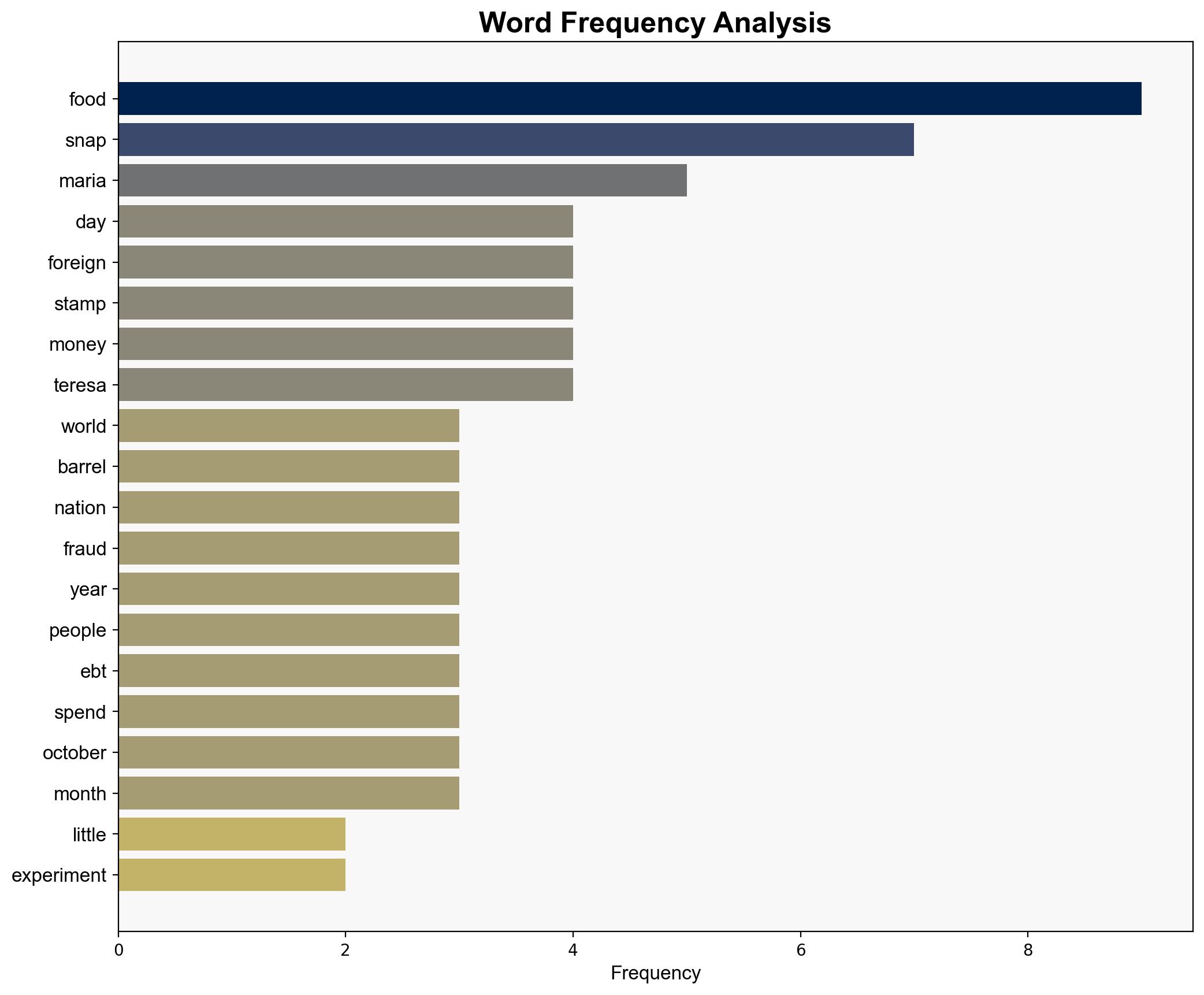

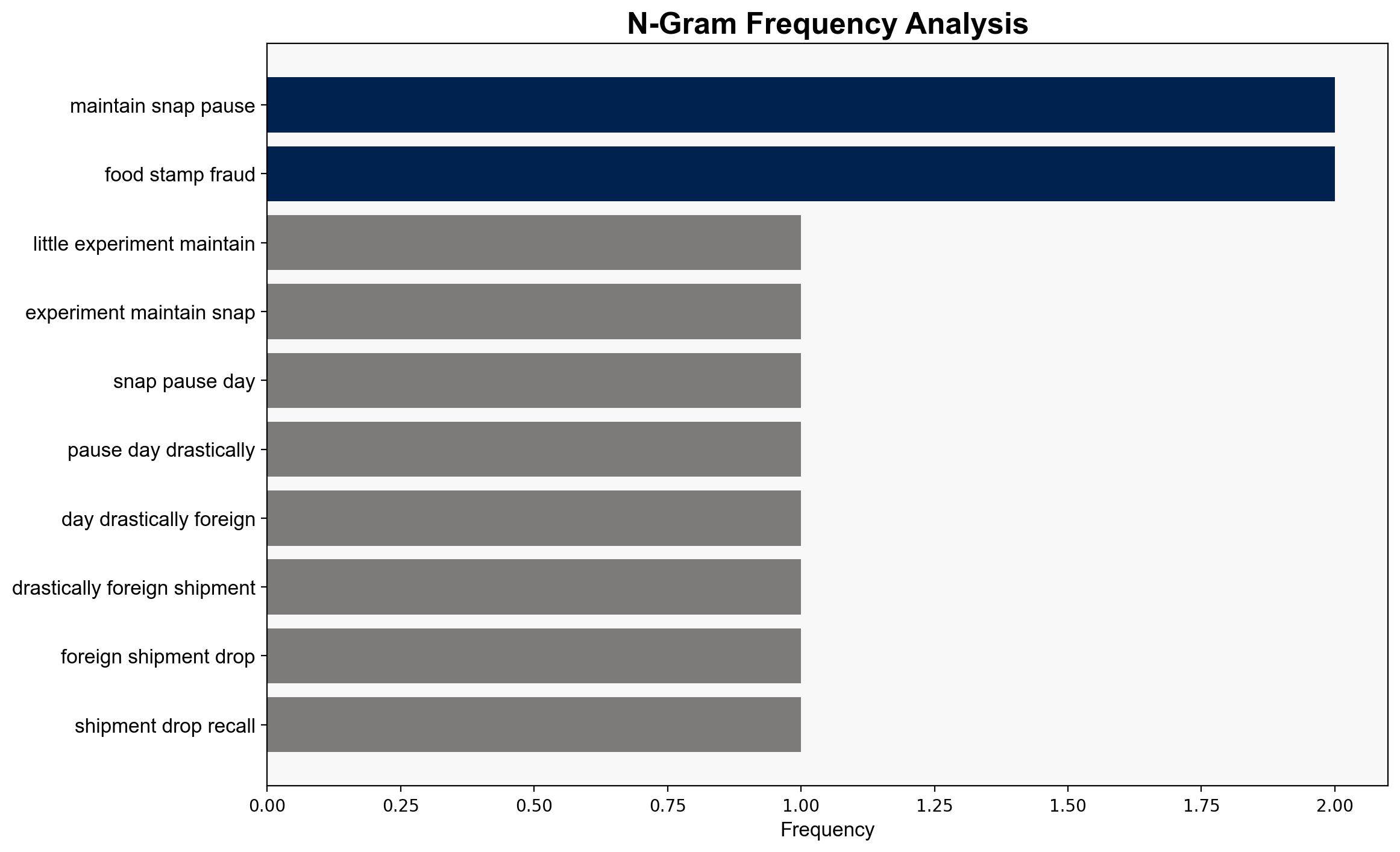

A little experiment Maintain SNAP pause for 30 days to see how drastically foreign shipments drop – Americanthinker.com

Published on: 2025-10-29

Intelligence Report: A little experiment Maintain SNAP pause for 30 days to see how drastically foreign shipments drop – Americanthinker.com

