Trumps DOJ will no longer prosecute cryptocurrency fraud – The Verge

Published on: 2025-04-08

Intelligence Report: Trumps DOJ will no longer prosecute cryptocurrency fraud – The Verge

1. BLUF (Bottom Line Up Front)

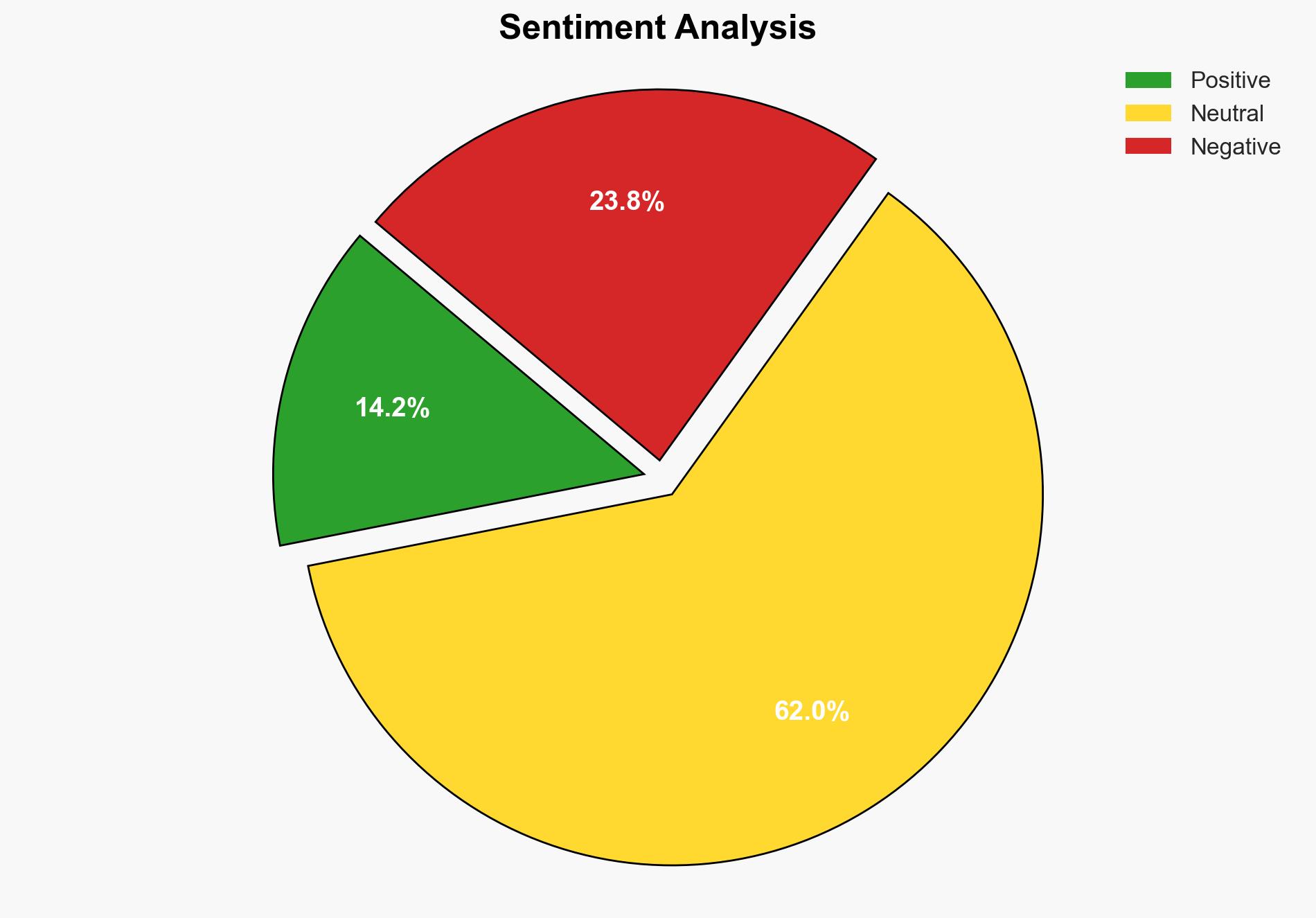

