Hong Kong Regulator Releases Crypto Staking Rules for Licensed Exchanges – CoinDesk

Published on: 2025-04-07

Intelligence Report: Hong Kong Regulator Releases Crypto Staking Rules for Licensed Exchanges – CoinDesk

1. BLUF (Bottom Line Up Front)

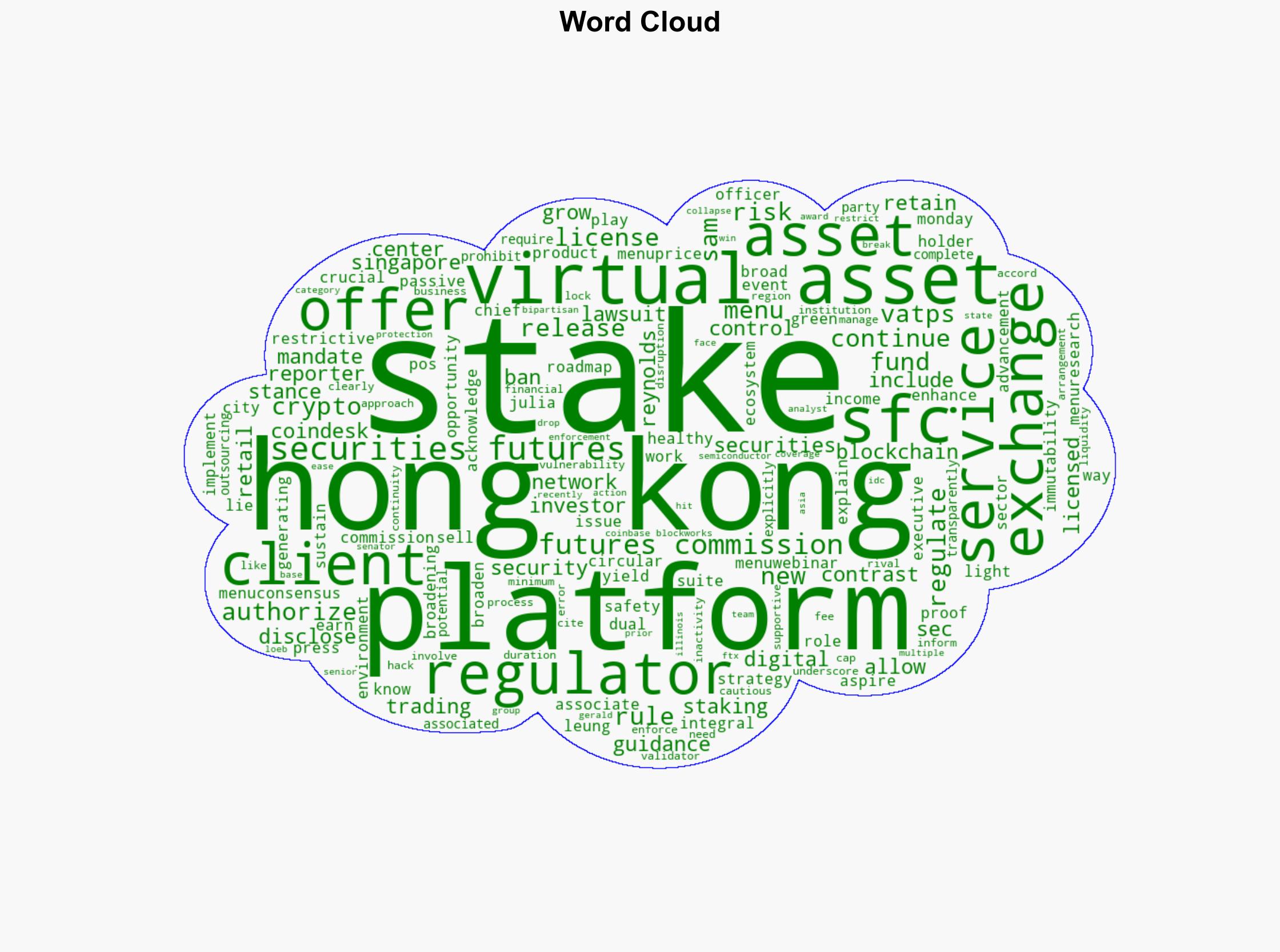

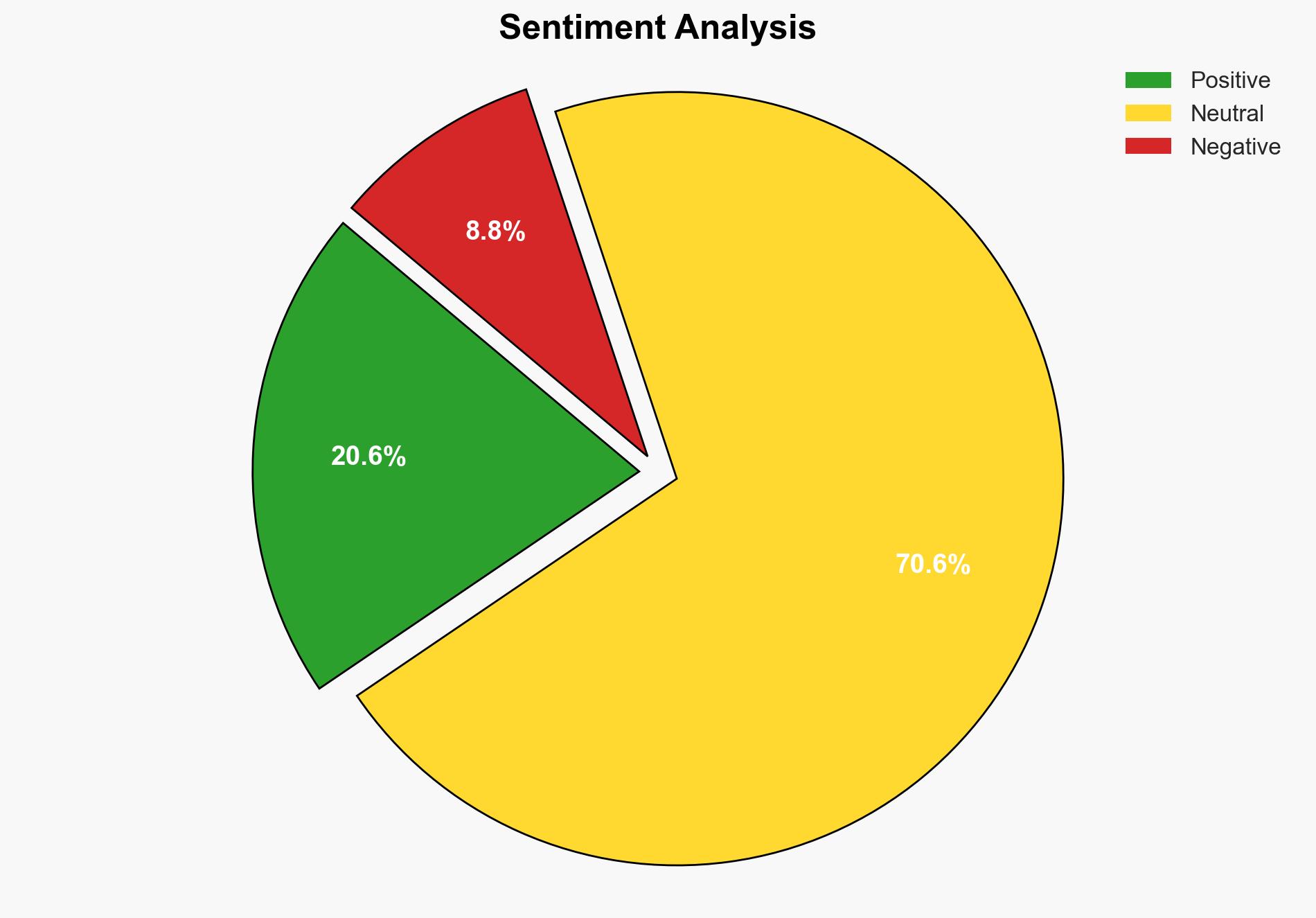

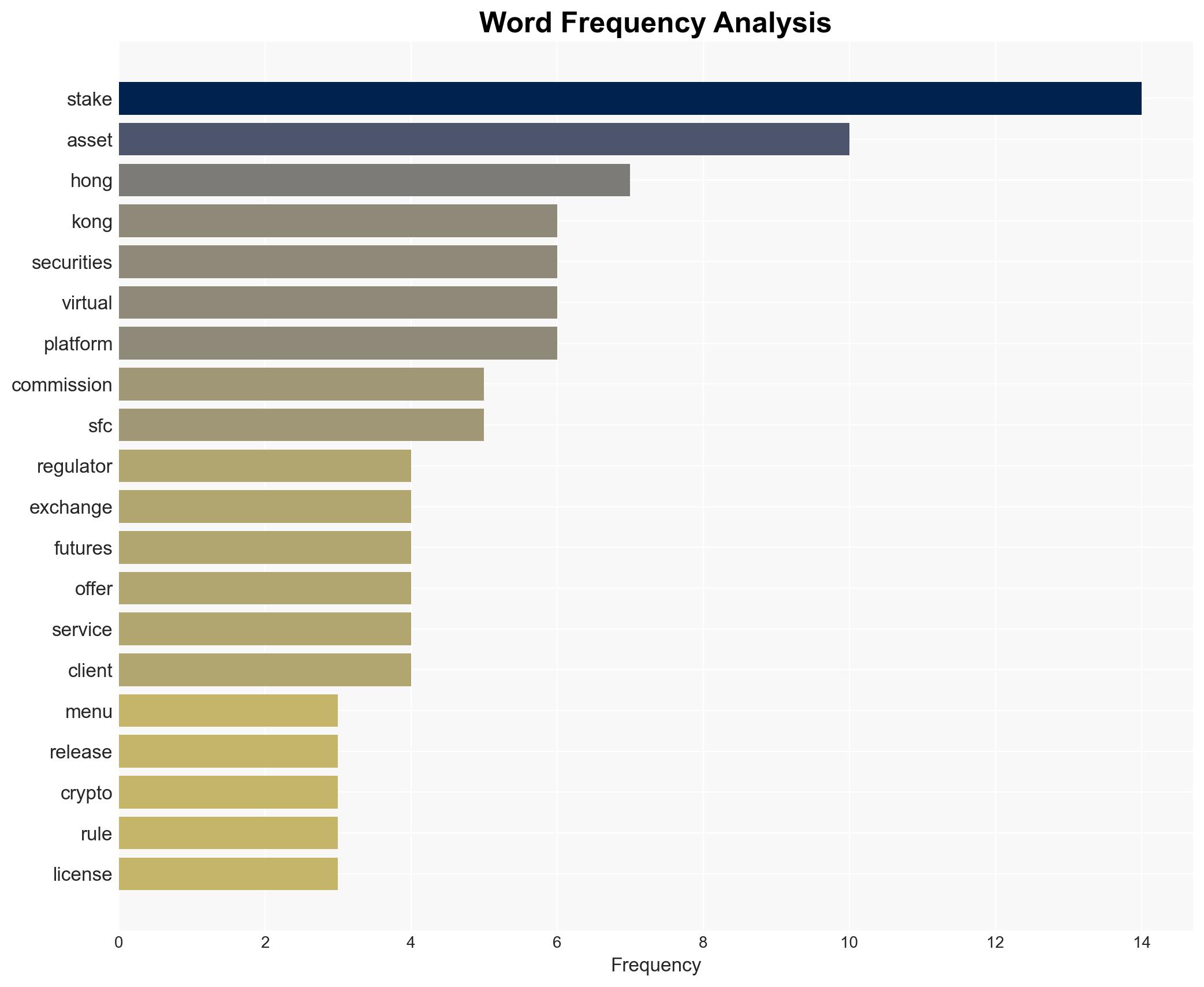

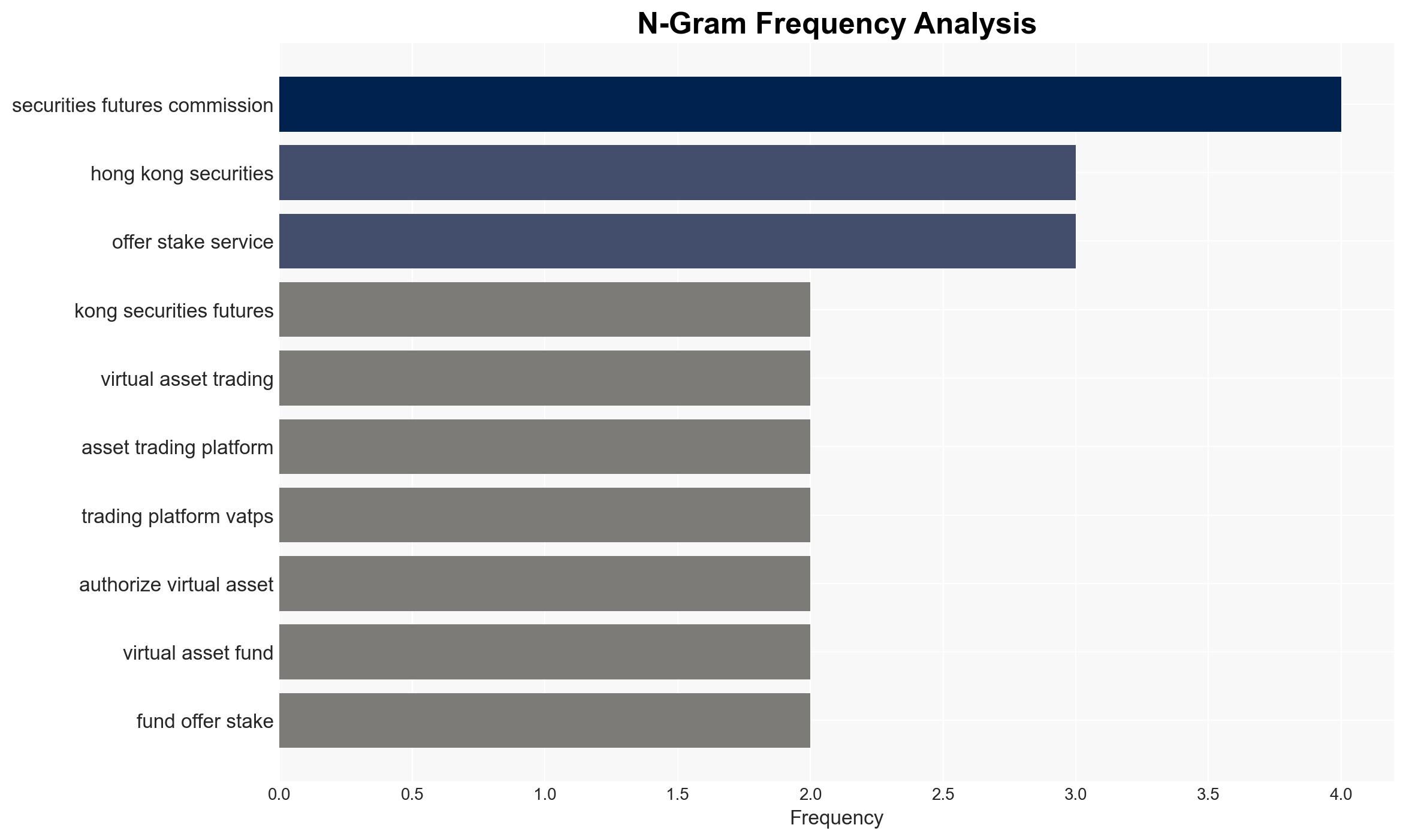

The Hong Kong Securities and Futures Commission (SFC) has issued new guidelines allowing licensed virtual asset trading platforms to offer crypto staking services. This move positions Hong Kong as a progressive player in the digital asset sector, contrasting with more restrictive stances in Singapore and the United States. The SFC mandates strict control over client assets and transparent risk disclosure, aiming to enhance investor protection while fostering growth in the virtual asset ecosystem.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

