AI-Driven Fraud Demands Modern Identity Verification – Forbes

Published on: 2025-04-12

Intelligence Report: AI-Driven Fraud Demands Modern Identity Verification – Forbes

1. BLUF (Bottom Line Up Front)

Organizations are facing increasingly sophisticated fraud attacks, driven by advancements in AI technology. These attacks include account takeovers, identity fraud, and deepfakes. Traditional identity verification methods are inadequate, leaving companies vulnerable. The need for modern, robust identity verification systems is critical to protect sensitive data, especially in industries like finance and healthcare. Immediate investment in advanced security measures is essential to mitigate these risks and maintain customer trust.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

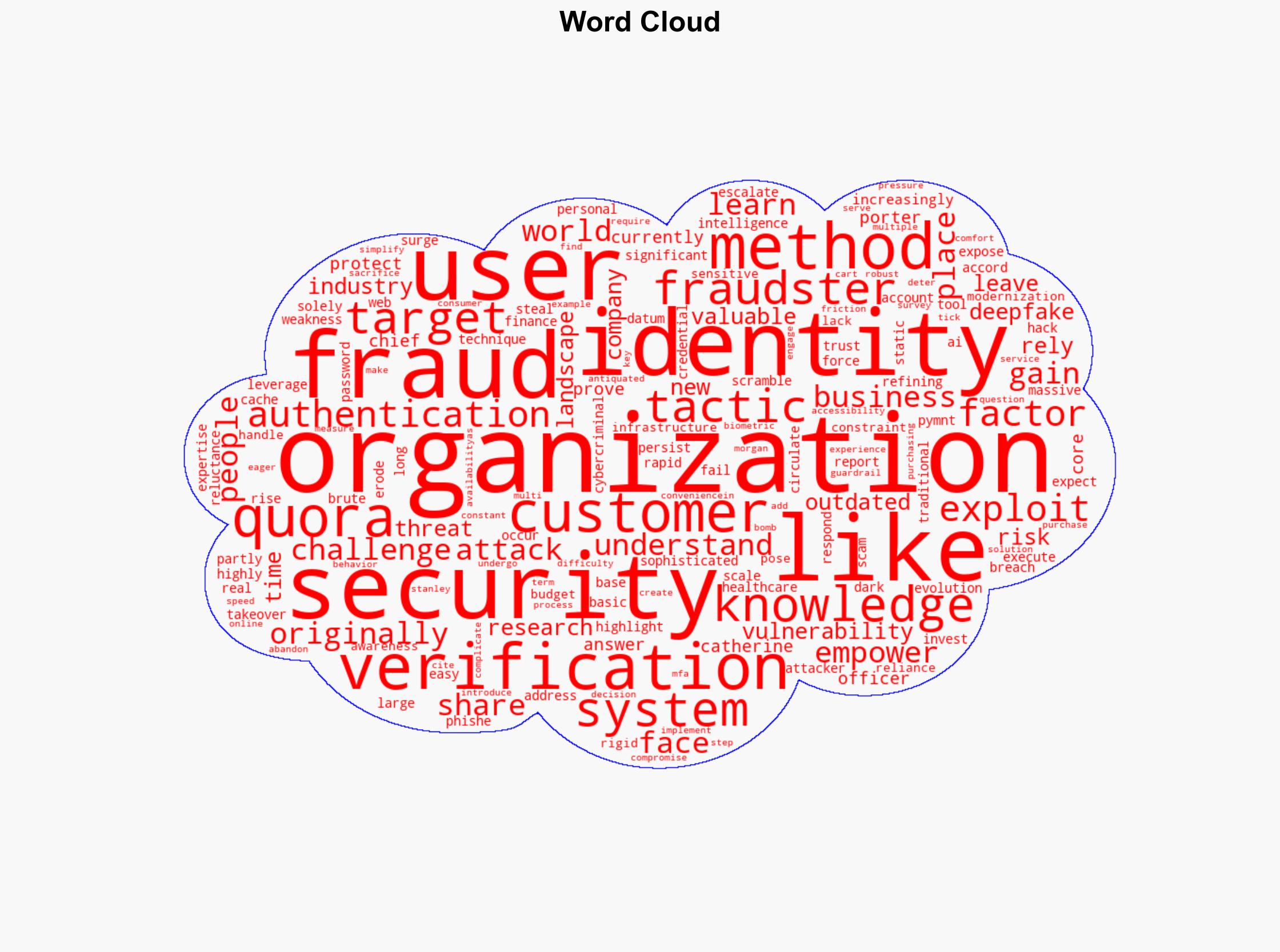

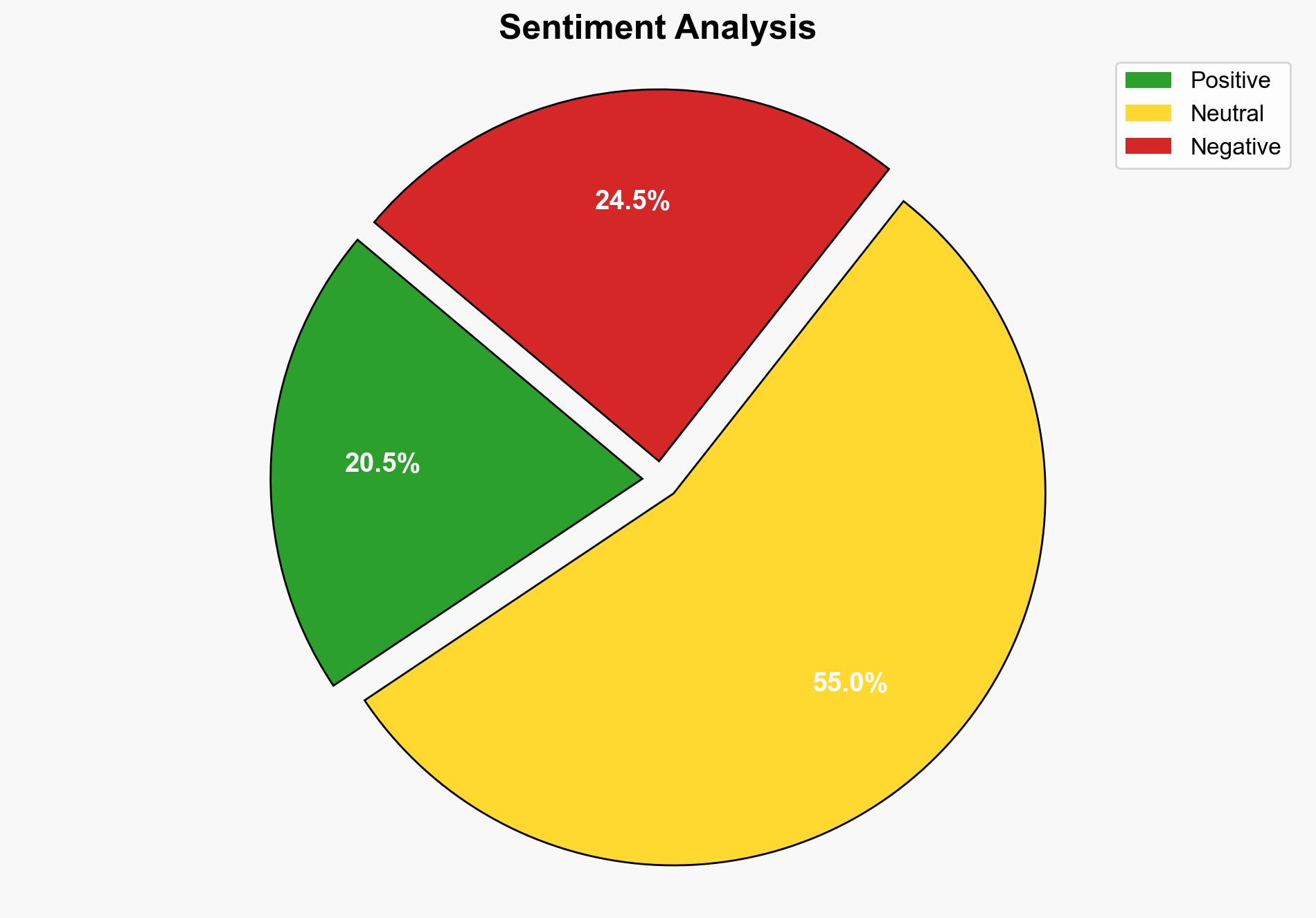

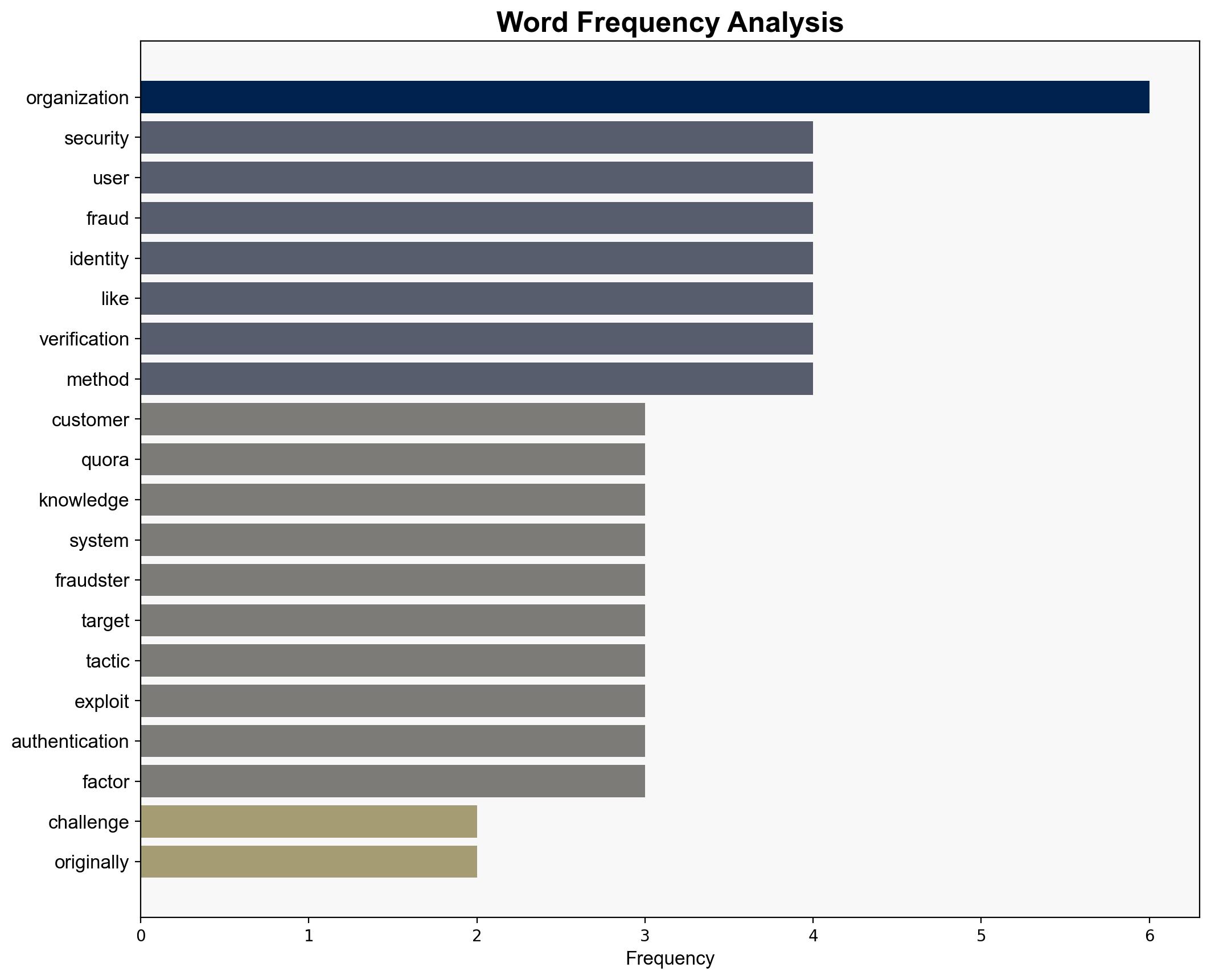

General Analysis

Fraudsters are leveraging AI to enhance the scale and sophistication of their attacks. The reliance on outdated security systems has left many organizations exposed. Research indicates that 83% of companies have been targeted by cybercriminals using advanced tactics. Despite the growing threat, there is a reluctance to invest in modern security solutions due to budget constraints and rigid infrastructures. The balance between robust security measures and maintaining a seamless customer experience remains a significant challenge.

3. Implications and Strategic Risks

The current landscape presents significant risks to national security, economic interests, and regional stability. The financial and healthcare sectors are particularly vulnerable due to the high value of personal data. The continuation of outdated security practices could lead to increased data breaches, financial losses, and erosion of consumer trust. The pressure to simplify user experiences without compromising security further complicates the situation.

