Aluminium market analysis Record highs and global dynamics – The Times of India

Published on: 2025-11-16

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Aluminium Market Dynamics and Strategic Implications

1. BLUF (Bottom Line Up Front)

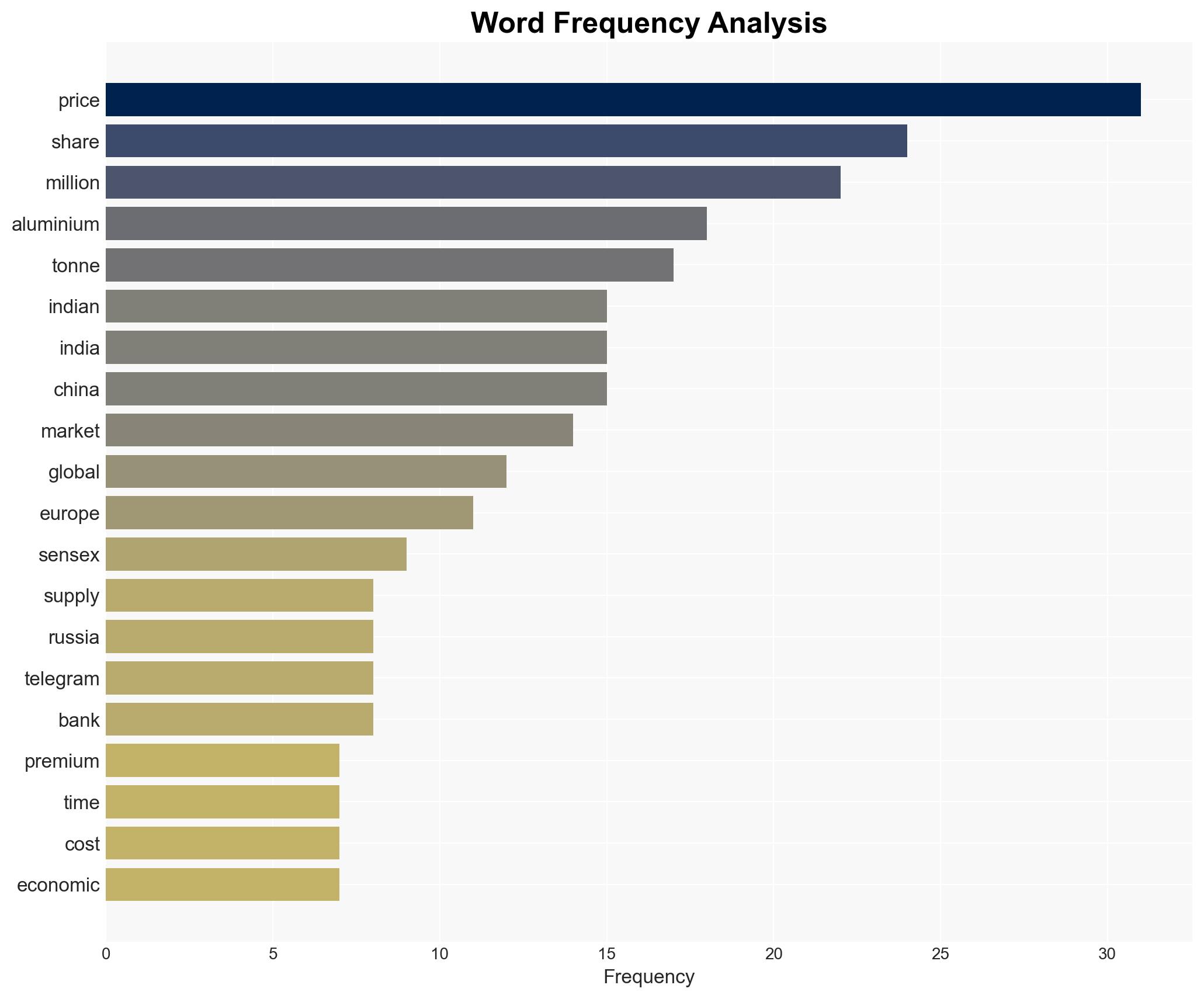

The Indian aluminium market is experiencing record high prices due to domestic supply constraints and global geopolitical factors. The most supported hypothesis is that domestic policy and global disruptions are creating a bifurcated market, leading to sustained high prices in India. The recommended action is to enhance domestic production capabilities and diversify import sources to mitigate supply risks. Confidence Level: Moderate.

