April 15 Hasnt Always Been Tax DayIt Used To Be Much Earlier – Forbes

Published on: 2025-04-15

Intelligence Report: April 15 Hasn’t Always Been Tax Day – Forbes

1. BLUF (Bottom Line Up Front)

The historical evolution of the U.S. income tax system highlights significant changes in tax policy, driven by economic needs and legal challenges. The shift from a flat tax during the Civil War to the eventual establishment of the Sixteenth Amendment underscores the complexity of tax legislation and its implications on national finance. Key findings indicate that the legal and economic landscape significantly influenced the development and implementation of tax policies, with lasting impacts on federal revenue generation.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

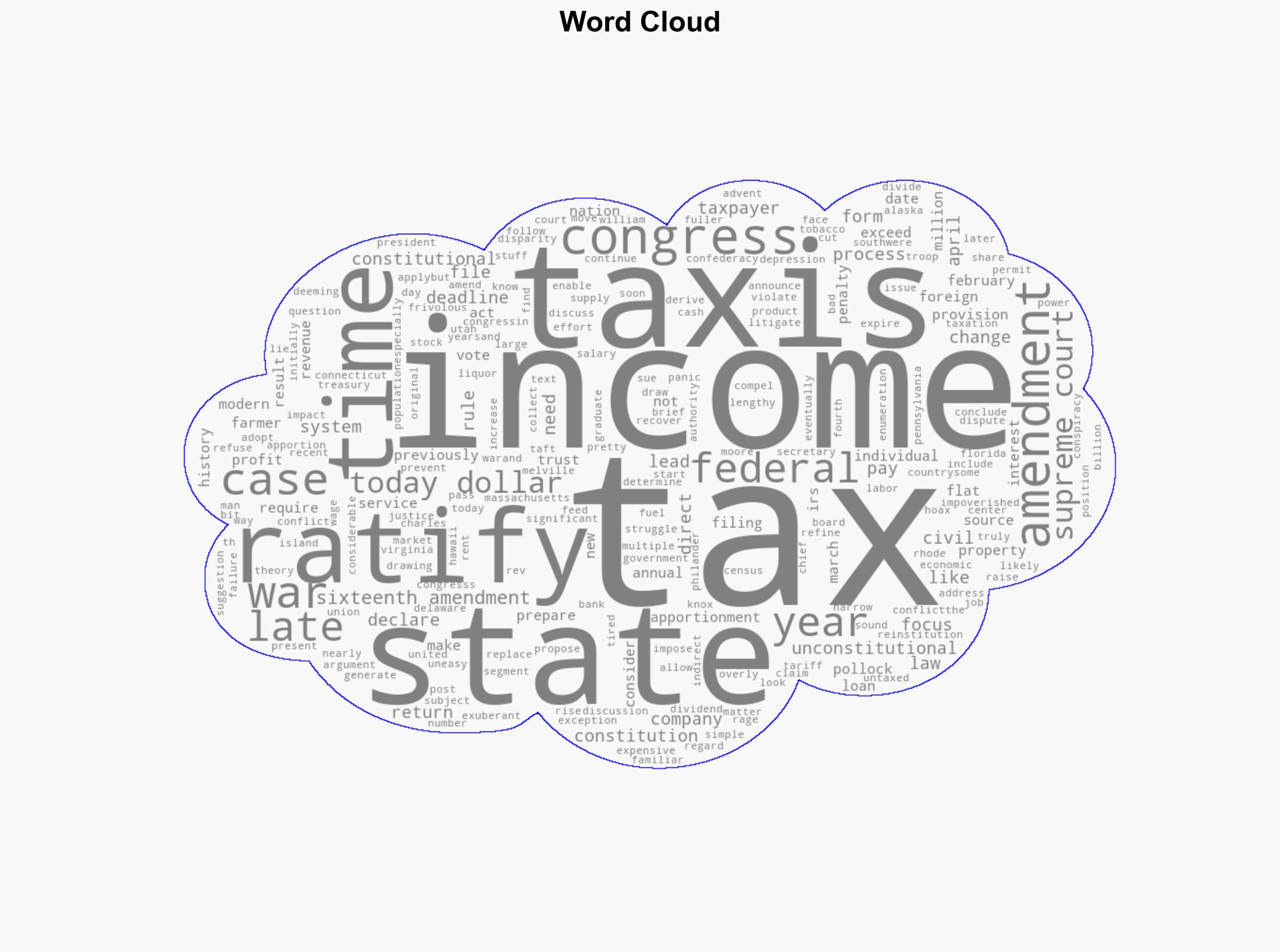

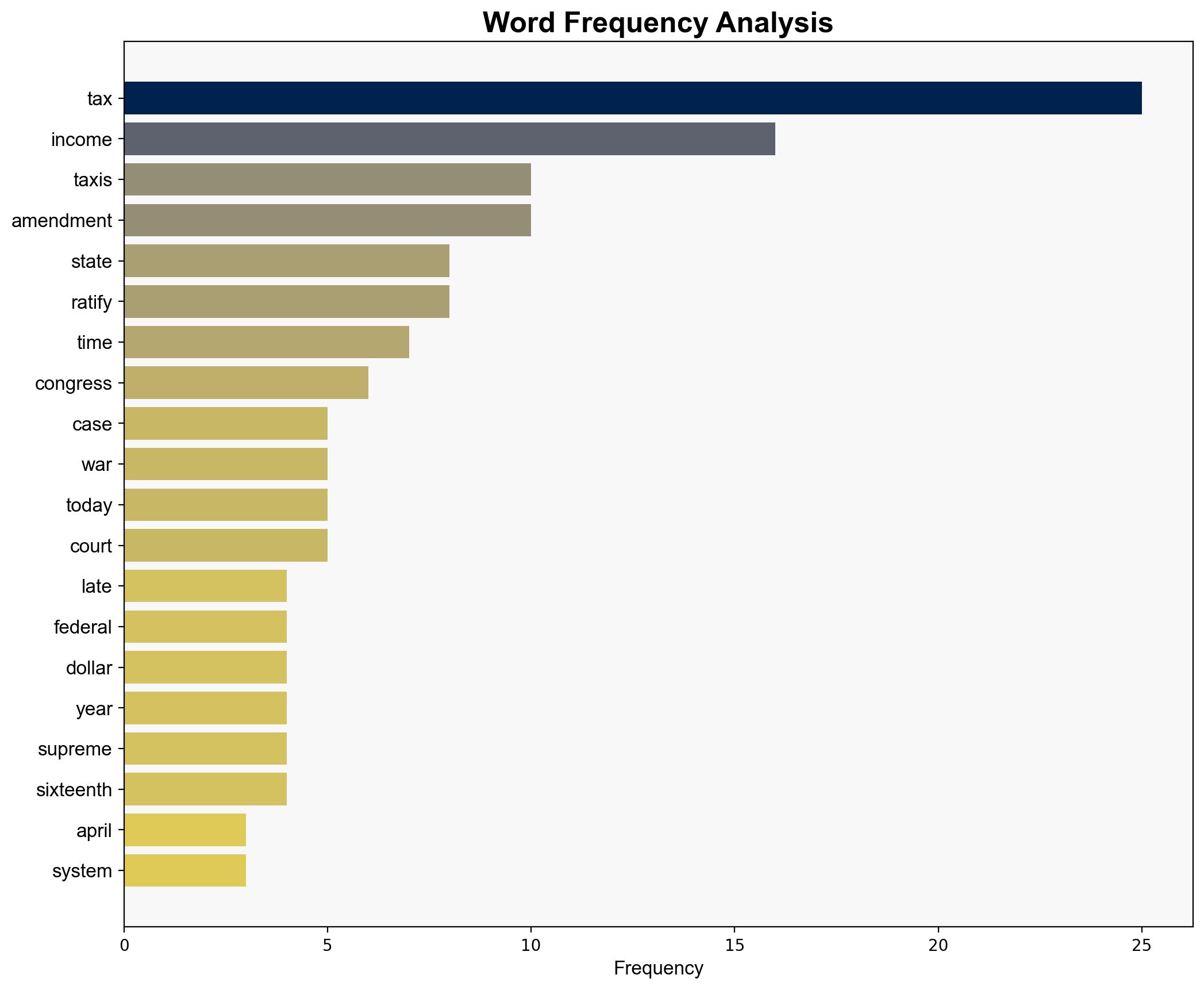

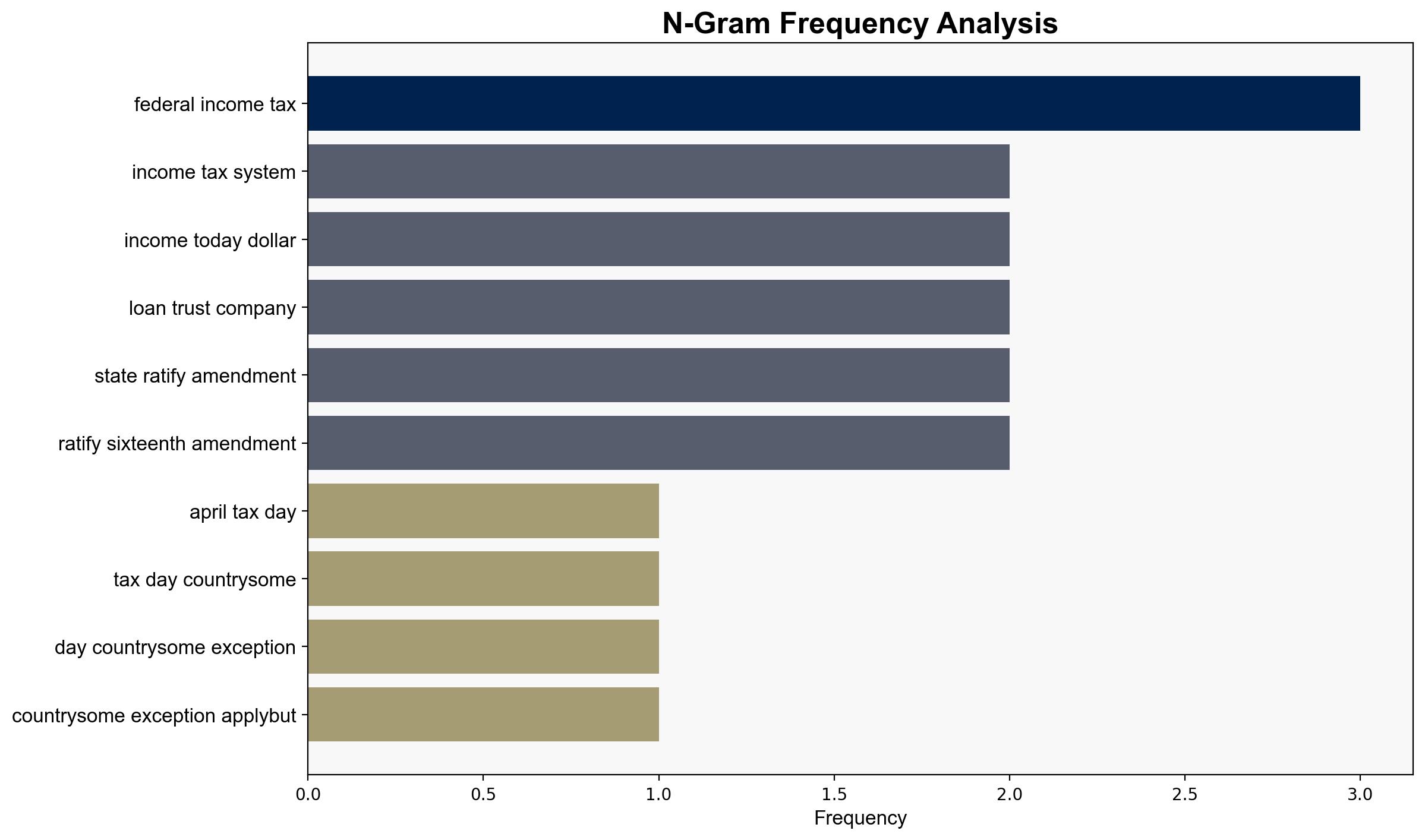

The U.S. income tax system has undergone substantial changes since its inception. Initially introduced during the Civil War as a means to finance military expenditures, the tax system evolved