Nippon Steels takeover of US Steel is done but the companies didnt release the national security deal struck with Trump – Fortune

Published on: 2025-06-19

Intelligence Report: Nippon Steel’s Takeover of US Steel and the Unreleased National Security Deal

1. BLUF (Bottom Line Up Front)

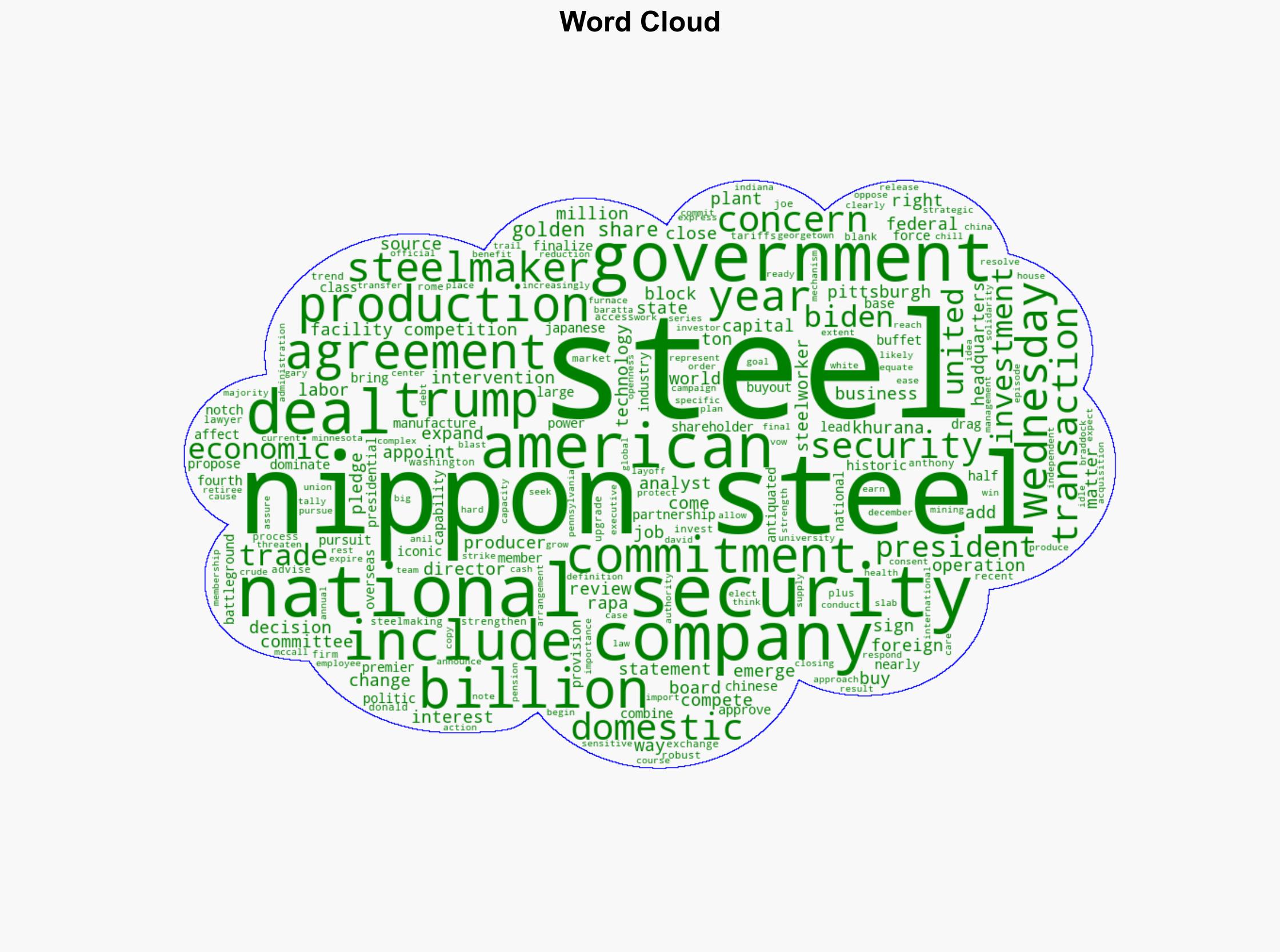

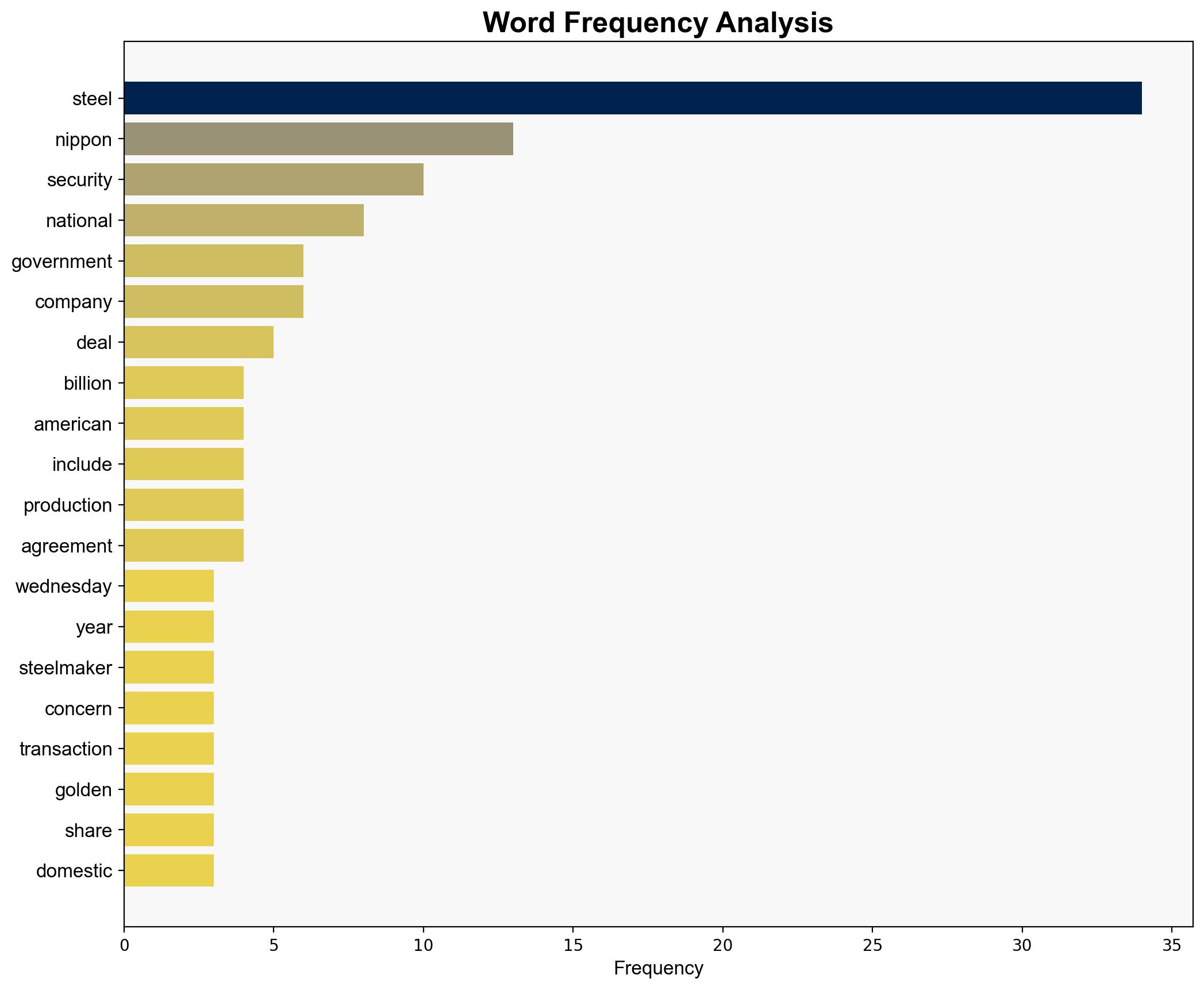

