Phishing fraud and the financial sectors crisis of trust – Help Net Security

Published on: 2025-04-08

Intelligence Report: Phishing Fraud and the Financial Sectors Crisis of Trust – Help Net Security

1. BLUF (Bottom Line Up Front)

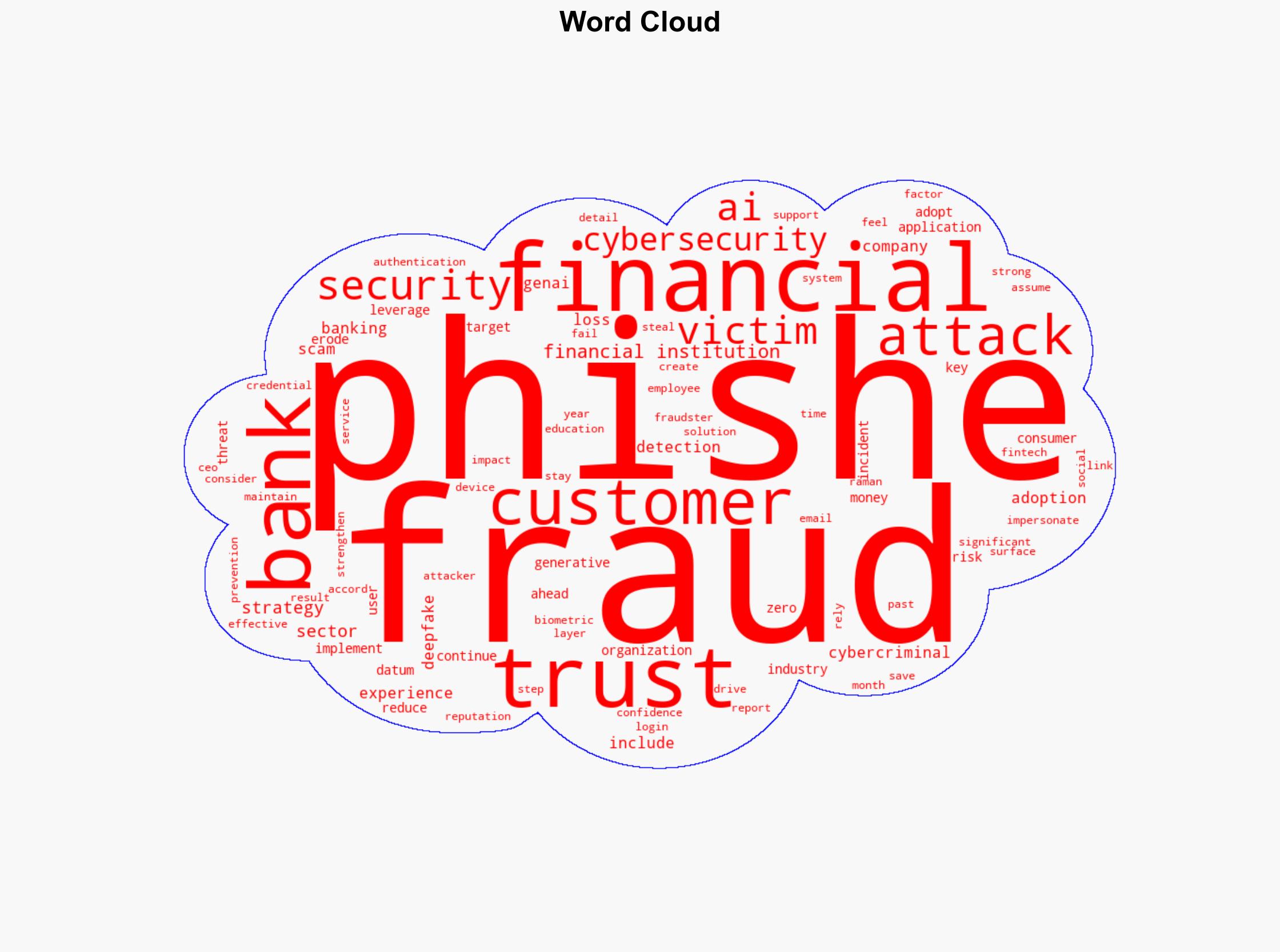

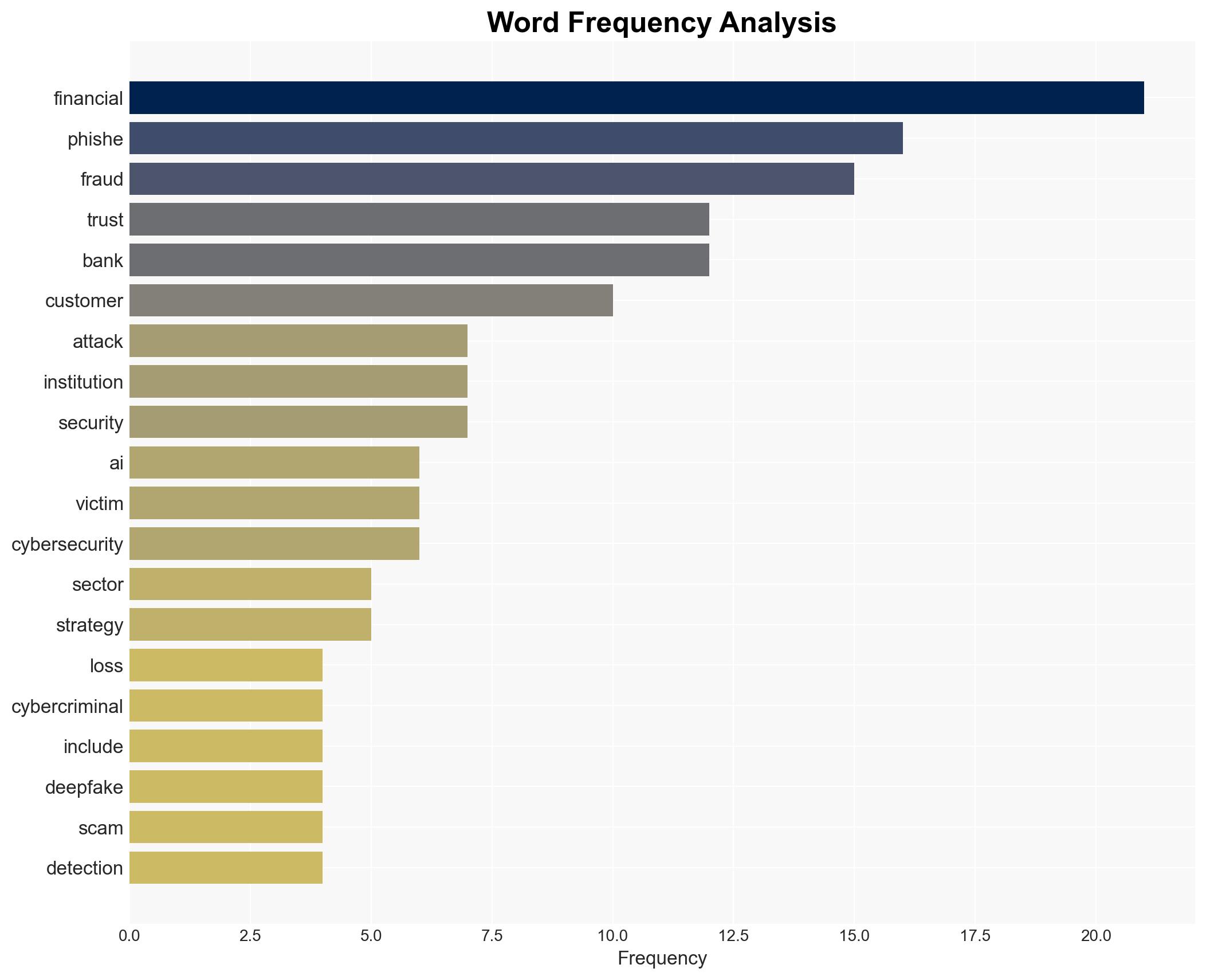

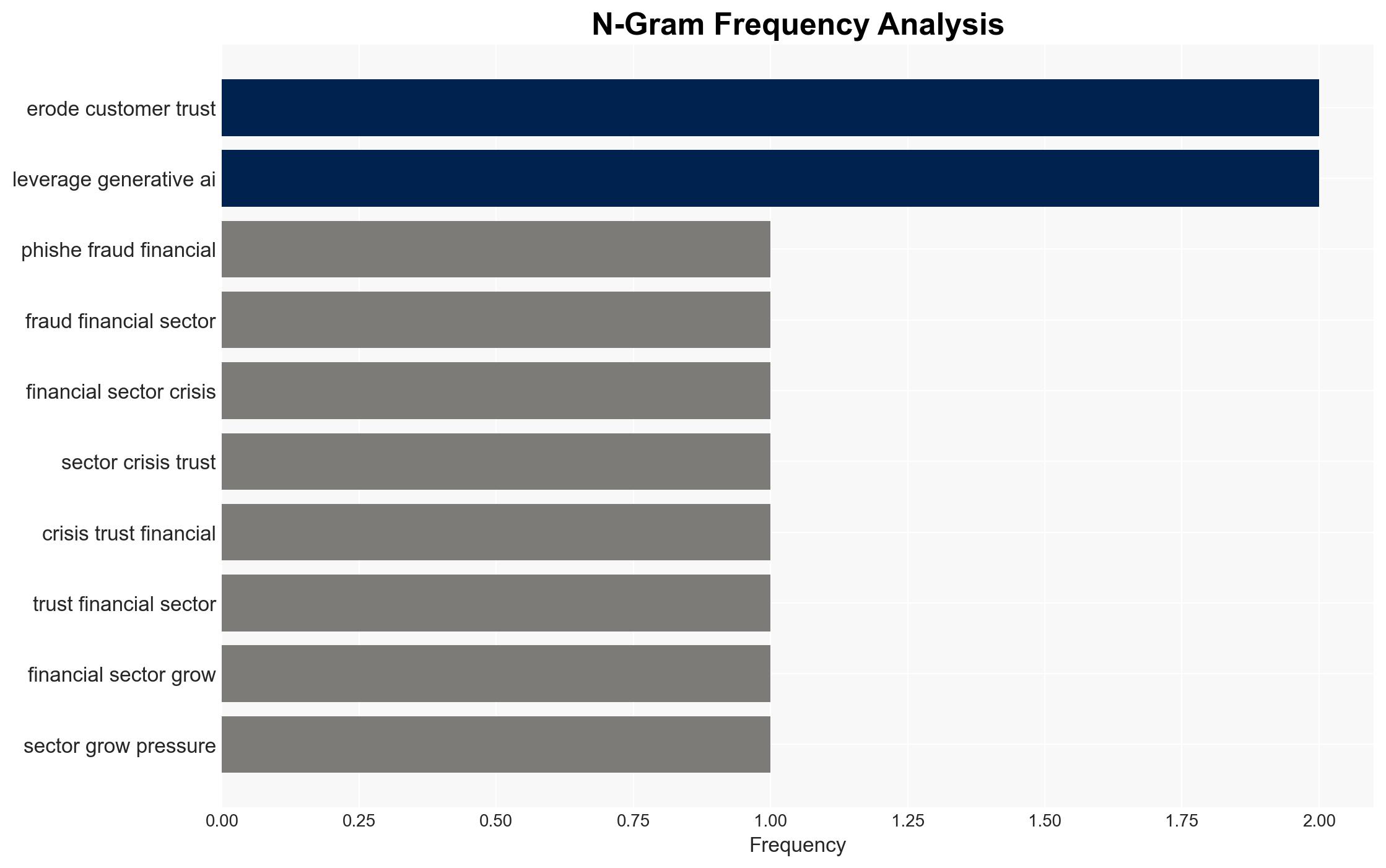

The financial sector is experiencing a significant crisis of trust due to the escalation of phishing fraud. Advanced phishing techniques, including spear phishing and AI-driven attacks like deepfake scams, are causing substantial financial losses and eroding customer trust. Immediate action is required to enhance cybersecurity measures, improve fraud detection, and restore consumer confidence.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

Phishing attacks have evolved from traditional methods to more sophisticated strategies, such as spear phishing and deepfake scams. Cybercriminals are increasingly targeting the financial sector, leveraging personal information and AI technologies to impersonate bank executives and customer service