Apple Dethroned by Microsoft As Top-Valued Company Amid Tariff Fears – MacRumors

Published on: 2025-04-09

Intelligence Report: Apple Dethroned by Microsoft As Top-Valued Company Amid Tariff Fears – MacRumors

1. BLUF (Bottom Line Up Front)

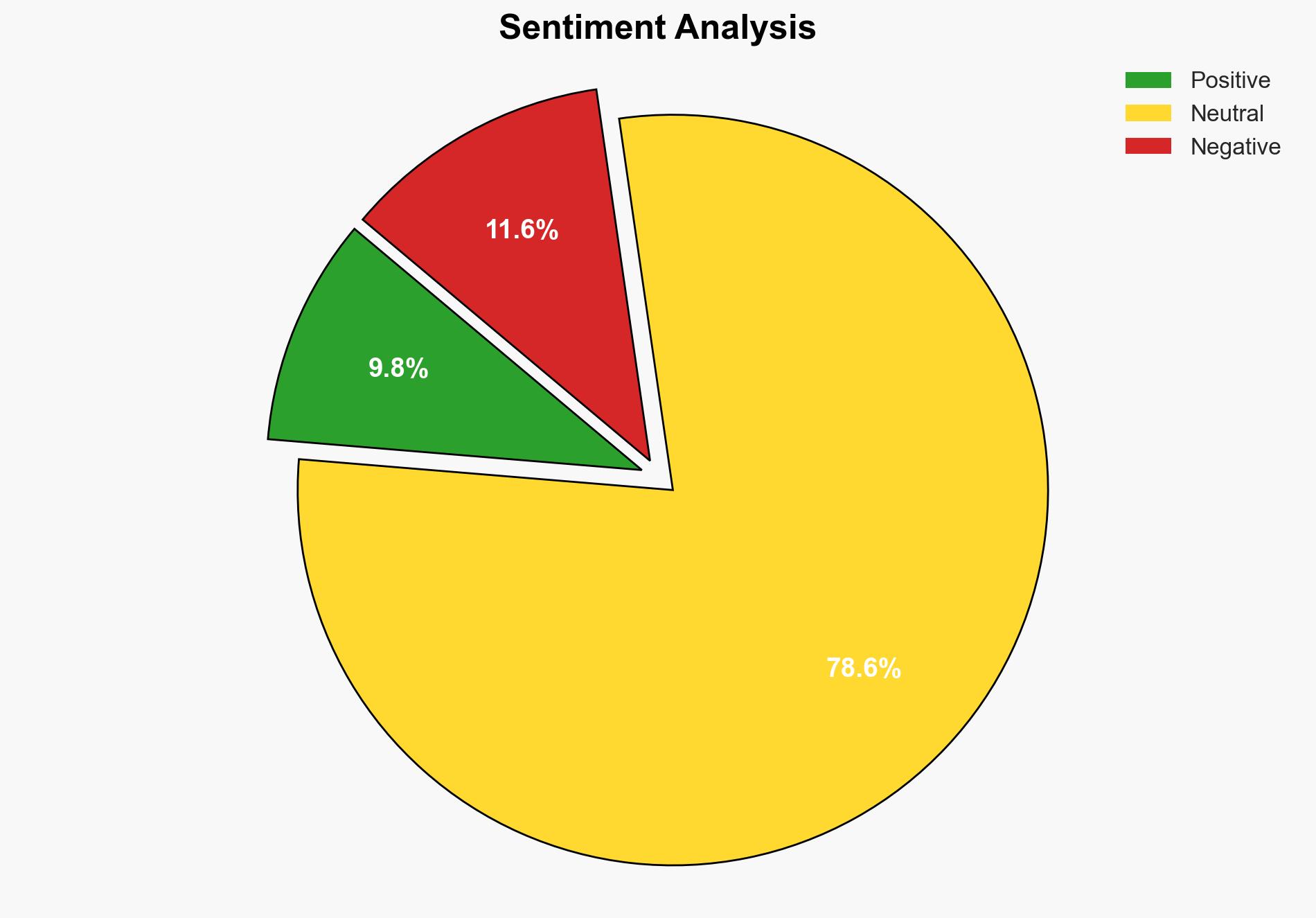

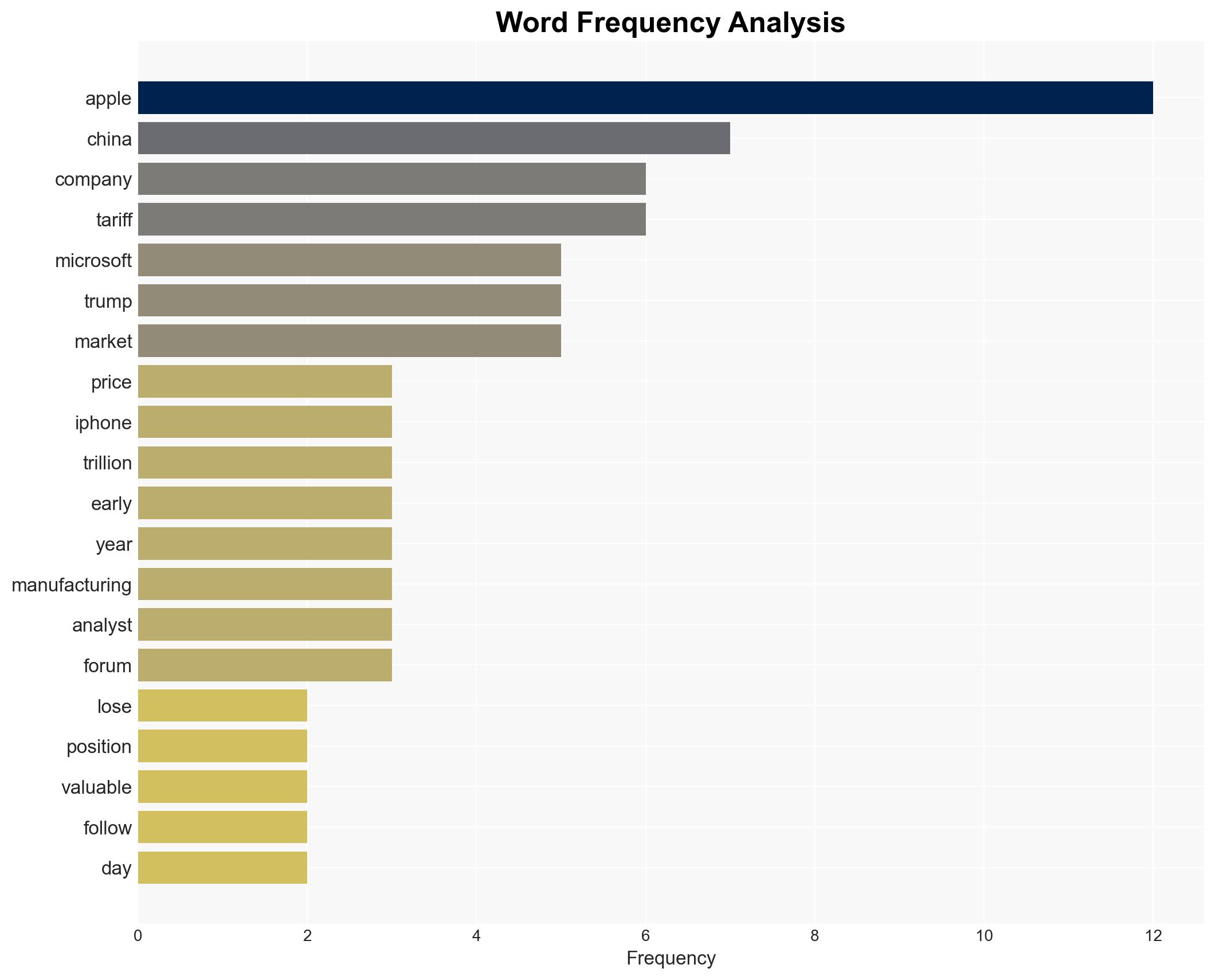

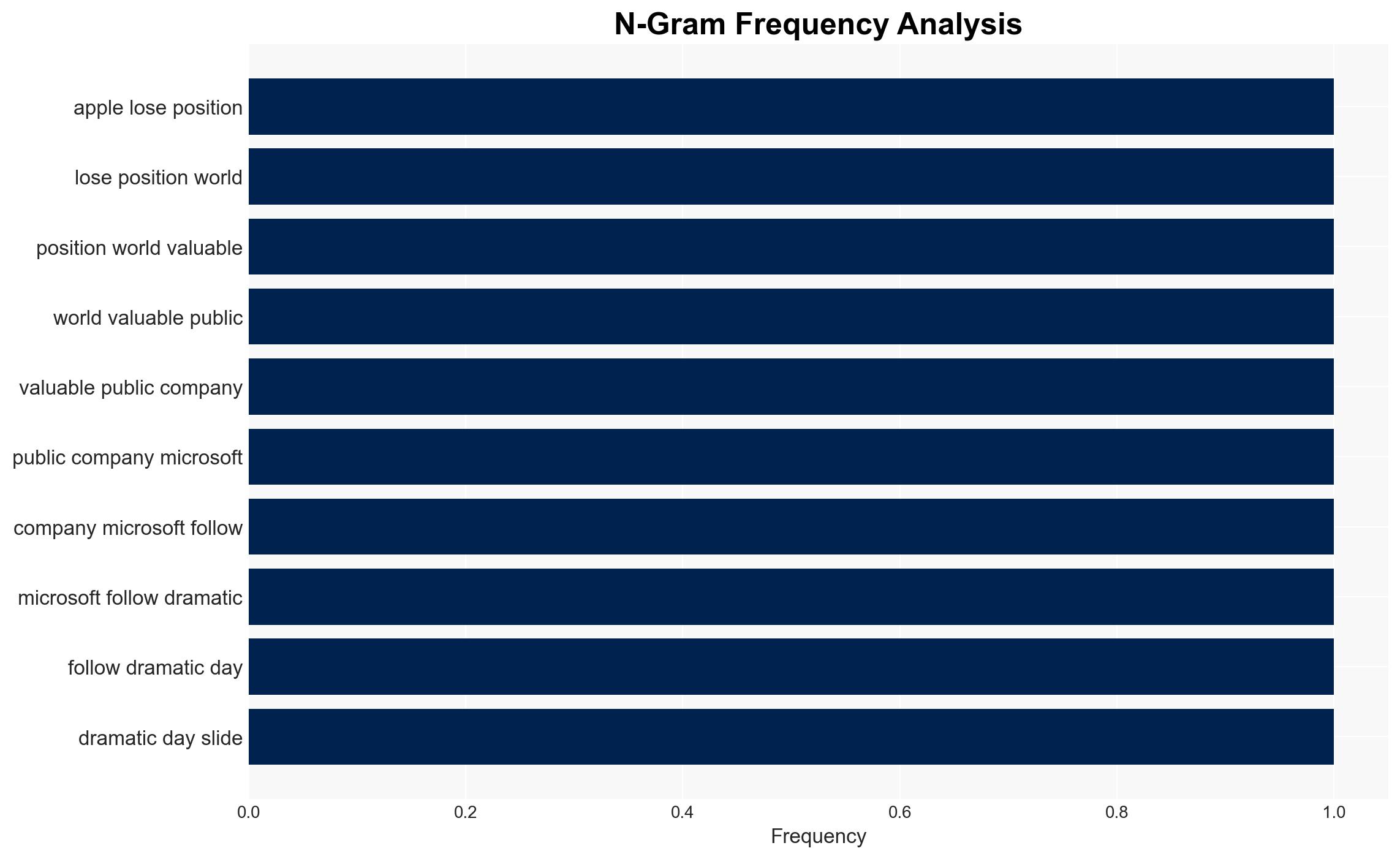

Apple has lost its position as the world’s most valuable public company to Microsoft due to a significant drop in its stock price. This decline is primarily attributed to concerns over escalating tariff tensions between the United States and China. The impact on Apple’s market capitalization highlights vulnerabilities in its reliance on Chinese manufacturing. Immediate strategic considerations include potential shifts in supply chain strategies and consumer pricing adjustments.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

