Air India faces 4000-crore hit from Pak airspace closure CEO Campbell Wilson – Livemint

Published on: 2025-10-29

Intelligence Report: Air India faces 4000-crore hit from Pak airspace closure CEO Campbell Wilson – Livemint

1. BLUF (Bottom Line Up Front)

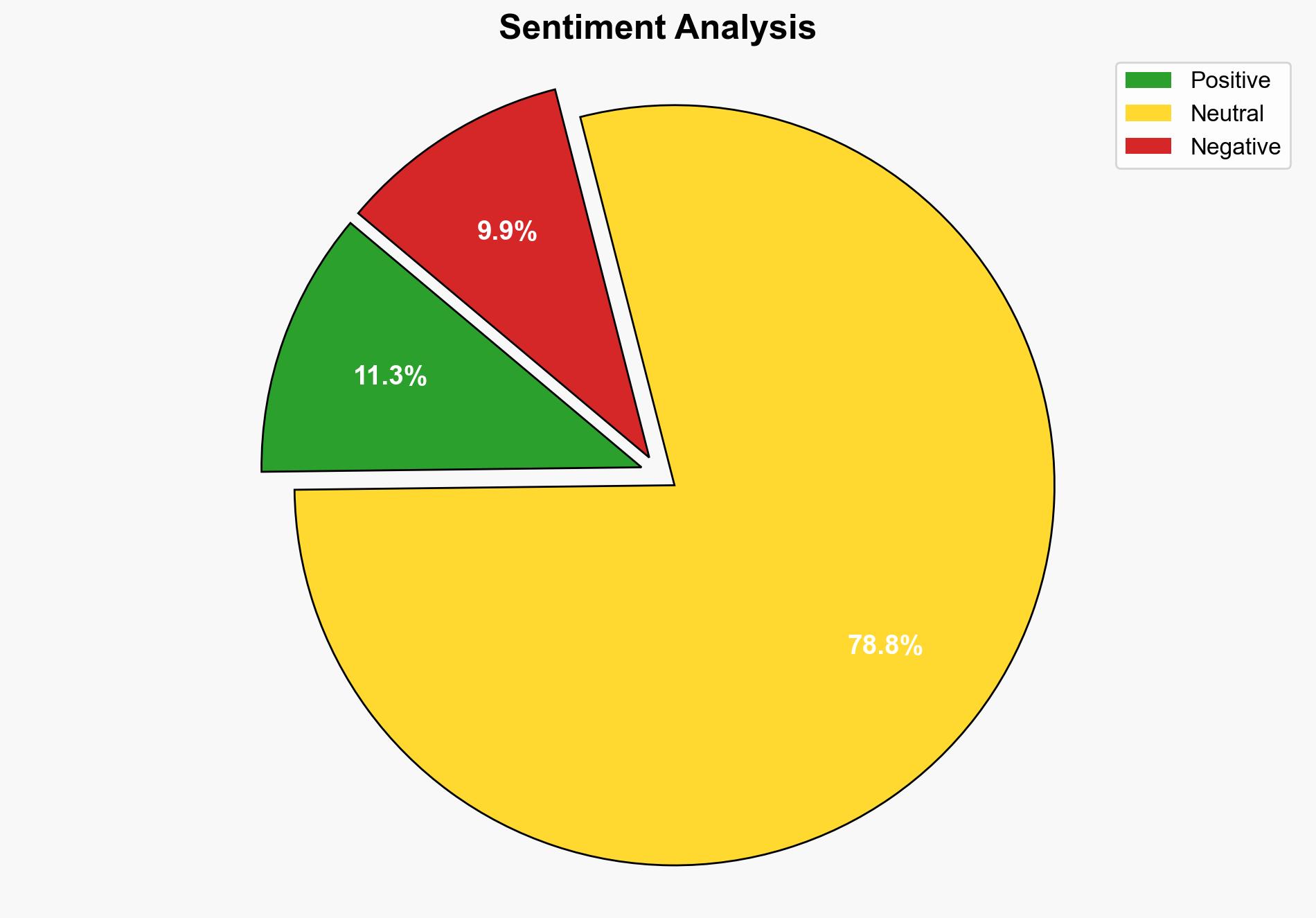

Air India’s financial hit due to the closure of Pakistani airspace is a significant challenge, compounded by existing operational and strategic hurdles. The most supported hypothesis suggests that Air India’s financial strain will necessitate strategic adjustments and potential government intervention. Confidence Level: Moderate. Recommended Action: Engage in diplomatic efforts to reopen airspace and explore alternative routes to mitigate financial losses.