2. Competing Hypotheses

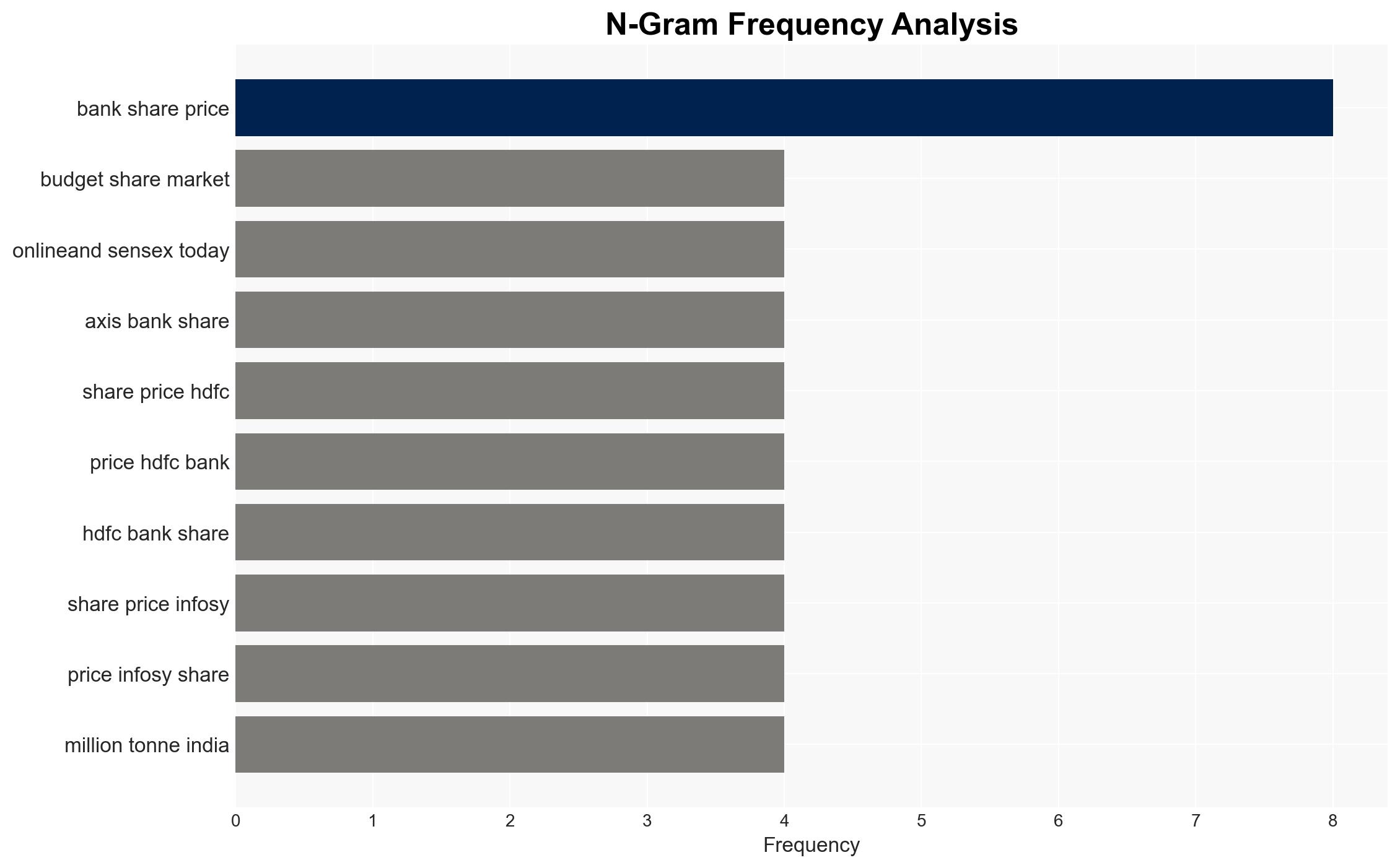

Hypothesis 1: Domestic policies, such as import restrictions and stringent BIS norms, are the primary drivers of high aluminium prices in India. These policies have created a tight supply situation, exacerbated by strong local demand.

Hypothesis 2: Global geopolitical factors, including the Russia-Ukraine conflict and energy crises, are the main contributors to high aluminium prices. These factors have disrupted global supply chains and increased production costs, influencing prices in India.