representatives. These attacks are difficult to detect and have led to significant financial losses and reputational damage for financial institutions. The rise of voice phishing (vishing) and SMS phishing (smishing) further complicates the threat landscape, as scammers mimic legitimate bank communications to deceive victims.

3. Implications and Strategic Risks

The persistent threat of phishing fraud poses several strategic risks, including:

- Loss of consumer trust in financial institutions, leading to potential customer attrition.

- Increased regulatory scrutiny and potential legal consequences for banks failing to prevent fraud.

- Economic impacts due to financial losses and the potential destabilization of the financial sector.

- National security risks if financial systems are compromised by cybercriminals.

4. Recommendations and Outlook

Recommendations:

- Enhance cybersecurity measures by adopting advanced threat detection technologies and AI-driven solutions.

- Implement comprehensive fraud prevention strategies, including regular employee training and customer awareness programs.

- Strengthen regulatory frameworks to ensure financial institutions are held accountable for fraud prevention and victim compensation.

- Foster collaboration between financial institutions, cybersecurity experts, and law enforcement agencies to share intelligence and best practices.

Outlook:

In the best-case scenario, financial institutions successfully implement robust cybersecurity measures, leading to a reduction in phishing incidents and restoration of consumer trust. In the worst-case scenario, continued phishing attacks result in severe financial losses and a significant decline in consumer confidence. The most likely outcome involves a gradual improvement in cybersecurity practices, with ongoing challenges as cybercriminals adapt to new defenses.

5. Key Individuals and Entities

The report mentions significant individuals and organizations involved in the analysis of phishing fraud and its impact on the financial sector. Notable individuals include Patrick Harding and Jennifer White, who have contributed insights into the current threat landscape and strategies for improving cybersecurity resilience.