Stocks close with gains as White House signals trade progress with China – The Hill

Published on: 2025-04-22

Intelligence Report: Stocks close with gains as White House signals trade progress with China – The Hill

1. BLUF (Bottom Line Up Front)

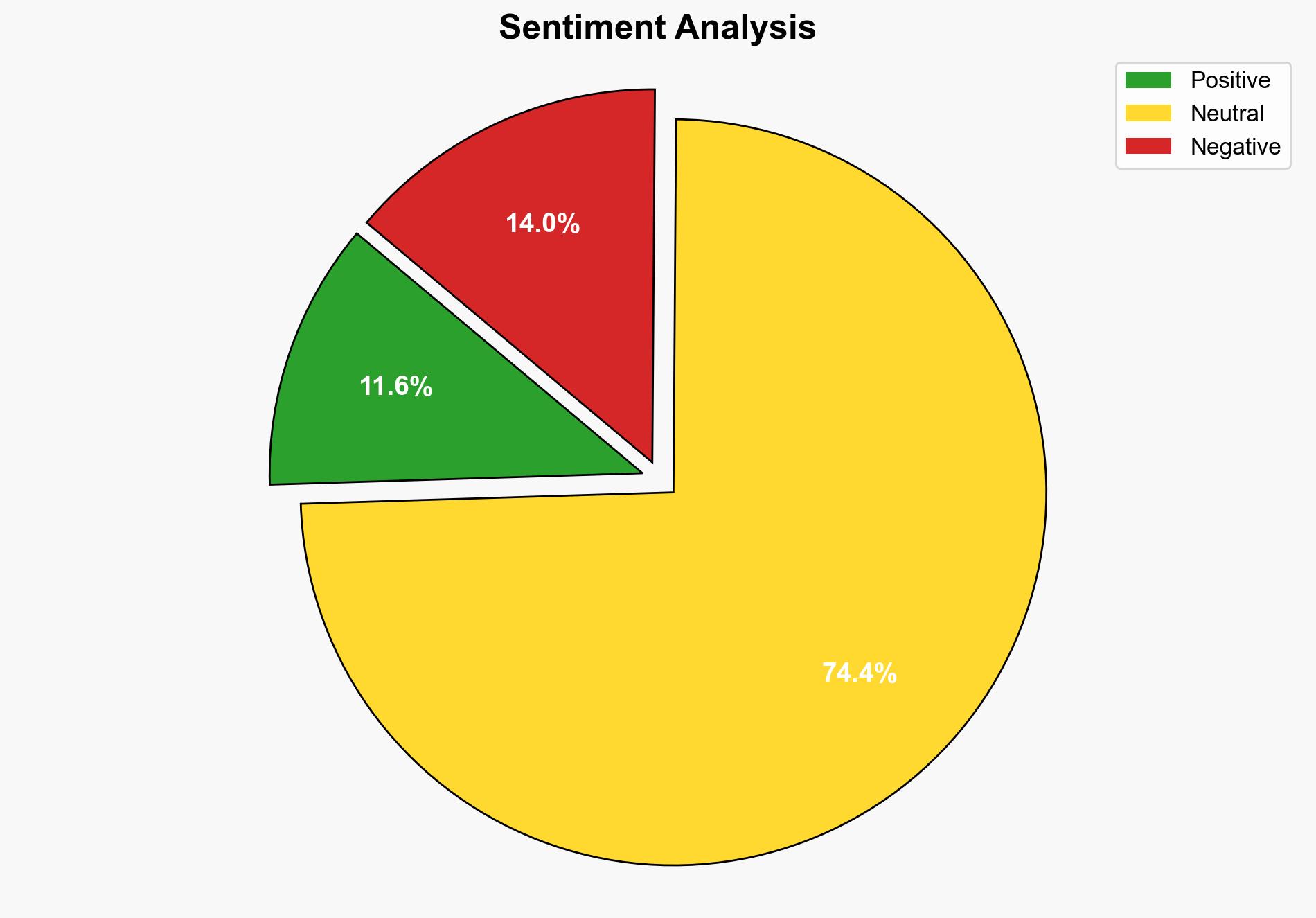

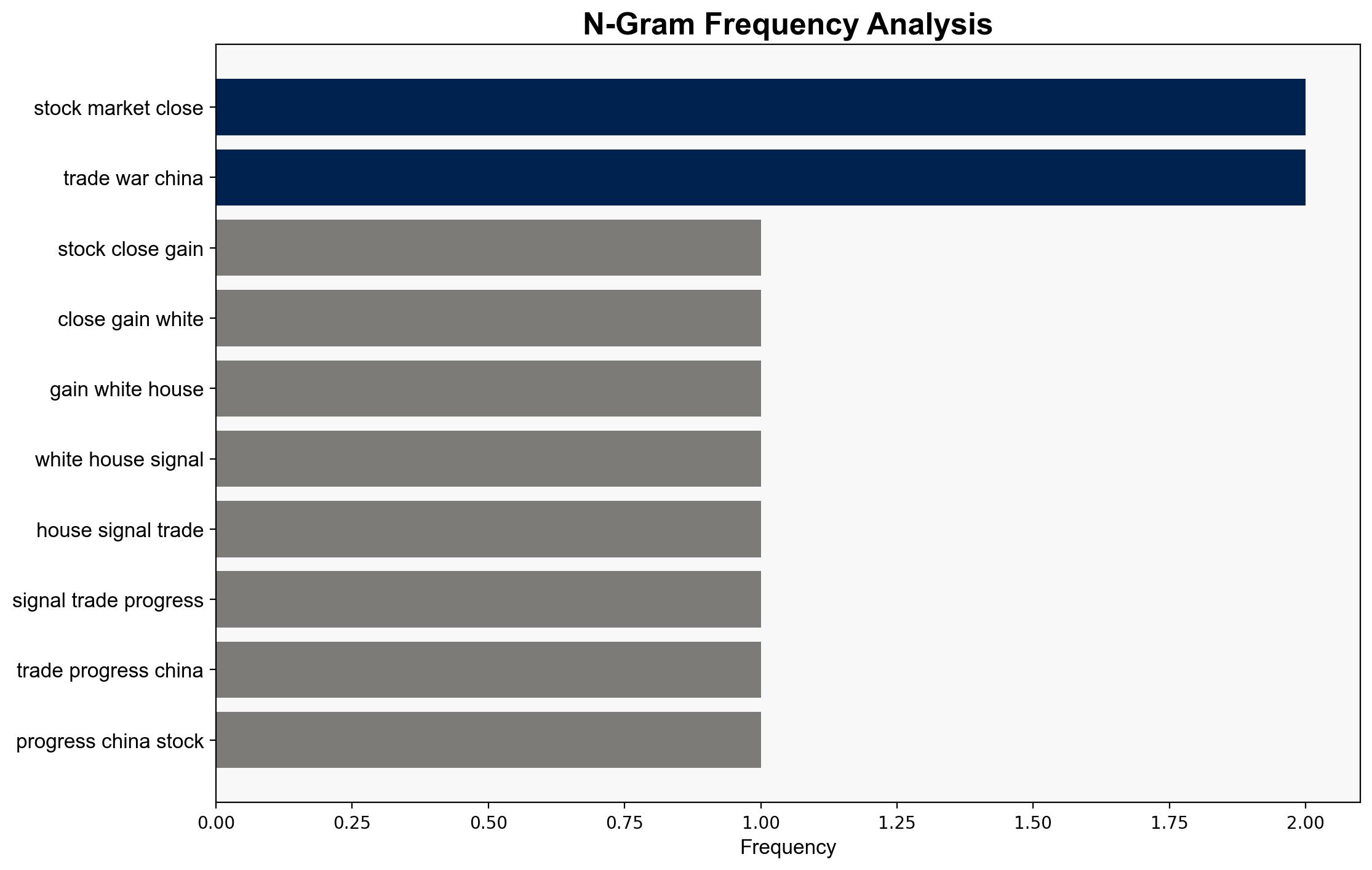

Recent developments suggest a potential de-escalation in the trade tensions between the United States and China, as indicated by positive market reactions and statements from key U.S. officials. The stock market’s recovery reflects optimism about a possible trade agreement, which could stabilize economic relations and enhance global market confidence. It is recommended to monitor further diplomatic engagements and market responses closely.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

SWOT Analysis

Strengths: Positive signals from U.S. officials regarding trade negotiations can bolster investor confidence and market stability.

Weaknesses: Continued uncertainty in trade policy could undermine long-term economic planning.

Opportunities: A successful trade agreement could enhance bilateral economic ties and global economic growth.

Threats: Failure to reach an agreement may lead to renewed market volatility and economic disruptions.

Cross-Impact Matrix

The interaction between U.S.-China trade negotiations and global economic indicators suggests that progress in talks could positively influence international markets, while setbacks may exacerbate existing economic tensions.

