US Steel Takeover by Nippon Back in Spotlight as Trump Demands Review – International Business Times

Published on: 2025-04-08

Intelligence Report: US Steel Takeover by Nippon Back in Spotlight as Trump Demands Review – International Business Times

1. BLUF (Bottom Line Up Front)

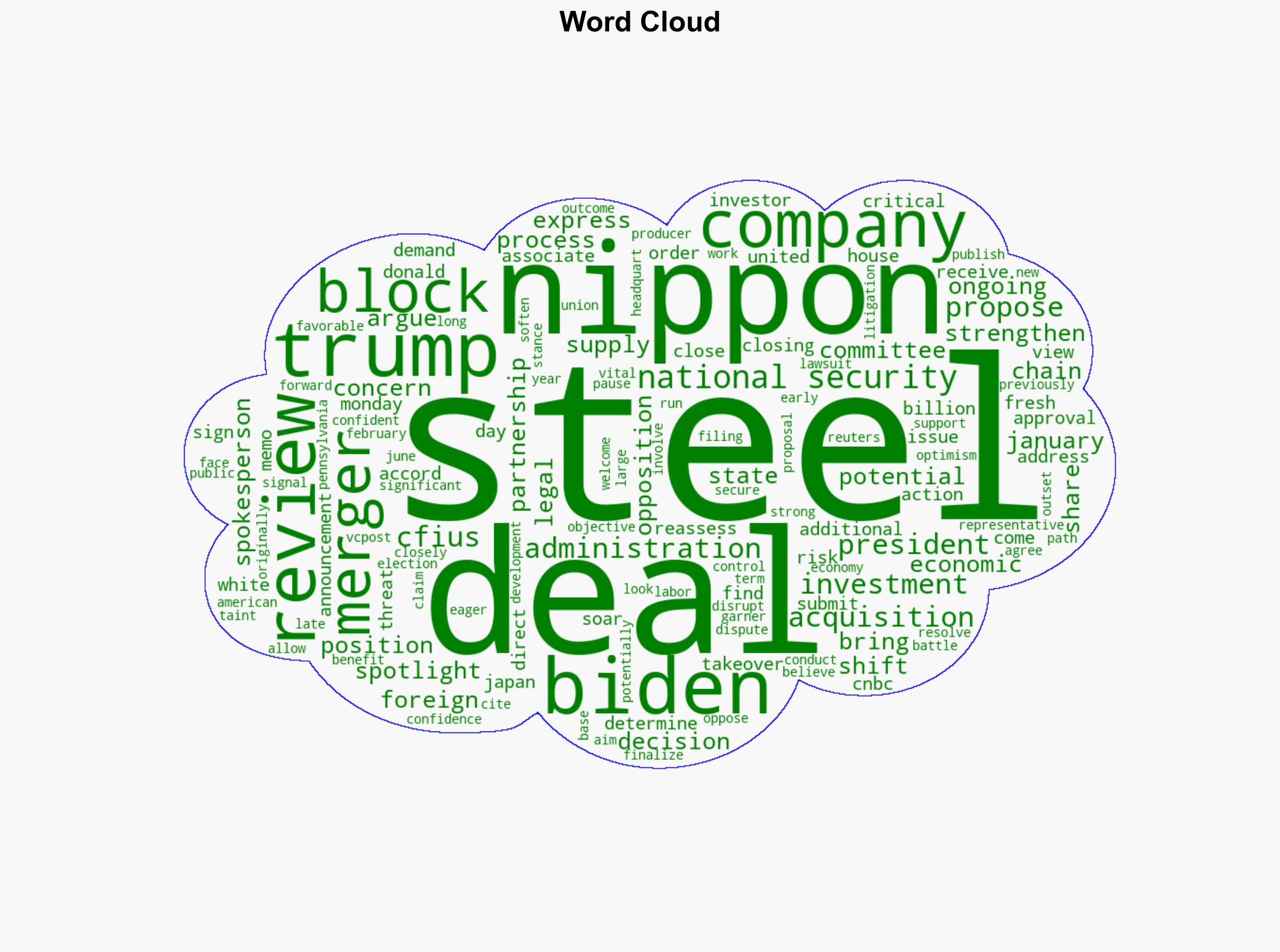

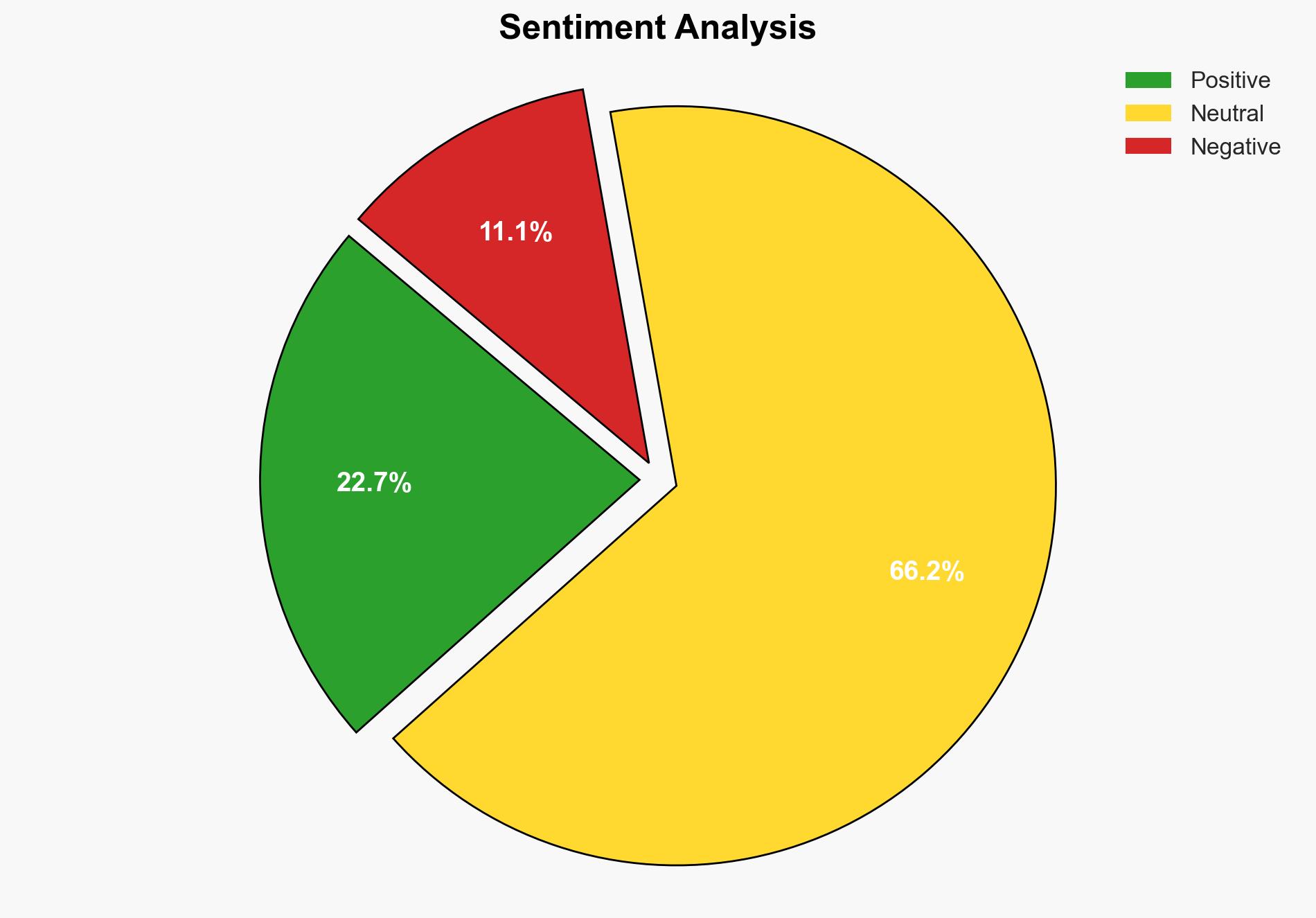

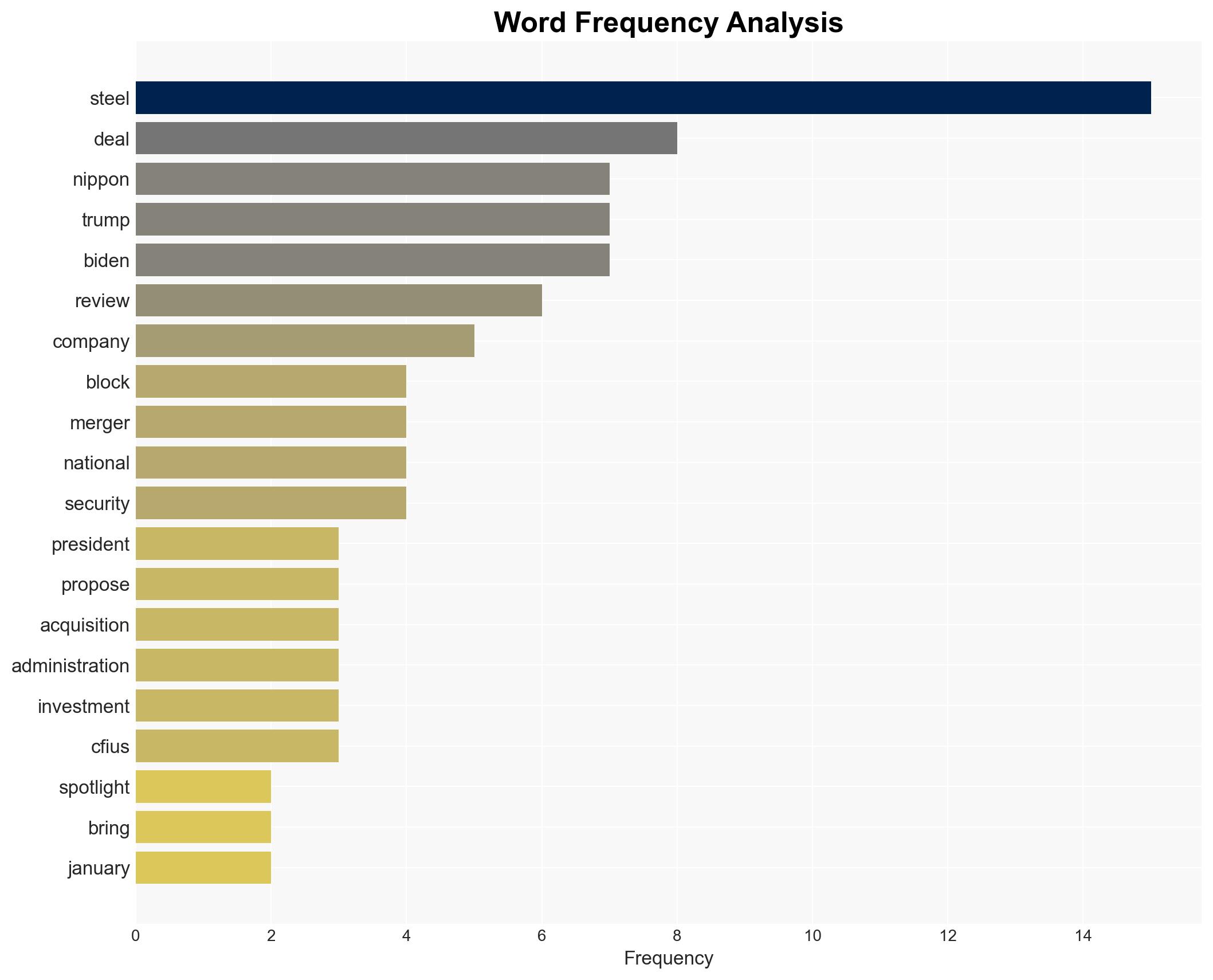

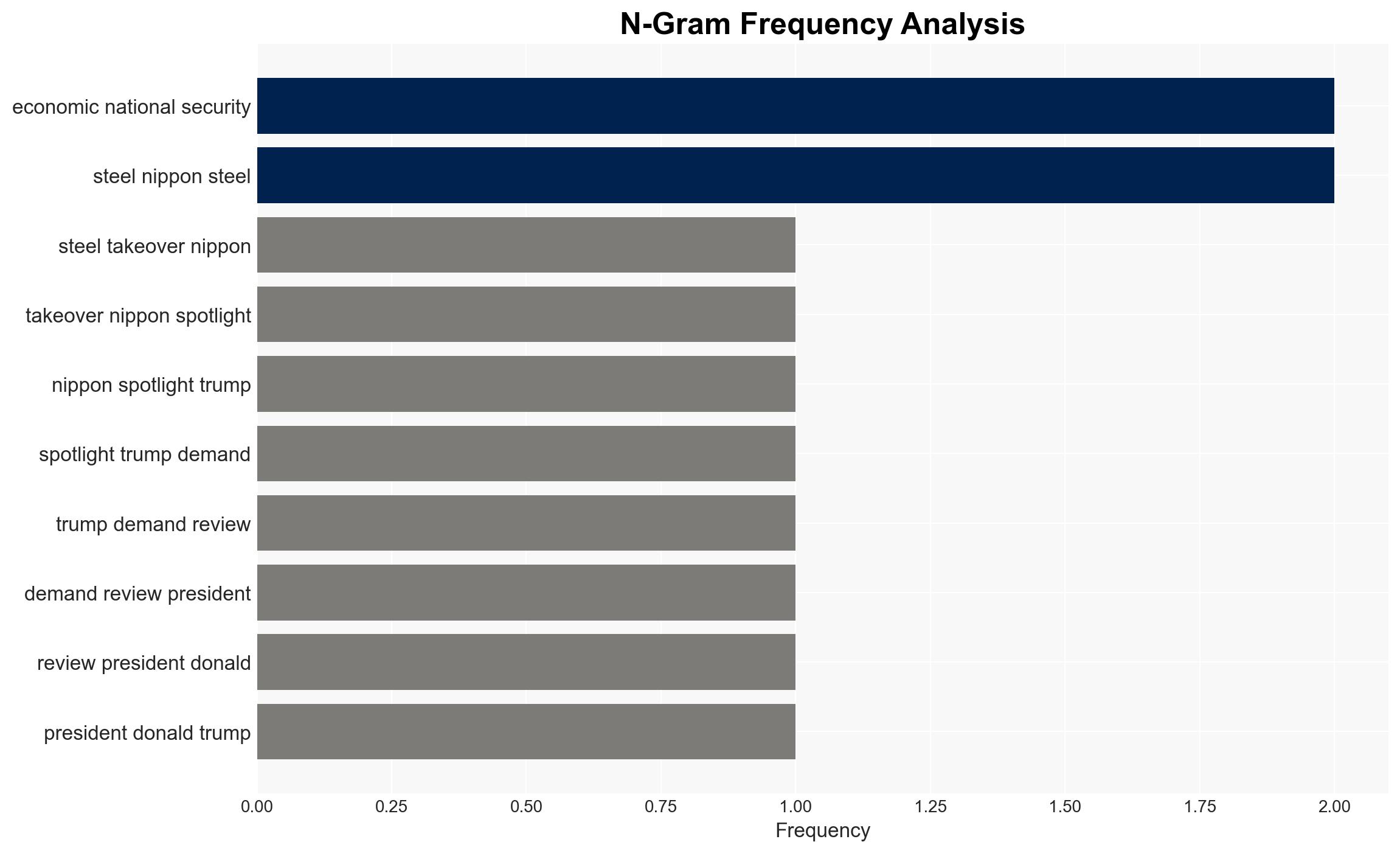

The proposed acquisition of US Steel by Nippon has resurfaced as a critical issue following a directive from Donald Trump for a fresh review. This acquisition, valued at billions, was previously blocked by the Biden administration due to national security concerns. The review, conducted by the Committee on Foreign Investment