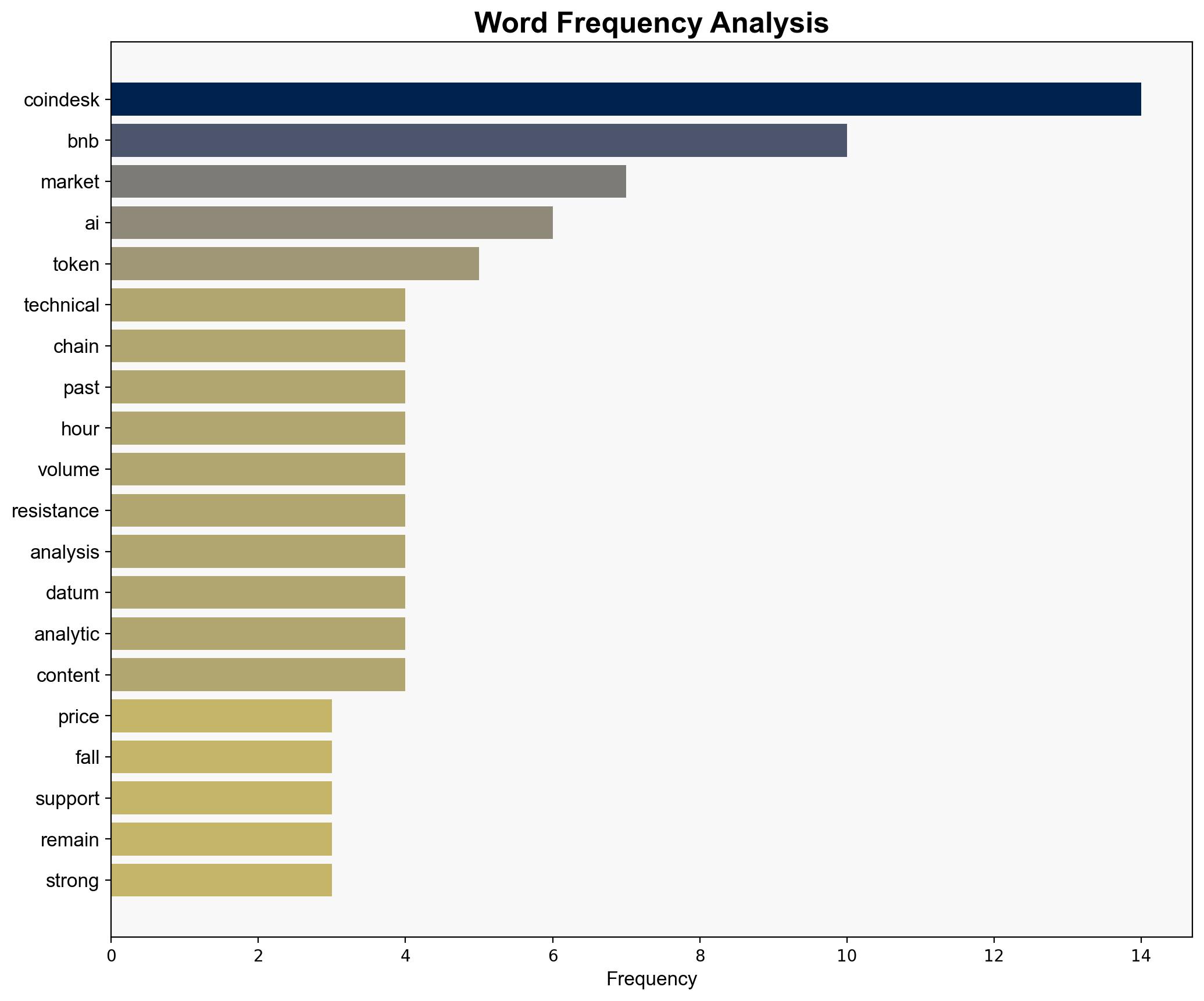

BNB Price Falls Below Technical Support as Market Awaits FOMC Clues Amid Geopolitical Tension – CoinDesk

Published on: 2025-06-17

Intelligence Report: BNB Price Falls Below Technical Support as Market Awaits FOMC Clues Amid Geopolitical Tension – CoinDesk