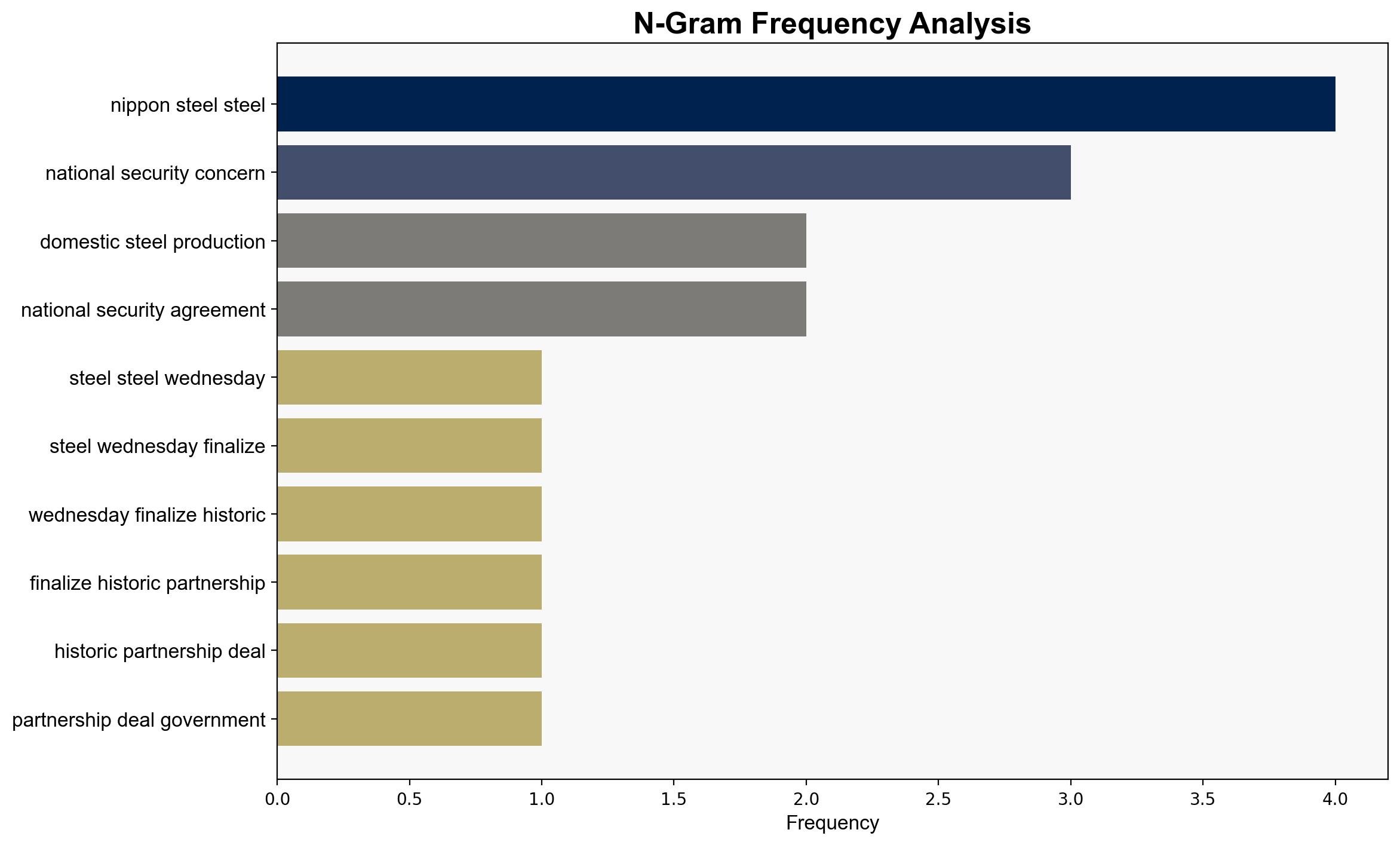

Nippon Steel has finalized its acquisition of US Steel, a move that has significant implications for national security and economic policy. Despite the completion of the deal, the specifics of the national security agreement made with the Trump administration remain undisclosed. This acquisition highlights the growing trend of equating economic security with national security, particularly in the context of US-China economic competition. It is crucial to monitor the strategic implications of this deal, especially concerning domestic steel production and foreign investment policies.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Cognitive Bias Stress Test

