Badenoch calls for end to oil and gas windfall tax – BBC News

Published on: 2025-06-13

Intelligence Report: Badenoch calls for end to oil and gas windfall tax – BBC News

1. BLUF (Bottom Line Up Front)

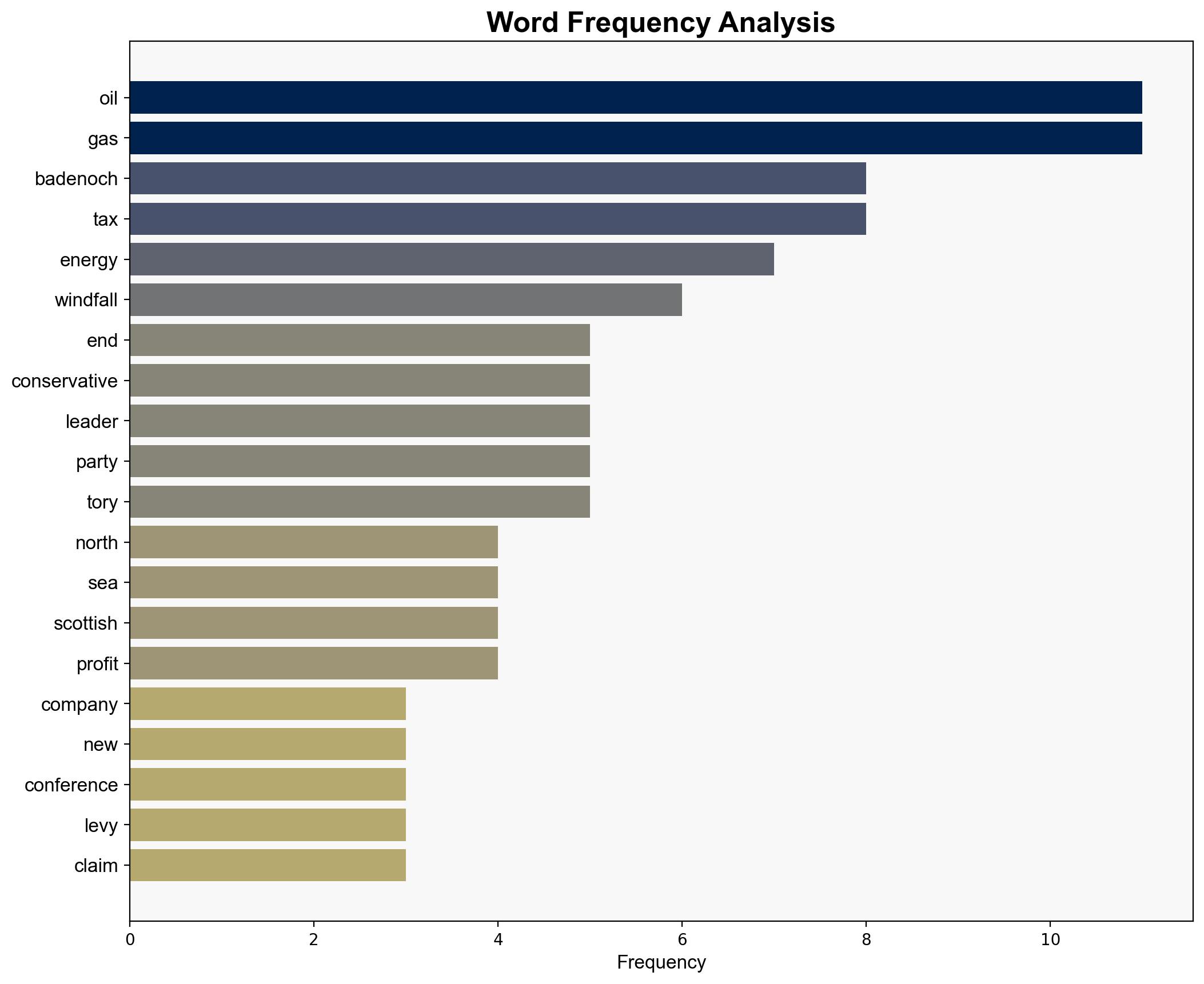

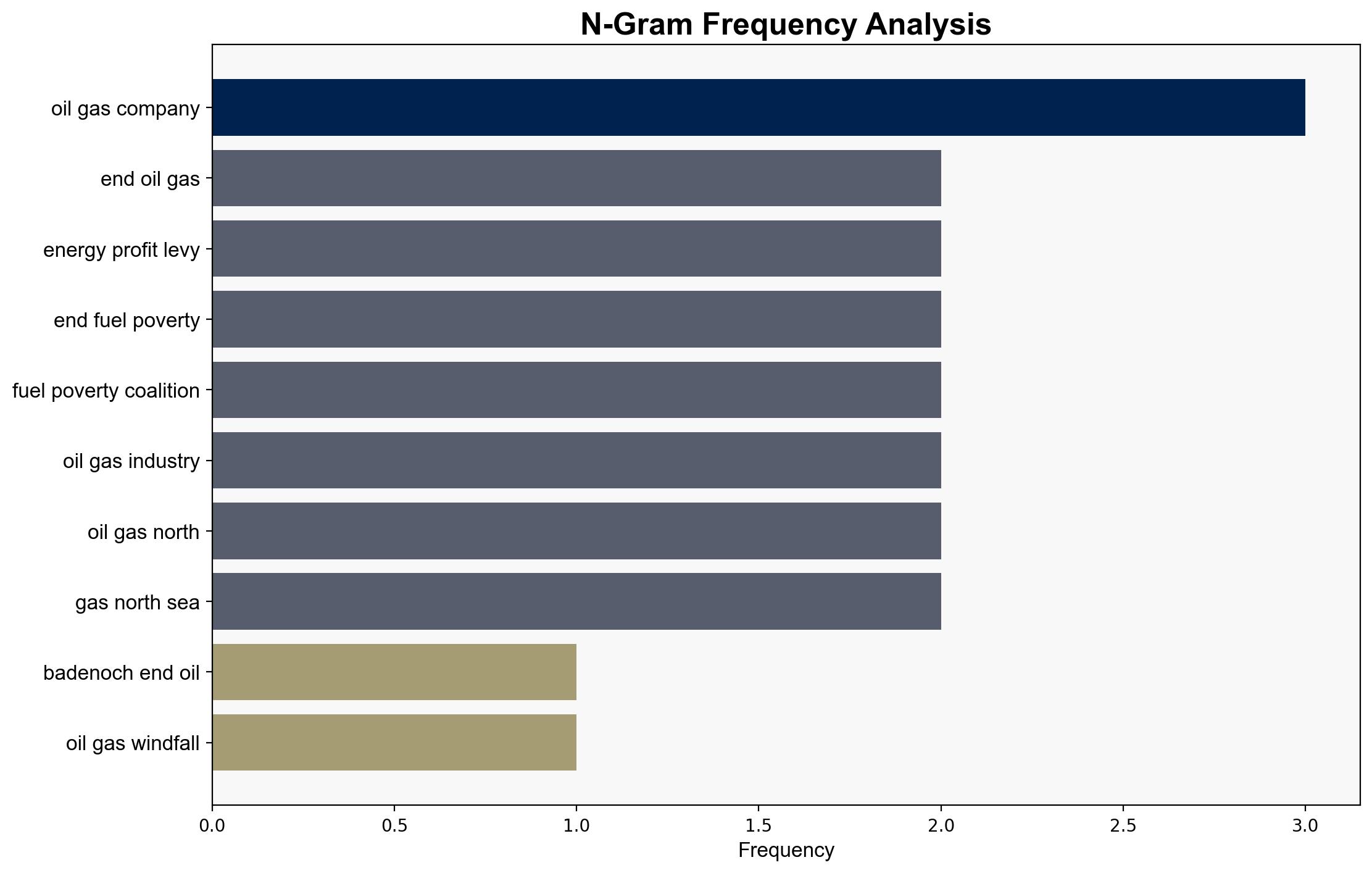

Kemi Badenoch has advocated for the termination of the windfall tax on oil and gas companies, arguing that it hampers investment in the sector. This stance has sparked criticism from opposition politicians and advocacy groups who emphasize the ongoing energy crisis and its impact on household bills. The strategic recommendation is to assess the potential economic and energy security implications of maintaining or removing the tax.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Cognitive Bias Stress Test

Potential biases in the assessment of the windfall tax’s impact on investment and energy security were examined. Red teaming exercises highlighted the need to consider both short-term economic gains and long-term energy sustainability.

