Steel Mergers Tariffs and US Competitiveness – Forbes

Published on: 2025-04-09

Intelligence Report: Steel Mergers Tariffs and US Competitiveness – Forbes

1. BLUF (Bottom Line Up Front)

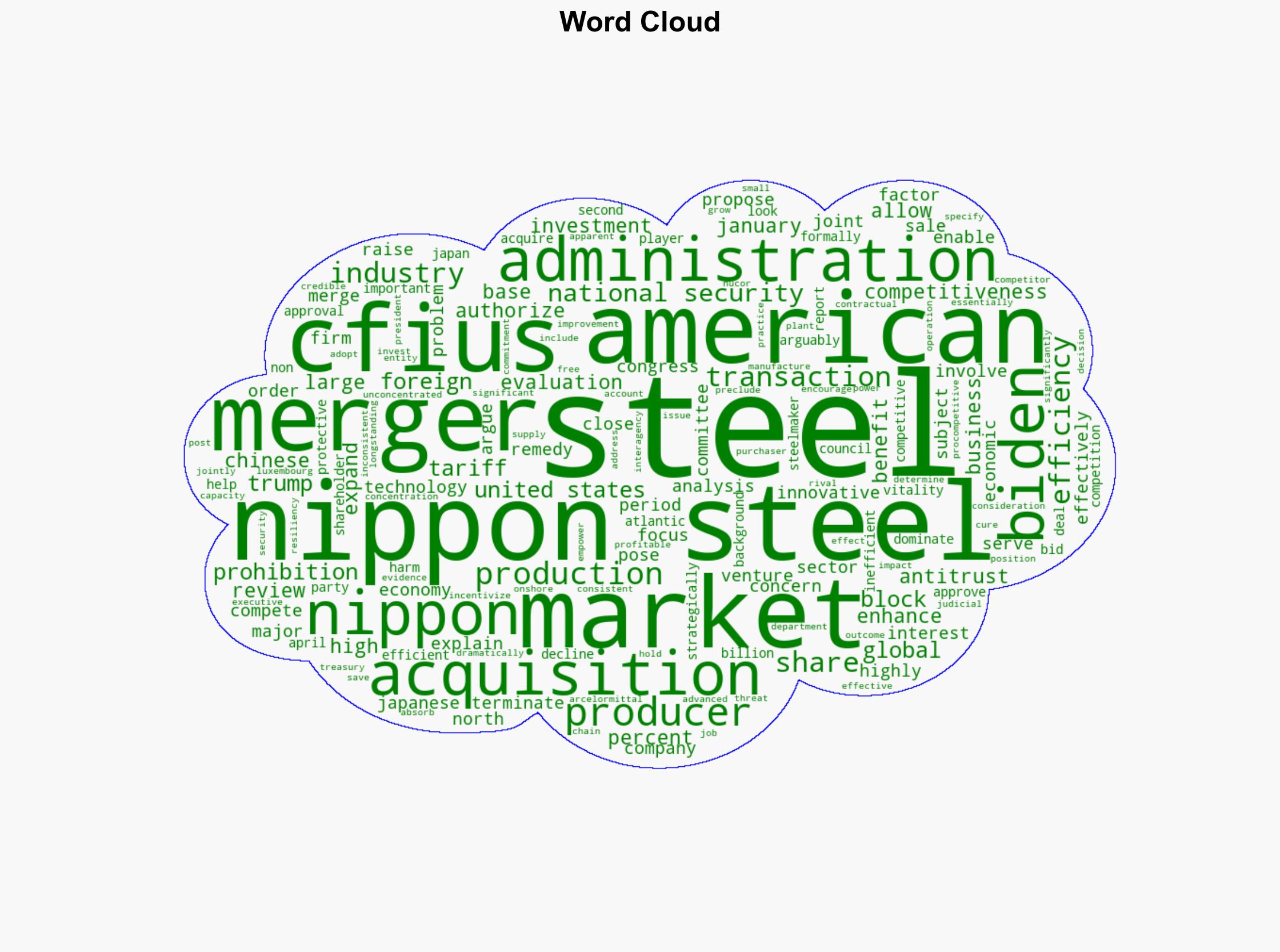

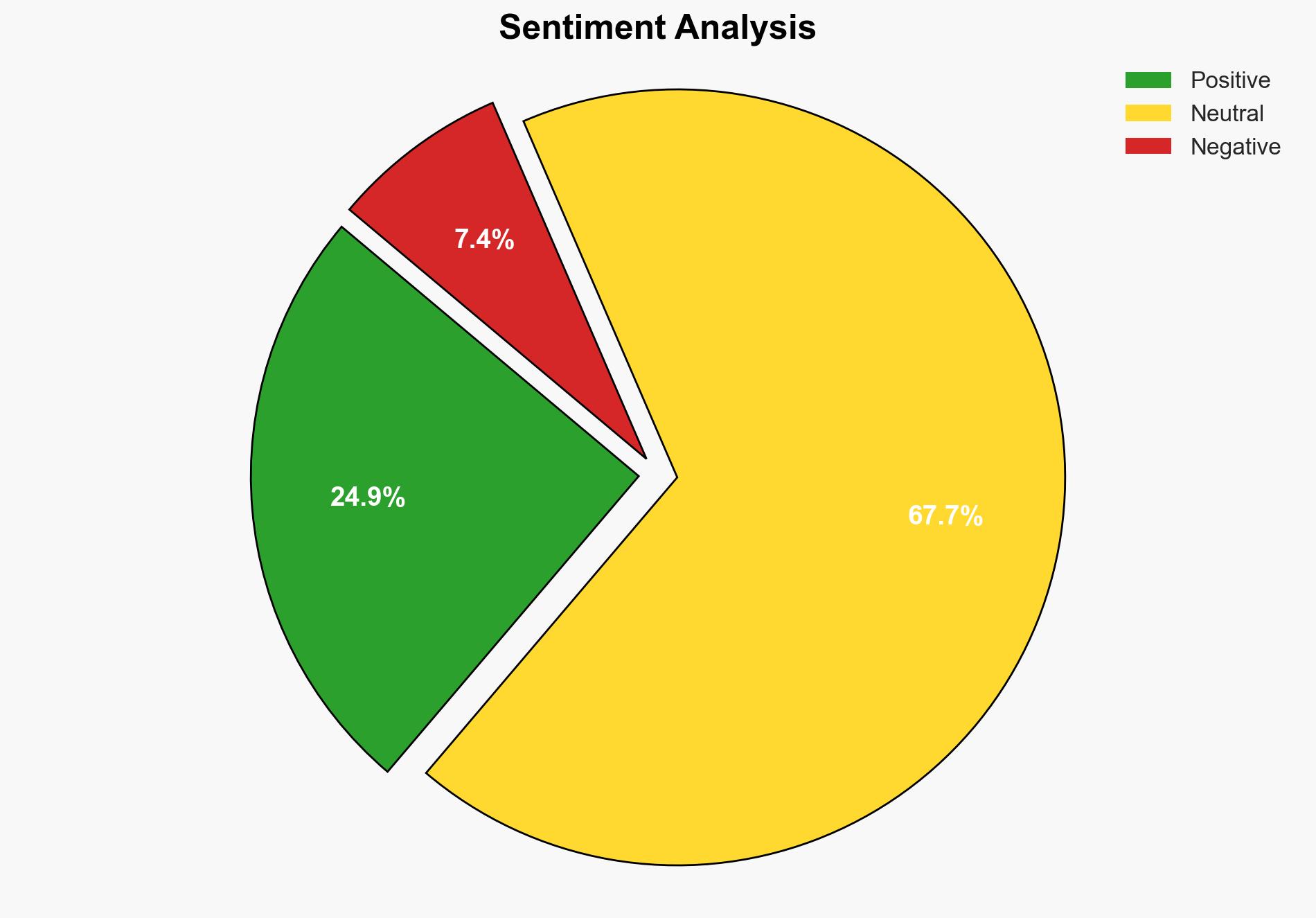

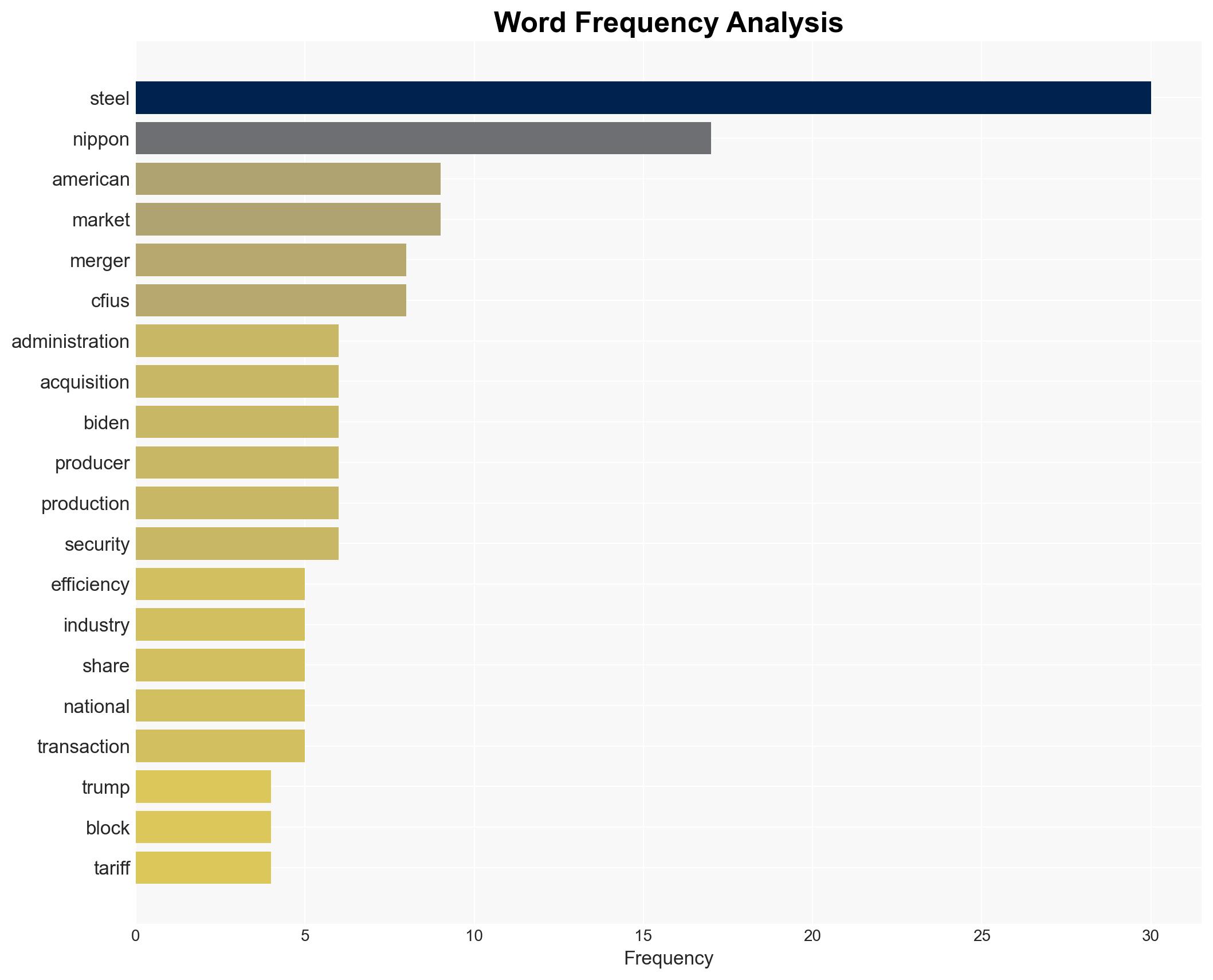

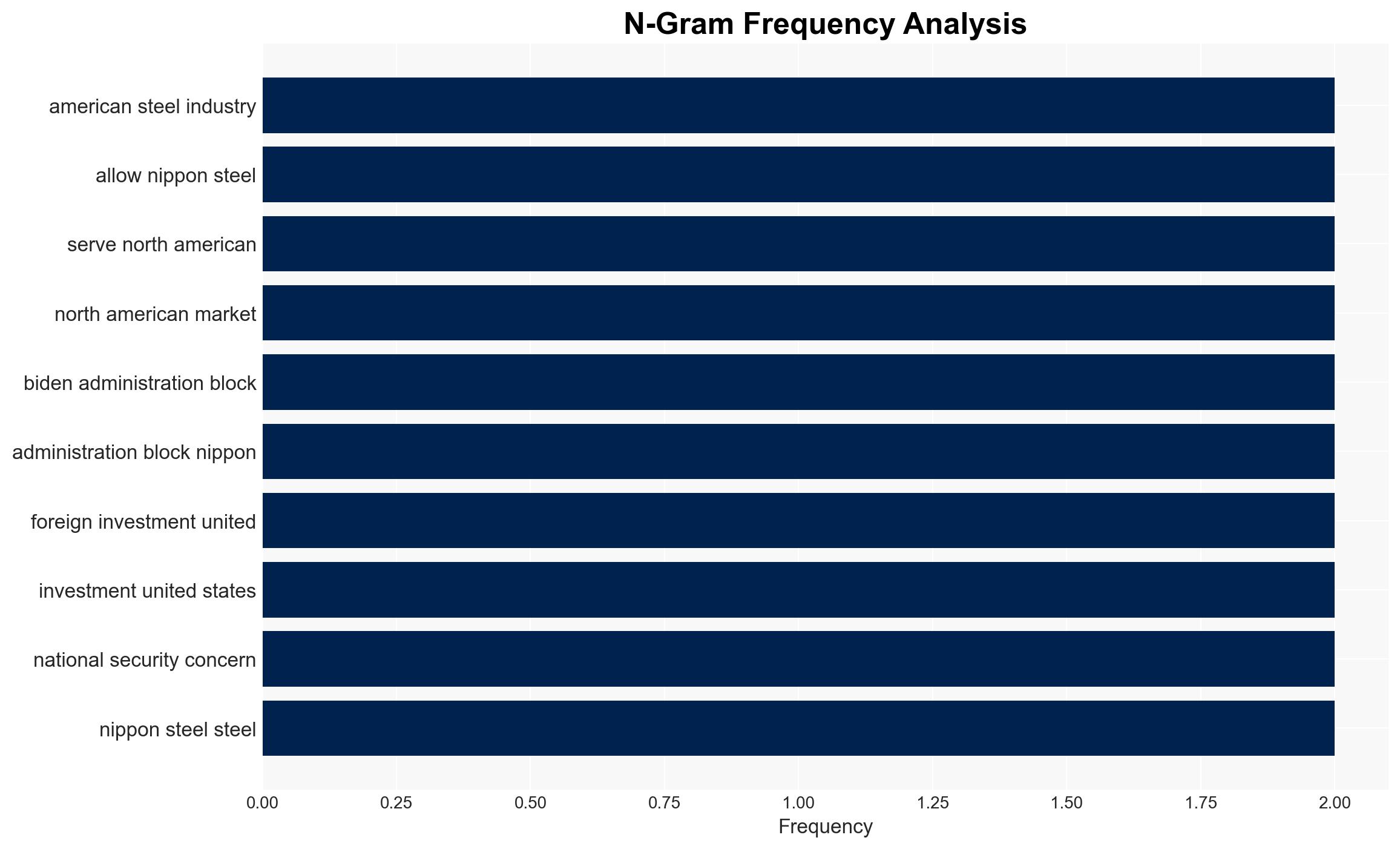

The proposed acquisition of a large Japanese steelmaker by Nippon Steel has been blocked by the current administration, despite potential benefits to the U.S. steel industry. The merger was anticipated to enhance efficiency and competitiveness in the American steel sector, allowing Nippon Steel to compete more effectively against Chinese firms. The decision to block the merger was based on national security concerns, as evaluated by the Committee on Foreign Investment in the United States (CFIUS).

