Lebanon central bank must counter money laundering and terrorist financing new governor says – The Jerusalem Post

Published on: 2025-04-04

Intelligence Report: Lebanon central bank must counter money laundering and terrorist financing new governor says – The Jerusalem Post

1. BLUF (Bottom Line Up Front)

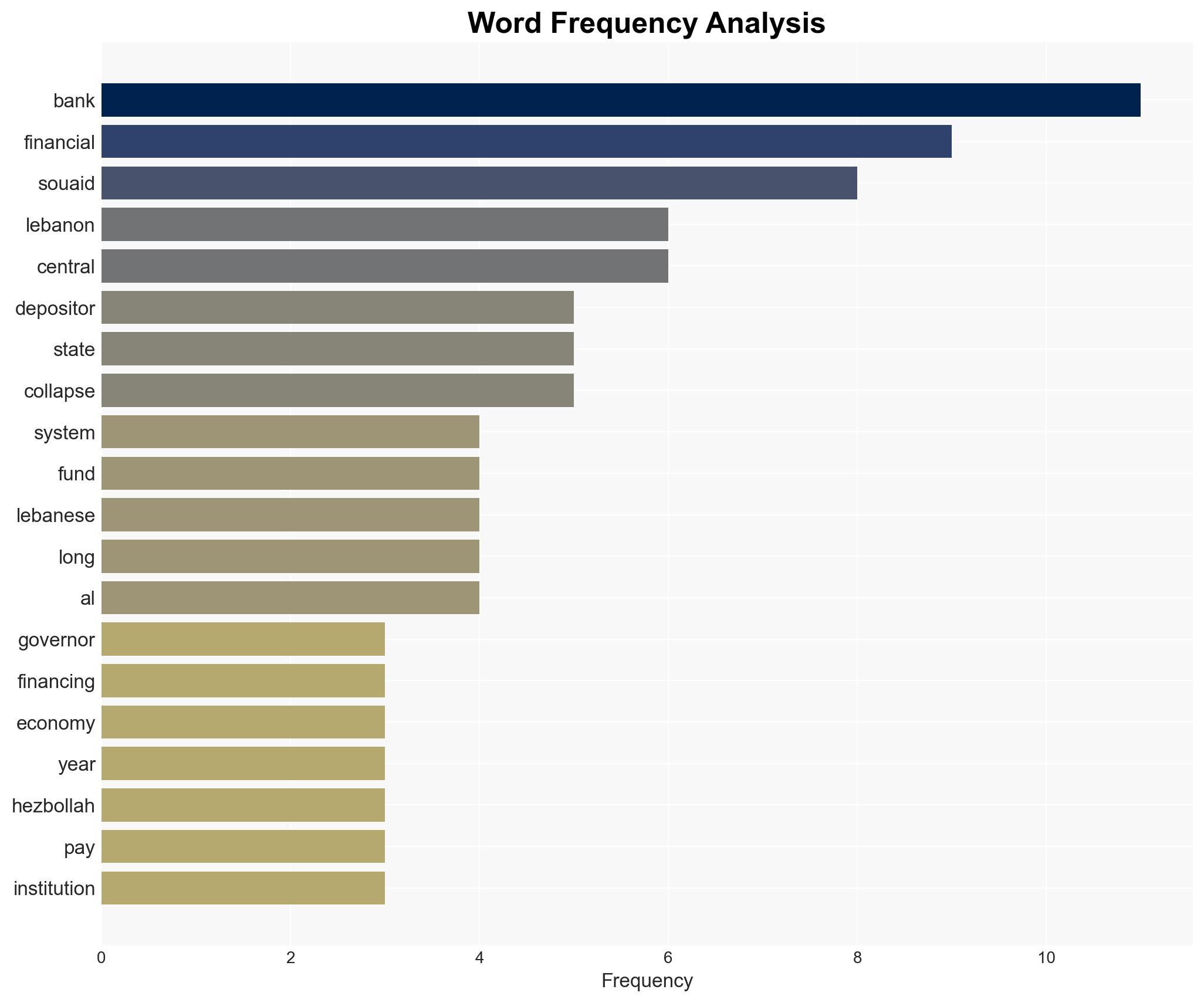

The newly appointed governor of Lebanon’s central bank, Karim Souaid, has outlined a strategic plan to counter money laundering and terrorist financing. The plan focuses on revitalizing Lebanon’s financial system, prioritizing small depositors, and removing Lebanon from the global financial watchdog’s grey list. Immediate actions include rescheduling public debt, recapitalizing commercial banks, and enhancing transparency and integrity within the banking sector.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