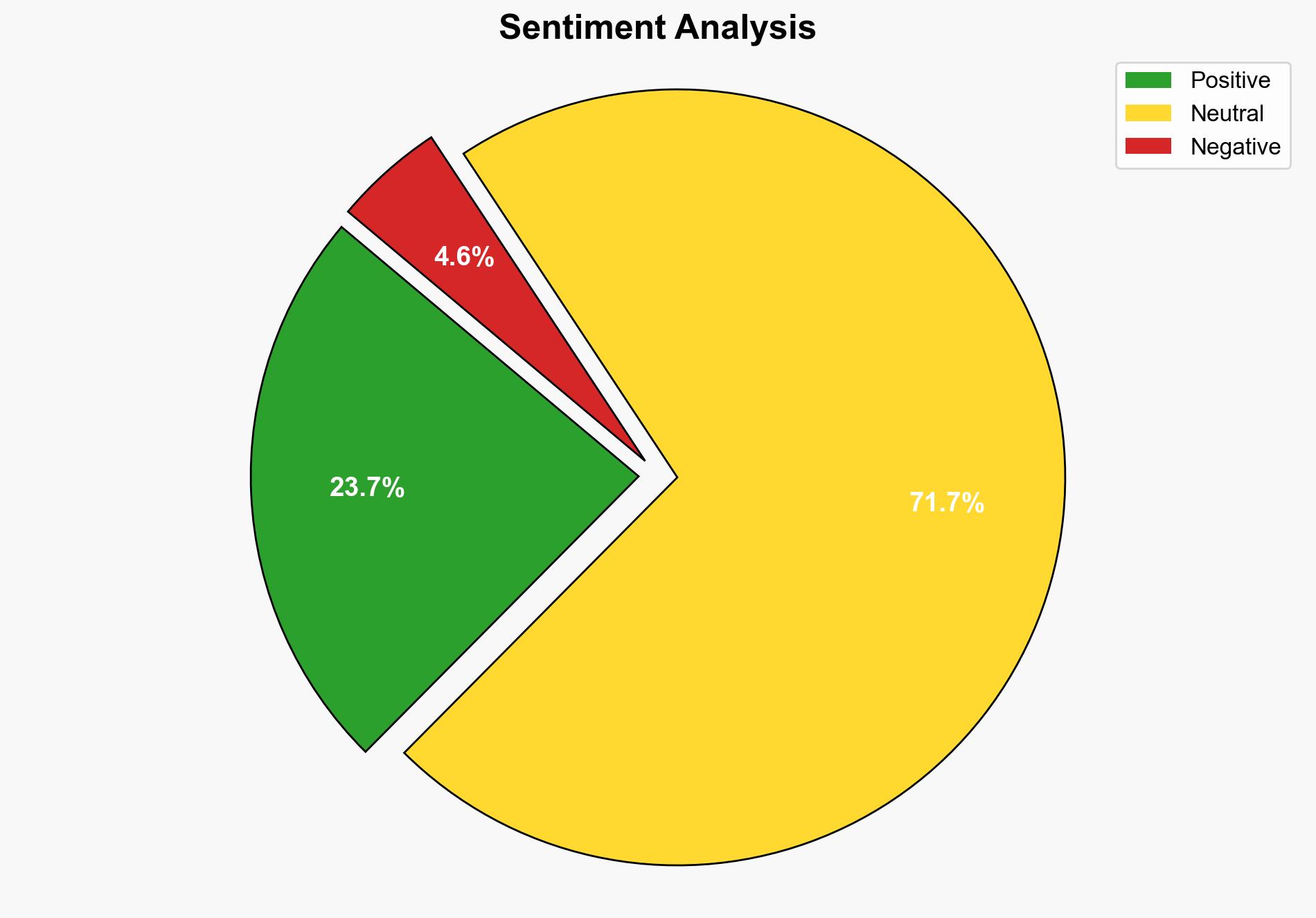

The analysis has been subjected to red teaming to identify and mitigate potential biases, ensuring a balanced assessment of the national security implications of the acquisition.

Bayesian Scenario Modeling

Probabilistic forecasting suggests a moderate likelihood of increased scrutiny on foreign investments in critical industries, potentially leading to more stringent regulatory measures.

Network Influence Mapping

The acquisition enhances Nippon Steel’s influence in the global steel market, potentially affecting competitive dynamics and strategic alliances, particularly in relation to Chinese steel producers.

3. Implications and Strategic Risks

The deal could lead to increased economic competition with China, impacting US domestic steel production and employment. The lack of transparency regarding the national security agreement may create uncertainty in foreign investment policies, potentially deterring future investments. Additionally, the “golden share” provision allowing US government oversight could set a precedent for future transactions, influencing international business strategies.

4. Recommendations and Outlook

- Enhance transparency in foreign investment agreements to build trust and ensure compliance with national security standards.

- Monitor the implementation of the “golden share” provision to assess its effectiveness in safeguarding national interests.

- Scenario Projections:

- Best Case: The acquisition strengthens US steel production capabilities and fosters innovation.

- Worst Case: Increased regulatory scrutiny deters foreign investments, impacting economic growth.

- Most Likely: Gradual adaptation to new regulatory norms with moderate impact on investment flows.

5. Key Individuals and Entities

Anthony Rapa, Anil Khurana

6. Thematic Tags

national security threats, economic security, foreign investment, US-China competition