Heineken Holding NV reports on 2025 first quarter trading – GlobeNewswire

Published on: 2025-04-16

Intelligence Report: Heineken Holding NV reports on 2025 first quarter trading – GlobeNewswire

1. BLUF (Bottom Line Up Front)

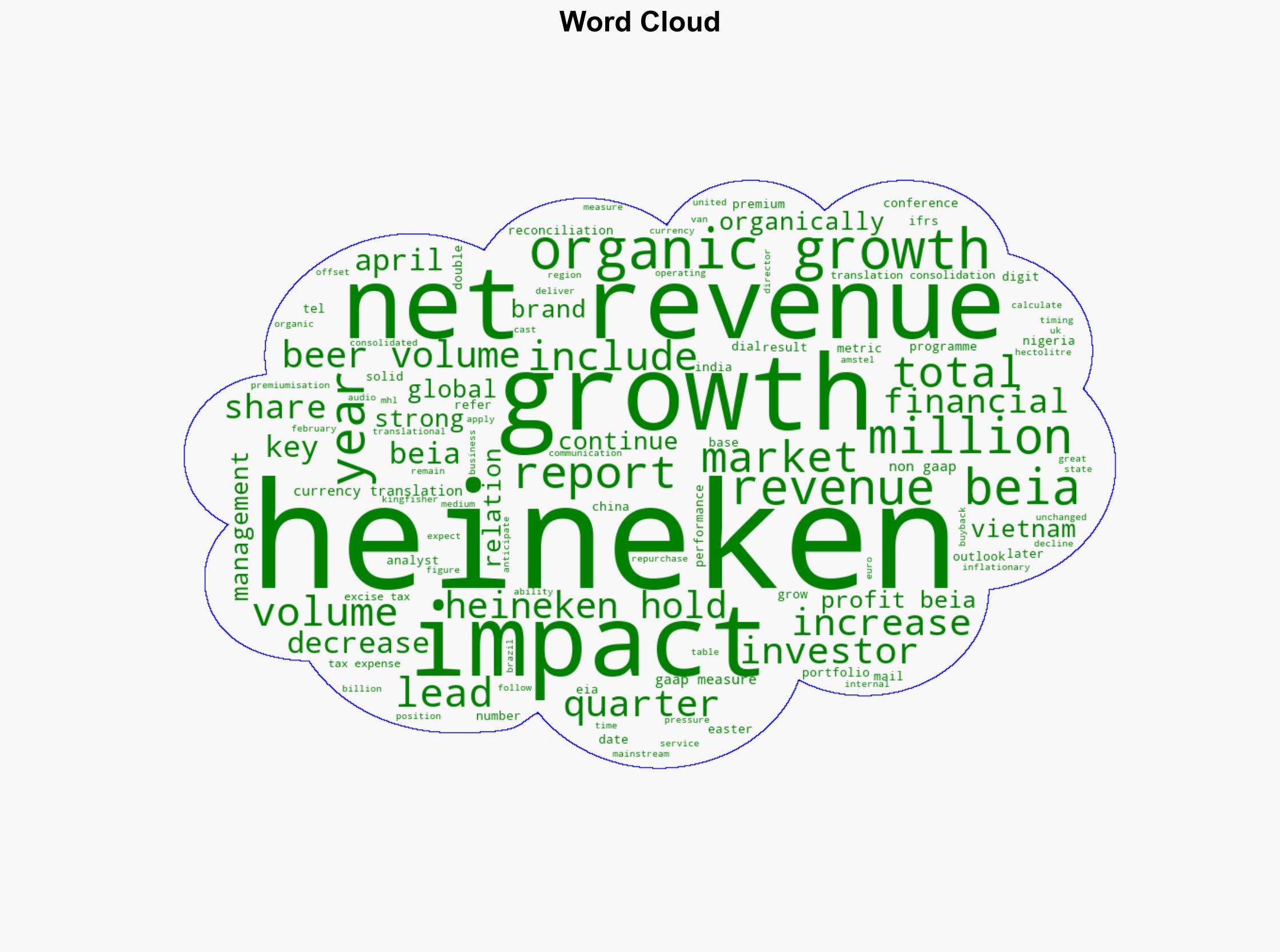

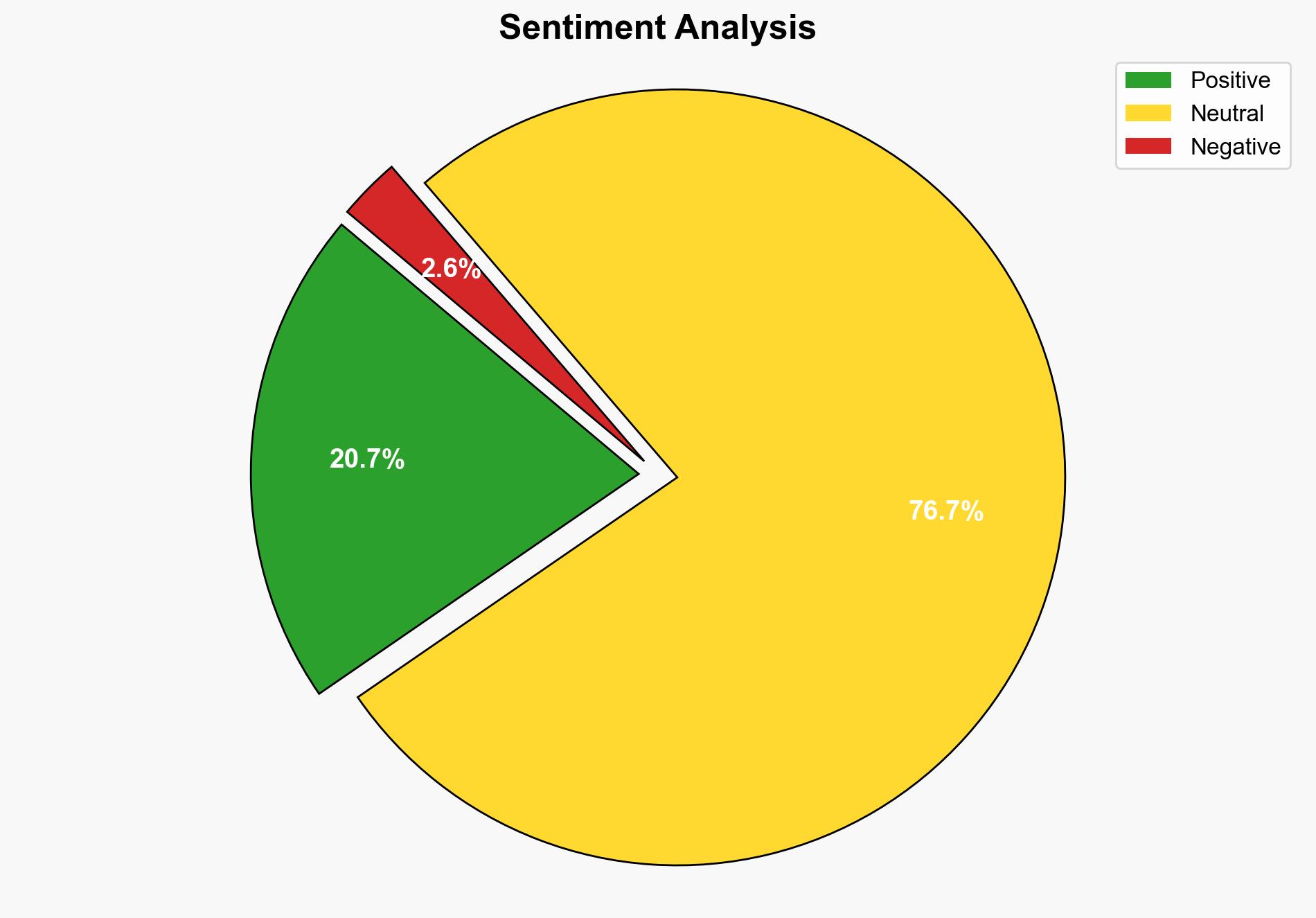

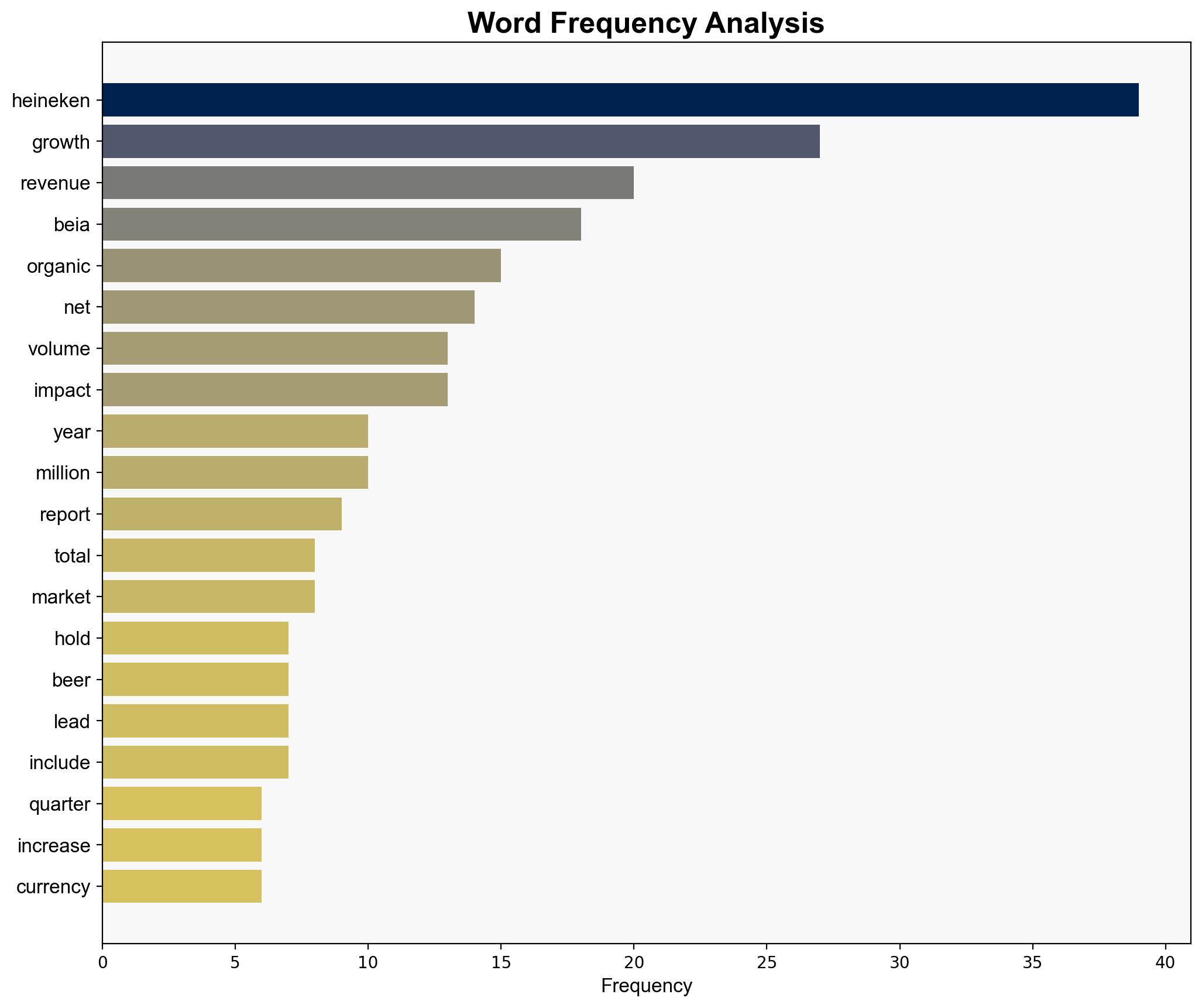

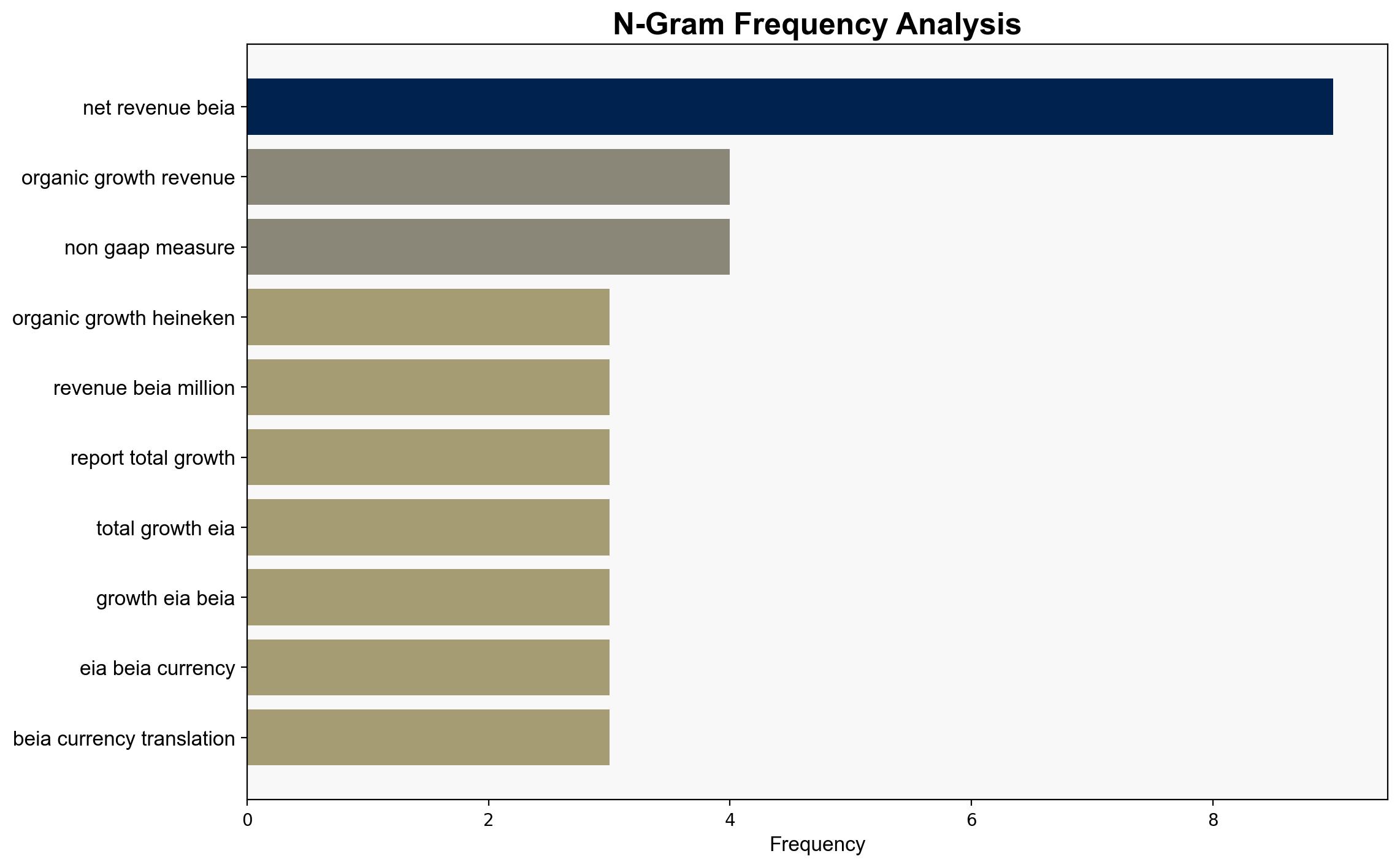

Heineken Holding N.V. reported a mixed performance for the first quarter of 2025, with a 4.9% decline in revenue but a slight organic growth in net revenue (beia) by 0.9%. Despite these challenges, the company maintains its full-year outlook, expecting operating profit (beia) to grow organically between 4% and 8%. Strategic focus