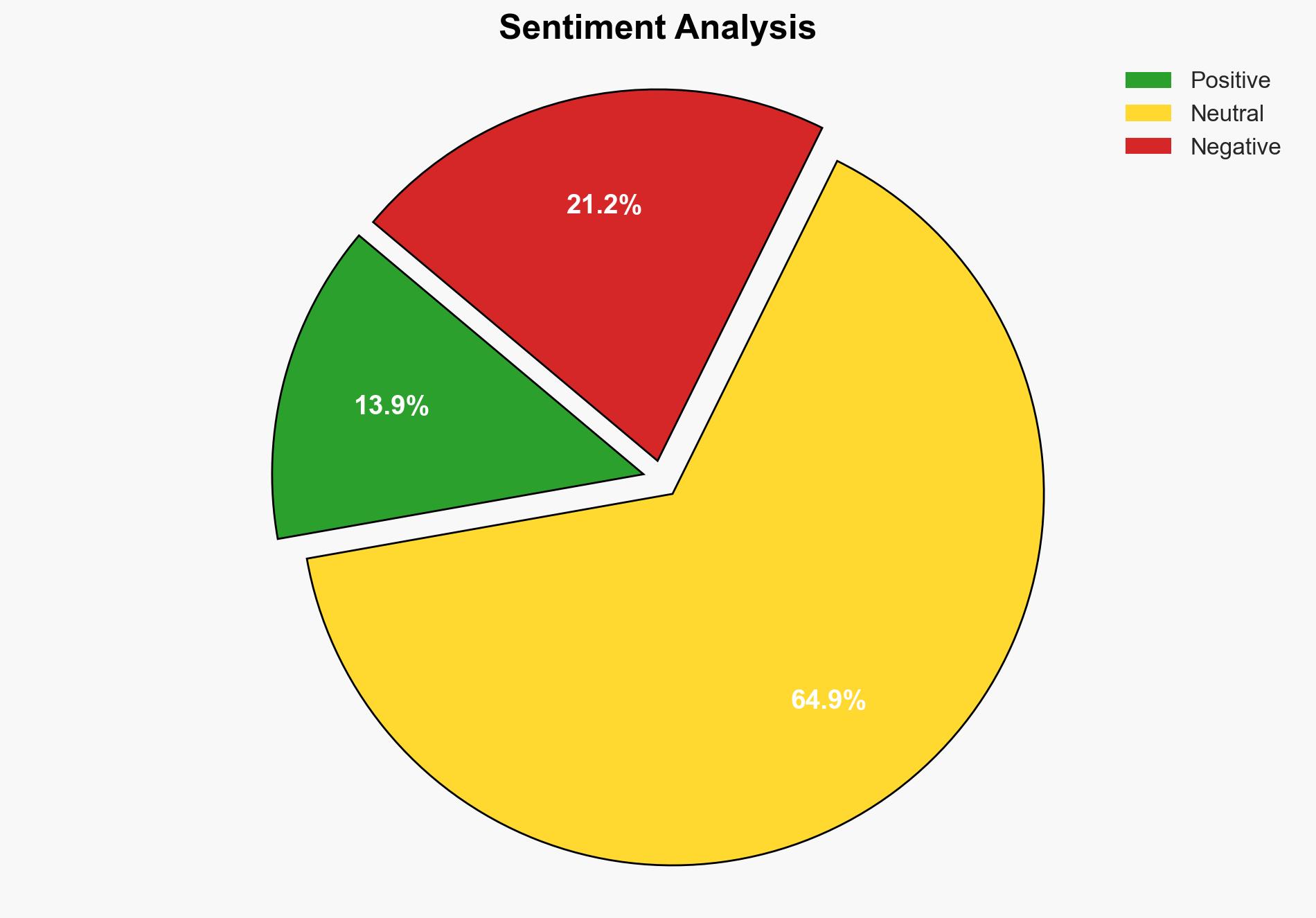

General Analysis

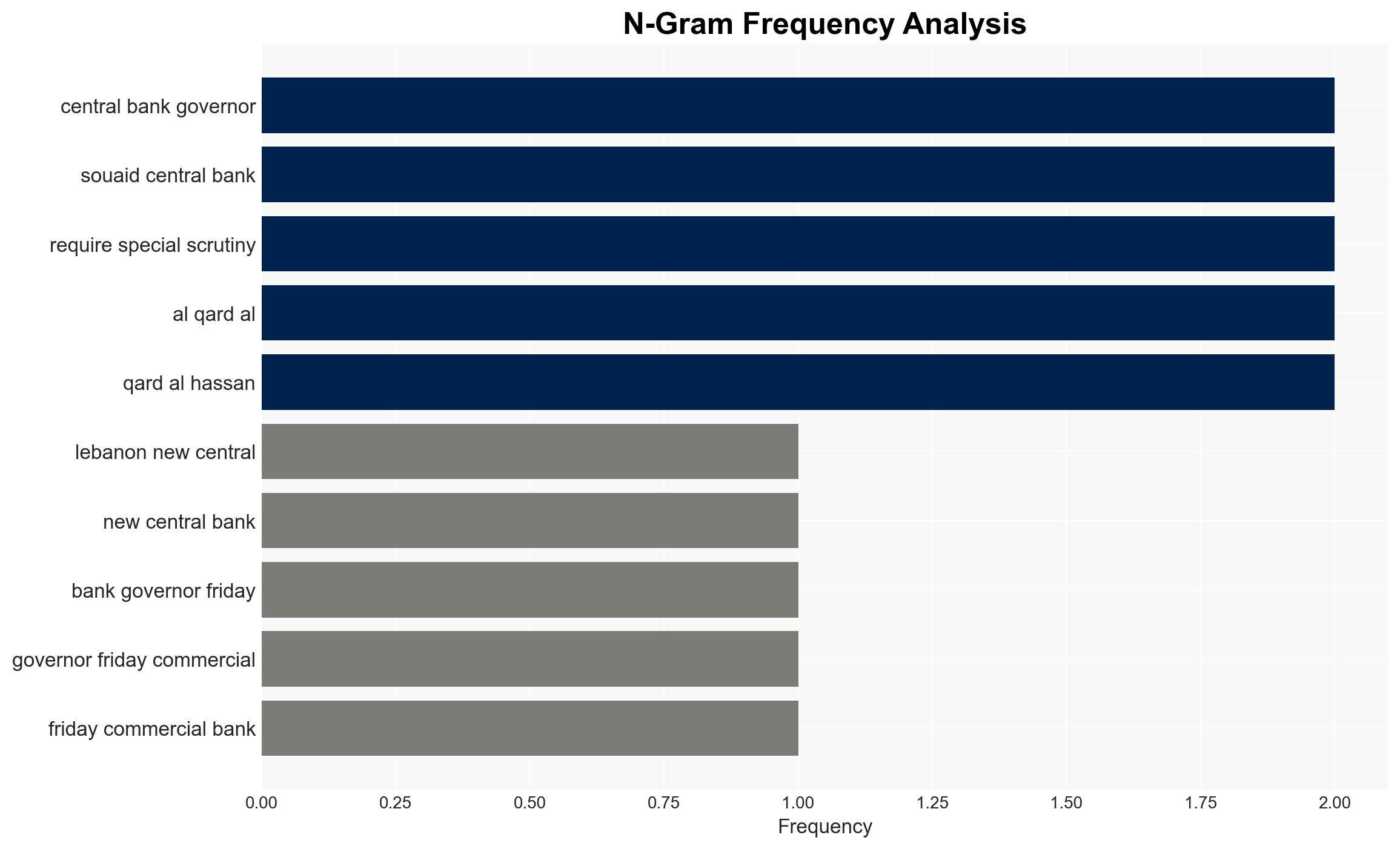

Lebanon’s financial crisis, exacerbated by historical mismanagement and corruption, has led to a severe economic downturn. Karim Souaid aims to address these challenges by implementing reforms that target the root causes of financial instability. The focus on countering money laundering and terrorist financing is critical, given the influence of groups like Hezbollah within the financial system. The strategy includes identifying and disclosing politically and financially influential individuals, as well as enforcing stricter monetary and credit laws.

3. Implications and Strategic Risks

The primary risks include potential resistance from vested interests that have historically blocked reforms. The ongoing influence of armed groups poses a threat to national security and regional stability. Economic interests may be compromised if foreign investment remains discouraged due to Lebanon’s grey list status. The success of these reforms is contingent upon the cooperation of private banks and the implementation of a comprehensive economic strategy.

4. Recommendations and Outlook

Recommendations:

- Implement regulatory changes to enhance transparency and accountability within the banking sector.

- Strengthen cooperation with international financial institutions to secure support for economic reforms.

- Develop technological solutions to monitor and prevent illicit financial activities.

Outlook:

In a best-case scenario, successful implementation of the outlined reforms could lead to economic recovery and removal from the grey list, attracting foreign investment. The worst-case scenario involves continued economic decline and increased instability if reforms are blocked. The most likely outcome is a gradual improvement contingent upon sustained political will and international support.

5. Key Individuals and Entities

The report mentions significant individuals and organizations, including Karim Souaid, Nawaf Salam, Wissam Mansouri, and Riad Salameh. Additionally, entities such as Hezbollah and Al Qard Al Hassan are highlighted for their roles in the financial landscape.