1. BLUF (Bottom Line Up Front)

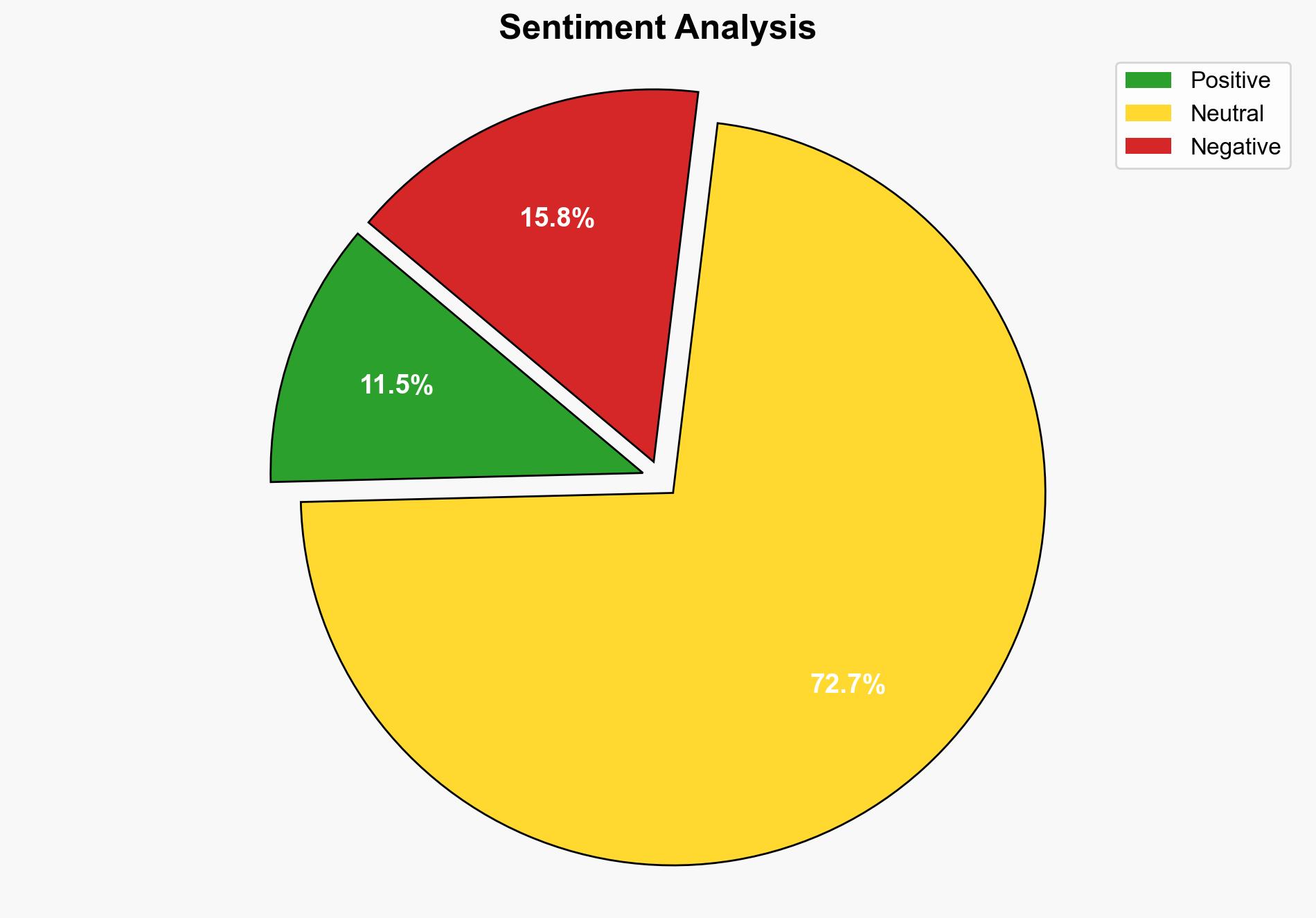

The analysis suggests that pausing SNAP benefits for 30 days could potentially reduce foreign remittances linked to food stamp fraud. However, this hypothesis is contingent on the assumption that such fraud is widespread and significantly impacts foreign markets. The most supported hypothesis is that the pause would lead to a temporary decrease in fraudulent activities but may not have a lasting impact. Confidence level: Moderate. Recommended action: Conduct a controlled pilot study to gather empirical data on the effects of a SNAP pause.

2. Competing Hypotheses

1. **Hypothesis A**: Pausing SNAP benefits for 30 days will significantly reduce foreign shipments and remittances linked to food stamp fraud.

– **Supporting Evidence**: Reports of fraudulent activities involving SNAP benefits being used to purchase goods for resale in foreign markets.

– **Structured Analysis**: Using ACH 2.0, this hypothesis is supported by anecdotal evidence and specific cases of fraud.

2. **Hypothesis B**: Pausing SNAP benefits will have minimal impact on foreign shipments and remittances, as the fraud is not as widespread as suggested.

– **Supporting Evidence**: Lack of comprehensive data on the scale of fraud and potential adaptive behaviors by fraudsters.

– **Structured Analysis**: Bayesian Scenario Modeling suggests that while fraud exists, its impact on foreign markets may be overstated.

3. Key Assumptions and Red Flags

– **Assumptions**: The scale of SNAP fraud is large enough to impact foreign markets; pausing SNAP will directly affect fraudulent activities.

– **Red Flags**: Reliance on anecdotal evidence; lack of comprehensive data on the scale and mechanisms of fraud.

– **Blind Spots**: Potential adaptive measures by fraudsters to circumvent a SNAP pause; socioeconomic impacts on legitimate SNAP beneficiaries.

4. Implications and Strategic Risks

– **Economic Risks**: Potential short-term disruption in foreign markets reliant on goods purchased through SNAP fraud.

– **Geopolitical Risks**: Strained relations with countries affected by reduced remittances.

– **Psychological Risks**: Public backlash from legitimate SNAP beneficiaries facing hardship due to the pause.

