Add Protection from Scammers with Cybercrime Insurance – TidBITS

Published on: 2025-04-11

Intelligence Report: Add Protection from Scammers with Cybercrime Insurance – TidBITS

1. BLUF (Bottom Line Up Front)

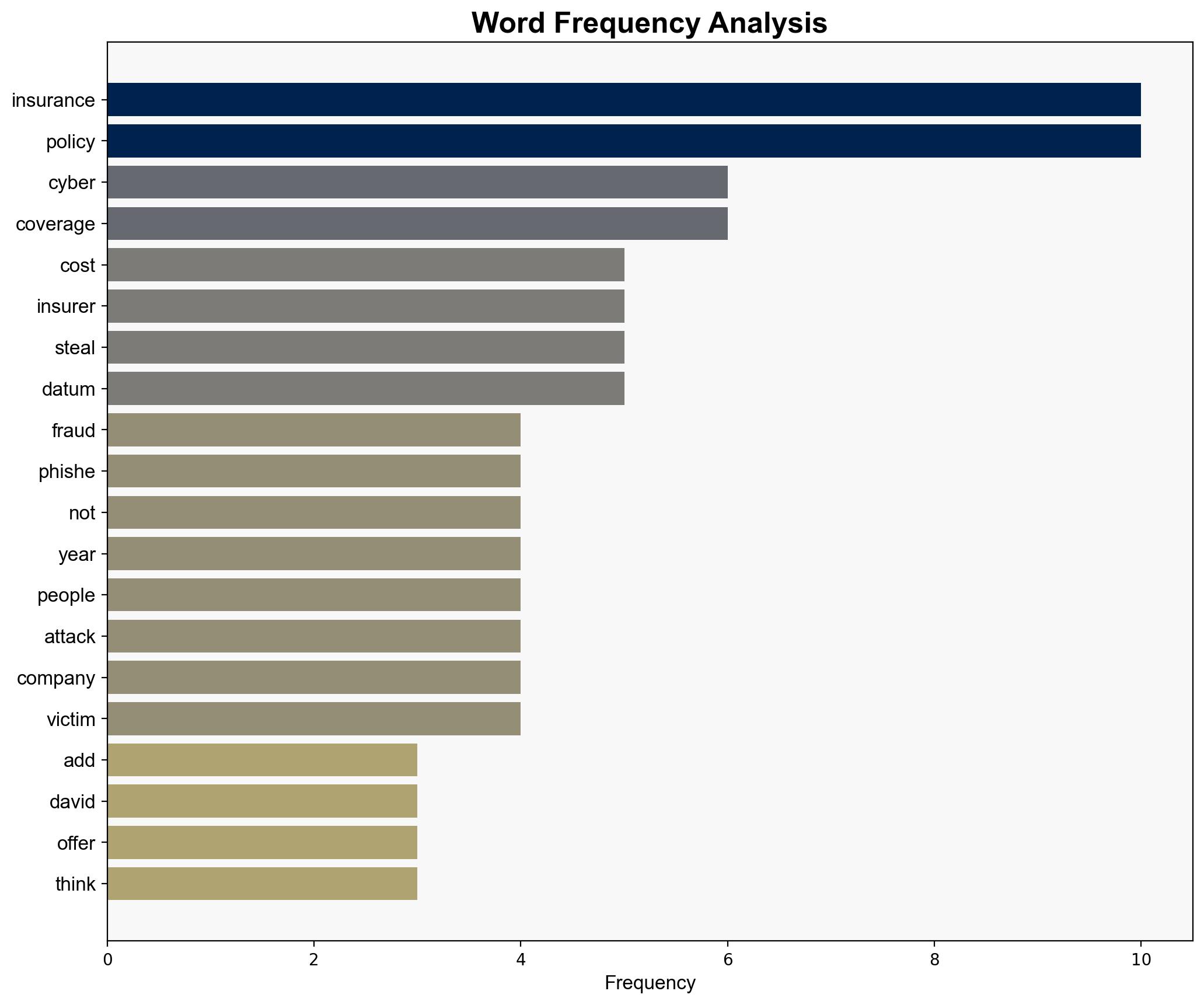

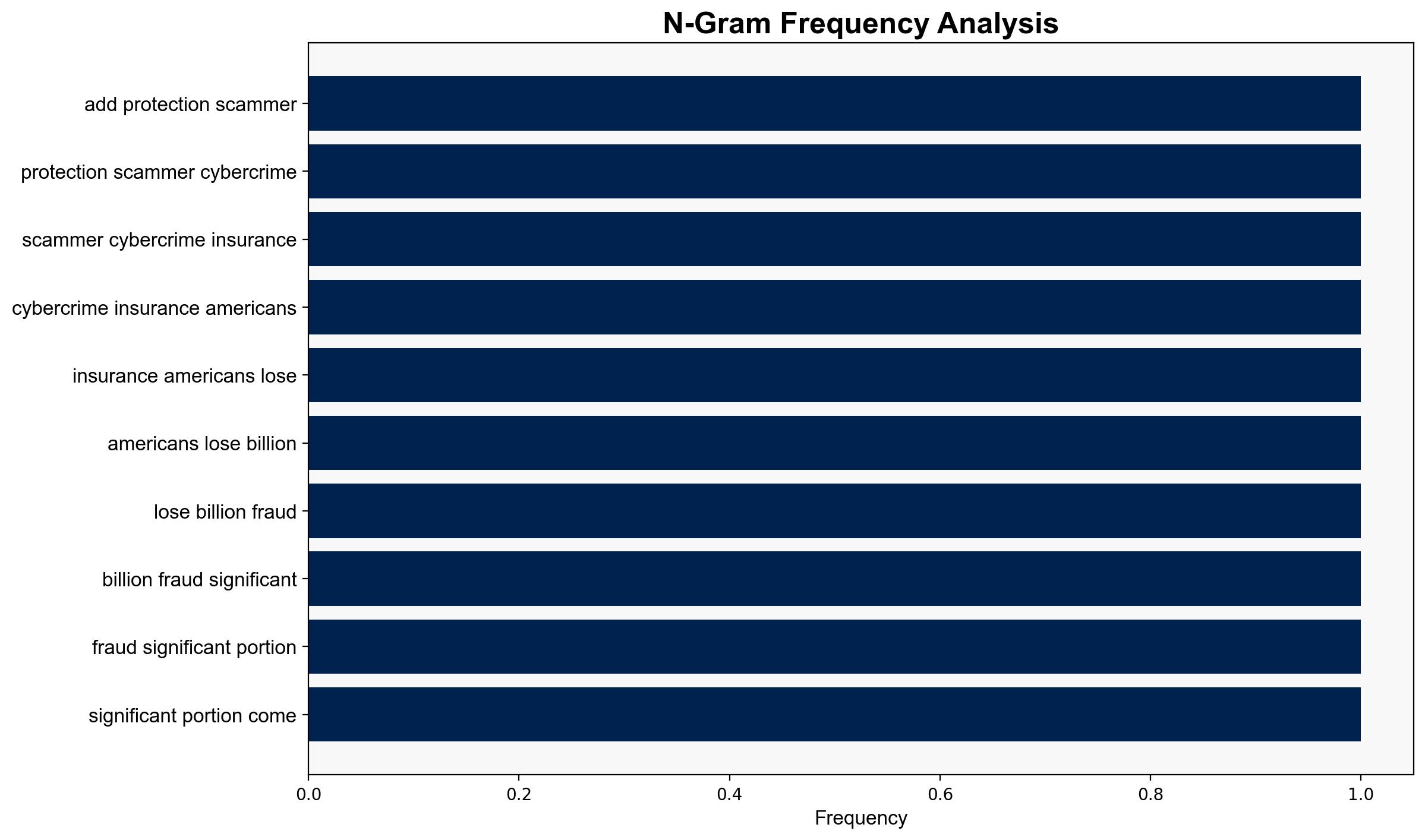

Cybercrime insurance is emerging as a critical tool for mitigating financial losses from scams and fraud, which cost Americans $12 billion in 2024. This insurance can provide reimbursement for losses due to phishing, smishing, and other scams. Stakeholders should consider integrating cybercrime insurance into existing policies or purchasing standalone options to protect against financial threats.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

