AAPL opens market at highest price since Trump tariff bombshell – AppleInsider

Published on: 2025-04-14

Intelligence Report: AAPL opens market at highest price since Trump tariff bombshell – AppleInsider

1. BLUF (Bottom Line Up Front)

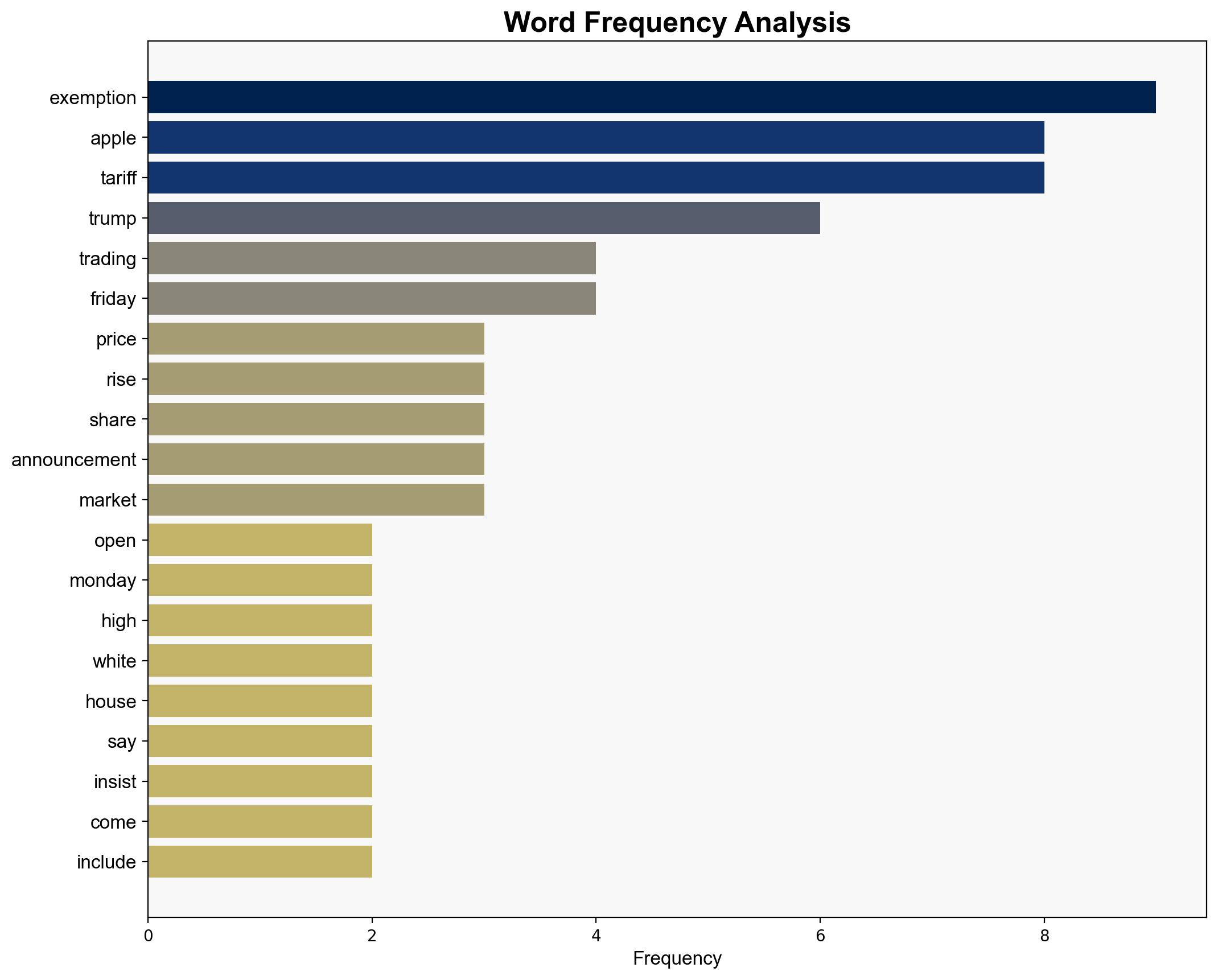

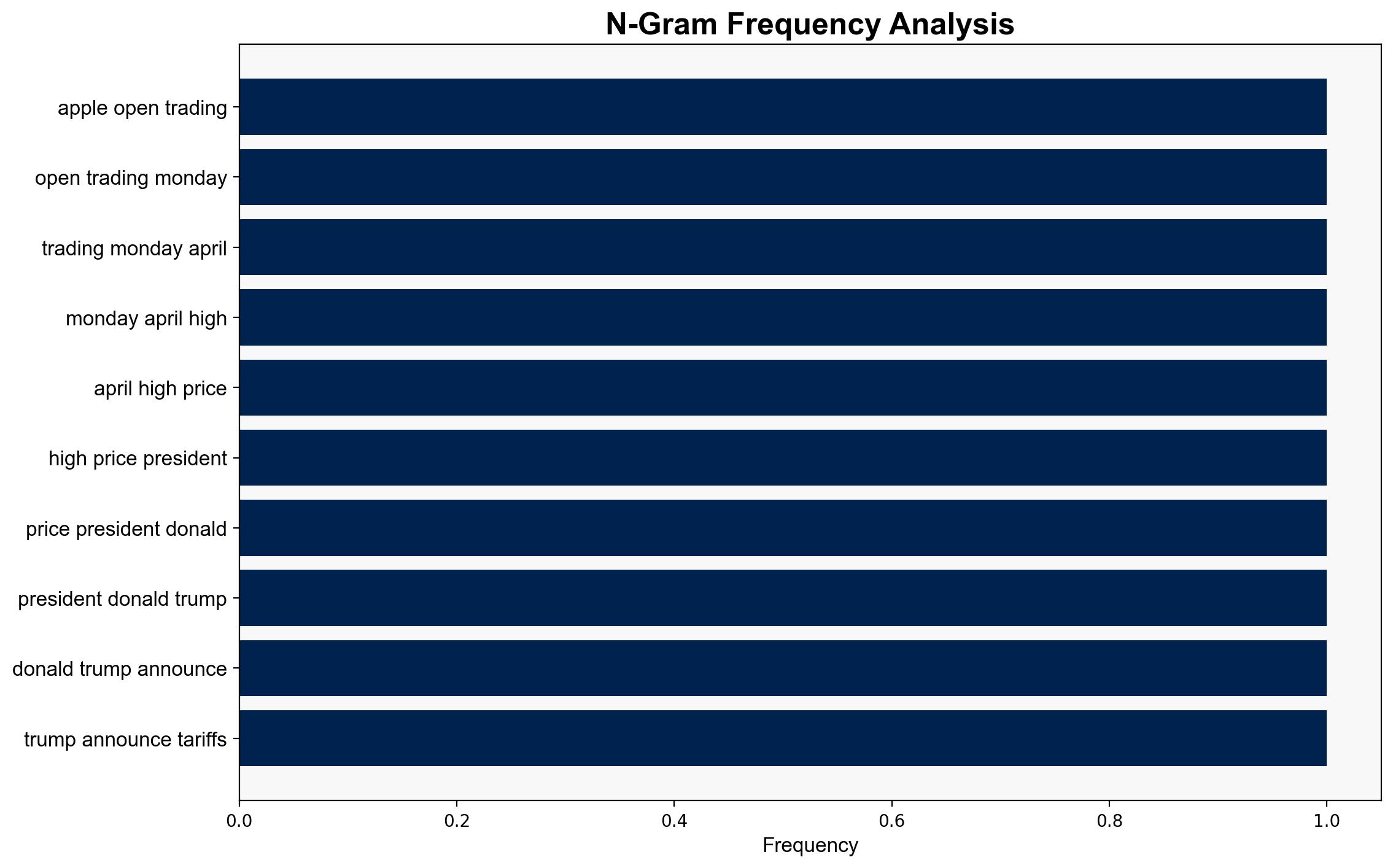

Apple shares opened at $211.44 on April 14, 2025, marking the highest price since the announcement of tariffs by Donald Trump. This surge follows a significant tariff exemption for Apple products, excluding minor items, announced unexpectedly on Friday. Despite initial volatility, market sentiment appears positive for Apple, though the situation remains fluid with potential policy shifts.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