5. Recommendations and Outlook

- Conduct a controlled pilot study to assess the impact of a SNAP pause on fraud and foreign shipments.

- Develop enhanced monitoring and verification systems to detect and prevent SNAP fraud.

- Scenario Projections:

- Best Case: Significant reduction in fraud with minimal impact on legitimate beneficiaries.

- Worst Case: Minimal impact on fraud, significant hardship for legitimate beneficiaries, and diplomatic tensions.

- Most Likely: Temporary reduction in fraud with adaptive measures by fraudsters.

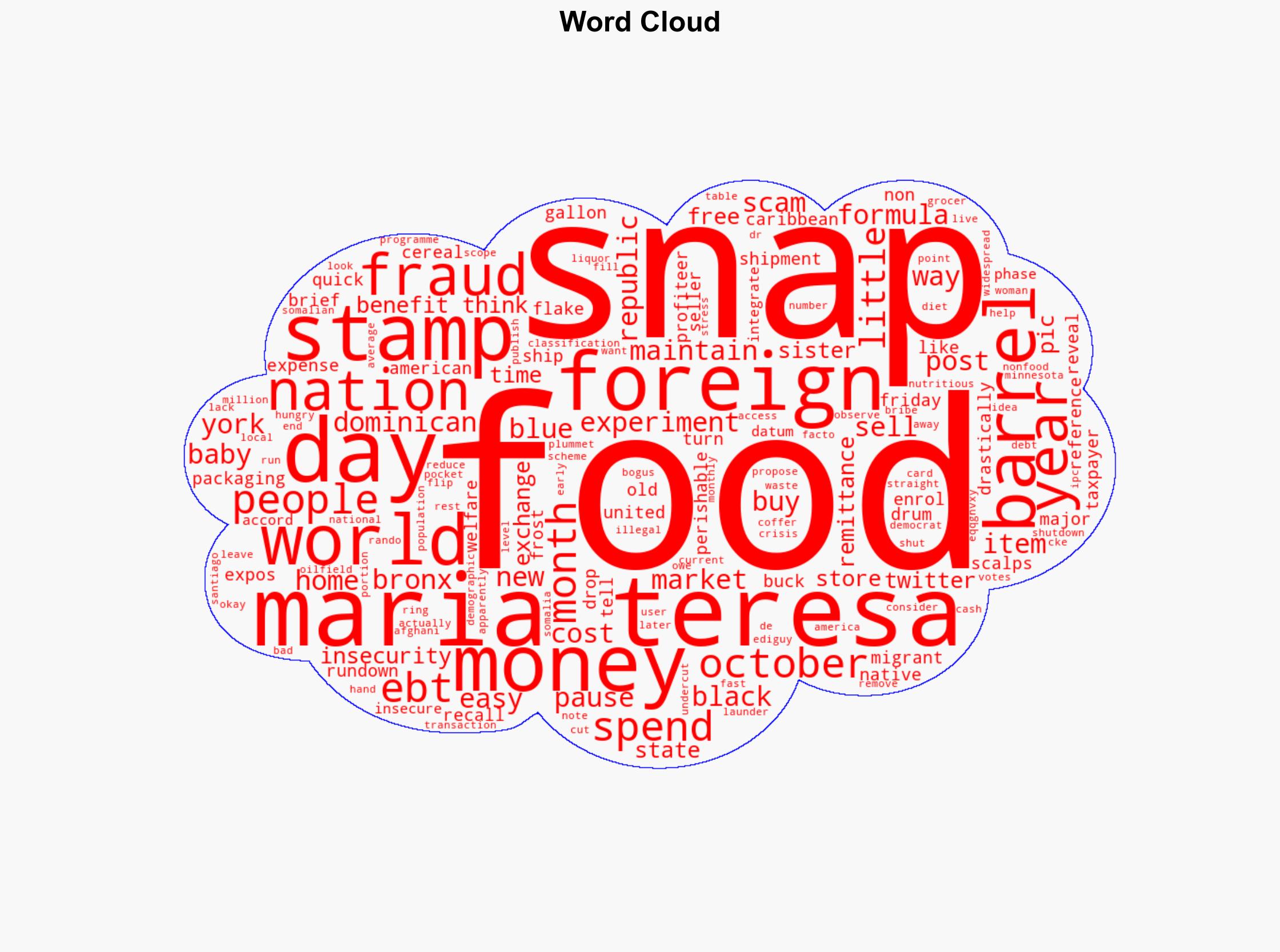

6. Key Individuals and Entities

– Maria Teresa: Allegedly involved in SNAP fraud activities.

– Dominican Republic: Mentioned as a destination for goods purchased through SNAP fraud.

7. Thematic Tags

national security threats, economic impact, fraud prevention, social welfare policy