2. Competing Hypotheses

Hypothesis 1: The closure of Pakistani airspace will lead to prolonged financial distress for Air India, necessitating strategic restructuring and potential government intervention.

Hypothesis 2: Air India will successfully mitigate the financial impact through operational adjustments and strategic partnerships, maintaining its transformation trajectory without significant external aid.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes that the airspace closure will persist and that Air India lacks sufficient internal resources to absorb the financial hit.

– Hypothesis 2 assumes that Air India can quickly adapt its operations and that alternative routes will be economically viable.

Red Flags:

– Lack of detailed financial data to support the 4000-crore impact estimate.

– Potential over-reliance on government support in Hypothesis 1.

– Underestimation of operational challenges in Hypothesis 2.

4. Implications and Strategic Risks

The airspace closure could lead to broader economic implications, affecting regional air travel and trade. Prolonged financial strain on Air India might result in reduced market competitiveness, impacting consumer trust and investor confidence. Geopolitical tensions could escalate if diplomatic resolutions are delayed, affecting regional stability.

5. Recommendations and Outlook

- Engage in diplomatic negotiations to reopen airspace, potentially through multilateral forums.

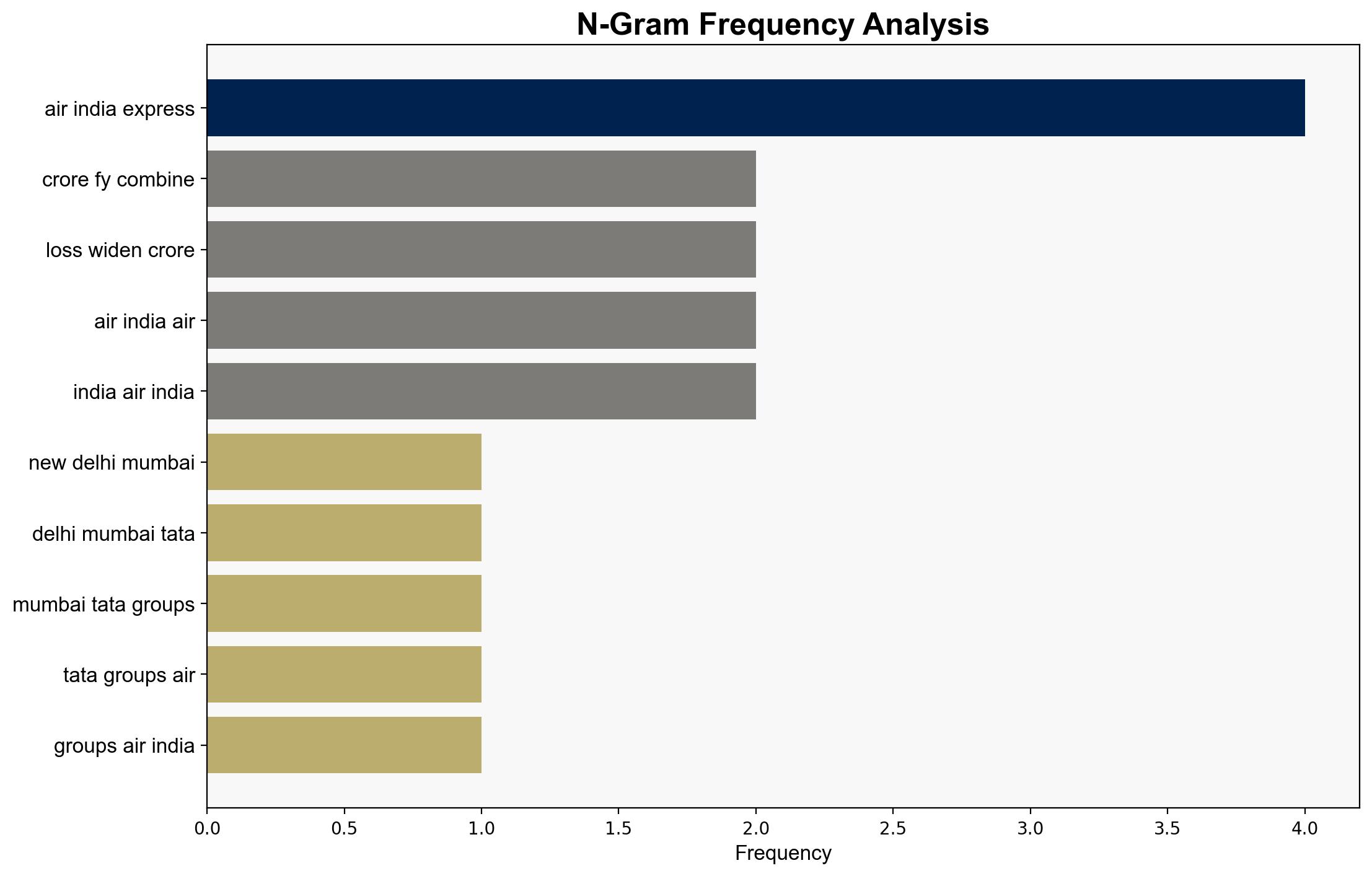

- Explore strategic partnerships with other airlines to share routes and reduce operational costs.

- Scenario Projections:

- Best Case: Airspace reopens, and Air India stabilizes financially through strategic partnerships.

- Worst Case: Prolonged closure leads to severe financial distress, requiring government bailout.

- Most Likely: Partial mitigation through operational adjustments, with moderate financial strain persisting.