Bayesian Scenario Modeling

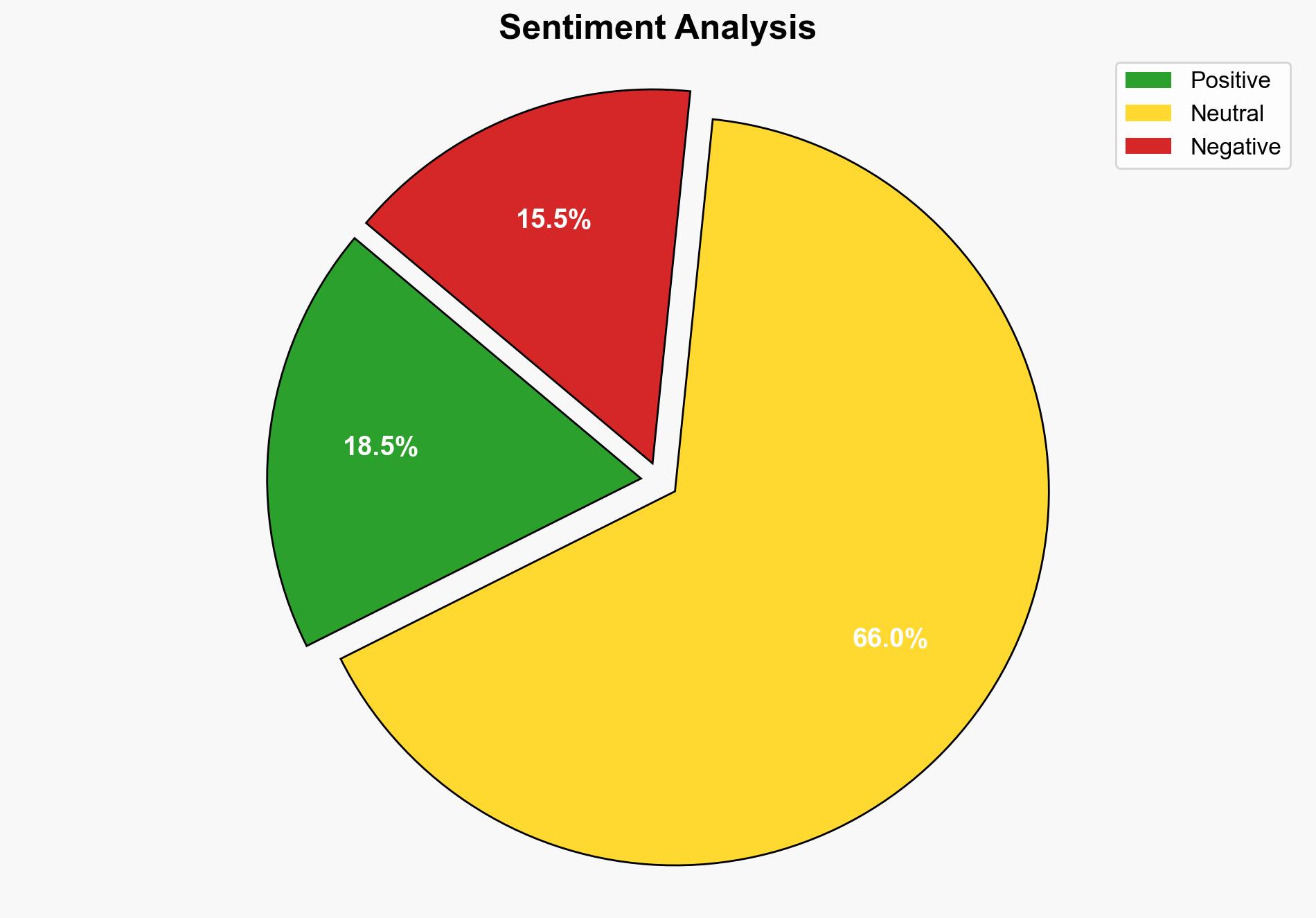

Probabilistic forecasting suggests a moderate likelihood of increased investment in the oil and gas sector if the tax is removed, but also a potential escalation in public dissent due to high energy costs.

Network Influence Mapping

The analysis mapped the influence of political leaders and advocacy groups on public opinion and policy decisions, indicating significant pressure from both sides of the debate.

3. Implications and Strategic Risks

The removal of the windfall tax could lead to increased investment in the North Sea oil and gas sector, potentially enhancing energy security. However, it may also exacerbate public dissatisfaction due to high energy prices and perceived government alignment with corporate interests. This could lead to increased political instability and economic inequality.

4. Recommendations and Outlook

- Conduct a comprehensive impact assessment of the windfall tax on both the energy sector and household energy costs.