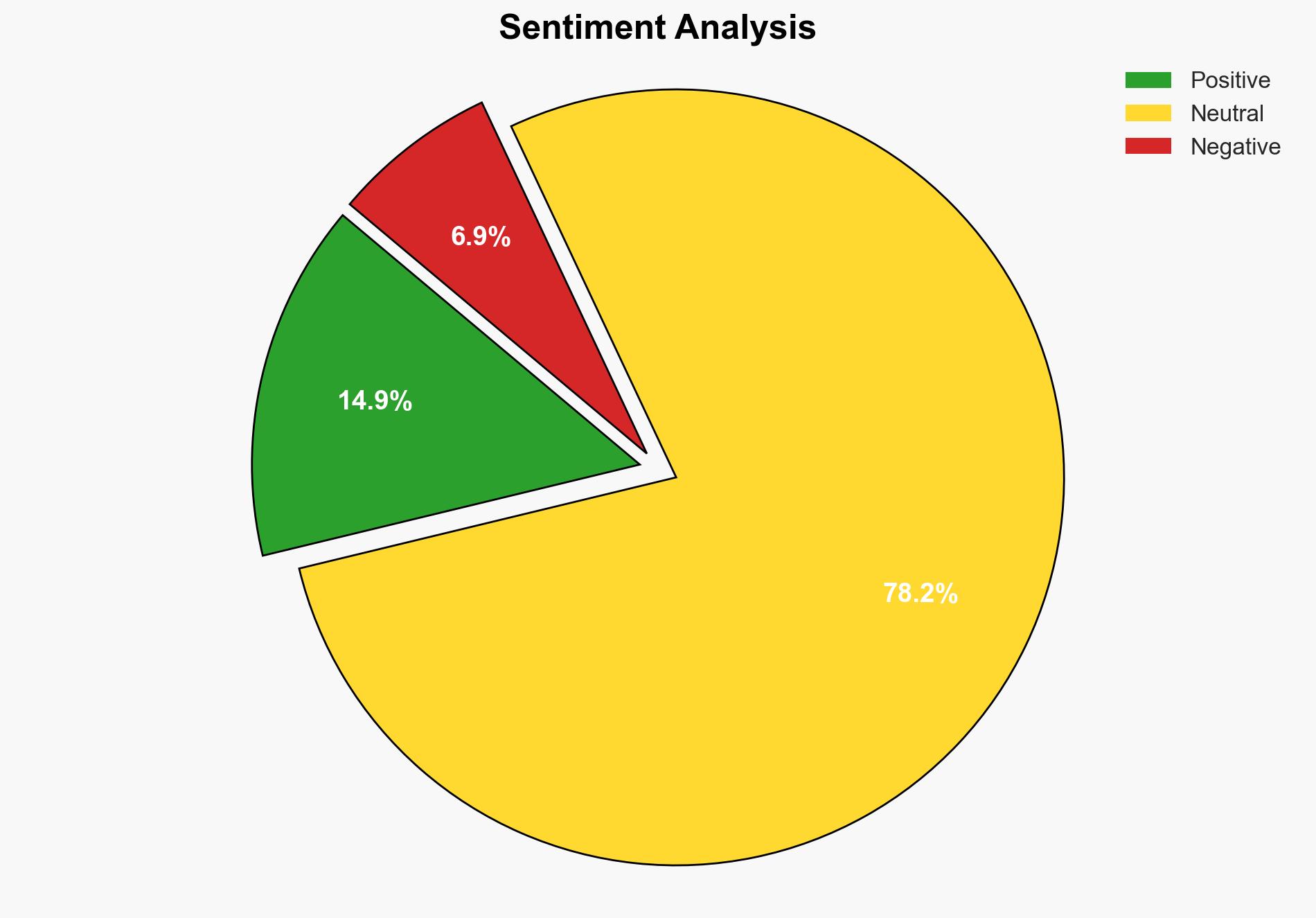

The evidence suggests that both domestic policies and global factors are contributing to the high prices. However, the domestic policy impact is more immediate and pronounced, as it directly affects supply and demand dynamics within India.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that current import restrictions and BIS norms will remain unchanged in the short term. Additionally, it is assumed that geopolitical tensions will continue to affect global supply chains.

Red Flags: A sudden policy shift in India or a resolution to the Russia-Ukraine conflict could alter the current market dynamics. Deception indicators include potential misinformation about supply capabilities or geopolitical developments.

4. Implications and Strategic Risks

The high aluminium prices pose economic risks, potentially impacting sectors reliant on aluminium, such as automotive and construction. Politically, sustained high prices could lead to public discontent and pressure on policymakers. Economically, continued reliance on imports amidst global disruptions could exacerbate supply risks.

5. Recommendations and Outlook

- Actionable Steps: Increase domestic aluminium production capacity and explore alternative import sources to reduce dependency on current suppliers.

- Best-case Scenario: Domestic production increases, and global tensions ease, leading to stabilized prices.

