Oil prices ease as market assesses Middle East tension – CNA

Published on: 2025-06-12

Intelligence Report: Oil prices ease as market assesses Middle East tension – CNA

1. BLUF (Bottom Line Up Front)

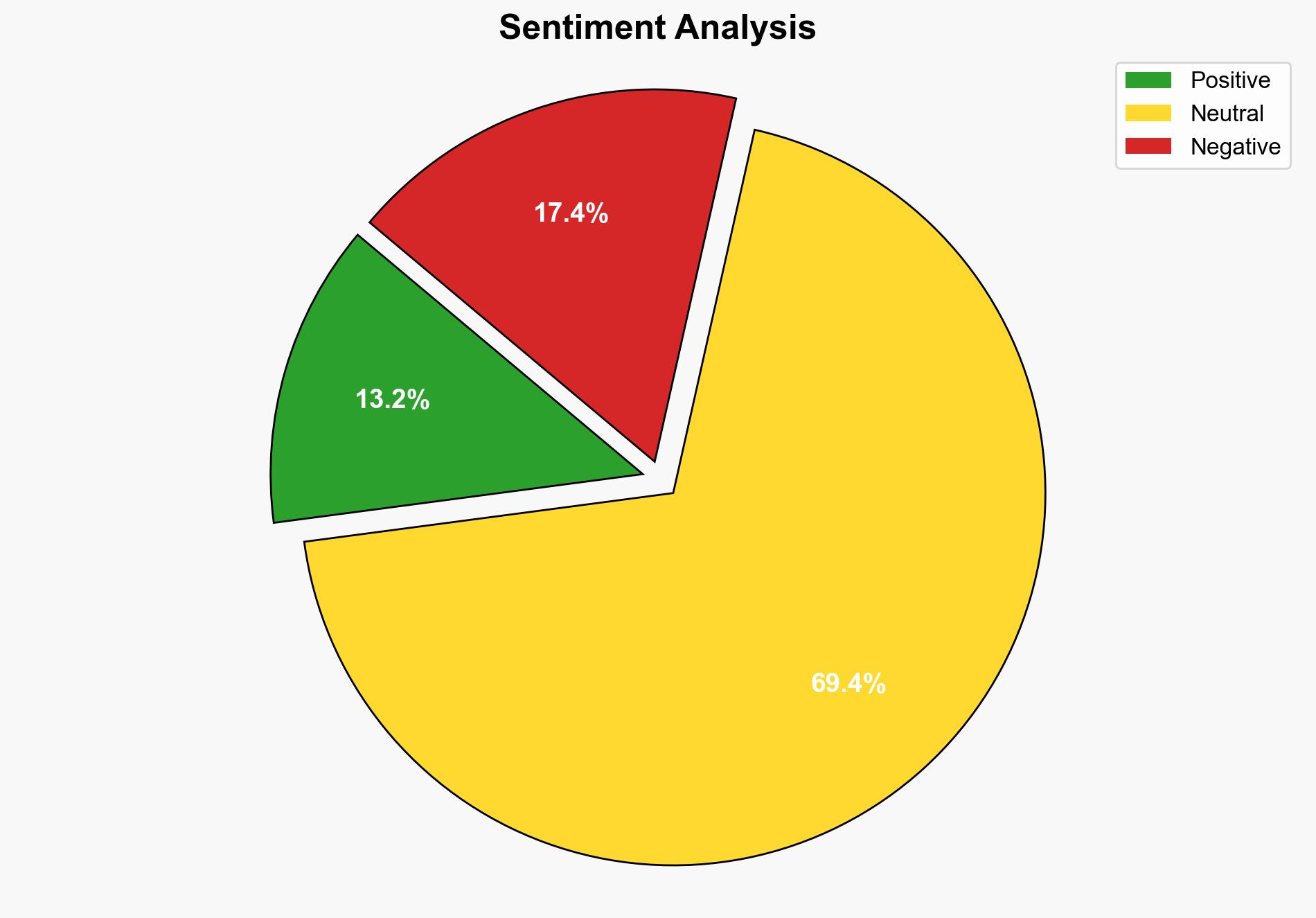

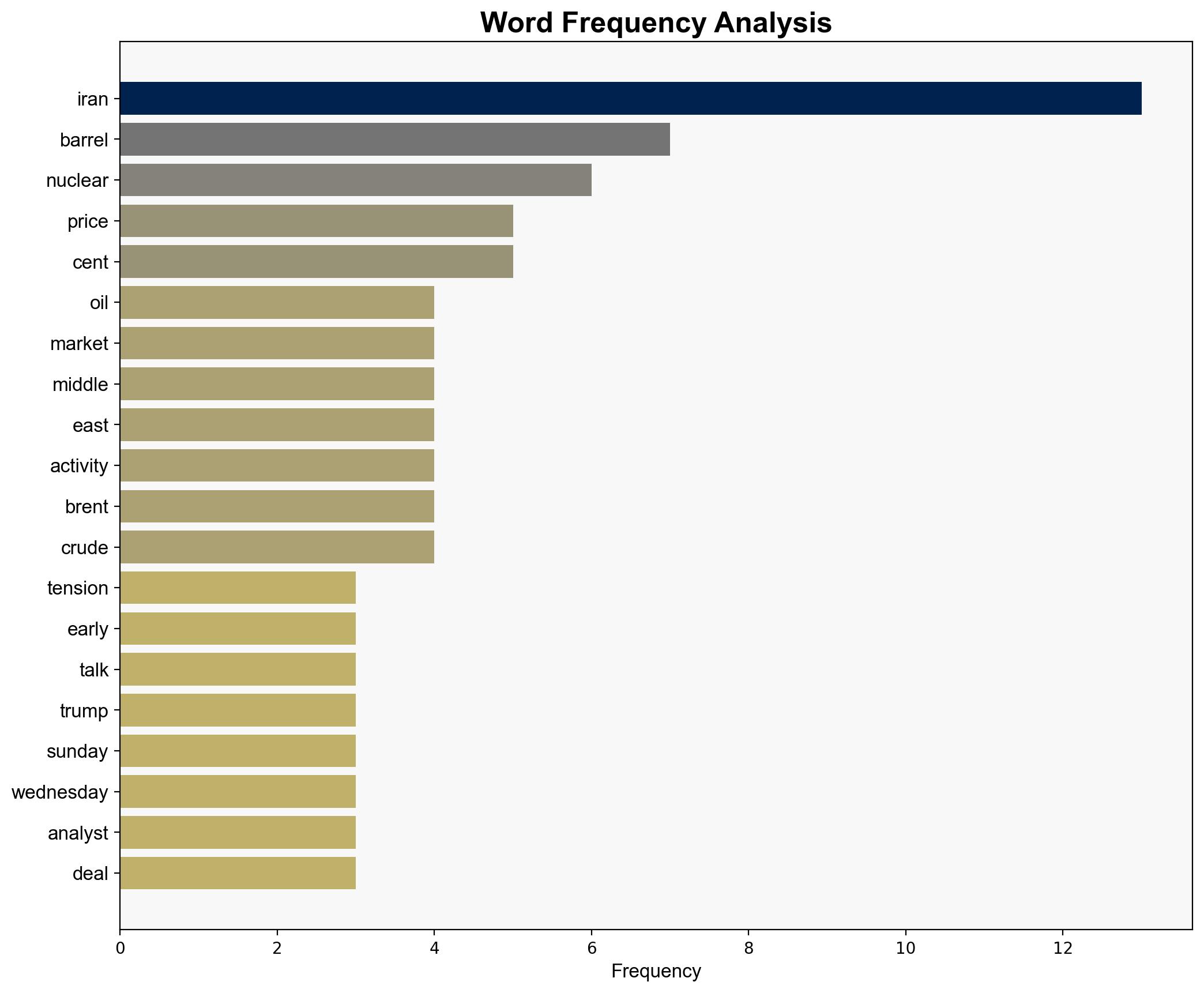

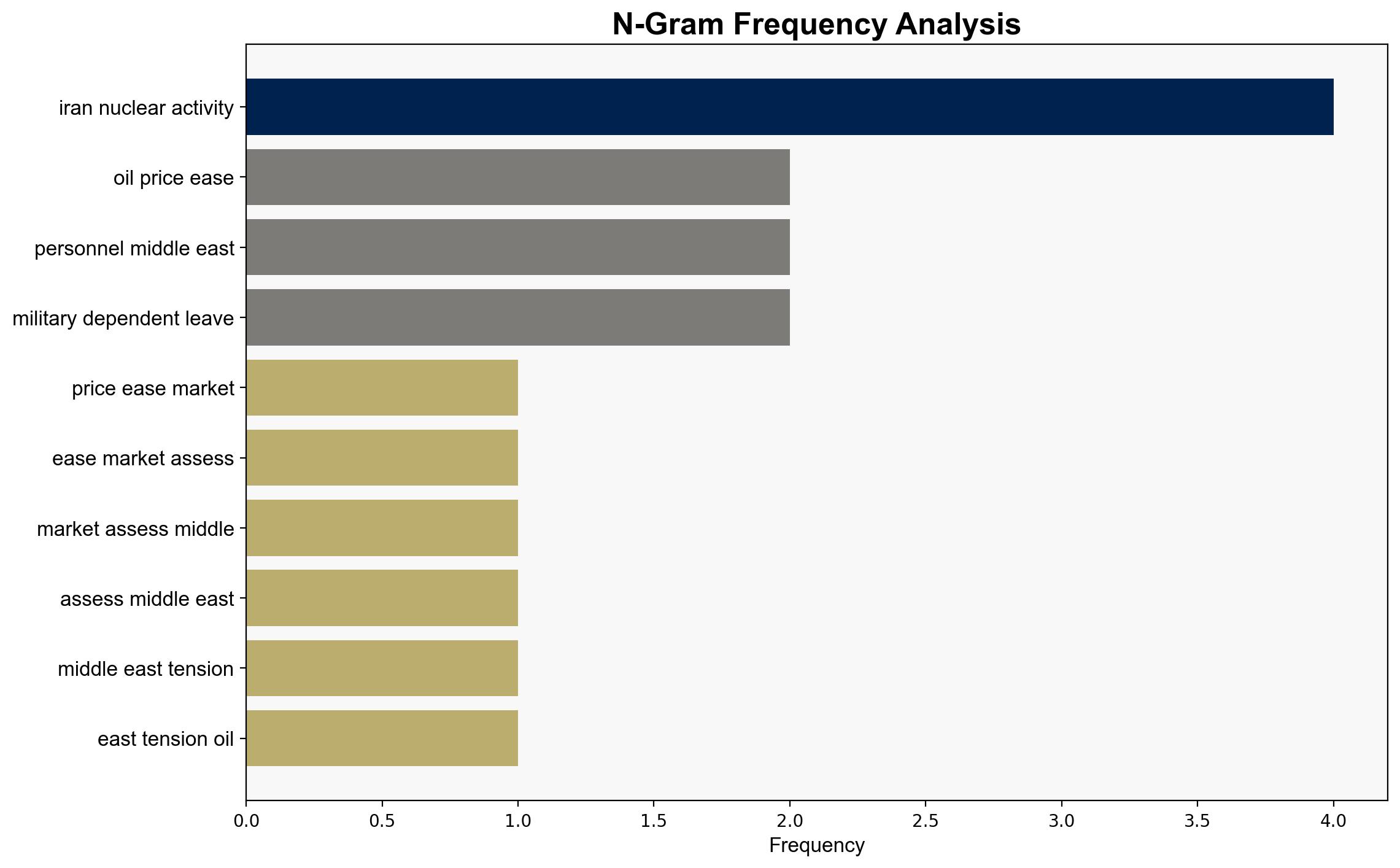

Oil prices have slightly decreased as the market evaluates tensions in the Middle East, particularly concerning Iran’s nuclear activities. The strategic focus is on the potential for supply disruptions and geopolitical developments. Recommendations include monitoring diplomatic engagements and preparing for potential market volatility.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