in the United States (CFIUS), aims to reassess the potential risks and benefits of the deal. The outcome of this review could significantly impact the US steel industry and national security interests.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

The acquisition of US Steel by Nippon has been a contentious issue, with significant political and economic implications. The initial blockage by the Biden administration was based on concerns over foreign control of a major US steel producer, which could disrupt critical supply chains. However, the recent directive from Donald Trump to reassess the deal indicates a potential shift in US policy towards foreign investments in strategic industries. This move could be seen as an attempt to balance economic growth with national security interests.

3. Implications and Strategic Risks

The primary risks associated with the Nippon acquisition of US Steel include potential threats to national security and the stability of critical supply chains. The deal could lead to increased foreign influence in the US steel industry, which is vital for national defense and infrastructure projects. Additionally, the political dynamics surrounding the review process, influenced by upcoming elections and labor union interests, could further complicate the situation.

4. Recommendations and Outlook

Recommendations:

- Conduct a thorough risk assessment to evaluate the national security implications of the acquisition.

- Engage with stakeholders, including industry experts and labor unions, to address concerns and build consensus.

- Consider implementing regulatory measures to safeguard critical supply chains while allowing for foreign investment.

Outlook:

In the best-case scenario, the review process leads to a mutually beneficial agreement that strengthens both economic and national security interests. In the worst-case scenario, the acquisition is blocked, leading to potential legal disputes and economic repercussions. The most likely outcome is a negotiated settlement that addresses key security concerns while allowing the deal to proceed under specific conditions.

5. Key Individuals and Entities

The report mentions significant individuals and organizations involved in the acquisition process:

- Donald Trump

- Joe Biden

- Nippon

- US Steel

- CFIUS