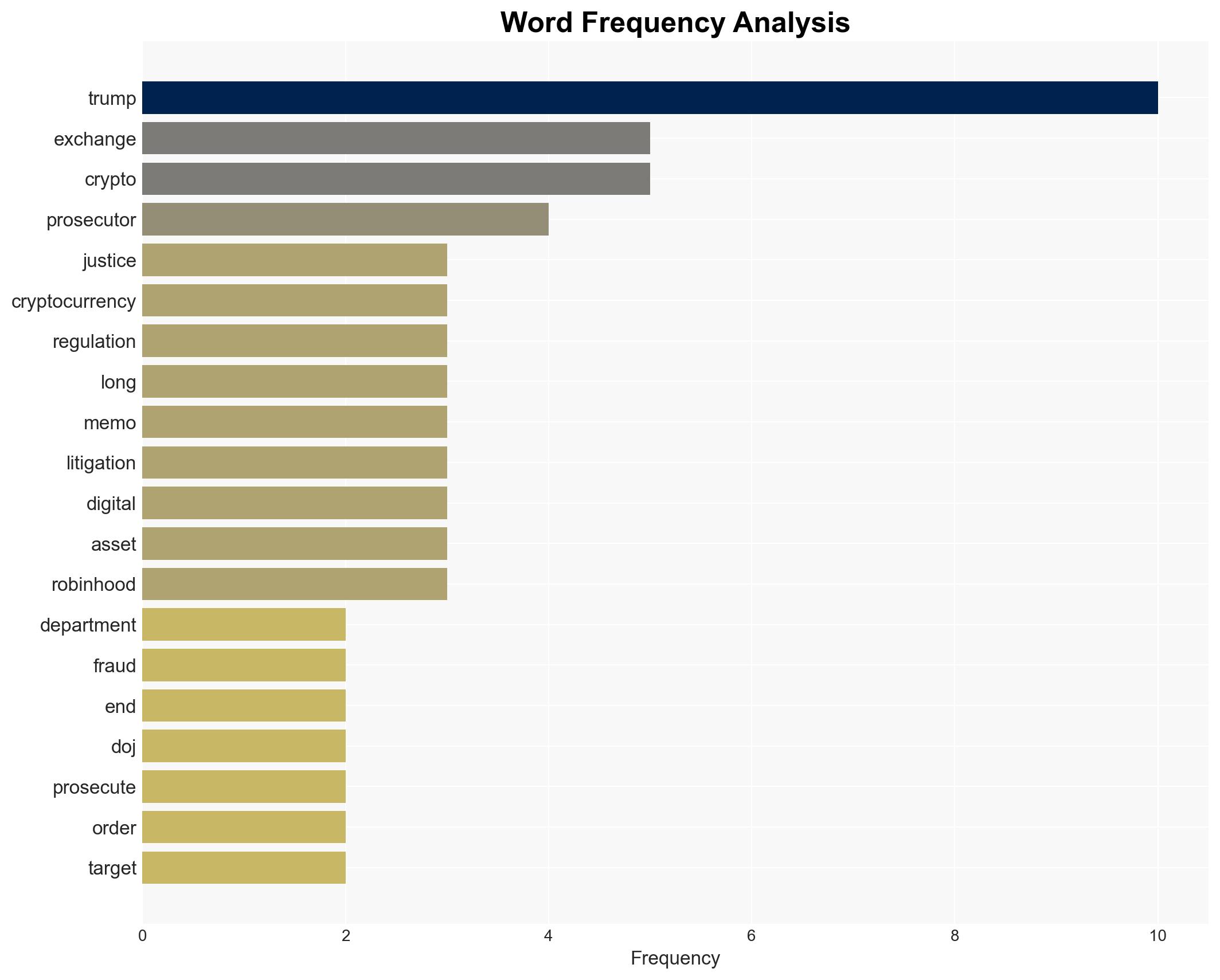

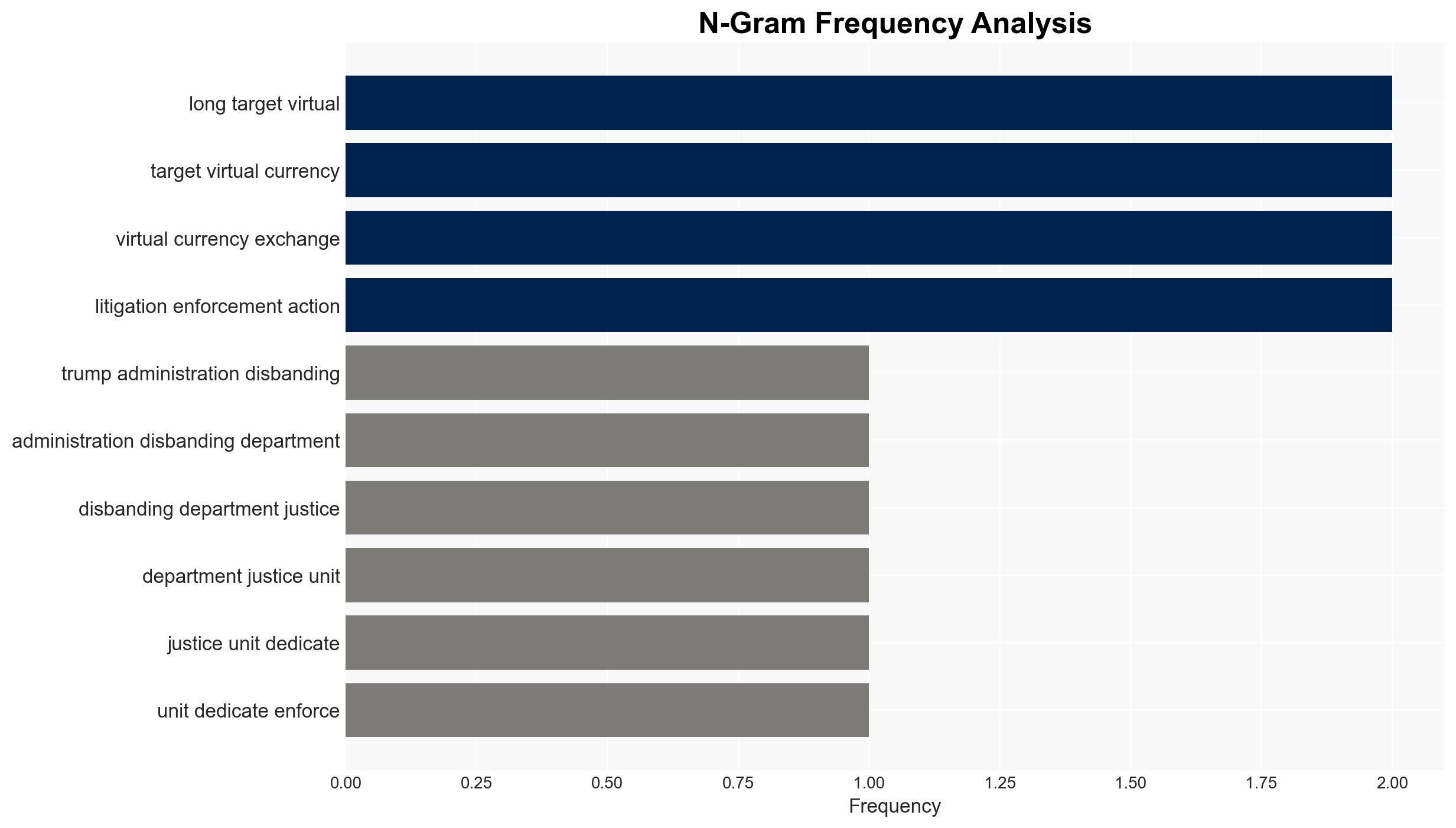

The Trump administration has decided to cease prosecuting cryptocurrency fraud by disbanding the Department of Justice unit dedicated to this effort. This strategic shift is expected to impact regulatory frameworks and enforcement actions related to digital assets. The decision aligns with recent political moves to deregulate the cryptocurrency industry, potentially increasing risks of fraud and misuse of digital currencies.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

