After slow divestment Canadas Scotiabank quietly reinvests in Israels genocide – Mondoweiss

Published on: 2025-06-07

Intelligence Report: After Slow Divestment, Canada’s Scotiabank Quietly Reinvests in Israel’s Genocide – Mondoweiss

1. BLUF (Bottom Line Up Front)

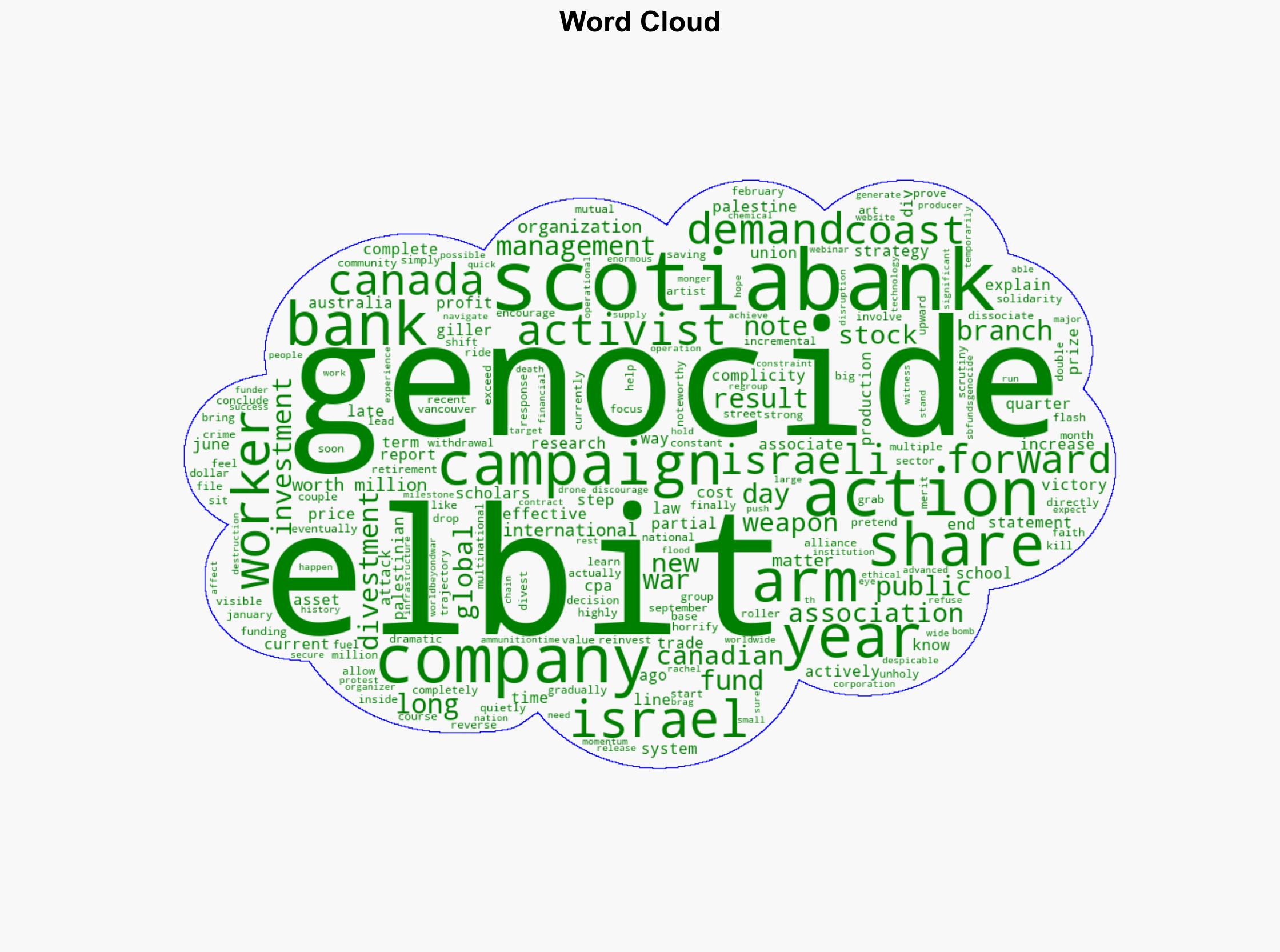

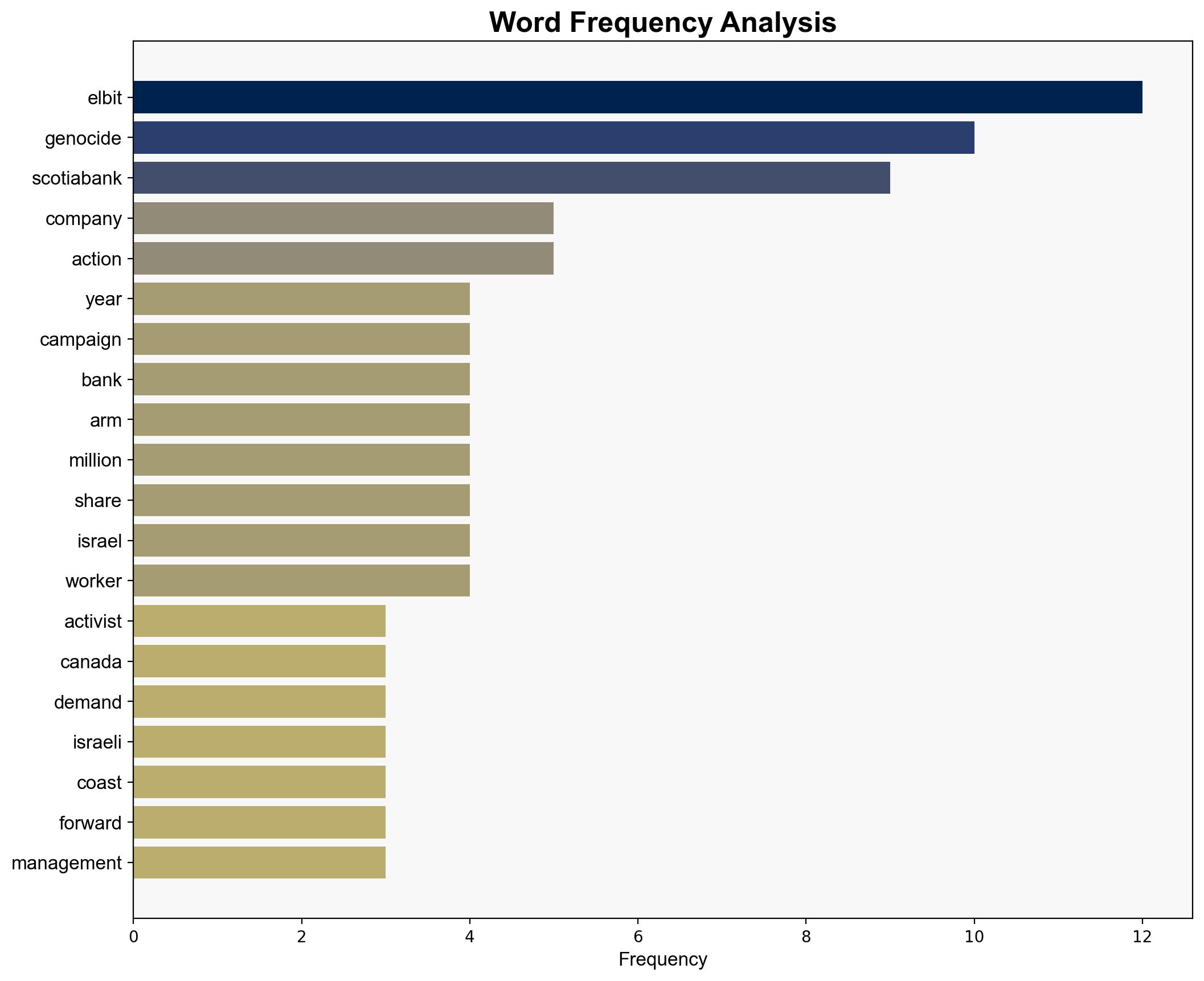