- Engage in dialogue with stakeholders to balance investment incentives with consumer protection.

- Scenario-based projections:

- Best case: Enhanced investment leads to energy security and economic growth.

- Worst case: Public backlash and increased political instability.

- Most likely: A mixed outcome with moderate investment gains and continued public discontent.

5. Key Individuals and Entities

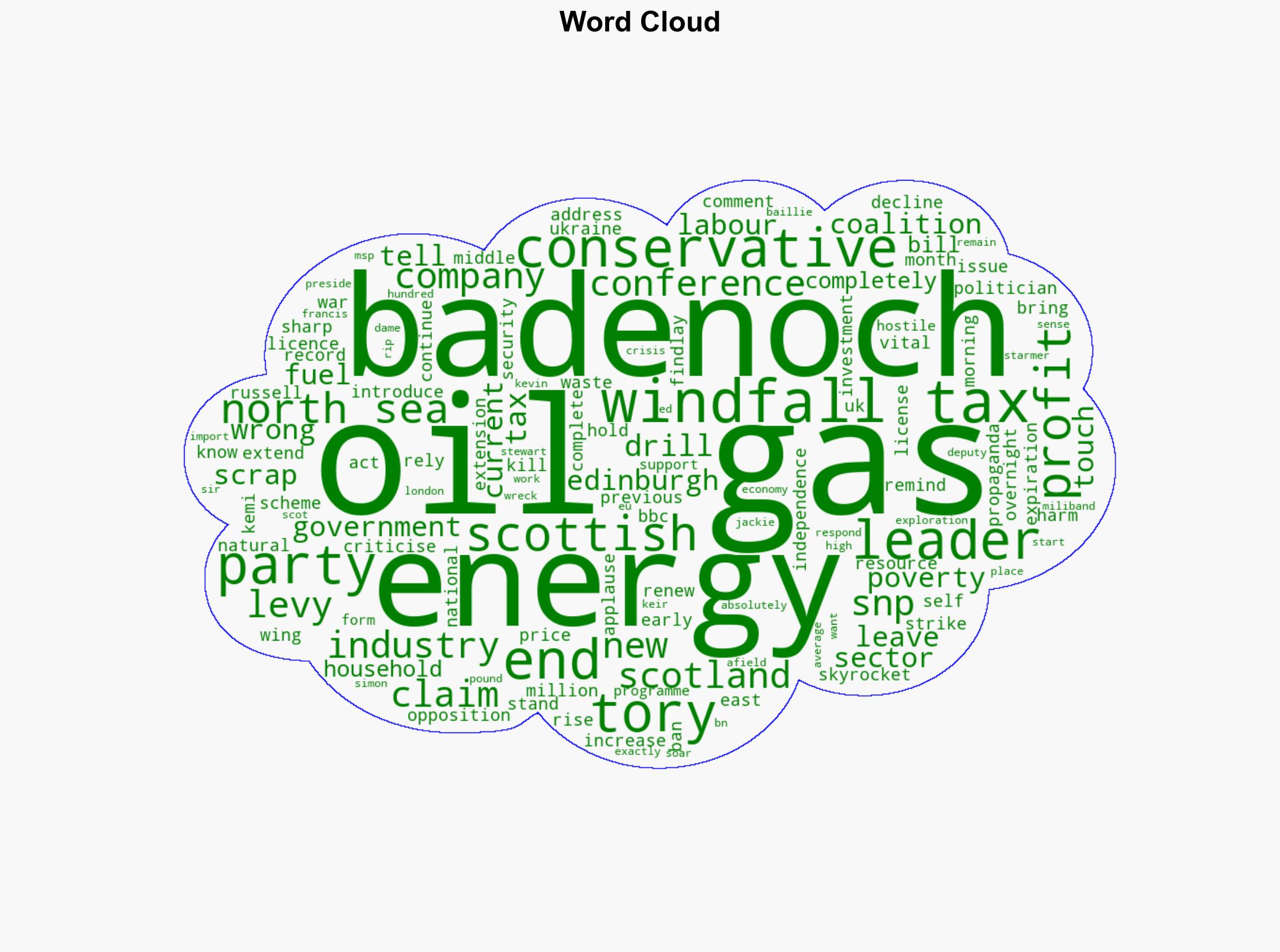

Kemi Badenoch, Simon Francis, Russell Findlay, Kevin Stewart, Jackie Baillie

6. Thematic Tags

energy policy, economic impact, political strategy, public opinion