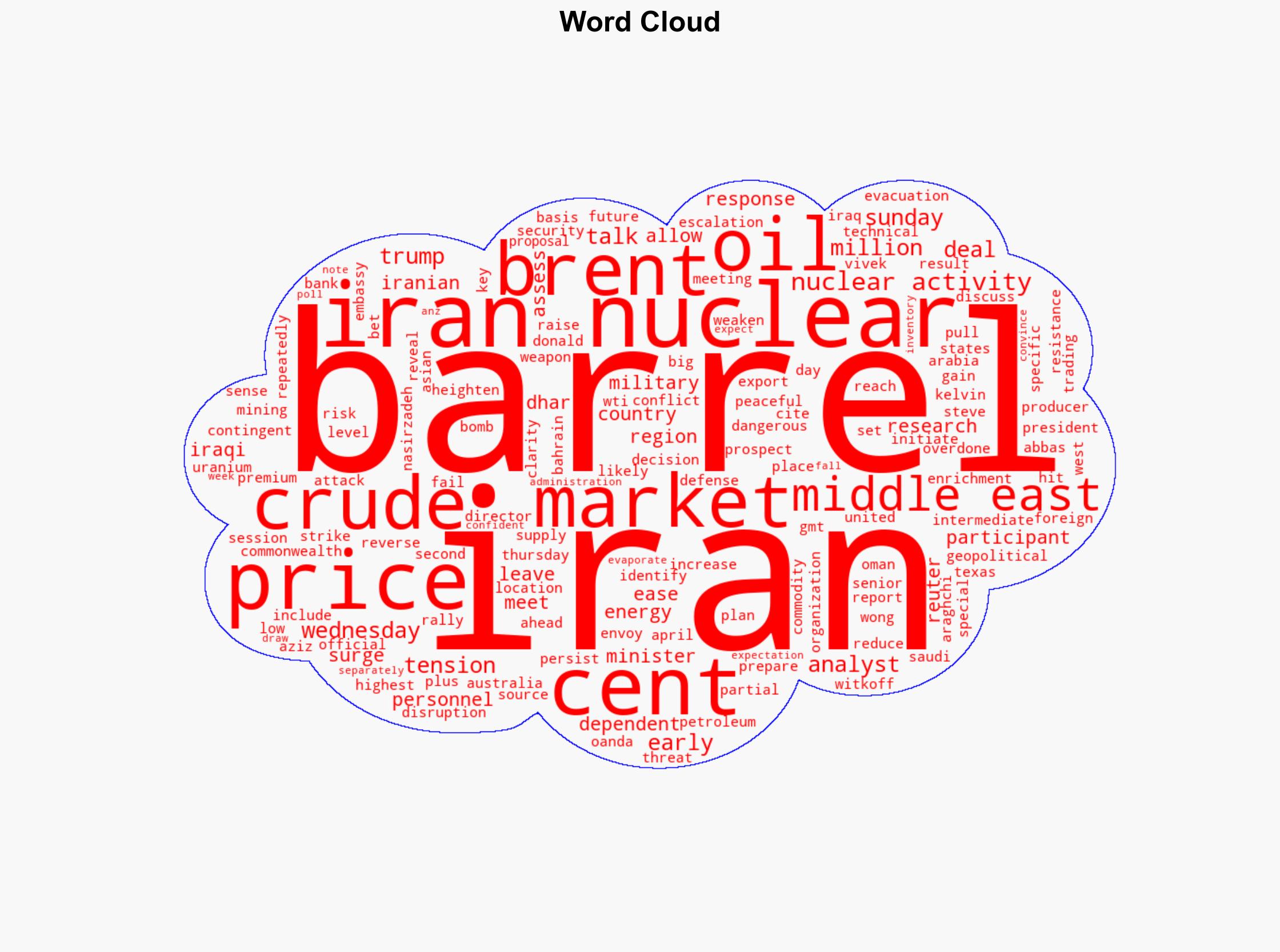

Surface events include recent fluctuations in oil prices and diplomatic talks regarding Iran’s nuclear program. Systemic structures involve geopolitical alliances and economic dependencies on Middle Eastern oil. Worldviews are shaped by regional power dynamics and historical tensions. Myths pertain to the perceived inevitability of conflict in the region.

Cross-Impact Simulation

The potential for increased tensions could lead to disruptions in oil supply, affecting global markets. Neighboring states may experience economic strain or increased military readiness, impacting regional stability.

Scenario Generation

Scenarios range from successful diplomatic resolutions leading to stabilized oil prices, to escalated conflicts causing significant market disruptions and increased geopolitical tensions.

3. Implications and Strategic Risks

The primary risk lies in the potential for conflict escalation, which could disrupt oil supplies and destabilize regional economies. Cyber threats targeting critical infrastructure and military assets may also increase. Cross-domain risks include the impact on global energy markets and potential retaliatory actions affecting international relations.

4. Recommendations and Outlook

- Enhance diplomatic efforts to de-escalate tensions and promote dialogue between involved parties.

- Prepare contingency plans for potential disruptions in oil supply, including strategic reserves and alternative energy sources.

- Scenario-based projections:

- Best case: Diplomatic resolution leads to stable oil prices and improved regional relations.

- Worst case: Escalation results in significant market disruptions and regional conflict.

- Most likely: Continued diplomatic efforts with periodic market volatility.

5. Key Individuals and Entities

Donald Trump, Vivek Dhar, Kelvin Wong, Aziz Nasirzadeh, Steve Witkoff, Abbas Araghchi

6. Thematic Tags

national security threats, geopolitical tensions, energy markets, Middle East stability