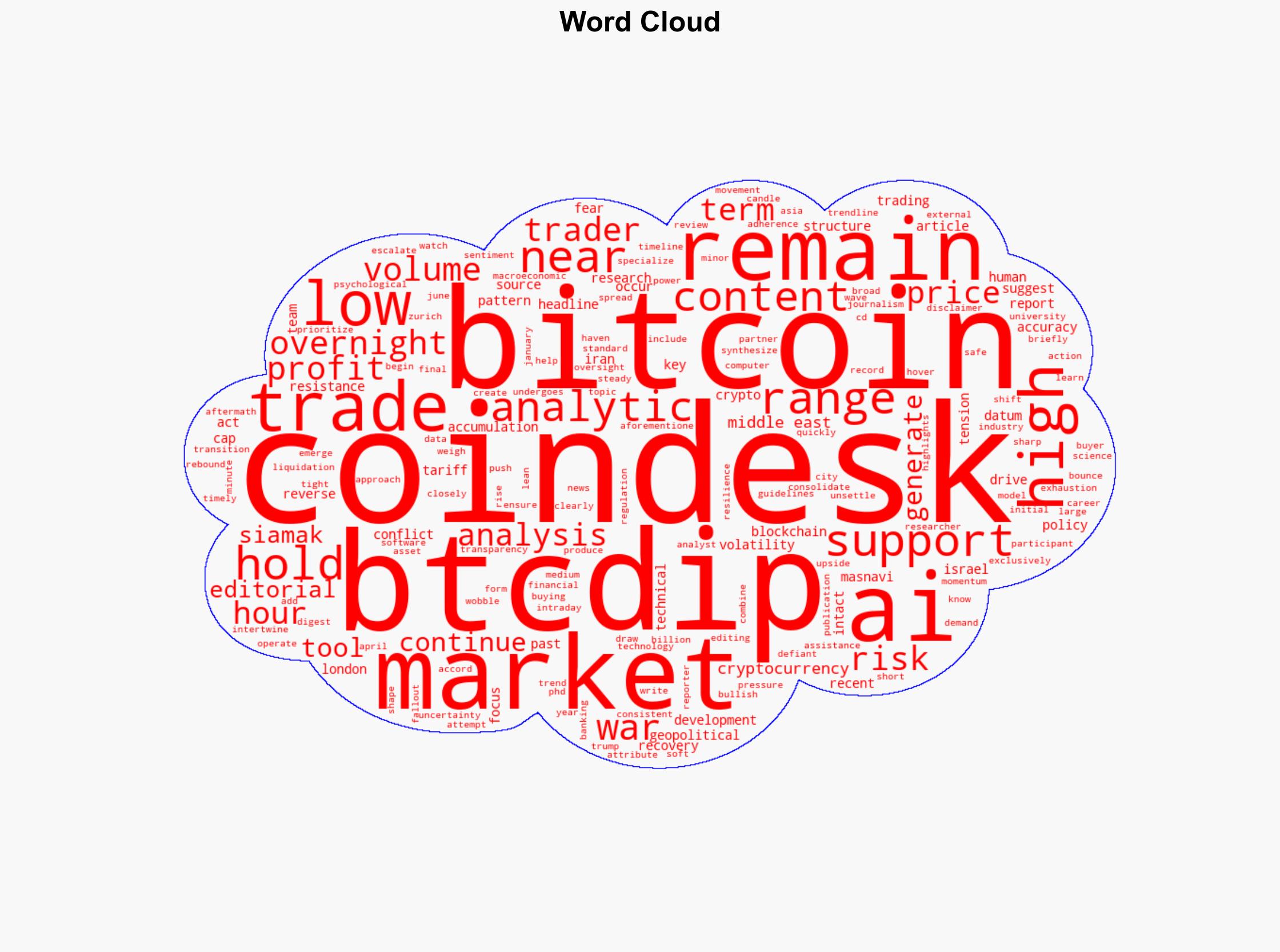

Bitcoin Remains Defiant Amid Escalating Middle East Conflict and Trade War Fears – CoinDesk

Published on: 2025-06-14

Intelligence Report: Bitcoin Remains Defiant Amid Escalating Middle East Conflict and Trade War Fears – CoinDesk

1. BLUF (Bottom Line Up Front)

Bitcoin demonstrates resilience amidst rising geopolitical tensions in the Middle East and global trade uncertainties. Despite overnight fluctuations, Bitcoin’s structural integrity remains robust, suggesting continued investor confidence. Key findings indicate that Bitcoin’s role as a potential safe-haven asset is being tested, with implications for broader market dynamics.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

