Crypto Cracks Late in Day Bitcoin Slumps Below 106K – CoinDesk

Published on: 2025-06-12

Intelligence Report: Crypto Cracks Late in Day Bitcoin Slumps Below 106K – CoinDesk

1. BLUF (Bottom Line Up Front)

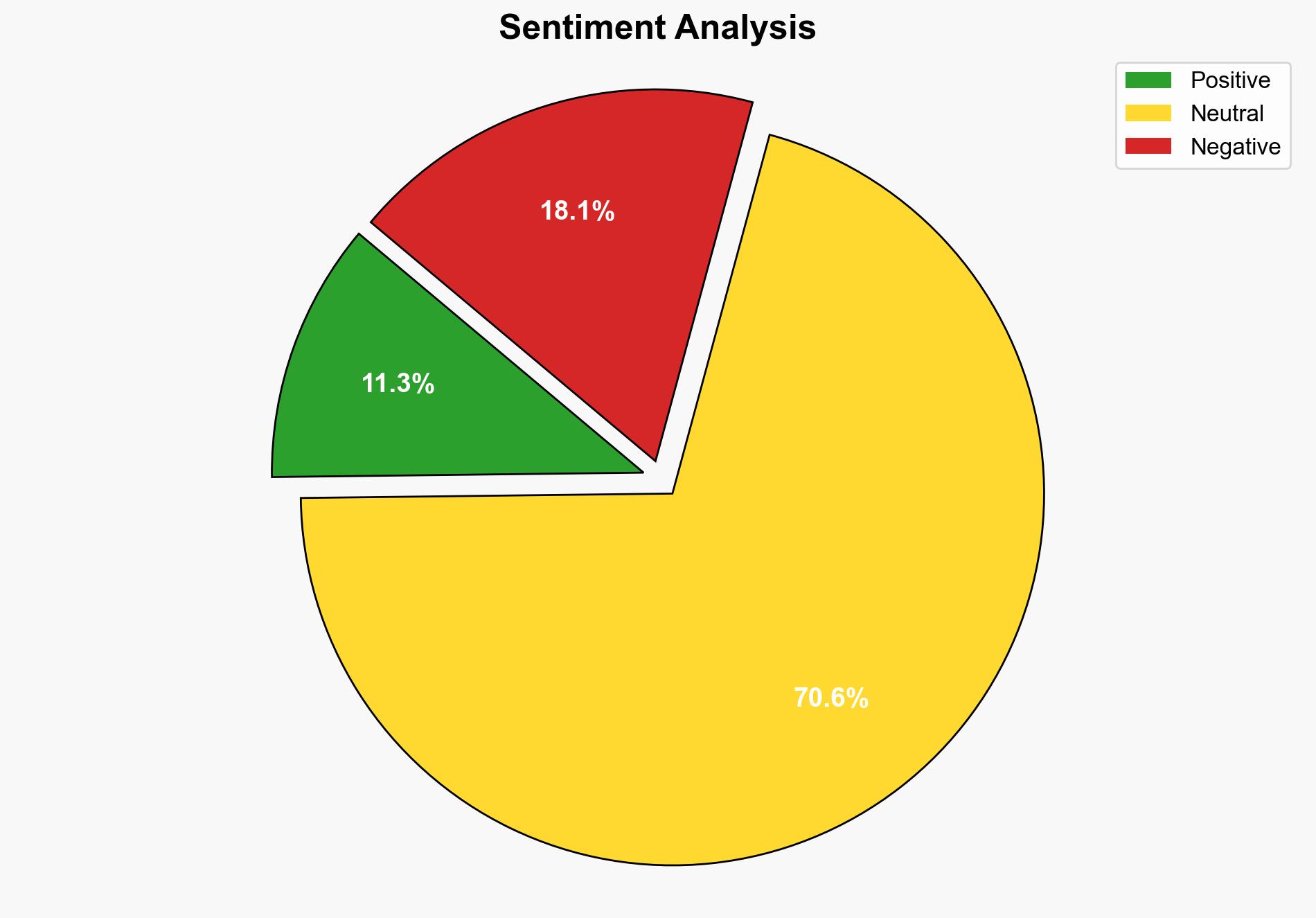

The recent slump in Bitcoin, falling below 106K, signals heightened volatility in cryptocurrency markets, exacerbated by geopolitical tensions and economic uncertainties. The interplay of macroeconomic factors, such as tariff threats and Middle East tensions, has intensified risk perceptions, leading to a significant selloff. Immediate strategic focus should be on monitoring geopolitical developments and their potential impact on financial markets.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