- Worst-case Scenario: Geopolitical tensions escalate, further disrupting supply chains and driving prices higher.

- Most-likely Scenario: Prices remain high due to ongoing domestic and global pressures, with gradual adjustments as market dynamics evolve.

6. Key Individuals and Entities

No specific individuals are named in the source text. Key entities include Indian policymakers, aluminium producers, and global trade partners.

7. Thematic Tags

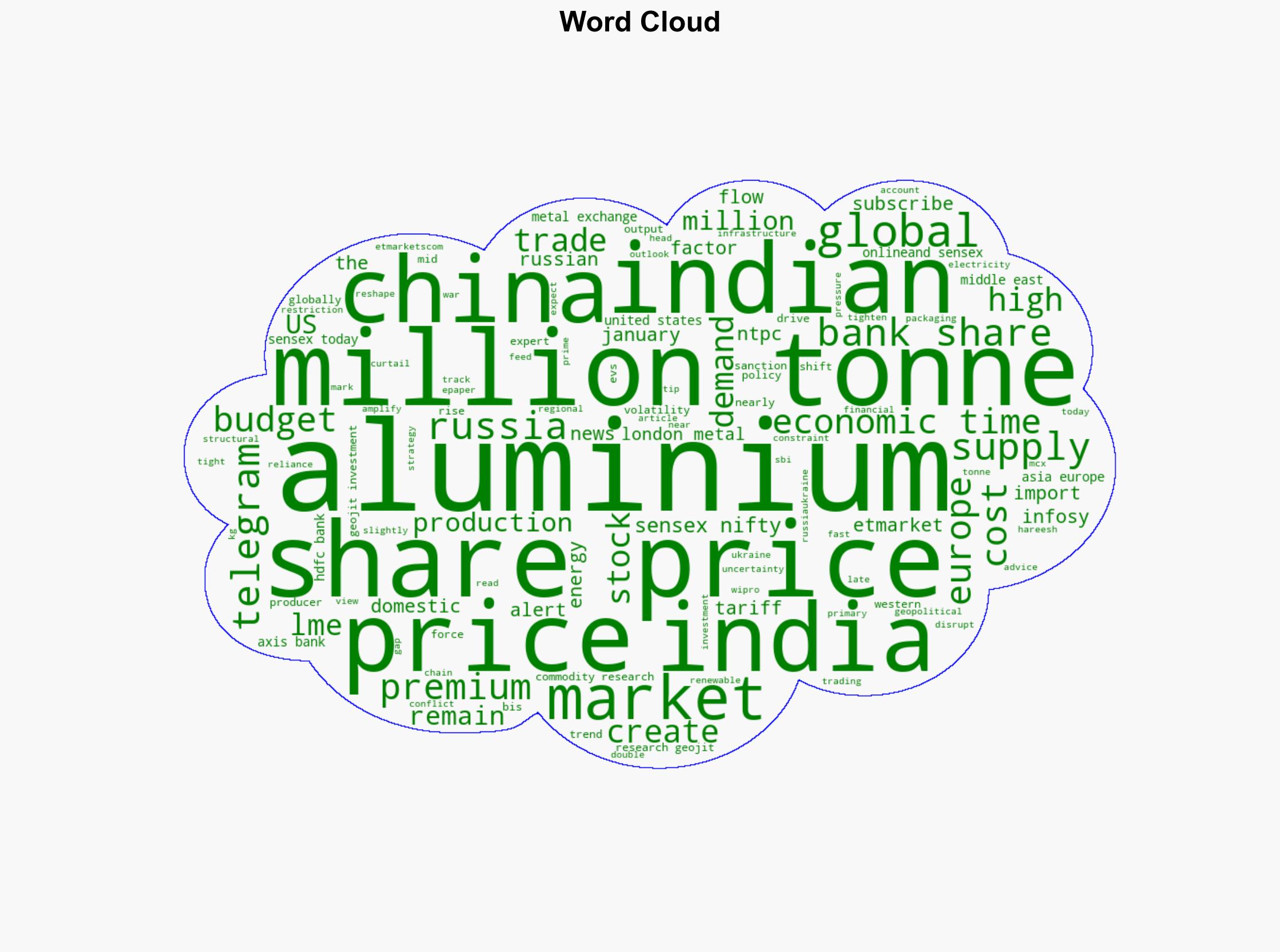

Regional Focus, Regional Focus: India, Global Geopolitics, Trade Policy, Energy Crisis, Supply Chain Disruption

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

- Bayesian Scenario Modeling: Forecast futures under uncertainty via probabilistic logic.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us

·