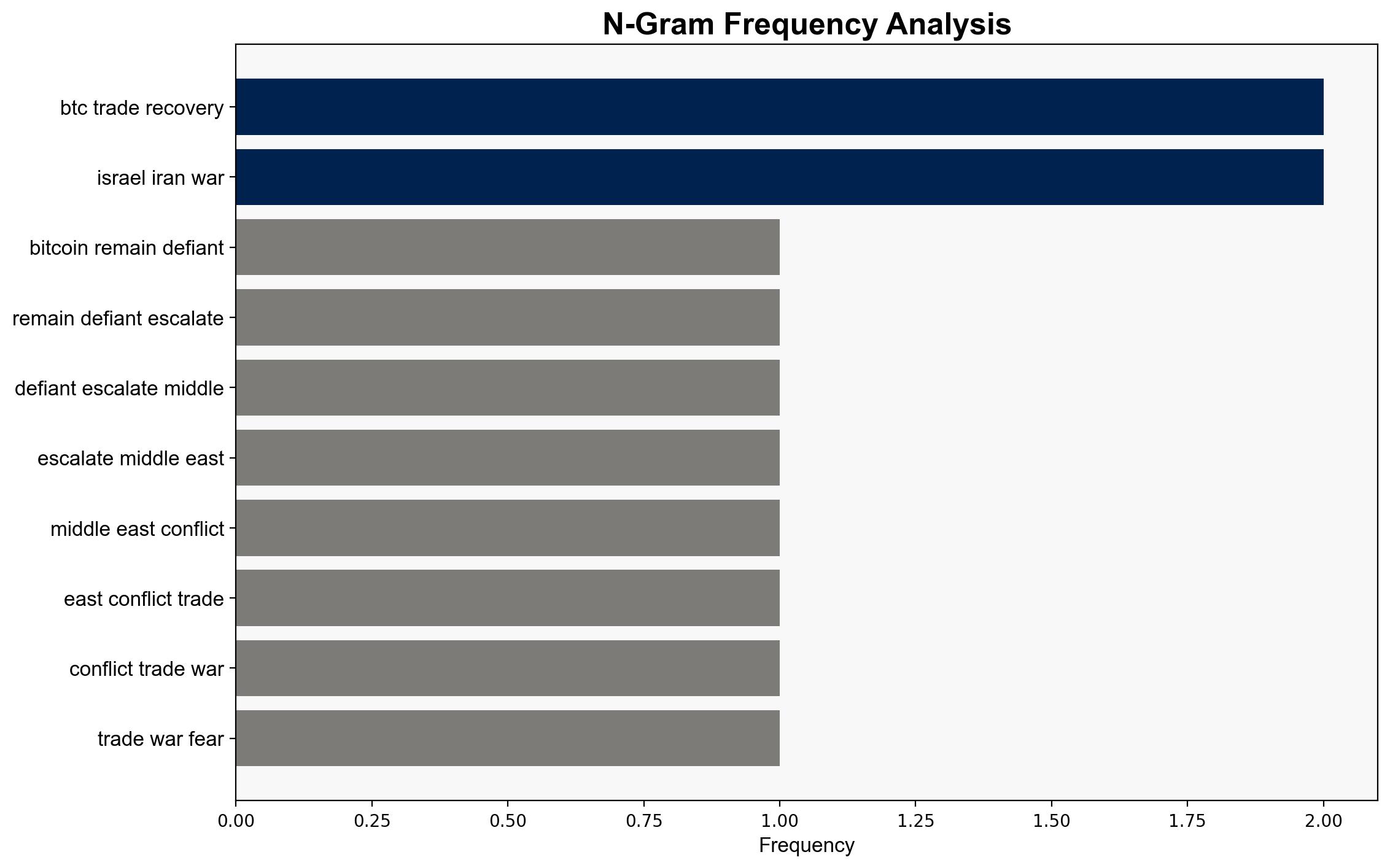

Surface events include the ongoing Israel-Iran conflict and trade tensions involving major economies. Systemic structures involve global financial markets’ response to geopolitical instability. Worldviews reflect a growing perception of Bitcoin as a hedge against traditional market volatility. Myths pertain to Bitcoin’s narrative as “digital gold.”

Cross-Impact Simulation

Simulations suggest that heightened regional conflicts could lead to increased Bitcoin demand as investors seek alternatives to traditional assets. Trade war escalations may further drive this trend, impacting global economic dependencies.

Scenario Generation

Under a scenario of prolonged conflict and trade disruptions, Bitcoin may experience increased volatility but also higher demand. Conversely, a resolution could stabilize traditional markets, reducing Bitcoin’s immediate appeal as a safe haven.

3. Implications and Strategic Risks

The persistence of geopolitical tensions poses risks to global economic stability, potentially increasing Bitcoin’s attractiveness as a non-correlated asset. However, this also introduces volatility risks. The intertwining of geopolitical and economic factors could lead to unpredictable market behaviors, affecting both traditional and digital asset classes.

4. Recommendations and Outlook

- Monitor geopolitical developments closely to assess their impact on Bitcoin and broader financial markets.

- Consider diversifying investment portfolios to include digital assets as a hedge against geopolitical risks.

- Scenario-based projections:

- Best Case: Geopolitical tensions ease, stabilizing markets and reducing Bitcoin volatility.

- Worst Case: Escalation leads to market instability, increasing Bitcoin demand but also volatility.

- Most Likely: Continued fluctuations with Bitcoin maintaining its role as a speculative safe haven.

5. Key Individuals and Entities

Siamak Masnavi

6. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus