Mideast Stocks Aramco Sink on Twin Threat From Tariffs Oil – Yahoo Entertainment

Published on: 2025-04-06

Intelligence Report: Mideast Stocks Aramco Sink on Twin Threat From Tariffs Oil – Yahoo Entertainment

1. BLUF (Bottom Line Up Front)

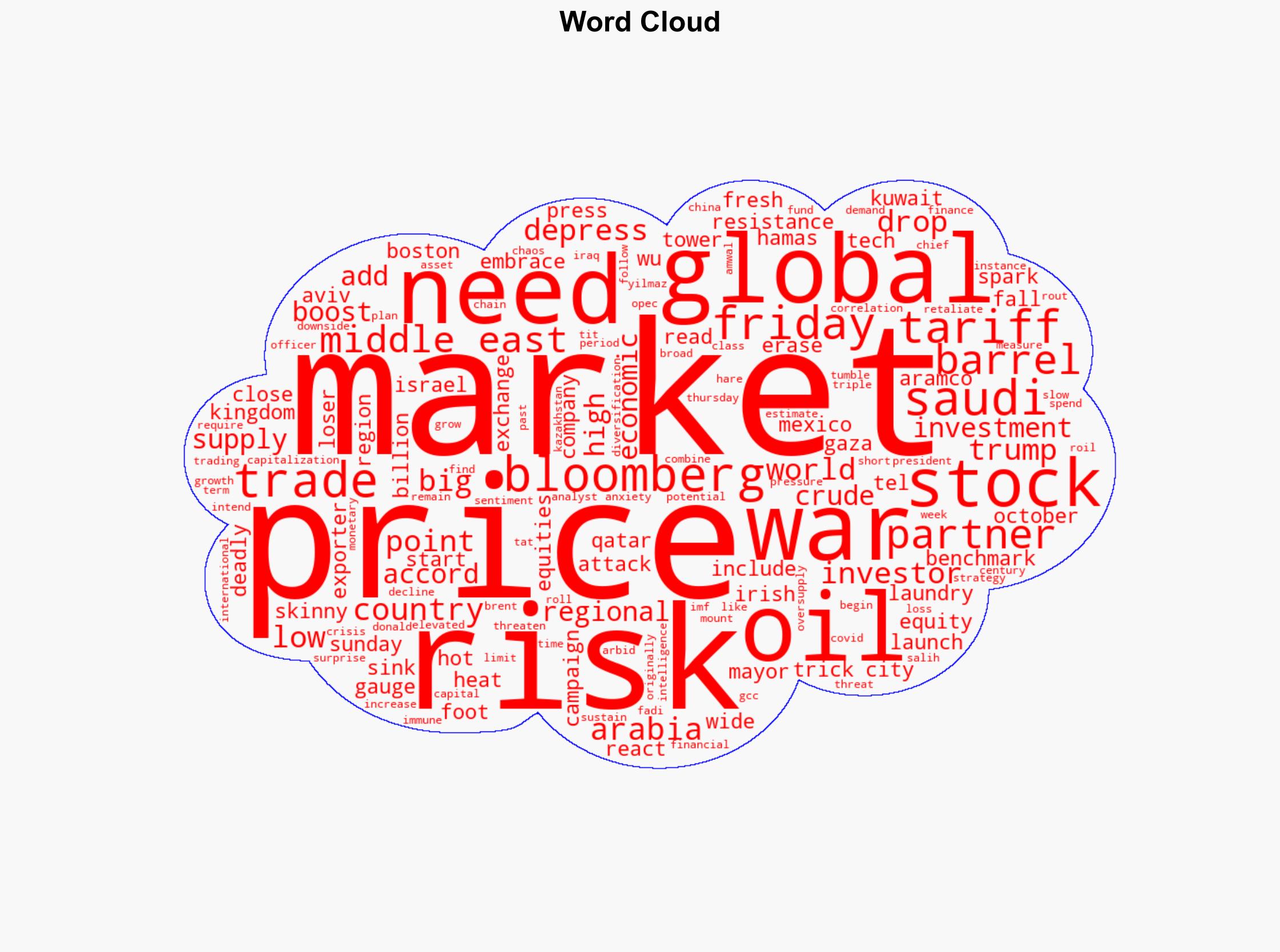

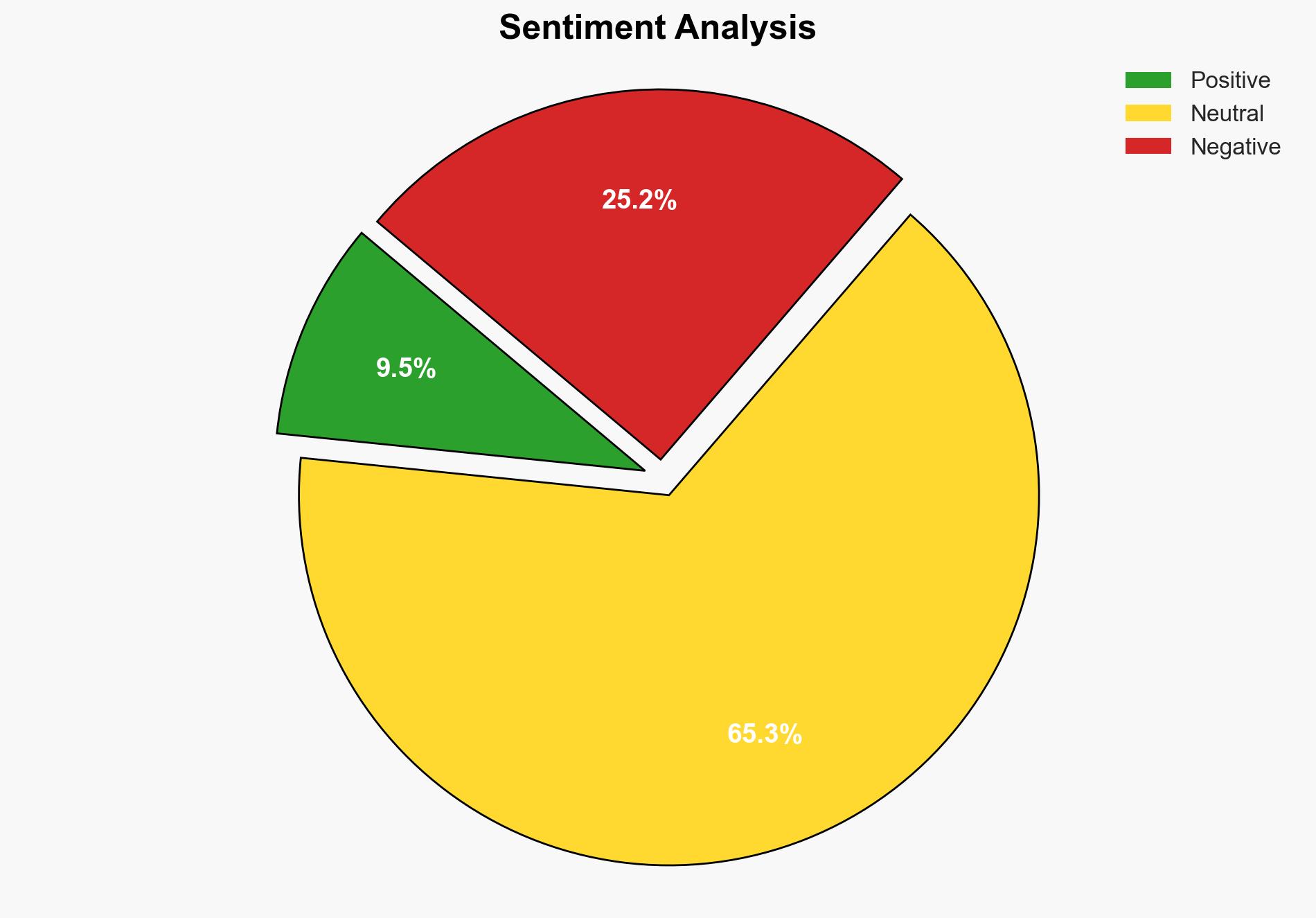