6. Key Individuals and Entities

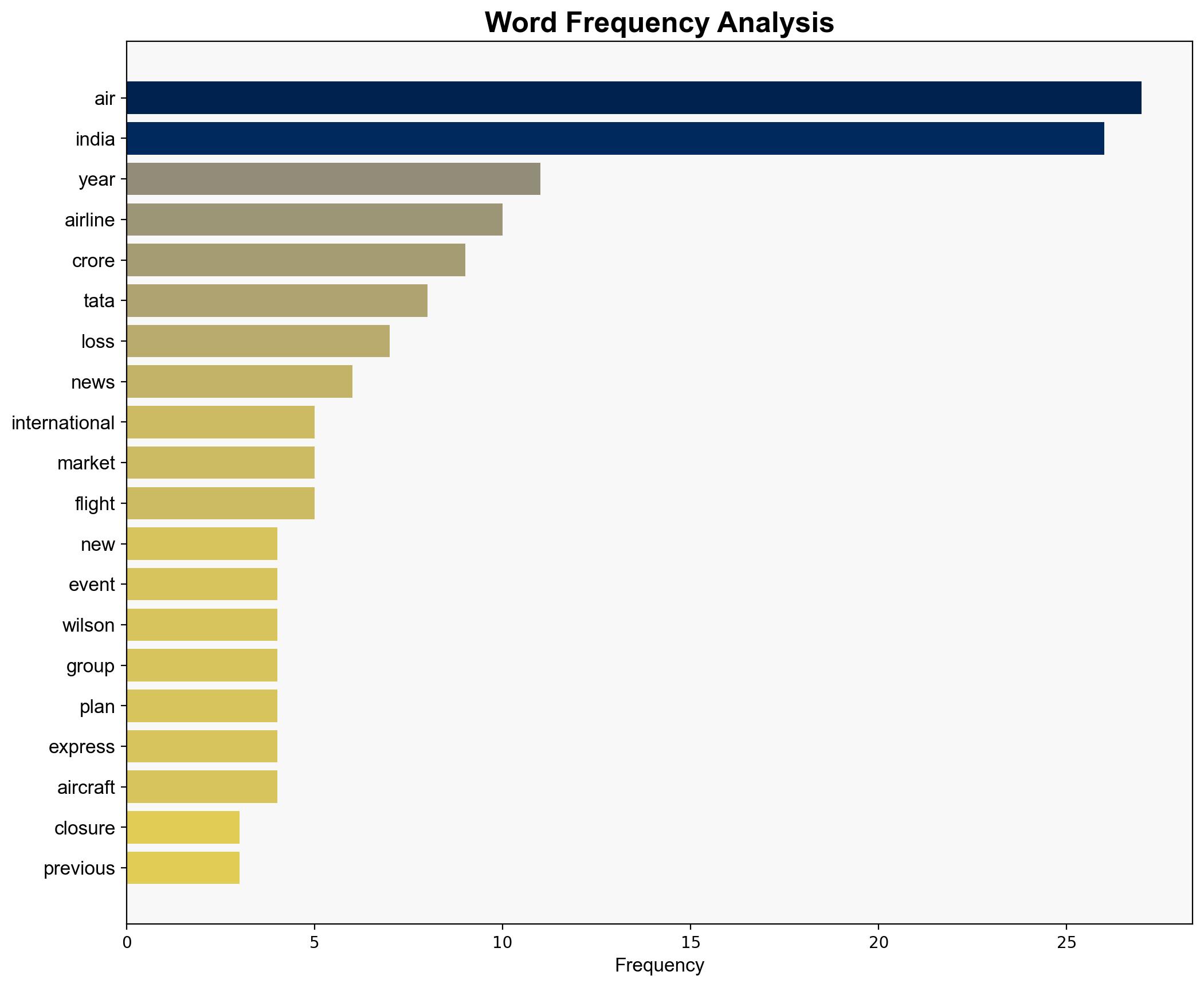

– Campbell Wilson

– Tata Group

– Air India

7. Thematic Tags