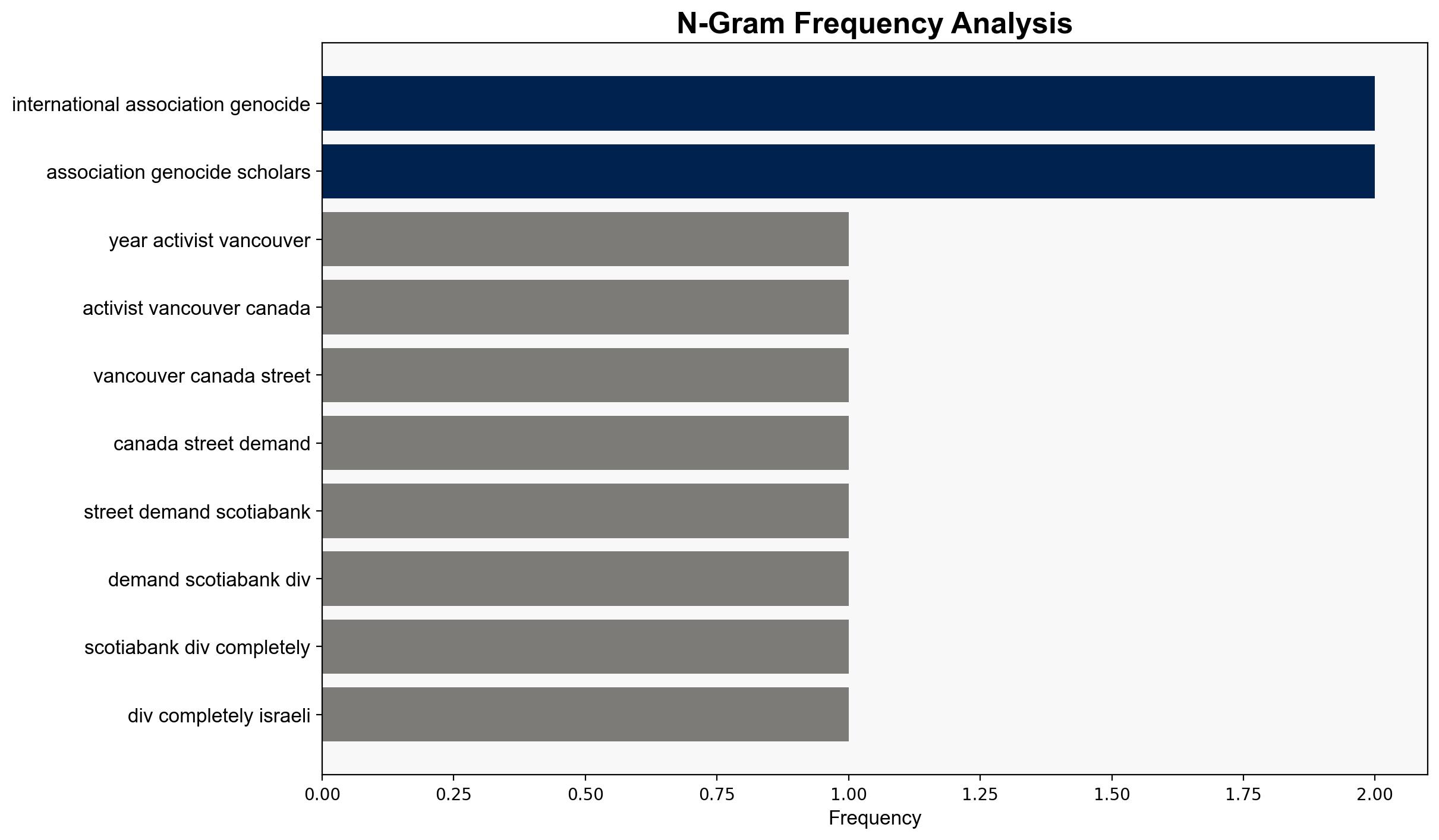

Scotiabank, after a period of divestment from Elbit Systems, a company linked to Israeli military operations, has reportedly reinvested in the firm. This move has sparked renewed activism and criticism from groups advocating against financial complicity in alleged human rights violations. The reinvestment raises questions about the bank’s ethical investment strategies and the potential reputational risks involved.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Cognitive Bias Stress Test

Potential biases in assessing Scotiabank’s investment decisions were identified and challenged through alternative analysis techniques, ensuring a balanced view of the bank’s strategic motivations.

