AI Miners Surge Pre-Market on Record 38B Oracle Data Center Deal Boosts Sector – CoinDesk

Published on: 2025-10-24

Intelligence Report: AI Miners Surge Pre-Market on Record 38B Oracle Data Center Deal Boosts Sector – CoinDesk

1. BLUF (Bottom Line Up Front)

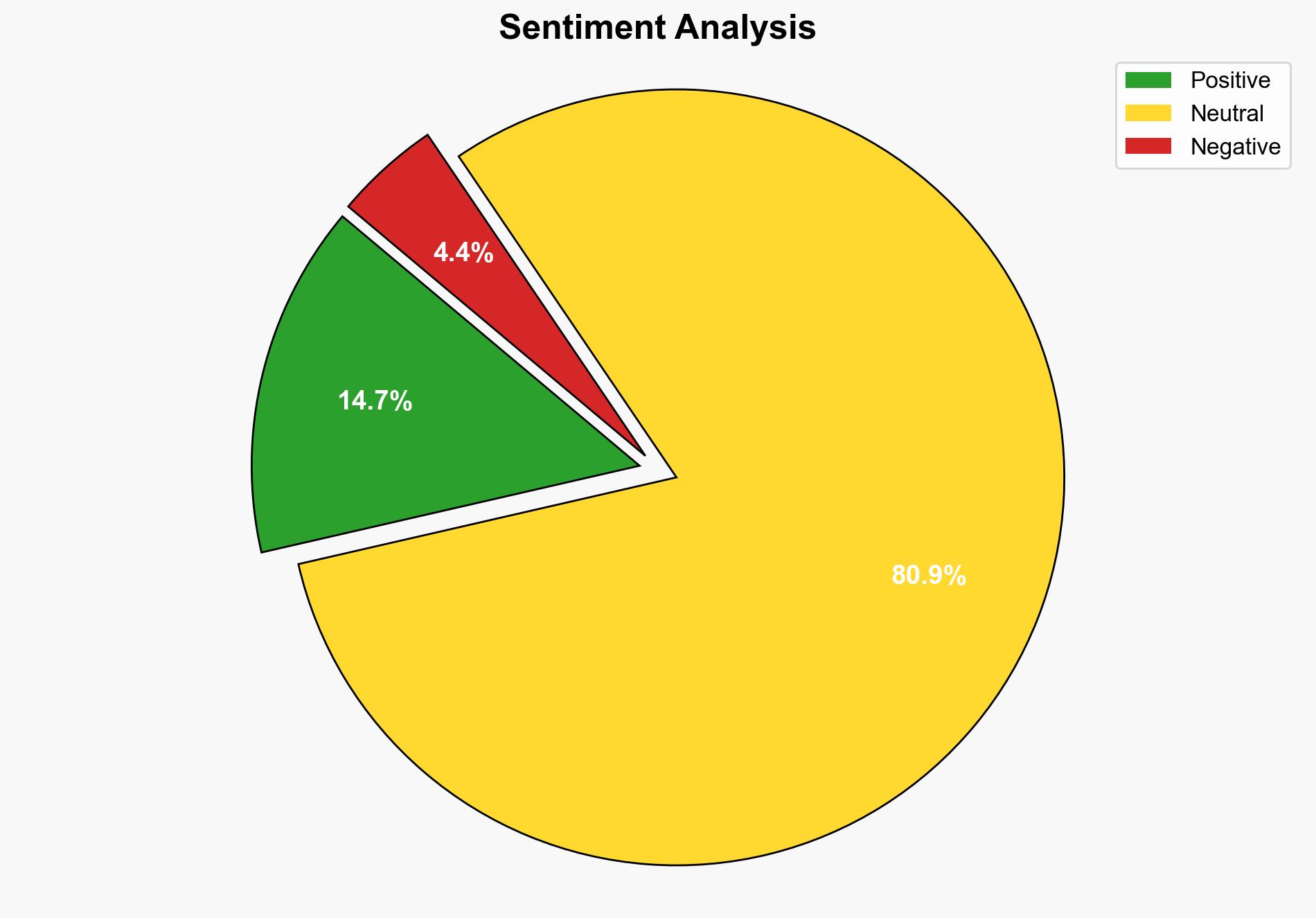

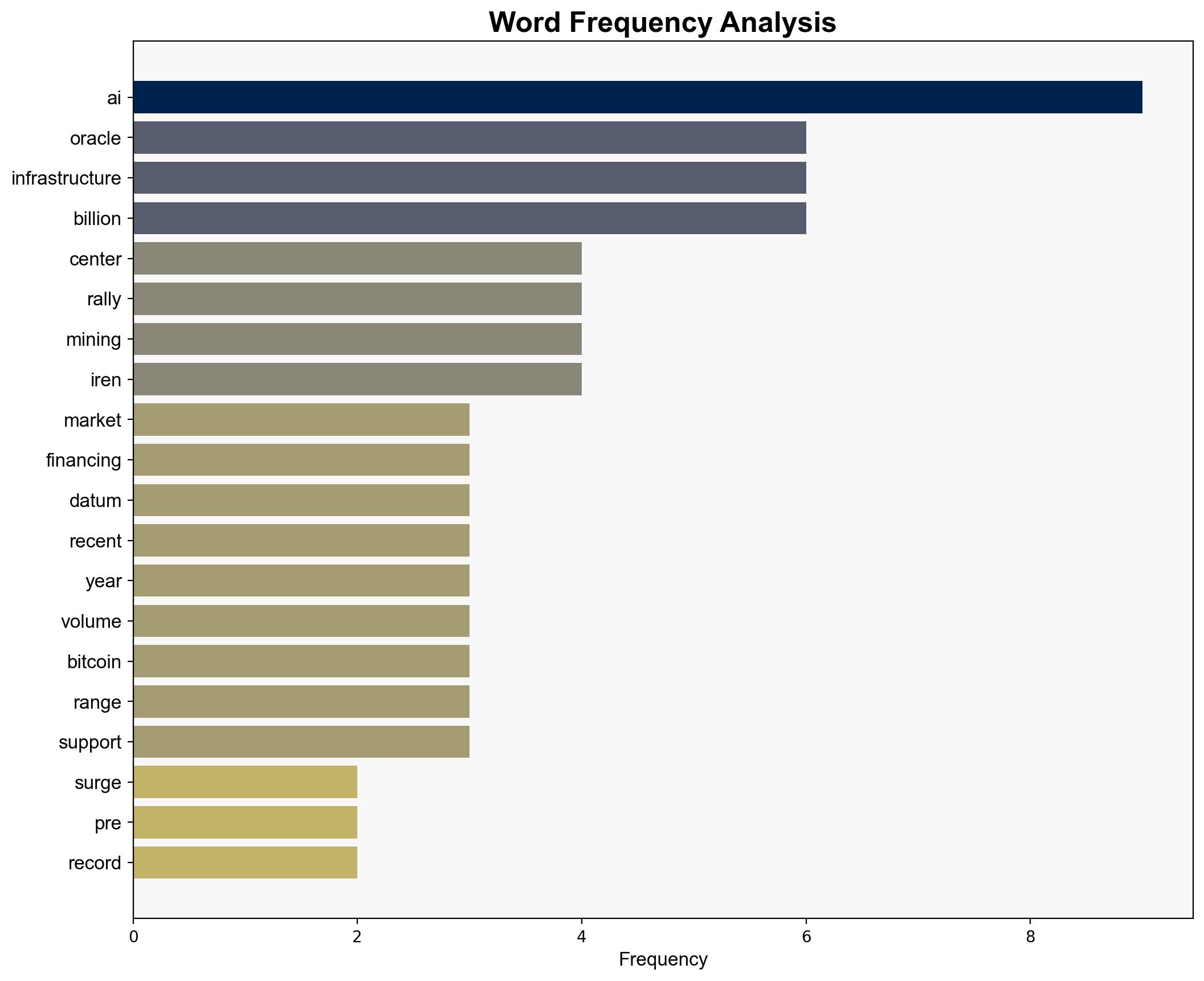

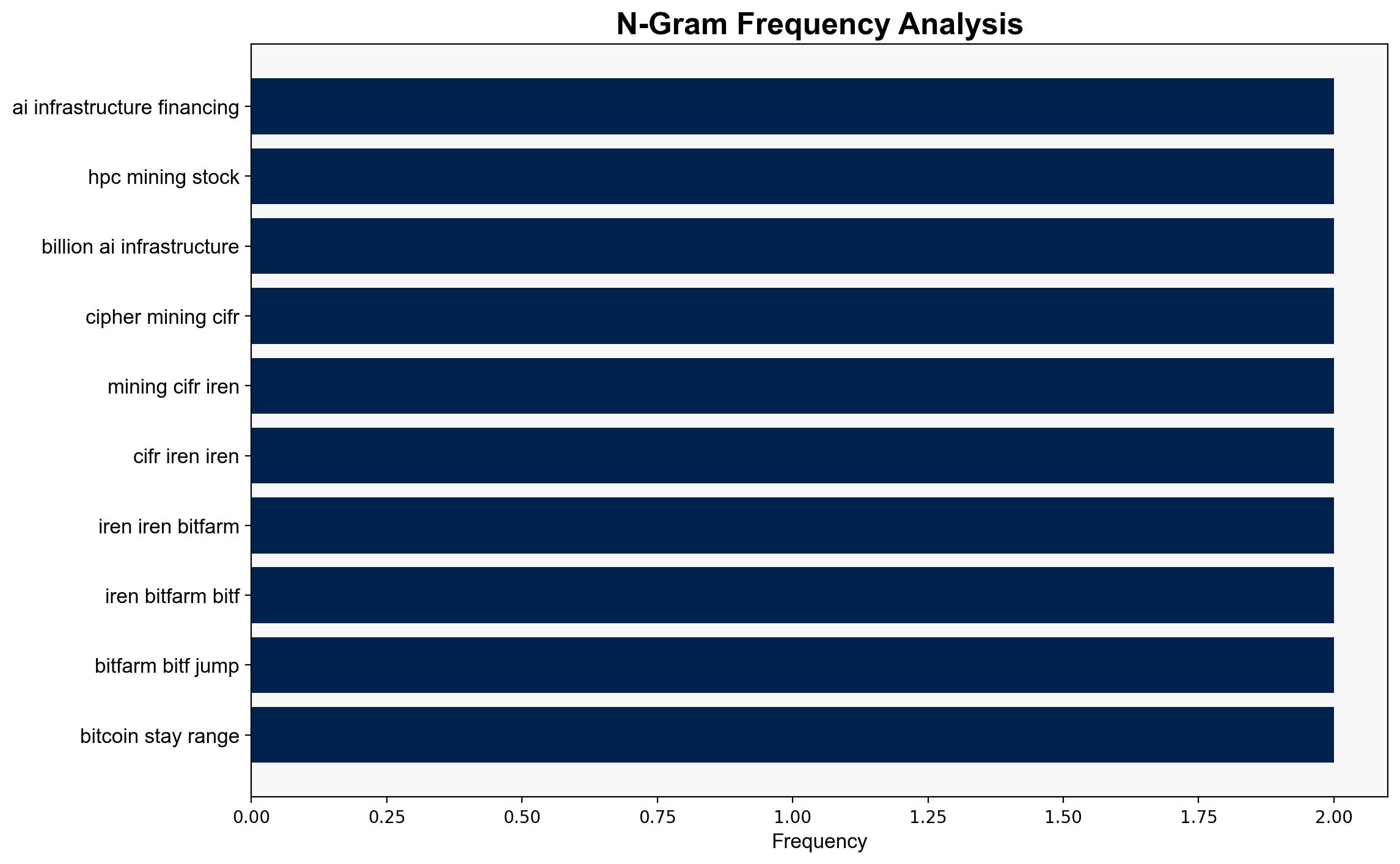

The surge in AI miner stocks pre-market is primarily driven by Oracle’s significant $38 billion data center financing, which is expected to bolster AI infrastructure. The most supported hypothesis is that this financial move will lead to sustained growth in AI and HPC mining sectors. Confidence Level: Moderate. Recommended action is to monitor the impact of Oracle’s investment on market dynamics and prepare for potential shifts in AI infrastructure demand.