The SFC’s decision to permit staking services is a strategic effort to bolster Hong Kong’s position as a leading digital asset hub. By allowing licensed exchanges to offer staking, the SFC is providing crypto holders with opportunities to earn passive income, thereby attracting more participants to the market. The guidelines emphasize the need for exchanges to maintain control over client assets and disclose associated risks, such as blockchain vulnerabilities and hacking threats. This regulatory framework aims to balance innovation with investor protection, setting a precedent in the region.

3. Implications and Strategic Risks

The introduction of staking services in Hong Kong could lead to increased competition among regional financial centers, potentially influencing regulatory approaches in neighboring jurisdictions. The emphasis on investor protection may mitigate risks of financial loss due to technical failures or cyber threats. However, the evolving regulatory landscape may pose challenges for exchanges in terms of compliance and operational adjustments. The strategic positioning of Hong Kong as a digital asset leader could enhance regional stability and economic growth but may also attract scrutiny from international regulators.

4. Recommendations and Outlook

Recommendations:

- Encourage continued dialogue between regulators and industry stakeholders to ensure the regulatory framework remains adaptive and supportive of innovation.

- Invest in technological infrastructure to enhance the security and resilience of digital asset platforms.

- Monitor international regulatory trends to anticipate and respond to potential shifts in the global digital asset landscape.

Outlook:

Best-case scenario: Hong Kong’s regulatory approach attracts significant investment and talent, solidifying its status as a leading digital asset hub.

Worst-case scenario: Regulatory challenges and security breaches undermine investor confidence, leading to market contraction.

Most likely outcome: A balanced regulatory environment fosters steady growth in the digital asset sector, with Hong Kong maintaining a competitive edge in the region.

5. Key Individuals and Entities

The report mentions Julia Leung and Sam Reynolds as significant individuals involved in the context of the developments. The Hong Kong Securities and Futures Commission is the primary regulatory body referenced in the report.