from a flat tax to a graduated tax structure. The Revenue Act of 1861 marked the beginning of federal income taxation, which was later challenged and deemed unconstitutional in 1895. The Supreme Court’s decision in the Pollock v. Farmers’ Loan and Trust Company case highlighted the constitutional limitations on direct taxation, prompting the eventual ratification of the Sixteenth Amendment. This amendment allowed for the taxation of income from all sources, addressing previous legal challenges and enabling a more robust federal revenue system.

3. Implications and Strategic Risks

The historical shifts in tax policy have significant implications for economic stability and governance. The reliance on income tax as a primary revenue source underscores the importance of a stable and equitable tax system. Legal challenges, such as those faced in the late 19th century, pose risks to fiscal policy and economic planning. The evolution of tax legislation reflects broader economic trends, including responses to war, economic depression, and market failures. These factors continue to influence contemporary tax policy and economic strategy.

4. Recommendations and Outlook

Recommendations:

- Enhance legal frameworks to ensure the constitutionality and fairness of tax policies.

- Implement regulatory measures to address economic disparities and ensure equitable tax burdens.

- Consider technological advancements to improve tax collection efficiency and compliance.

Outlook:

Best-case scenario: Continued refinement of tax policies leads to increased revenue stability and economic growth.

Worst-case scenario: Legal challenges and economic downturns disrupt tax revenue streams, affecting government operations.

Most likely outcome: Gradual adjustments to tax policies in response to economic and legal developments, maintaining a balance between revenue needs and taxpayer equity.

5. Key Individuals and Entities

The report references Charles Pollock and Melville Fuller as significant figures in the historical context of U.S. tax policy. Their involvement in legal challenges shaped the trajectory of income tax legislation and its constitutional interpretation.