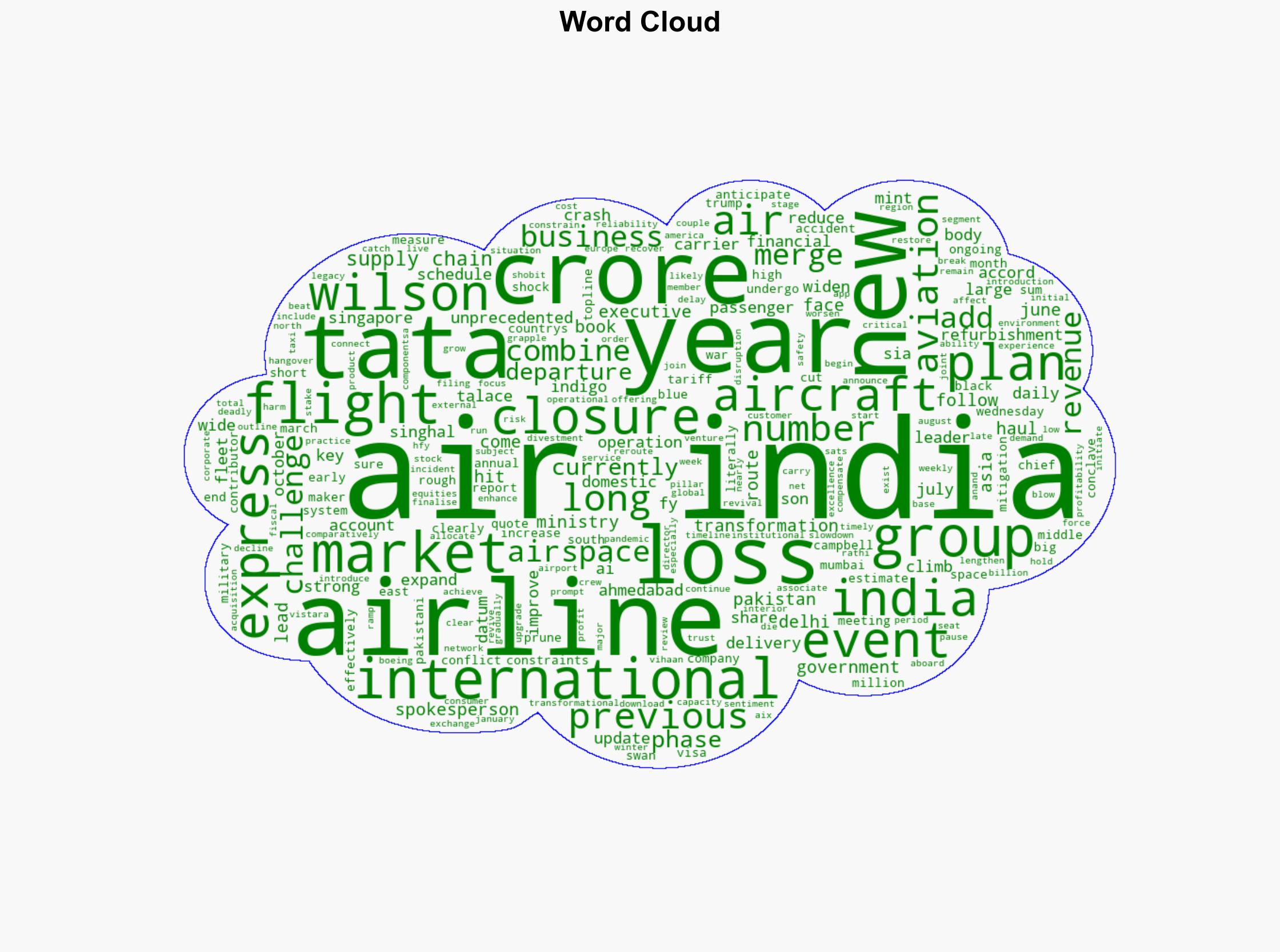

national security threats, economic impact, regional focus, aviation industry challenges