2. Competing Hypotheses

1. **Hypothesis A**: Oracle’s $38 billion investment in data centers will lead to a sustained rally in AI and HPC mining stocks, driven by increased demand for AI infrastructure.

2. **Hypothesis B**: The current surge in AI miner stocks is a temporary reaction to the news, and the market will correct itself once the initial excitement dissipates, as seen in previous sector-wide corrections.

Using ACH 2.0, Hypothesis A is better supported due to the scale of Oracle’s investment and its strategic alignment with AI infrastructure growth. Hypothesis B lacks support as there is no immediate indication of factors that would lead to a quick market correction.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that Oracle’s investment will directly translate into increased demand for AI infrastructure. It is also assumed that the market will react rationally to this investment.

– **Red Flags**: The potential for overvaluation of AI mining stocks due to speculative trading. Lack of detailed information on how Oracle’s investment will be operationalized could lead to misinterpretation of its impact.

4. Implications and Strategic Risks

– **Economic**: A sustained rally could attract more investment into AI infrastructure, potentially leading to a bubble if not managed carefully.

– **Cyber**: Increased AI infrastructure could become a target for cyber threats, necessitating enhanced cybersecurity measures.

– **Geopolitical**: Oracle’s partnership with OpenAI could influence global AI leadership dynamics, particularly in the context of U.S.-China tech competition.

