How Financial Inclusion and Health Can Move More People into the Middle Class – SPONSOR CONTENT FROM MASTERCARD – Harvard Business Review

Published on: 2025-04-21

Intelligence Report: How Financial Inclusion and Health Can Move More People into the Middle Class

1. BLUF (Bottom Line Up Front)

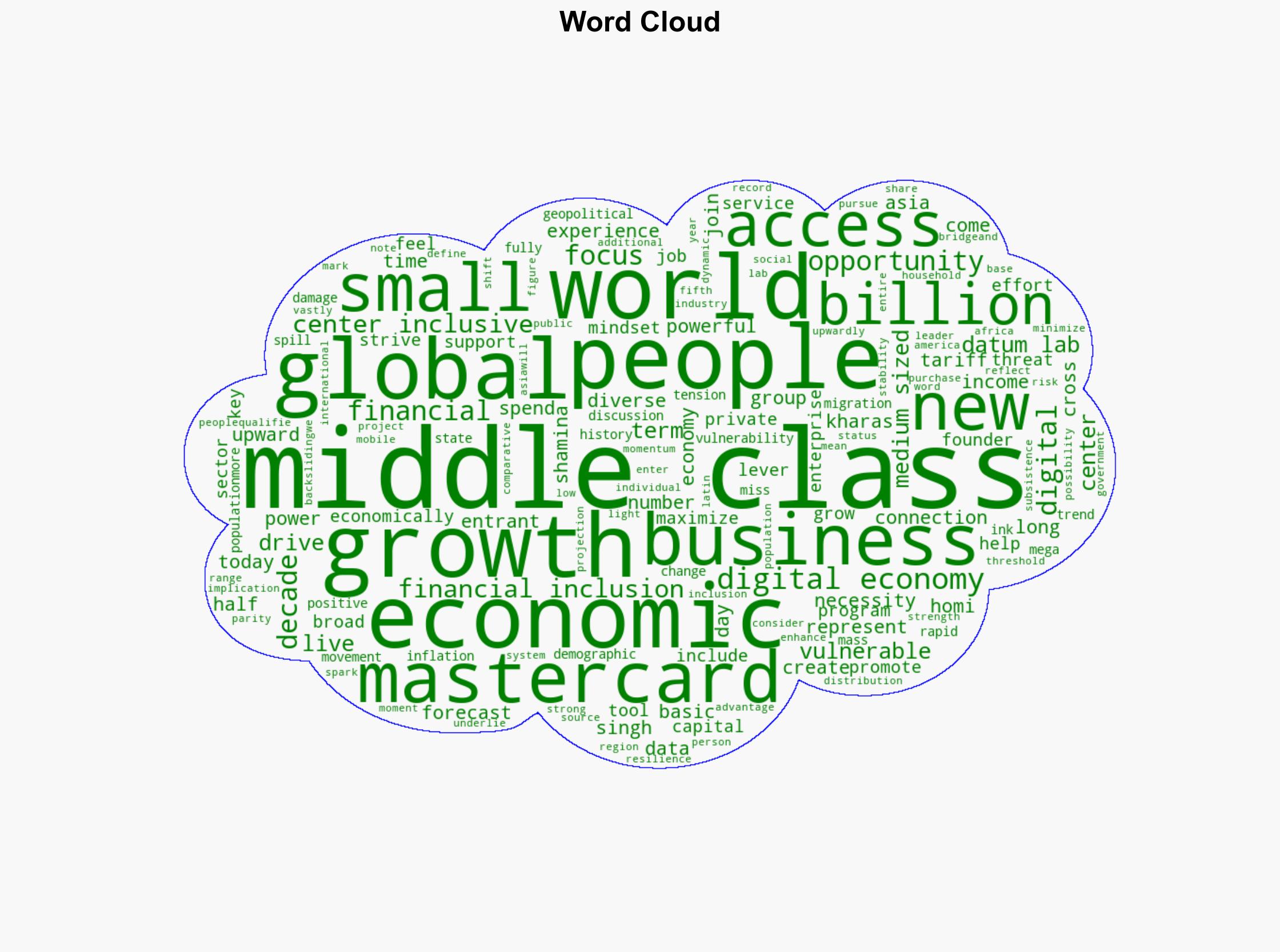

Financial inclusion and health initiatives are pivotal in transitioning economically vulnerable populations into the global middle class. This report identifies strategic opportunities for leveraging digital financial tools and entrepreneurship to drive economic mobility, particularly in Asia, Latin America, and Africa. Key recommendations include enhancing access to financial services and fostering small business growth.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Analysis of Competing Hypotheses (ACH)

The hypothesis that digital financial inclusion is a primary driver of economic mobility is supported by evidence of increased access to financial services and digital tools. Alternative hypotheses, such as reliance solely on traditional economic policies, are less supported given the rapid technological advancements and demographic shifts.