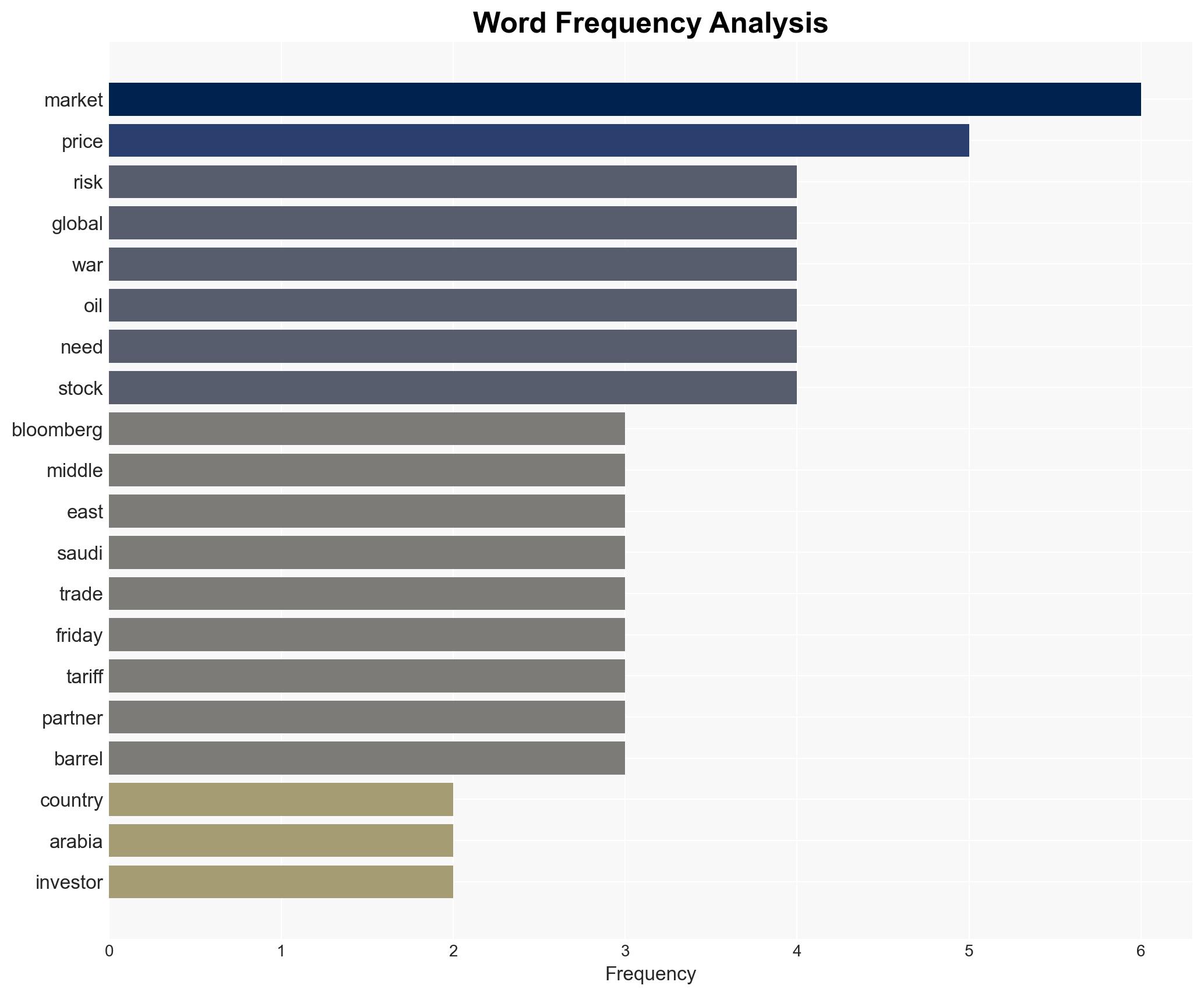

The Middle East stock markets, including Saudi Arabia’s, experienced significant declines due to escalating global trade tensions and falling oil prices. Saudi Aramco, a major regional company, saw a substantial decrease in market capitalization. The ongoing trade war, initiated by tariff measures from the United States and retaliatory actions by China, has heightened investor anxiety and threatens to prolong a period of low oil prices. This situation poses significant risks to economic diversification strategies in the region.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

