe crackdowns by the regime.

- Political / Geopolitical: Potential for increased Iranian influence in proxy conflicts, further straining U.S. alliances in the region.

- Security / Counter-Terrorism: Heightened risk of Iranian-backed terrorist activities as a form of retaliation.

- Cyber / Information Space: Increased likelihood of Iranian cyber operations targeting U.S. interests as a form of asymmetric warfare.

- Economic / Social: Continued economic hardship could lead to greater social unrest and potential humanitarian crises.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Enhance intelligence monitoring of Iranian military and proxy activities; increase diplomatic engagement with regional allies to mitigate destabilization.

- Medium-Term Posture (1–12 months): Develop resilience measures for potential Iranian cyber threats; explore diplomatic channels for potential de-escalation.

- Scenario Outlook:

- Best: Iran returns to negotiations, leading to a gradual easing of sanctions.

- Worst: Iran escalates regional conflicts and accelerates nuclear development.

- Most-Likely: Continued economic strain with periodic escalations in regional tensions.

6. Key Individuals and Entities

- Scott Bessent, U.S. Treasury Secretary

- Ayandeh Bank, Iranian financial institution

- Hamas, Proxy group

- Hezbollah, Proxy group

7. Thematic Tags

regional conflicts, sanctions, Iran, nuclear negotiations, economic collapse, regional stability, proxy conflicts, cyber threats

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Conflicts Briefs ·

Daily Summary ·

Support us