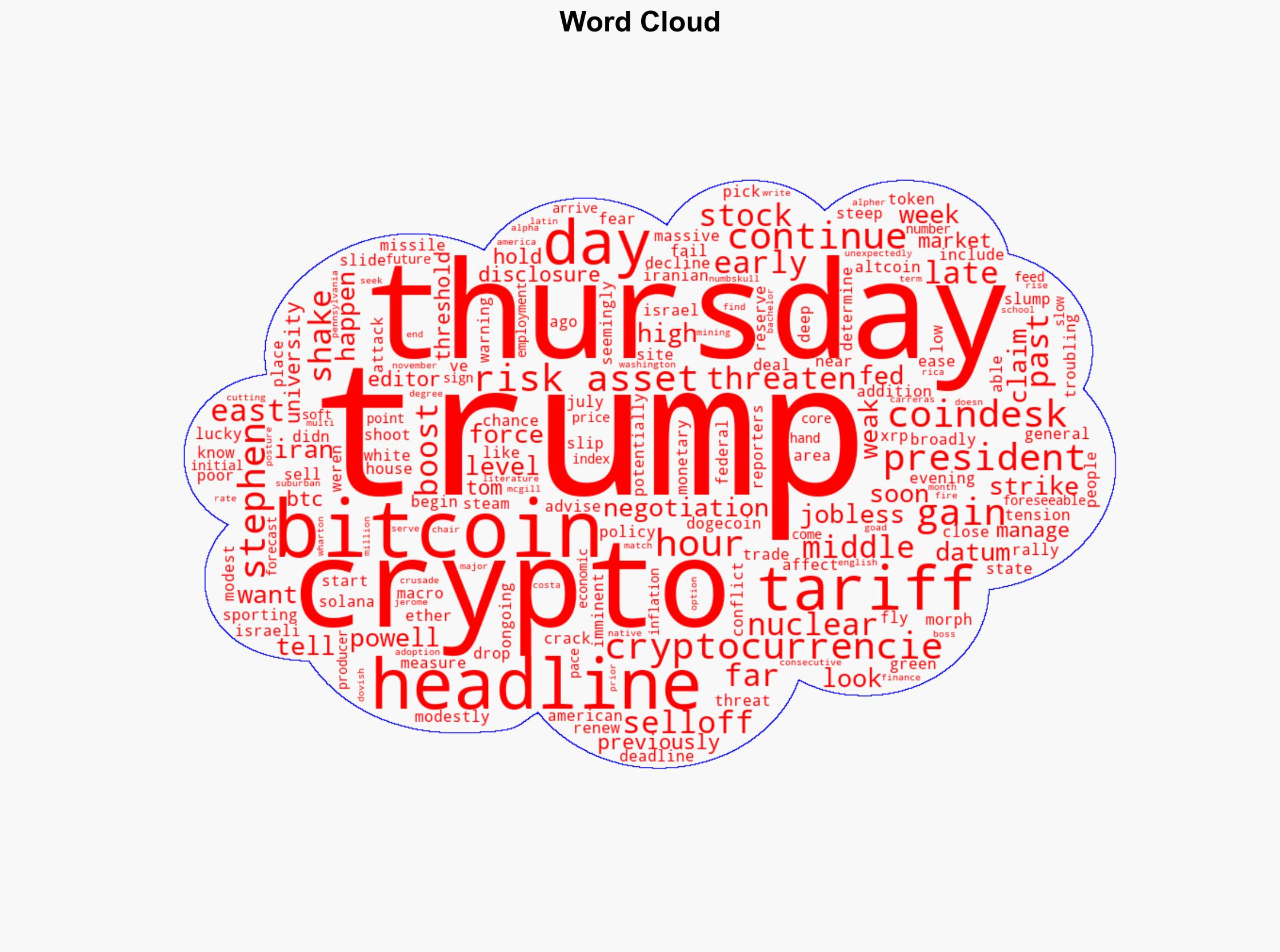

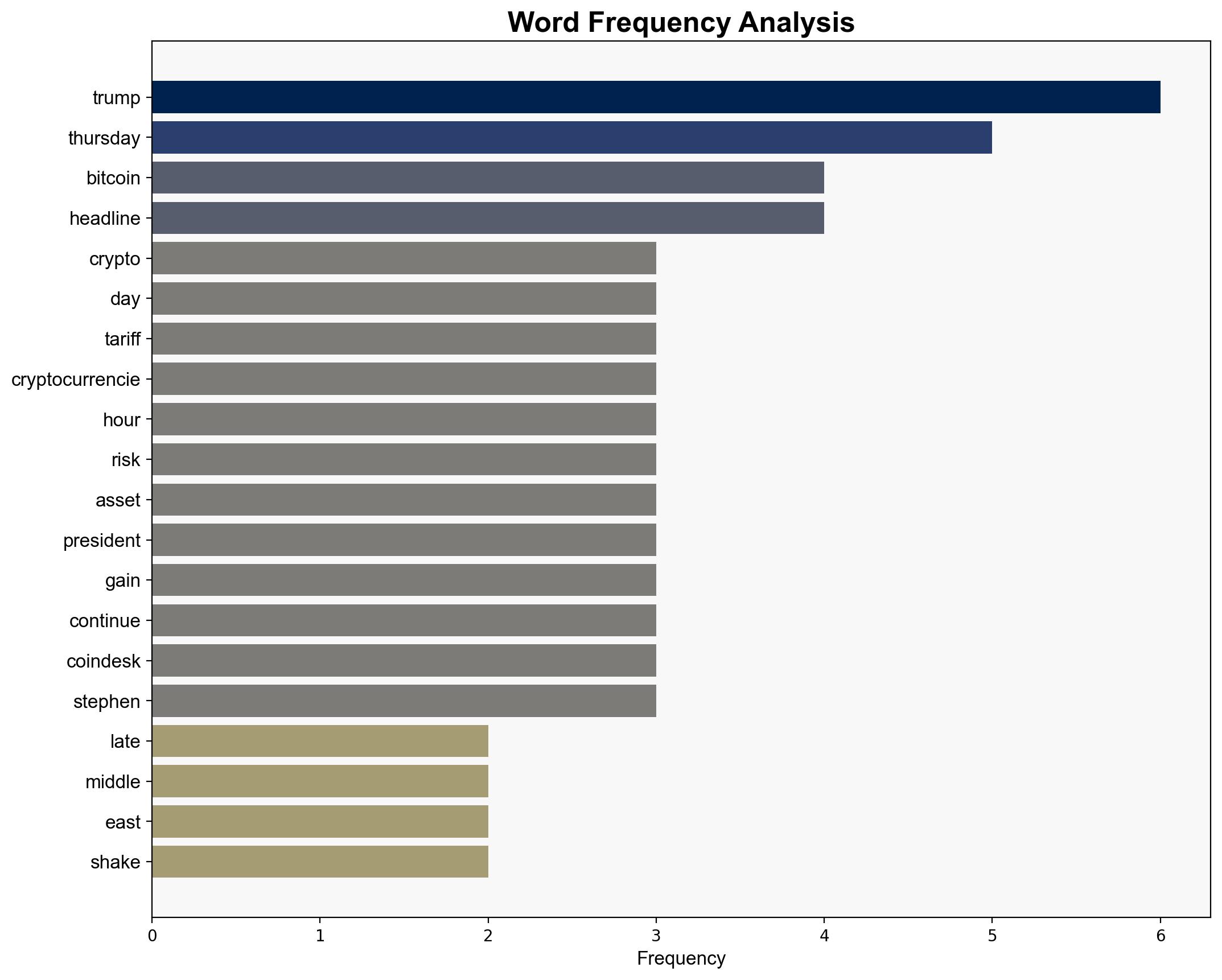

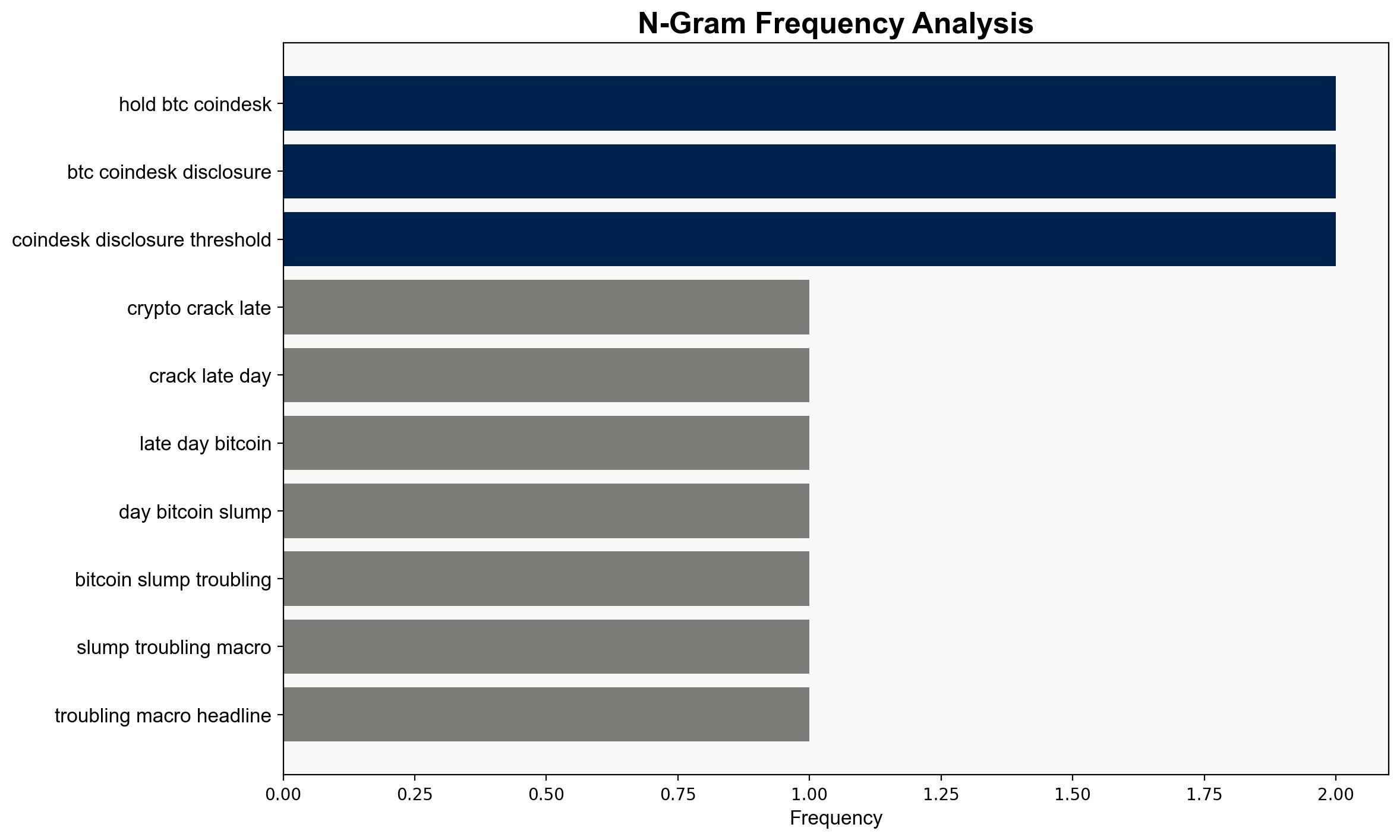

Surface events include the sharp decline in Bitcoin and other cryptocurrencies. Systemic structures involve global economic policies and geopolitical tensions, particularly U.S. tariff threats and Middle East conflicts. The prevailing worldview reflects uncertainty and risk aversion in financial markets. Myths pertain to the perceived instability of cryptocurrencies as safe havens.

Cross-Impact Simulation

The potential for increased tariffs and Middle East tensions could further destabilize global markets, affecting cryptocurrency valuations. Economic dependencies, such as trade relations and energy supplies, may exacerbate these impacts.

Scenario Generation

Scenarios include a continued decline in cryptocurrency values if geopolitical tensions escalate, stabilization if diplomatic resolutions are achieved, or a rebound driven by policy shifts from central banks.

3. Implications and Strategic Risks

The current environment presents risks of increased market volatility, potential cyber threats targeting financial systems, and broader economic instability. Cascading effects could include disruptions in global trade and heightened tensions in conflict-prone regions.

4. Recommendations and Outlook

- Monitor geopolitical developments closely, particularly U.S. tariff policies and Middle East negotiations, to anticipate market reactions.

- Enhance cybersecurity measures to protect against potential threats targeting financial infrastructures.

- Scenario-based projections:

- Best case: Diplomatic resolutions lead to market stabilization.

- Worst case: Escalation of conflicts results in prolonged market downturns.

- Most likely: Continued volatility with intermittent recoveries.

5. Key Individuals and Entities

Donald Trump, Jerome Powell, Stephen Alpher, Tom Carreras

6. Thematic Tags

national security threats, cybersecurity, economic volatility, geopolitical tensions