SWOT Analysis

Strengths: Growing digital infrastructure and supportive policy frameworks.

Weaknesses: Limited financial literacy and access in remote areas.

Opportunities: Expanding digital payment systems and microfinance.

Threats: Economic instability and geopolitical tensions.

Indicators Development

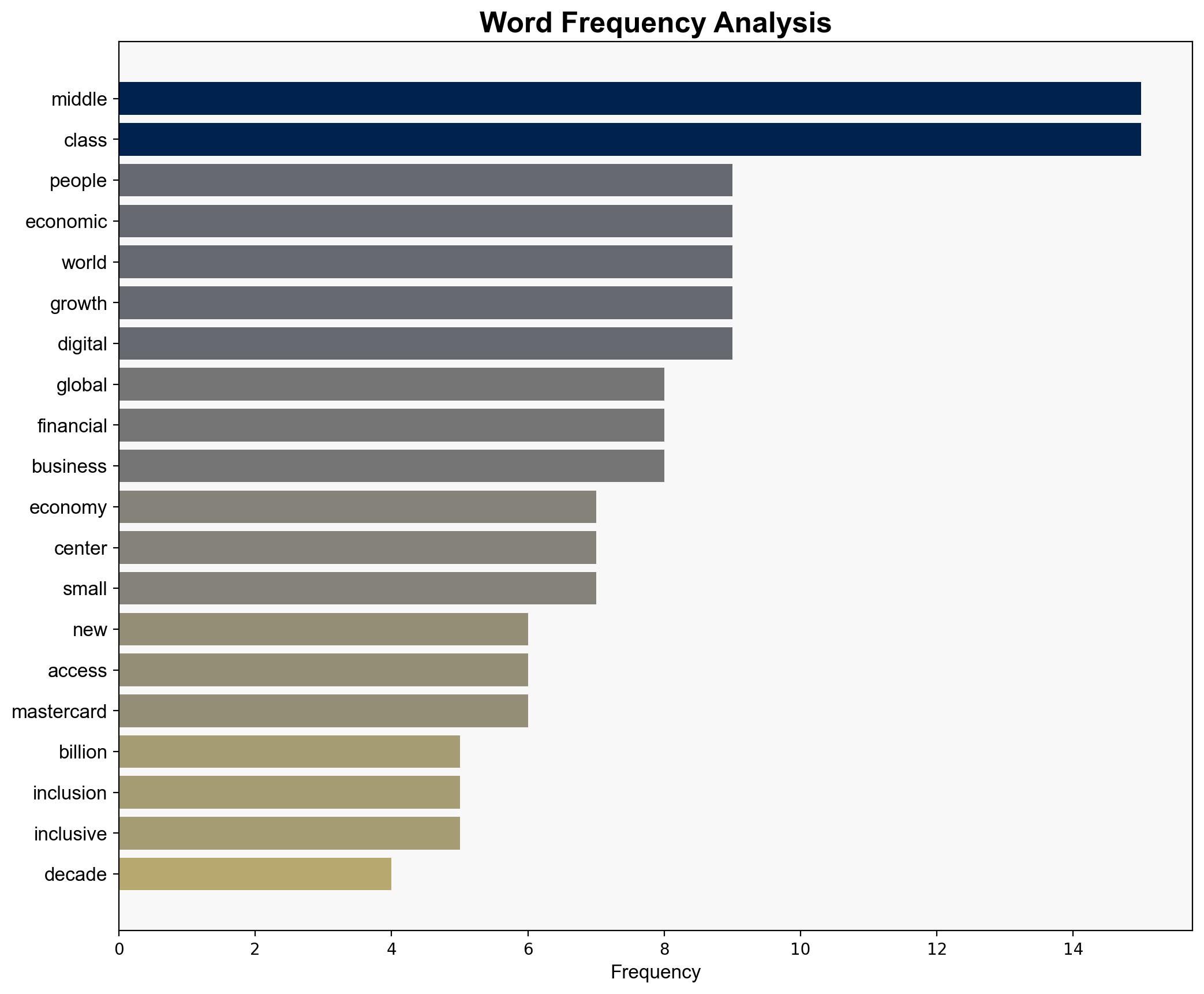

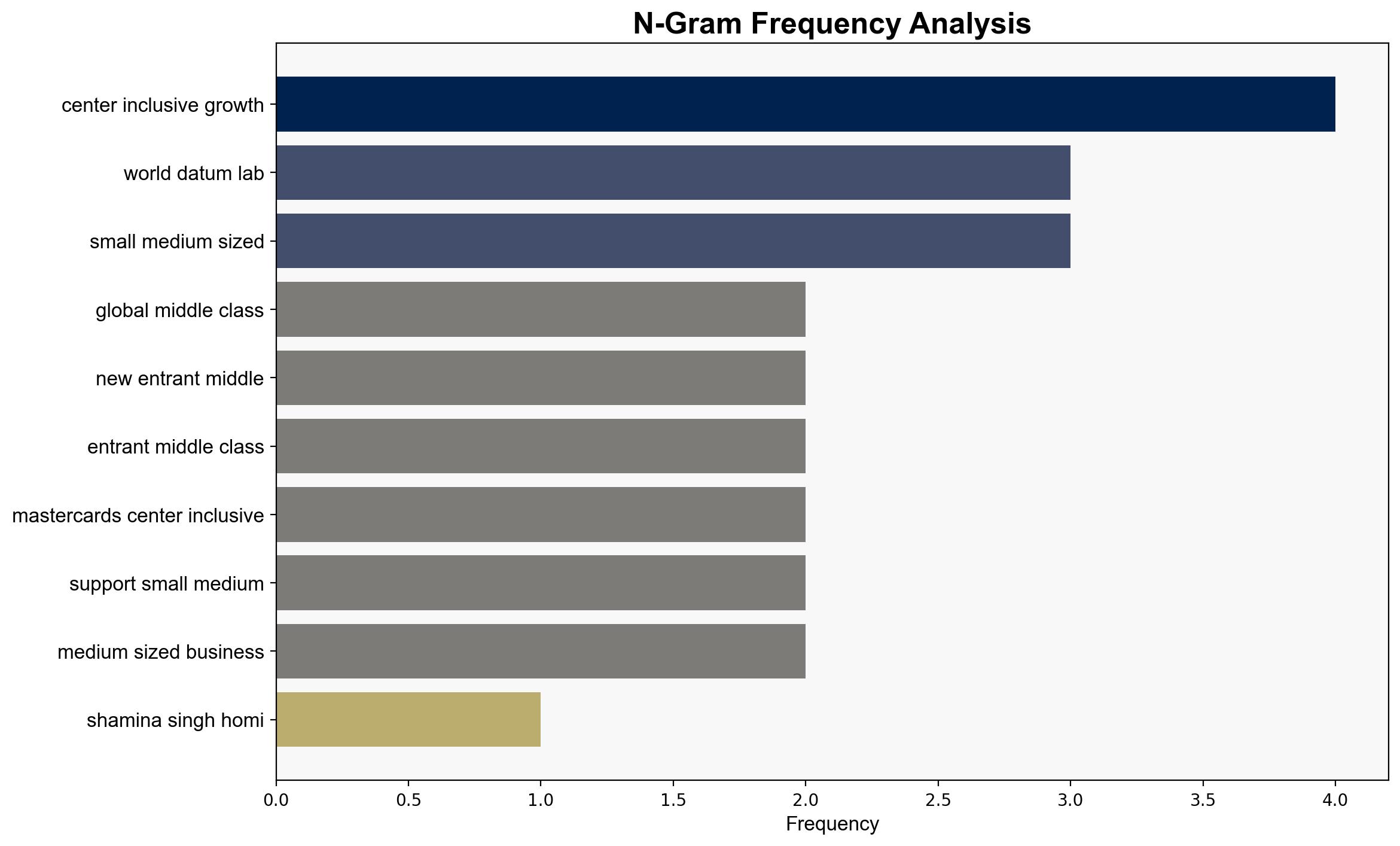

Key indicators include the rate of digital financial service adoption, growth in small and medium-sized enterprises (SMEs), and shifts in consumer spending patterns. Monitoring these indicators can signal progress or setbacks in economic mobility efforts.

3. Implications and Strategic Risks

The expansion of the middle class through financial inclusion could stabilize global economic systems but also poses risks of increased inequality if not managed inclusively. Geopolitical tensions and economic volatility remain significant threats to sustained growth.

4. Recommendations and Outlook

- Enhance digital literacy programs to maximize the benefits of financial inclusion.

- Support policies that encourage SME growth and entrepreneurship.

- Best Case: Rapid adoption of digital financial tools leads to significant economic mobility.

- Worst Case: Economic instability undermines financial inclusion efforts.

- Most Likely: Gradual progress with regional variations in success rates.

5. Key Individuals and Entities

Shamina Singh, Homi Kharas

6. Thematic Tags

(‘financial inclusion, economic mobility, digital economy, entrepreneurship, global middle class’)