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

The merger between Nippon Steel and the Japanese steelmaker was expected to enhance the efficiency of the U.S. steel industry by introducing advanced technologies and increasing production capacity. This would have allowed Nippon Steel to operate tariff-free within the North American market, aligning with previous administration interests in onshoring foreign production. The merger posed minimal antitrust issues due to the unconcentrated nature of the steel industry and Nippon Steel’s small global market share.

3. Implications and Strategic Risks

Blocking the merger could hinder the U.S. steel industry’s ability to compete globally, particularly against Chinese firms that dominate the market. The decision may also impact foreign investment perceptions, potentially discouraging future investments in strategically important industries. National security concerns remain a priority, with CFIUS expanding its evaluation criteria to include supply chain resiliency and technological leadership.

4. Recommendations and Outlook

Recommendations:

- Reassess the national security risks associated with the merger, considering potential economic benefits and industry competitiveness.

- Encourage policies that balance national security with economic growth, possibly through targeted divestitures or behavioral remedies.

- Strengthen domestic steel production capabilities to reduce reliance on foreign entities.

Outlook:

Best-case scenario: The U.S. steel industry adapts to the competitive landscape, leveraging domestic innovations to enhance global competitiveness.

Worst-case scenario: The industry faces increased competition from Chinese firms, leading to a decline in market share and economic impact.

Most likely outcome: The industry experiences moderate growth, with ongoing challenges in balancing national security and economic interests.

5. Key Individuals and Entities

The report mentions significant individuals and organizations such as Nippon Steel, a large Japanese steelmaker, and the Committee on Foreign Investment in the United States (CFIUS). These entities play crucial roles in the strategic decisions affecting the steel industry and national security.