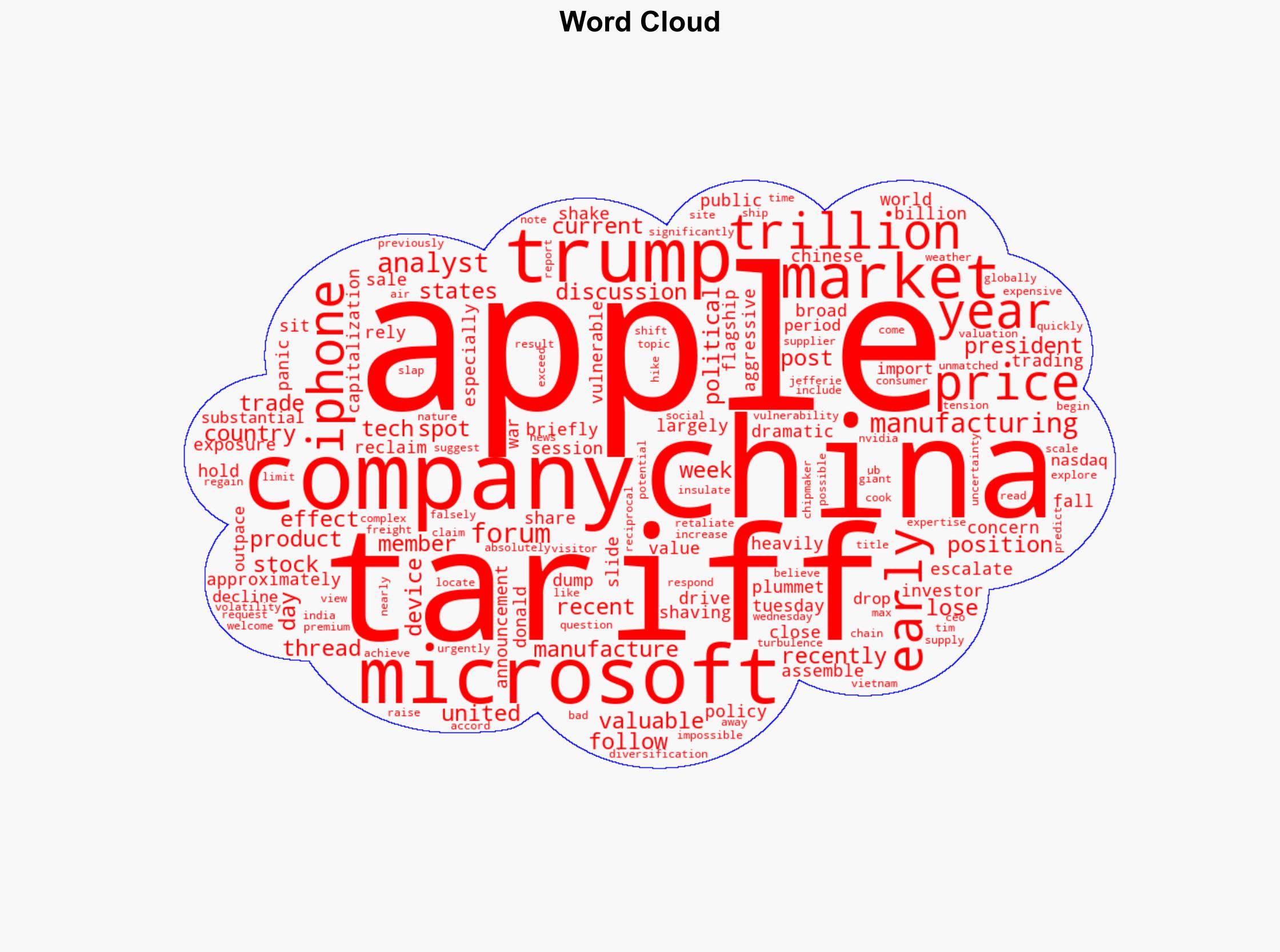

Apple’s market capitalization fell below $1 trillion as its stock price plummeted, driven by investor panic over the company’s exposure to Chinese manufacturing. The tariff war, intensified by recent announcements, has led to broader market instability, with the Nasdaq experiencing significant declines. Analysts predict potential price increases for Apple’s products in the United States, which could affect consumer demand. Despite efforts to diversify manufacturing to countries like India and Vietnam, a rapid shift away from China remains challenging.

3. Implications and Strategic Risks

The ongoing trade tensions pose several strategic risks, including:

- Economic Impact: Increased tariffs could lead to higher consumer prices and reduced demand for tech products.

- Supply Chain Disruption: Apple’s dependency on Chinese manufacturing makes it vulnerable to supply chain disruptions.

- Market Volatility: Continued uncertainty may lead to further market instability, affecting investor confidence.

4. Recommendations and Outlook

Recommendations:

- Encourage diversification of manufacturing locations to reduce dependency on China.

- Explore technological innovations to mitigate cost impacts from tariffs.

- Engage in diplomatic efforts to stabilize trade relations and reduce tariff impacts.

Outlook:

Best-case Scenario: Resolution of trade tensions leads to stabilization of markets and recovery of stock prices.

Worst-case Scenario: Prolonged trade war results in sustained market volatility and significant economic downturn.

Most Likely Outcome: Continued fluctuations in market valuations with gradual adjustments in supply chain strategies.

5. Key Individuals and Entities

The report mentions significant individuals and organizations, including Donald Trump, Tim Cook, Apple, Microsoft, and Nvidia. These entities play crucial roles in the unfolding events and strategic decisions.