5. Recommendations and Outlook

- Monitor Oracle’s implementation of the data center projects to assess real-time impact on AI infrastructure demand.

- Prepare for a potential market correction by analyzing historical patterns of similar investment announcements.

- Scenario Projections:

- Best: Sustained growth in AI sector leading to technological advancements and economic benefits.

- Worst: Market bubble bursts, leading to significant financial losses and reduced investor confidence.

- Most Likely: Moderate growth with periodic corrections as market adjusts to new information.

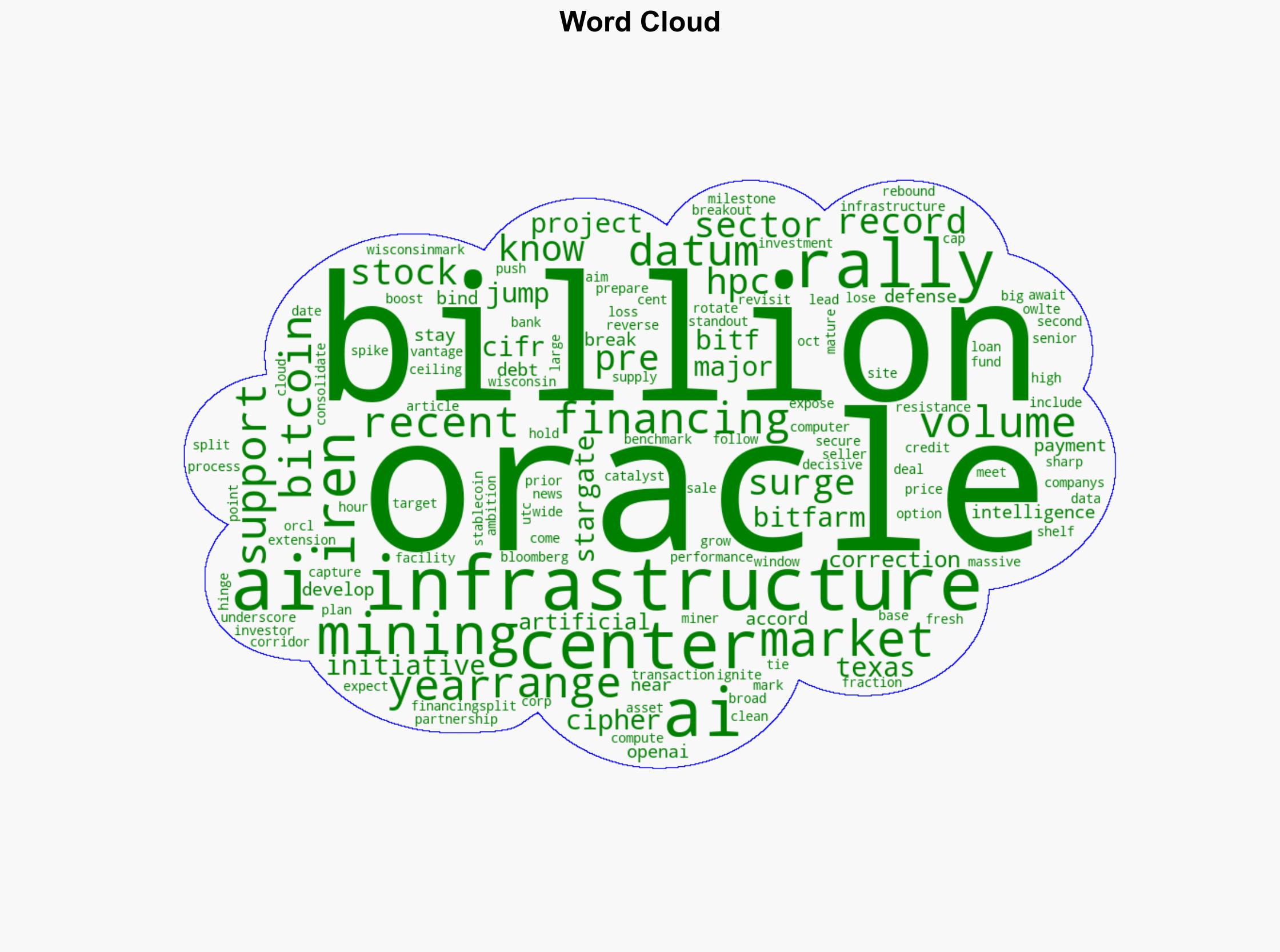

6. Key Individuals and Entities

– Oracle Corp

– OpenAI

– Cipher Mining

– Bitfarm

– Vantage Data Center

7. Thematic Tags

national security threats, cybersecurity, economic growth, AI infrastructure, market dynamics