on premium beer and digital platforms has shown positive trends, though currency fluctuations and regional market dynamics pose ongoing challenges.

2. Detailed Analysis

The following structured analytic techniques have been applied:

SWOT Analysis

Strengths: Strong brand presence and premium beer growth, particularly Heineken® with a 4.6% increase. Effective digital platform integration with a 16% increase in gross merchandise value.

Weaknesses: Overall beer volume decreased by 2.1%, impacted by calendar events and currency fluctuations.

Opportunities: Expansion in Asia Pacific and Africa & Middle East regions, leveraging digital platforms to capture fragmented markets.

Threats: Currency volatility, particularly with the Euro, Mexican Peso, Brazilian Real, and Ethiopian Birr, and potential economic instability in key markets.

Cross-Impact Matrix

The strengthening Euro has negatively impacted revenue, affecting Heineken’s pricing strategy in regions like Latin America and Africa. Conversely, growth in premium segments and digital platforms could buffer against regional economic downturns.

Scenario Generation

If currency volatility persists, Heineken may need to adjust pricing strategies further, potentially impacting market share. Alternatively, continued growth in premium segments and digital engagement could offset these pressures, maintaining profitability.

3. Implications and Strategic Risks

The primary risk lies in currency fluctuations impacting revenue and profit margins. Additionally, regional economic instability could affect consumer spending patterns. However, strategic investments in premium products and digital platforms present opportunities to mitigate these risks.

4. Recommendations and Outlook

- Enhance currency hedging strategies to mitigate financial exposure from volatile exchange rates.

- Continue expanding digital platforms to increase market penetration in fragmented regions.

- Focus on premium product lines to capitalize on consumer trends and offset volume declines.

- Monitor regional economic indicators closely to adapt strategies proactively.

5. Key Individuals and Entities

Heineken Holding N.V., Heineken N.V.