Scenario Generation

Best Case: A comprehensive trade deal is reached, leading to sustained market gains and improved bilateral relations.

Worst Case: Talks collapse, resulting in heightened trade barriers and significant market downturns.

Most Likely: Incremental progress with periodic fluctuations in market sentiment as negotiations continue.

3. Implications and Strategic Risks

The ongoing trade discussions present both opportunities and risks. A successful resolution could mitigate economic tensions and foster global stability. However, prolonged uncertainty may lead to increased market volatility and geopolitical friction, impacting global supply chains and economic growth.

4. Recommendations and Outlook

- Encourage diplomatic efforts to finalize a trade agreement, emphasizing mutual economic benefits.

- Prepare for potential market volatility by diversifying investment strategies and monitoring geopolitical developments.

- Scenario-based projections suggest maintaining a flexible approach to policy adjustments in response to evolving trade negotiations.

5. Key Individuals and Entities

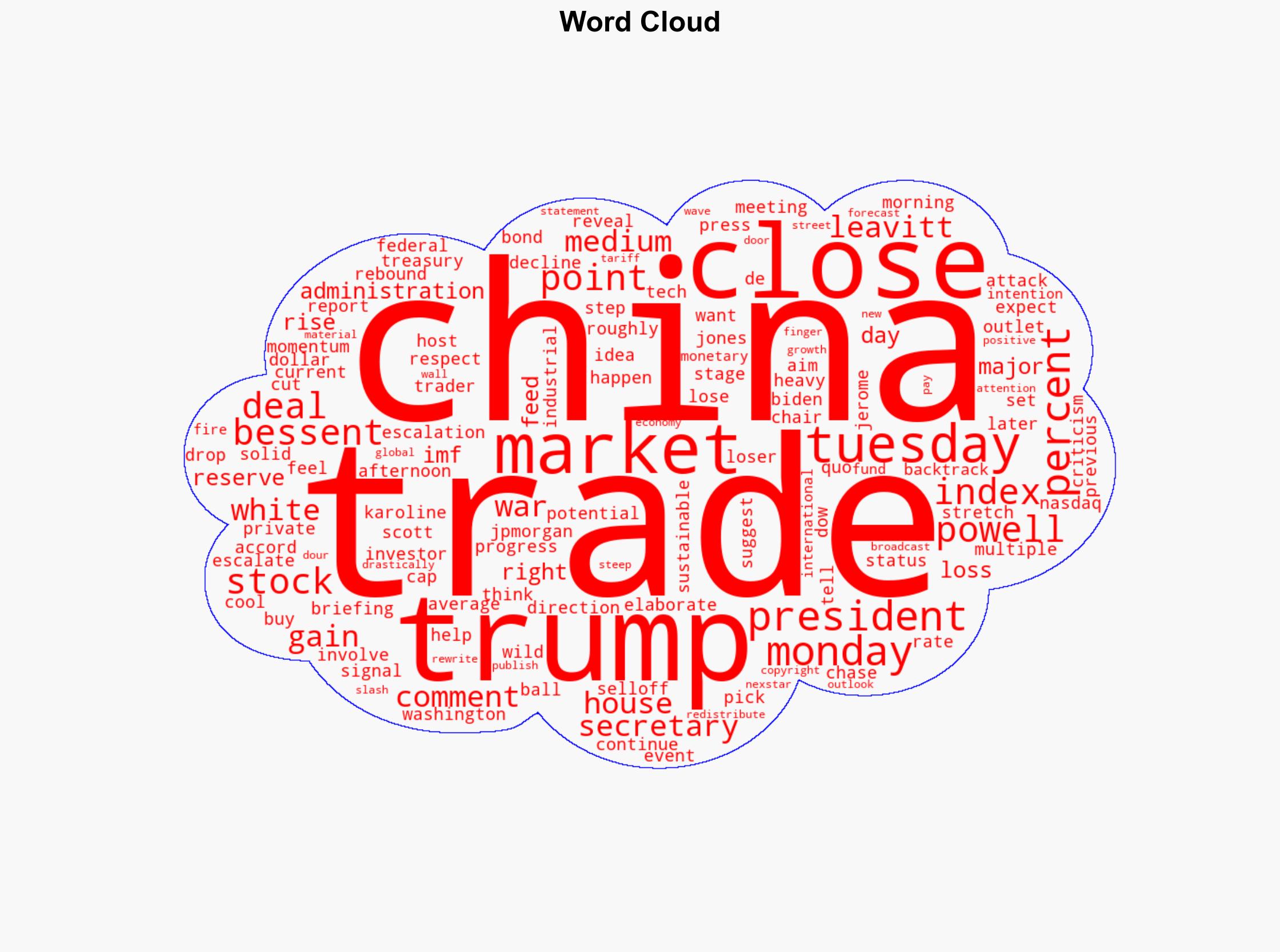

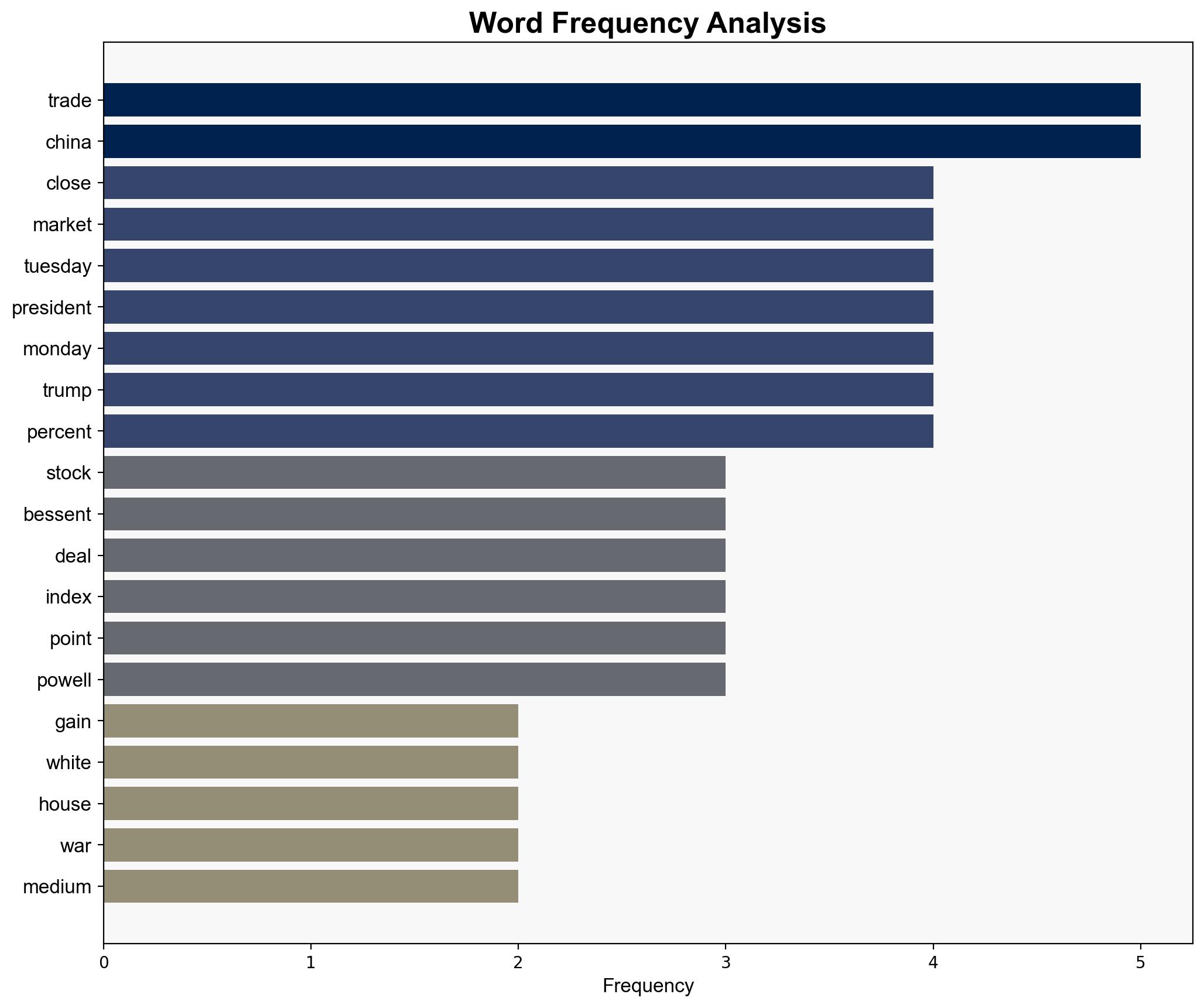

Scott Bessent, Karoline Leavitt, Jerome Powell

6. Thematic Tags

(‘trade negotiations, economic stability, market volatility, U.S.-China relations’)