4. Recommendations and Outlook

Recommendations:

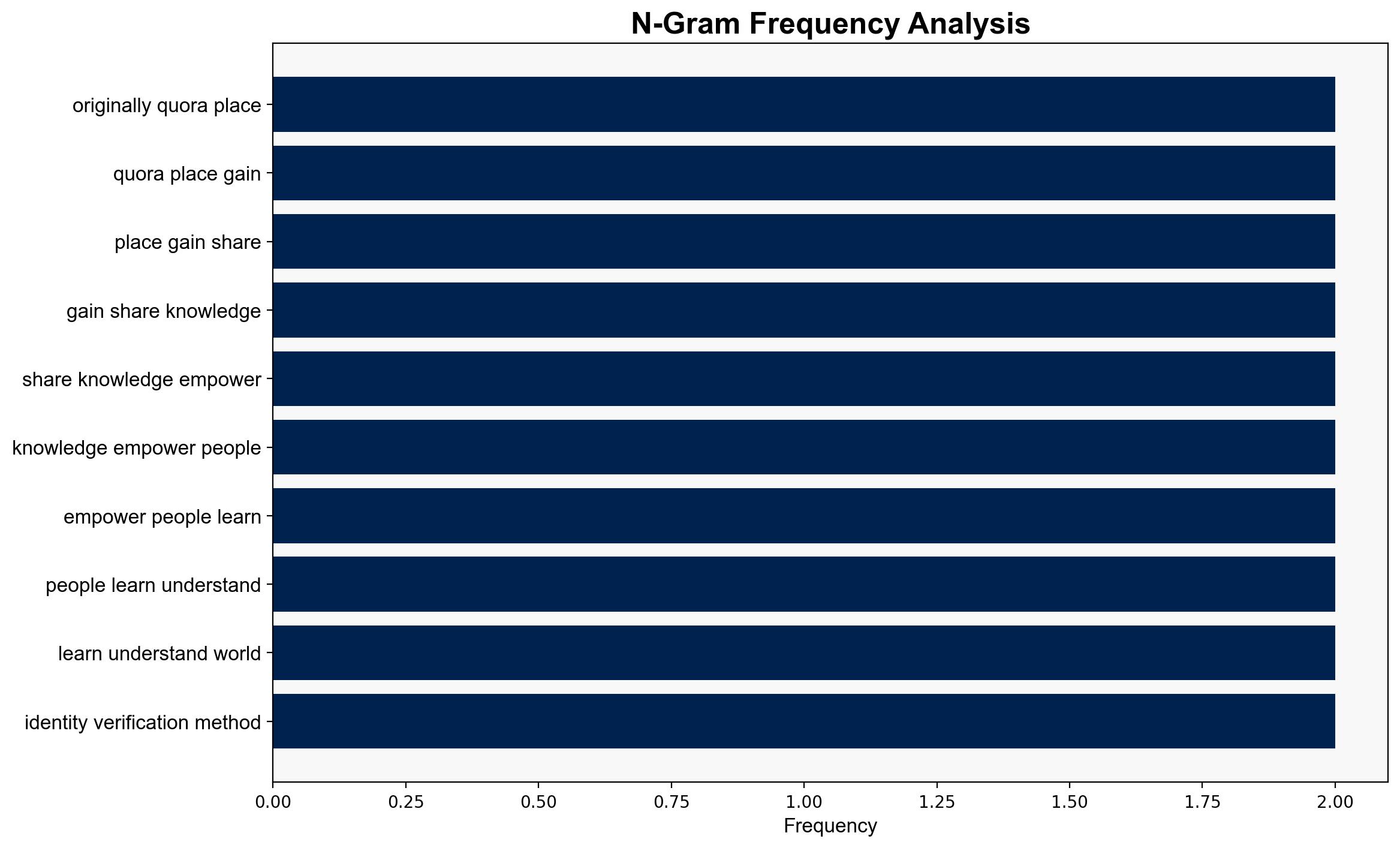

- Invest in advanced identity verification technologies such as multi-factor authentication and biometric verification.

- Enhance awareness and training programs to educate stakeholders on emerging fraud tactics.

- Encourage regulatory bodies to establish guidelines for modern identity verification practices.

- Implement flexible security frameworks that can adapt to evolving threats without compromising user experience.

Outlook:

Best-case scenario: Organizations adopt modern security measures, significantly reducing fraud incidents and maintaining customer trust.

Worst-case scenario: Continued reliance on outdated methods leads to widespread data breaches and financial losses.

Most likely scenario: A gradual shift towards modern verification methods, with ongoing challenges in balancing security and user experience.

5. Key Individuals and Entities

The report mentions Catherine Porter and research from PYMNTS Intelligence and Morgan Stanley. These entities provide insights into the current security challenges and consumer expectations.