Bayesian Scenario Modeling

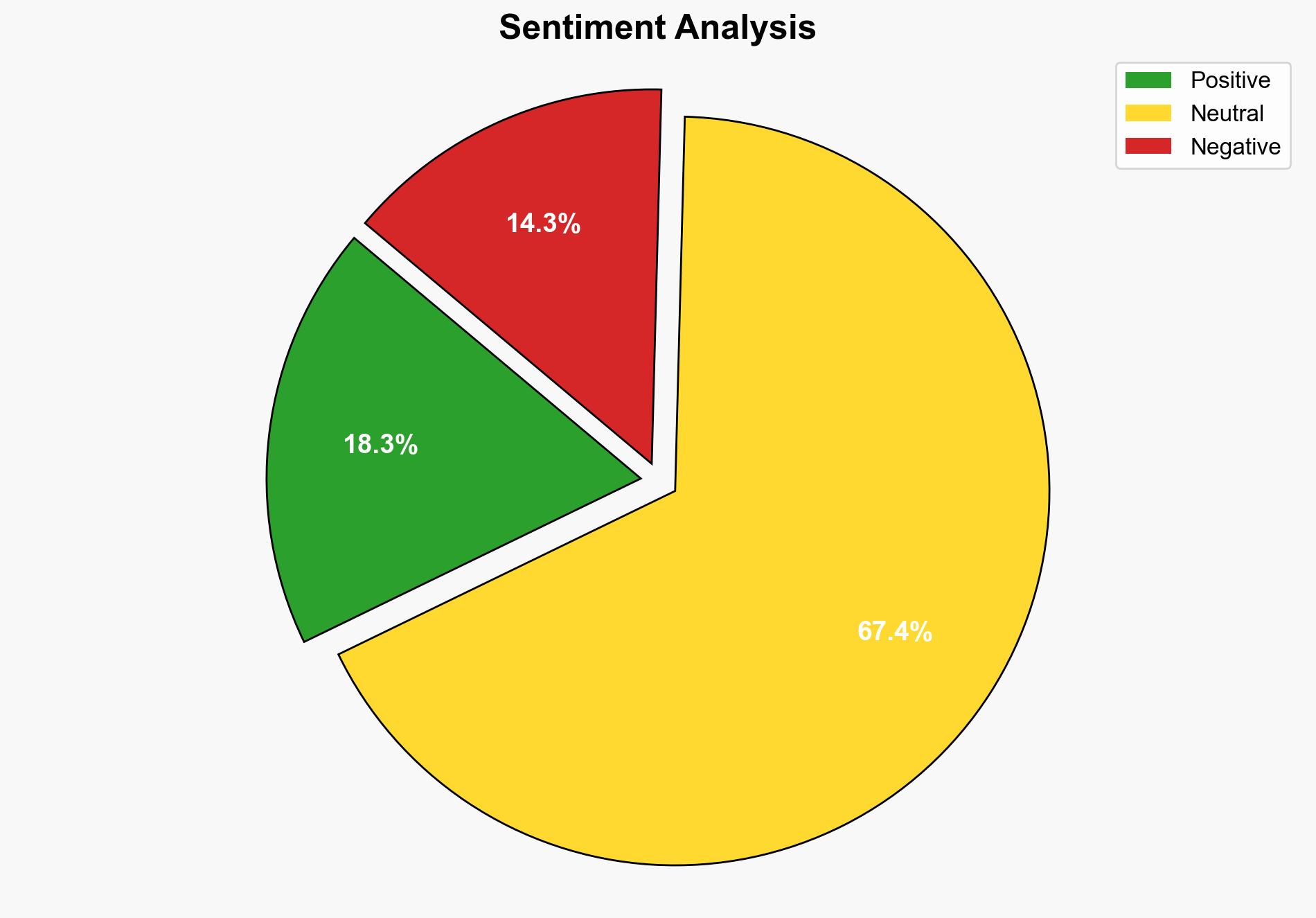

Probabilistic forecasting suggests a moderate likelihood of increased activist pressure leading to further divestment or policy changes by Scotiabank, contingent on public and media scrutiny.

Network Influence Mapping

The analysis mapped the influence of activist groups and media on Scotiabank’s decision-making processes, highlighting the potential for reputational damage and financial impact.

3. Implications and Strategic Risks

Scotiabank’s reinvestment in Elbit Systems may lead to heightened scrutiny from human rights organizations and potential backlash from customers and stakeholders. This could result in reputational damage and financial repercussions if activist campaigns gain traction. Additionally, the bank’s actions may influence other financial institutions’ investment strategies, potentially affecting broader market dynamics.

4. Recommendations and Outlook

- Scotiabank should conduct a comprehensive risk assessment of its investment portfolio, considering ethical implications and stakeholder perceptions.

- Engage with stakeholders, including activist groups, to address concerns and enhance transparency in investment decisions.

- Scenario-based projections suggest that maintaining the current investment strategy could lead to increased activist actions (worst case), while proactive engagement and divestment could mitigate reputational risks (best case).

5. Key Individuals and Entities

Rachel Small, Canada Palestine Association, Elbit Systems, Scotiabank

6. Thematic Tags

national security threats, ethical investment, human rights, financial sector, activism