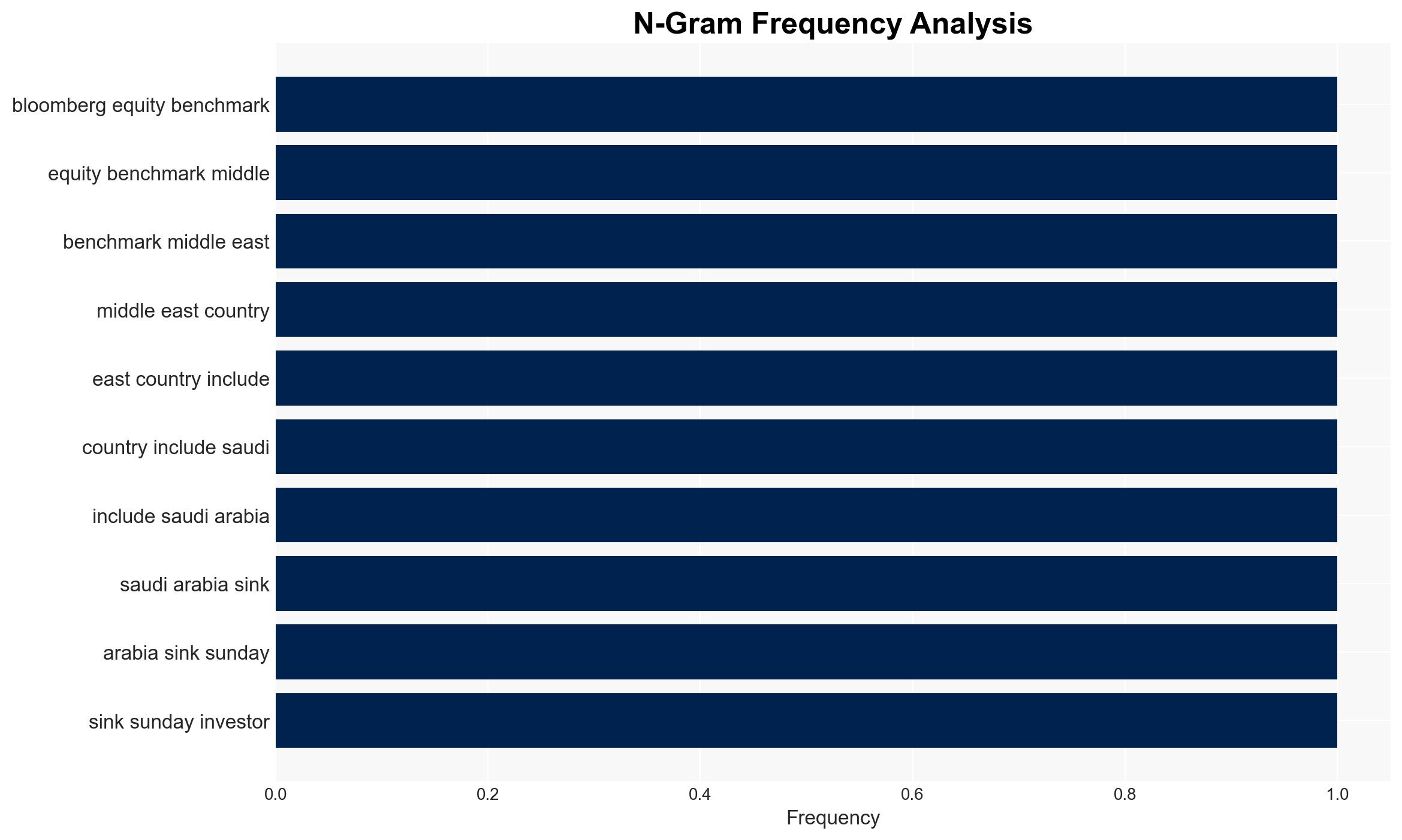

The Middle East stock markets, particularly in Saudi Arabia, Qatar, and Kuwait, have been adversely affected by global economic uncertainties. The initiation of a trade war, marked by high tariffs from the United States and subsequent retaliatory tariffs by China, has disrupted global supply chains and slowed economic growth. This has led to a decrease in investor confidence, further exacerbated by the recent conflict between Hamas and Israel, which has added geopolitical instability to the region.

The decline in oil prices, with Brent crude experiencing significant drops, has compounded these issues. OPEC’s decision to increase supply has added to market volatility, creating an oversupply that further depresses prices. This situation is critical for countries like Saudi Arabia and Iraq, which rely heavily on oil revenue to fund their economic diversification efforts.

3. Implications and Strategic Risks

The current economic and geopolitical environment presents several strategic risks:

- Prolonged low oil prices threaten the fiscal stability of oil-dependent economies in the Middle East, potentially derailing economic diversification plans.

- The trade war between the United States and China could lead to a broader global economic slowdown, impacting export-dependent economies worldwide.

- Regional instability, exacerbated by conflicts such as the one between Hamas and Israel, poses risks to national security and investor confidence.

4. Recommendations and Outlook

Recommendations:

- Middle Eastern countries should accelerate their economic diversification efforts to reduce reliance on oil revenues.

- Governments should engage in diplomatic efforts to de-escalate trade tensions and promote stable international trade relations.

- Investment in regional security measures is crucial to mitigate the impact of geopolitical conflicts on economic stability.

Outlook:

Best-case scenario: Successful diplomatic negotiations lead to a resolution of the trade war, stabilizing global markets and allowing oil prices to recover. Regional conflicts are contained, and economic diversification efforts gain momentum.

Worst-case scenario: The trade war escalates, leading to a global recession. Oil prices remain low, severely impacting Middle Eastern economies. Regional conflicts intensify, further destabilizing the area.

Most likely scenario: Continued volatility in oil prices and global markets, with gradual progress in economic diversification. Regional tensions persist but do not escalate significantly.

5. Key Individuals and Entities

The report mentions significant individuals and organizations, including Donald Trump, Fadi Arbid, Salih Yilmaz, and Saudi Aramco. These individuals and entities play crucial roles in the unfolding economic and geopolitical landscape.