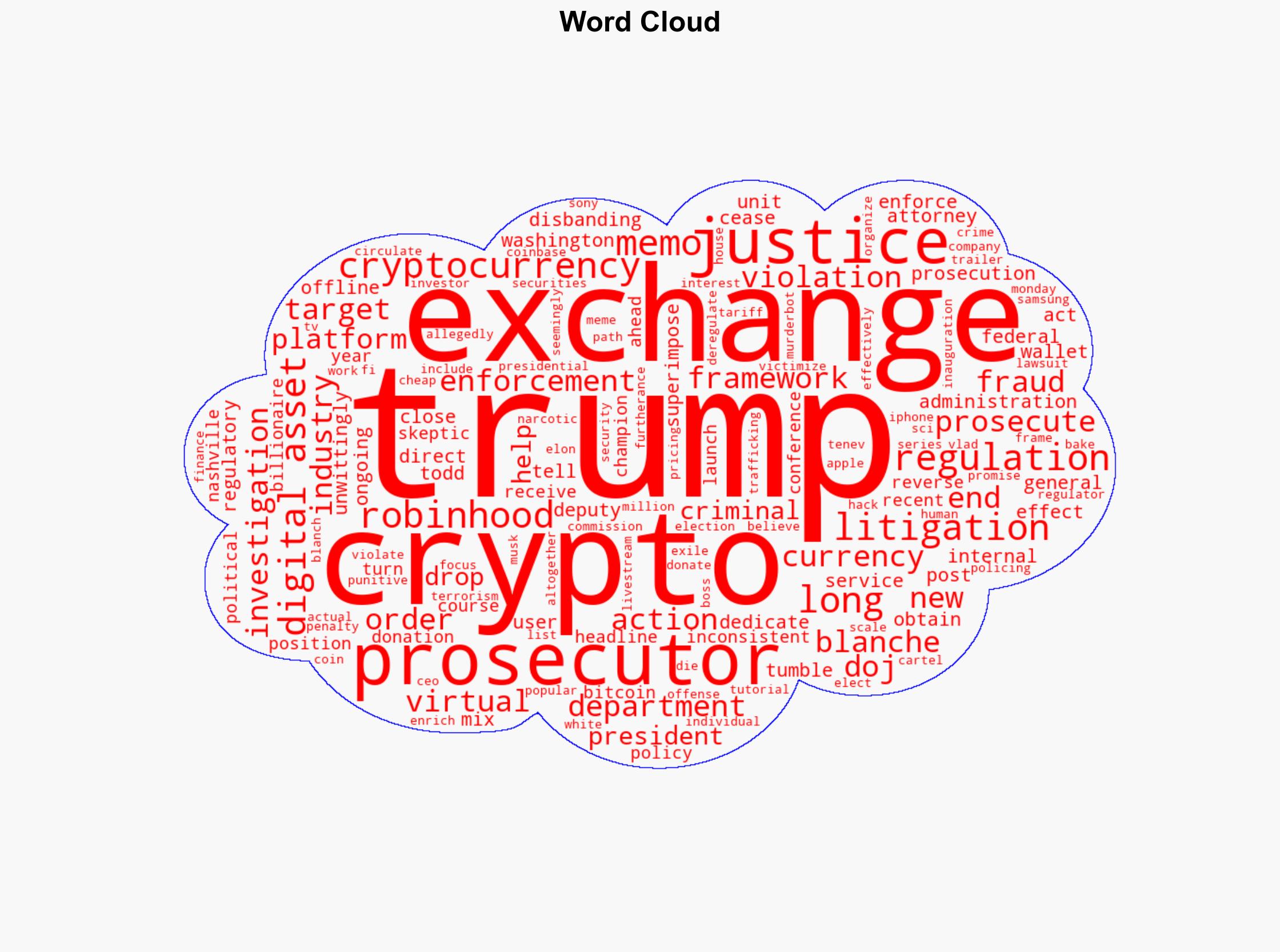

The decision to halt prosecution of cryptocurrency fraud reflects a broader trend of deregulation under the Trump administration. This move may embolden cryptocurrency exchanges and related services, potentially leading to increased fraudulent activities. The internal memo, obtained by a major news outlet, directs federal prosecutors to cease litigation and enforcement actions against virtual currency exchanges and related services. This shift may signal a prioritization of political and economic interests over regulatory enforcement.

3. Implications and Strategic Risks

The cessation of cryptocurrency fraud prosecution poses several strategic risks:

- Increased vulnerability to financial crimes, including fraud, money laundering, and funding of illicit activities.

- Potential destabilization of the cryptocurrency market due to reduced regulatory oversight.

- Challenges to national security as digital assets may be used to finance terrorism, narcotics, and organized crime.

These risks could have significant implications for economic interests and regional stability, particularly if other nations follow suit in deregulating cryptocurrency markets.

4. Recommendations and Outlook

Recommendations:

- Enhance monitoring and intelligence-gathering efforts to detect and prevent cryptocurrency-related crimes.

- Consider implementing alternative regulatory measures to ensure the integrity of digital asset markets.

- Encourage international cooperation to maintain a coordinated approach to cryptocurrency regulation.

Outlook:

Best-case scenario: The deregulation leads to innovation and economic growth in the cryptocurrency sector, with minimal increase in fraudulent activities due to effective self-regulation by industry players.

Worst-case scenario: A significant rise in financial crimes and market instability, undermining investor confidence and leading to economic repercussions.

Most likely outcome: A moderate increase in fraudulent activities, with ongoing debates about the need for regulatory frameworks to balance innovation and security.

5. Key Individuals and Entities

The report mentions significant individuals and organizations:

- Trump

- Todd Blanche

- Vlad Tenev

- Robinhood

- Coinbase

These individuals and entities are central to the developments discussed, influencing both policy decisions and market dynamics.