1. BLUF (Bottom Line Up Front)

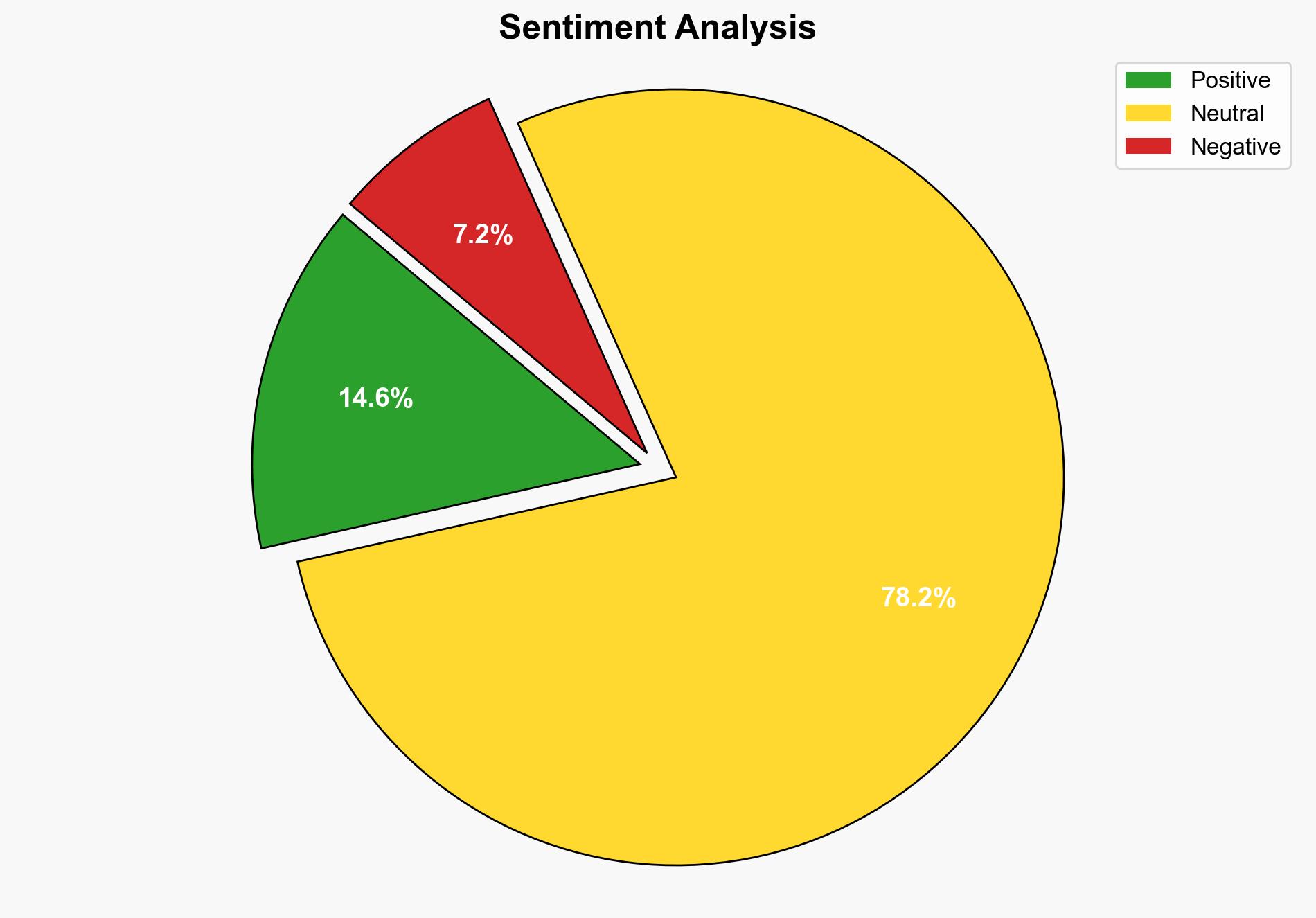

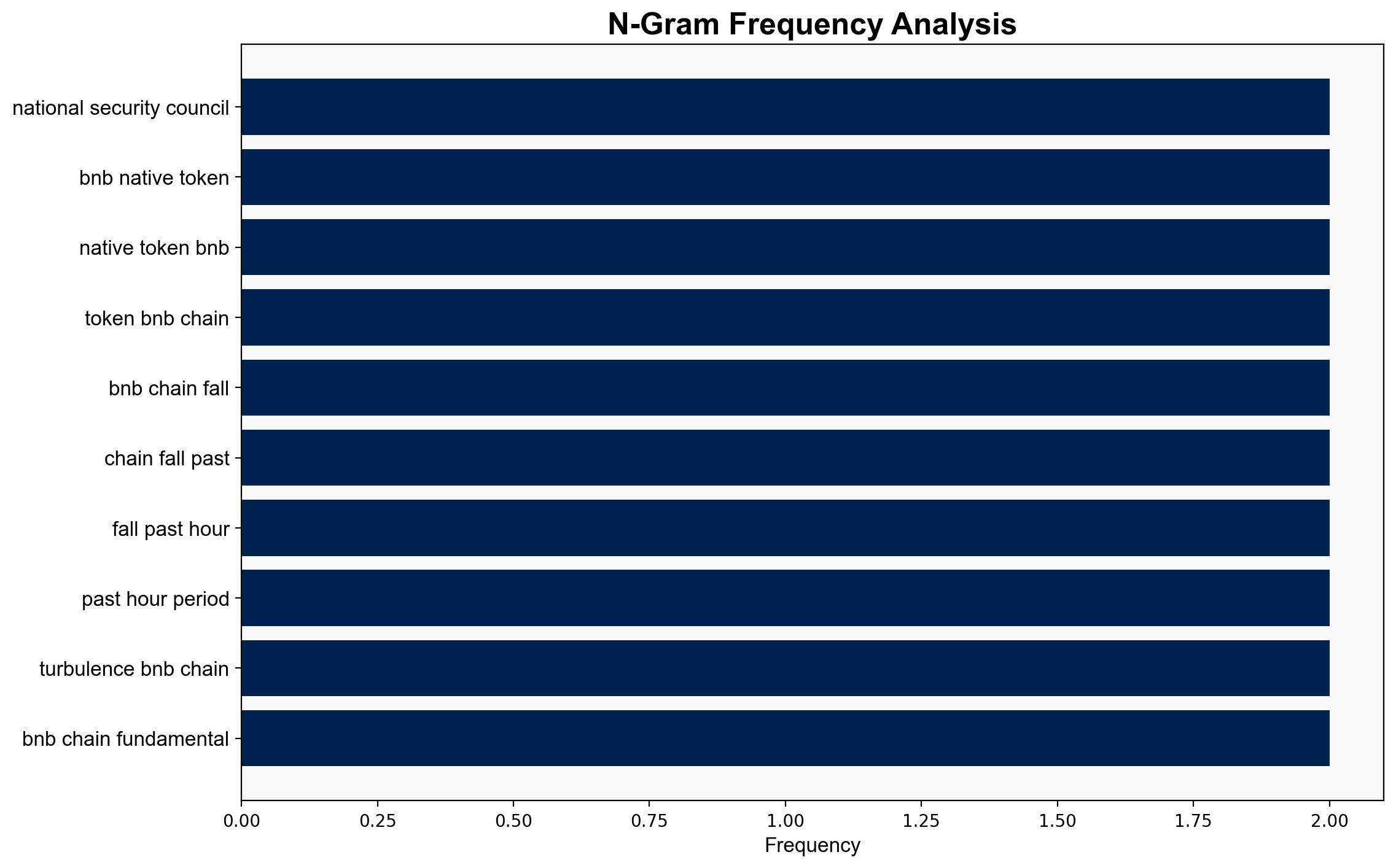

The BNB token has experienced a price drop below technical support levels due to heightened market unease stemming from geopolitical tensions between Israel and Iran, compounded by anticipation of the Federal Open Market Committee (FOMC) meeting. Despite short-term volatility, the BNB Chain’s fundamentals remain robust. Strategic recommendations include monitoring geopolitical developments and FOMC outcomes to anticipate market movements.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Cognitive Bias Stress Test

Potential biases were identified and mitigated through structured challenge techniques, ensuring a balanced assessment of market conditions and geopolitical factors.

Bayesian Scenario Modeling

Probabilistic forecasting was used to assess the likelihood of conflict escalation between Israel and Iran, impacting global markets.

Network Influence Mapping

Influence relationships were mapped to evaluate the impact of key actors on market dynamics and geopolitical tensions.

Narrative Pattern Analysis

Ideological narratives surrounding the geopolitical situation were deconstructed to assess potential threats and market sentiment.

3. Implications and Strategic Risks

The ongoing geopolitical tensions and potential FOMC decisions pose risks to global markets, particularly in the cryptocurrency sector. The interplay between geopolitical developments and economic policy decisions could lead to increased volatility. Systemic vulnerabilities may arise from cascading effects across political, economic, and cyber domains.

4. Recommendations and Outlook

- Monitor geopolitical developments, particularly the Israel-Iran conflict, for potential market impacts.

- Assess FOMC meeting outcomes to gauge future interest rate changes and their effects on liquidity and risk assets.

- Scenario-based projections:

- Best Case: De-escalation of geopolitical tensions and favorable FOMC outcomes stabilize markets.

- Worst Case: Escalation of conflict and adverse FOMC decisions lead to significant market downturns.

- Most Likely: Continued volatility with intermittent stabilization as geopolitical and economic factors evolve.

5. Key Individuals and Entities

Donald Trump, Francisco Rodriguez

6. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus