Theres No Such Thing As Adjusting The Gold Price To Inflation – Forbes

Published on: 2025-04-13

Intelligence Report: There’s No Such Thing As Adjusting The Gold Price To Inflation – Forbes

1. BLUF (Bottom Line Up Front)

The article from Forbes challenges the notion of adjusting the gold price to inflation, arguing that both gold and the foot are constants. The key finding is that inflation is a policy choice rather than an economic inevitability. The report highlights the flawed logic in redefining economic measures, drawing parallels to altering physical constants. It concludes that inflation is an attempt to rewrite reality, which is visible and ineffective. Recommendations include maintaining consistent economic measures and avoiding artificial adjustments that distort market realities.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

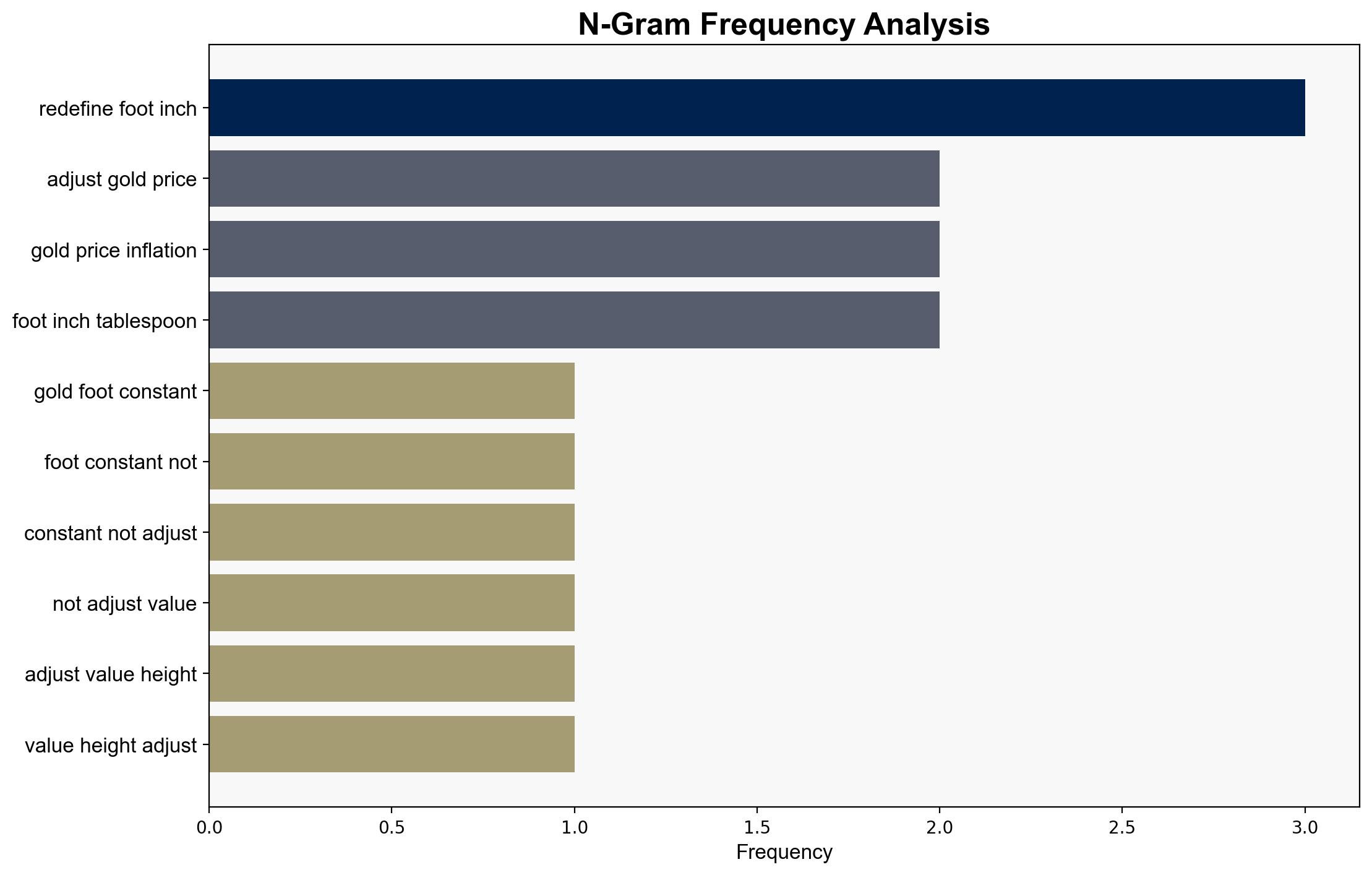

The article uses the analogy of redefining the foot to critique the practice of adjusting economic measures like gold prices for inflation. The argument is that such adjustments are misleading and do not reflect true economic conditions. Inflation is described as a deliberate policy choice that distorts reality, similar to redefining physical measurements. The analysis suggests that attempts to make U.S. companies more competitive through currency devaluation are misguided and do not consider the broader economic implications.

3. Implications and Strategic Risks

The article implies significant risks to economic stability if inflation is misunderstood or mismanaged. Redefining economic measures can lead to distorted market perceptions and poor policy decisions. This could impact national security by undermining economic confidence and regional stability through competitive devaluation. The potential for economic misinformation poses a threat to informed decision-making and could lead to misguided strategies.

4. Recommendations and Outlook

Recommendations:

- Maintain consistent economic measures to ensure accurate market assessments.

- Avoid artificial adjustments that distort market realities and lead to poor policy decisions.

- Enhance economic literacy among policymakers to prevent the adoption of flawed economic strategies.

Outlook:

Best-case scenario: Policymakers recognize the importance of consistent economic measures, leading to more stable economic policies and improved market confidence.

Worst-case scenario: Continued reliance on flawed economic adjustments results in market instability and decreased global competitiveness.

Most likely outcome: A gradual shift towards more accurate economic assessments as the limitations of current practices become more apparent.

5. Key Individuals and Entities

The report mentions Kim Jong Un and Stephen Miran in the context of illustrating flawed economic logic. These individuals are used to emphasize the broader argument against adjusting economic measures like gold prices for inflation.