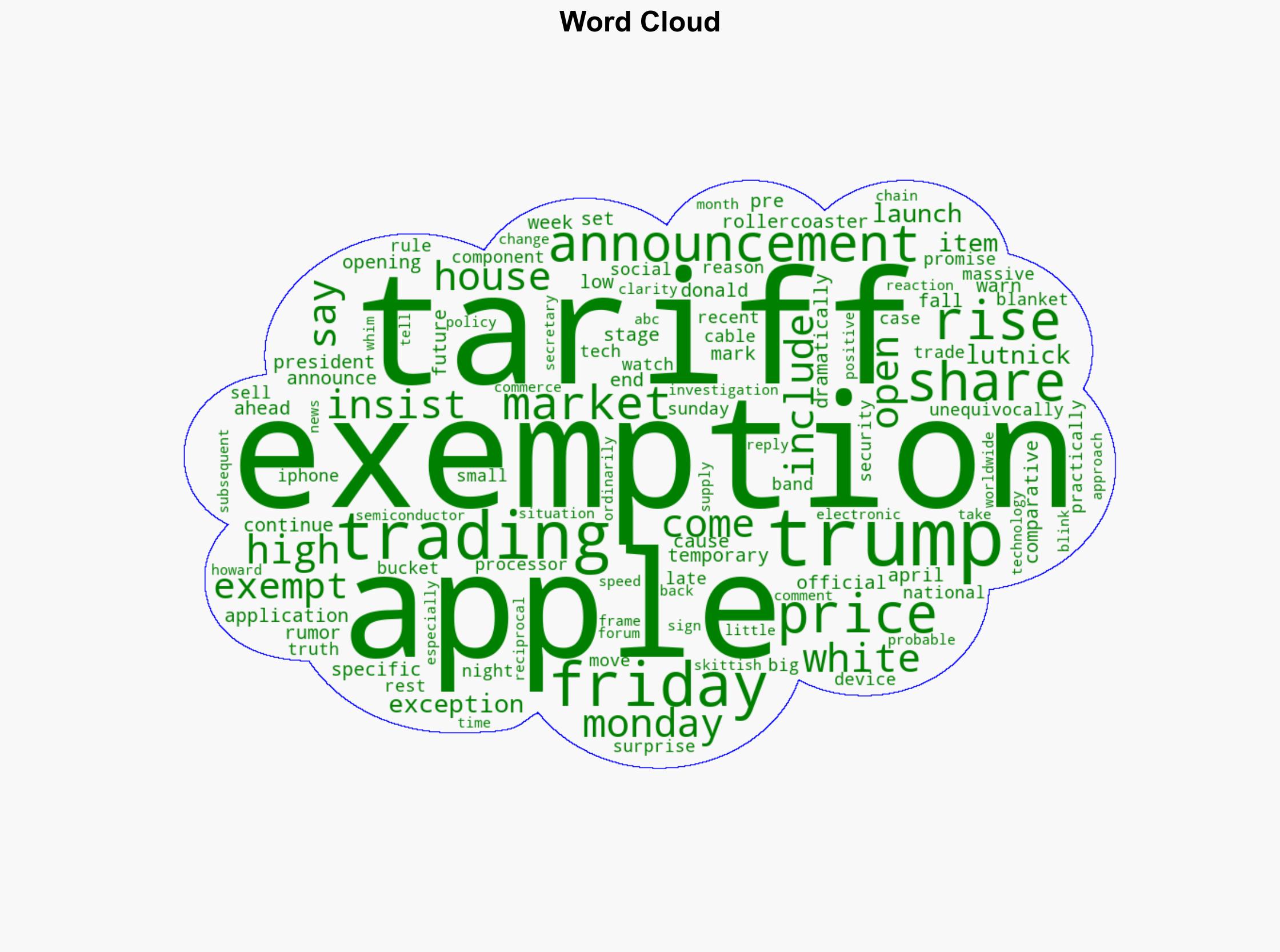

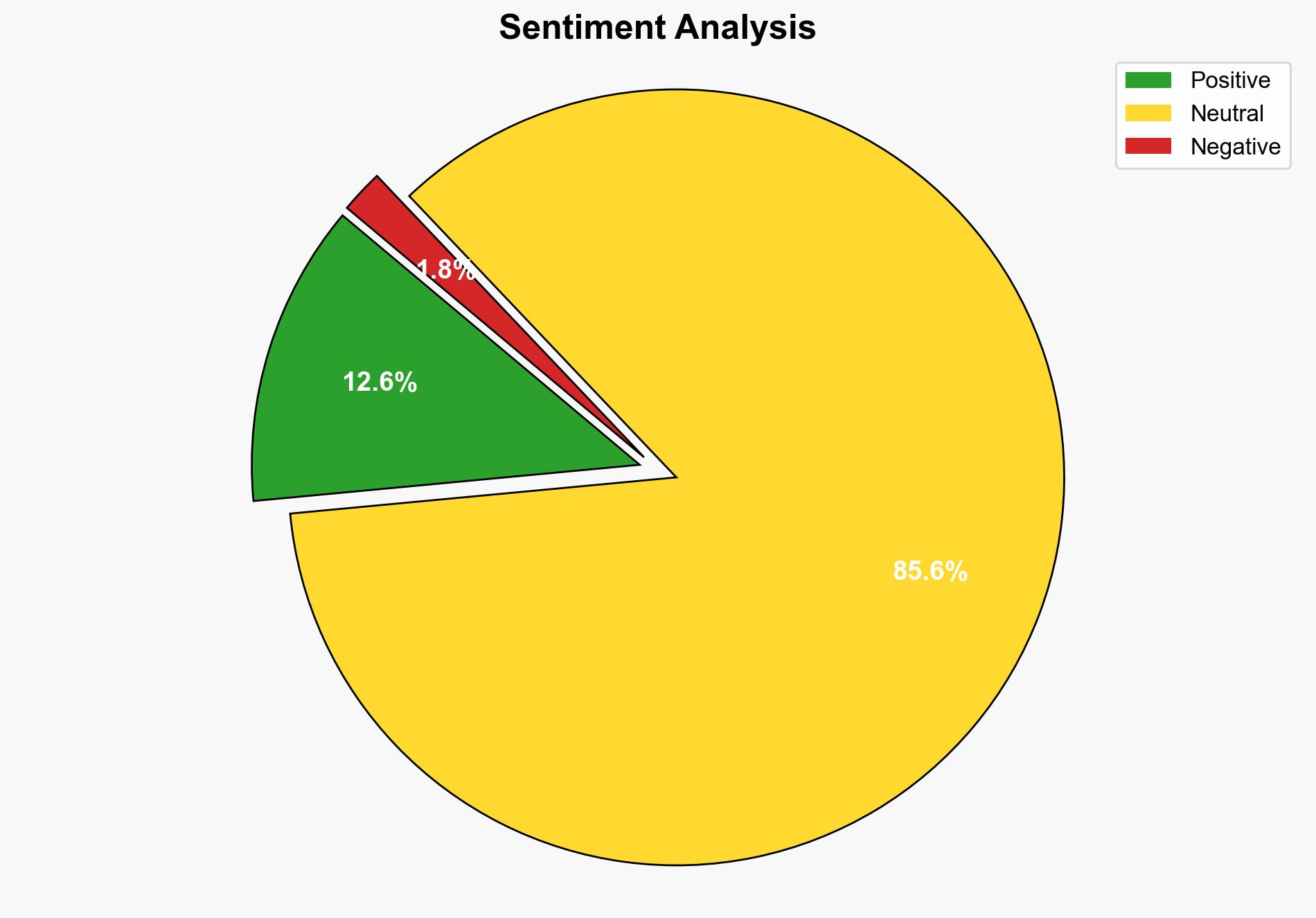

The recent tariff exemptions granted to Apple and other tech companies have temporarily alleviated market concerns, leading to a rise in Apple’s stock price. The exemption covers most Apple products, sparing them from the 145% tariff, which was initially imposed. However, the lack of clarity and consistency in policy announcements, coupled with the potential for further trade investigations, introduces uncertainty. The market’s current positive response may be short-lived if further policy shifts occur.

3. Implications and Strategic Risks

The primary risk involves the potential re-imposition of tariffs on tech products, which could destabilize markets and affect global supply chains. The announcement of a national security trade investigation into the electronics supply chain by Donald Trump could lead to further regulatory actions, impacting not only Apple but the broader tech industry. Economic interests are at stake, with potential repercussions for regional stability if trade tensions escalate.

4. Recommendations and Outlook

Recommendations:

- Monitor policy announcements closely to anticipate and mitigate potential market disruptions.

- Engage in diplomatic efforts to clarify trade policies and secure long-term exemptions for critical tech products.

- Encourage diversification of supply chains to reduce dependency on tariff-affected regions.

Outlook:

Best-case scenario: Continued exemptions and stable trade relations lead to sustained growth in Apple’s stock price and market stability.

Worst-case scenario: Re-imposition of tariffs and further trade investigations result in market volatility and supply chain disruptions.

Most likely outcome: Short-term stability with potential for future volatility depending on policy developments and international trade negotiations.

5. Key Individuals and Entities

The report mentions significant individuals such as Donald Trump and Howard Lutnick. Key entities include Apple and the broader tech industry. These individuals and entities play pivotal roles in the unfolding trade dynamics.