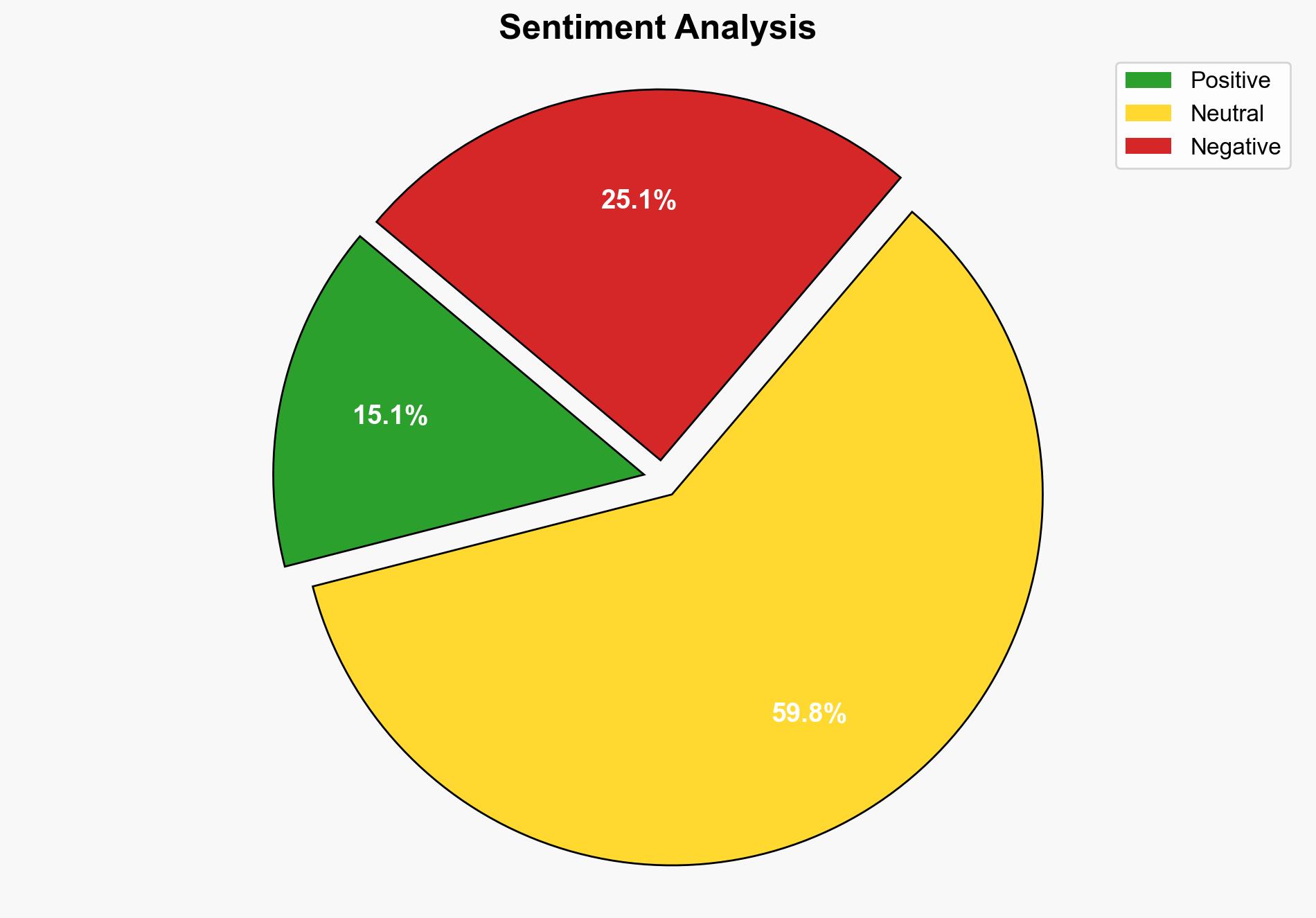

General Analysis

The rise in cybercrime, particularly through phishing and social media scams, has led to significant financial losses. Cybercrime insurance offers a potential solution by covering some or all costs associated with data loss, cyber extortion, and direct theft. The insurance market provides options ranging from endorsements on existing homeowner policies to standalone policies for renters. The cost varies based on coverage levels, with prices between $25 to $300 annually.

3. Implications and Strategic Risks

The increasing prevalence of cybercrime poses risks to individual financial security and broader economic stability. Without adequate protection, individuals may face significant financial losses, potentially leading to decreased consumer confidence and economic strain. The trend of sophisticated scams, such as “pig-butchering,” highlights the need for enhanced protective measures.

4. Recommendations and Outlook

Recommendations:

- Encourage individuals to evaluate their current insurance policies and consider adding cybercrime coverage.

- Promote awareness of cybercrime insurance options through public information campaigns.

- Advocate for regulatory frameworks that support the development and accessibility of cyber insurance products.

Outlook:

In the best-case scenario, widespread adoption of cybercrime insurance could significantly reduce the financial impact of scams. In the worst-case scenario, continued underinsurance may exacerbate economic vulnerabilities. The most likely outcome is a gradual increase in insurance uptake as awareness grows, leading to better financial resilience against cyber threats.

5. Key Individuals and Entities

The report mentions David Strom and Nerdwallet as sources of information on cybercrime insurance. Additionally, Chubb and Blink are highlighted as providers offering comprehensive coverage options.