America’s Coming Resource Crunch – International Business Times

Published on: 2025-10-20

Intelligence Report: America’s Coming Resource Crunch – International Business Times

1. BLUF (Bottom Line Up Front)

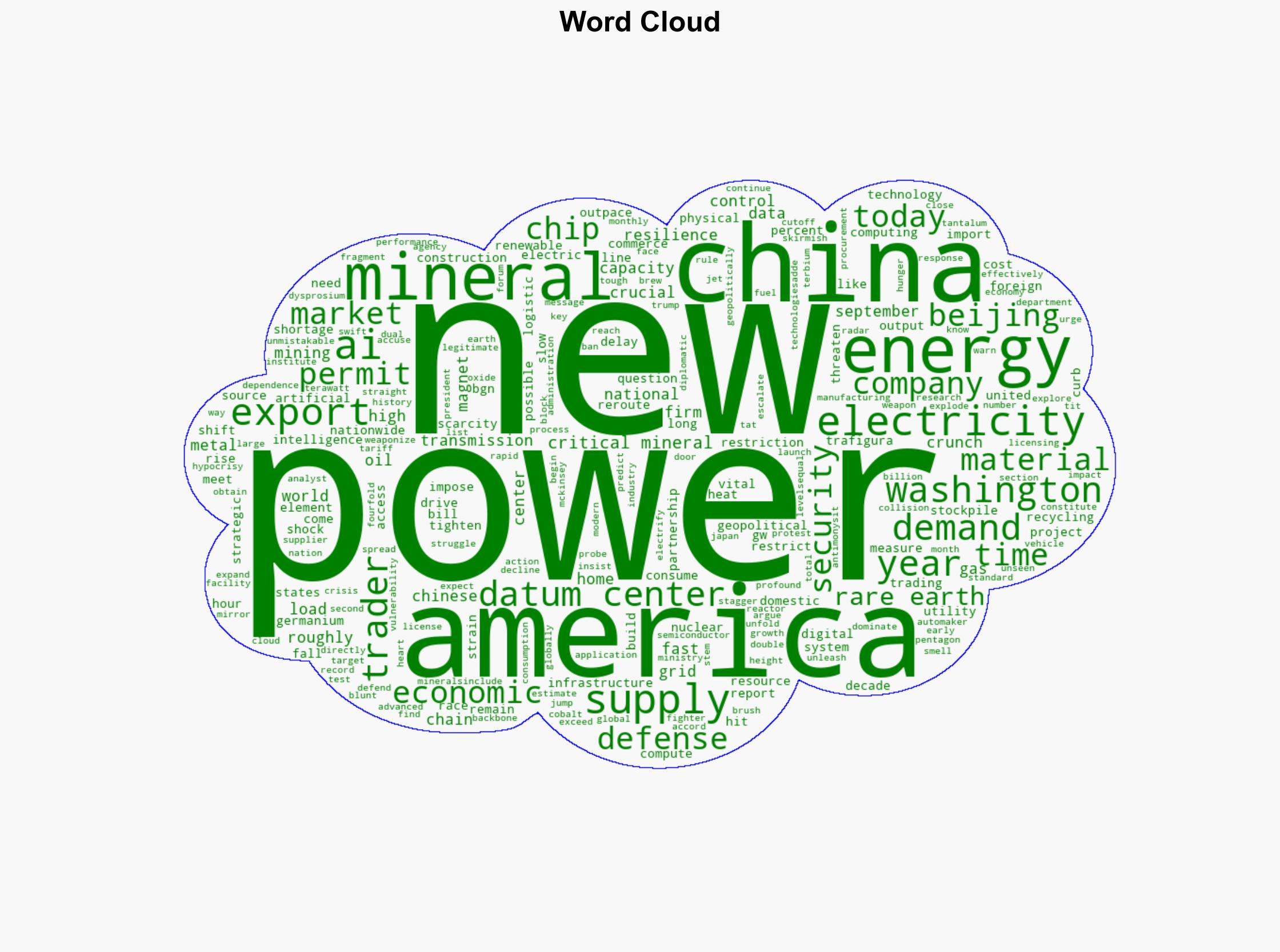

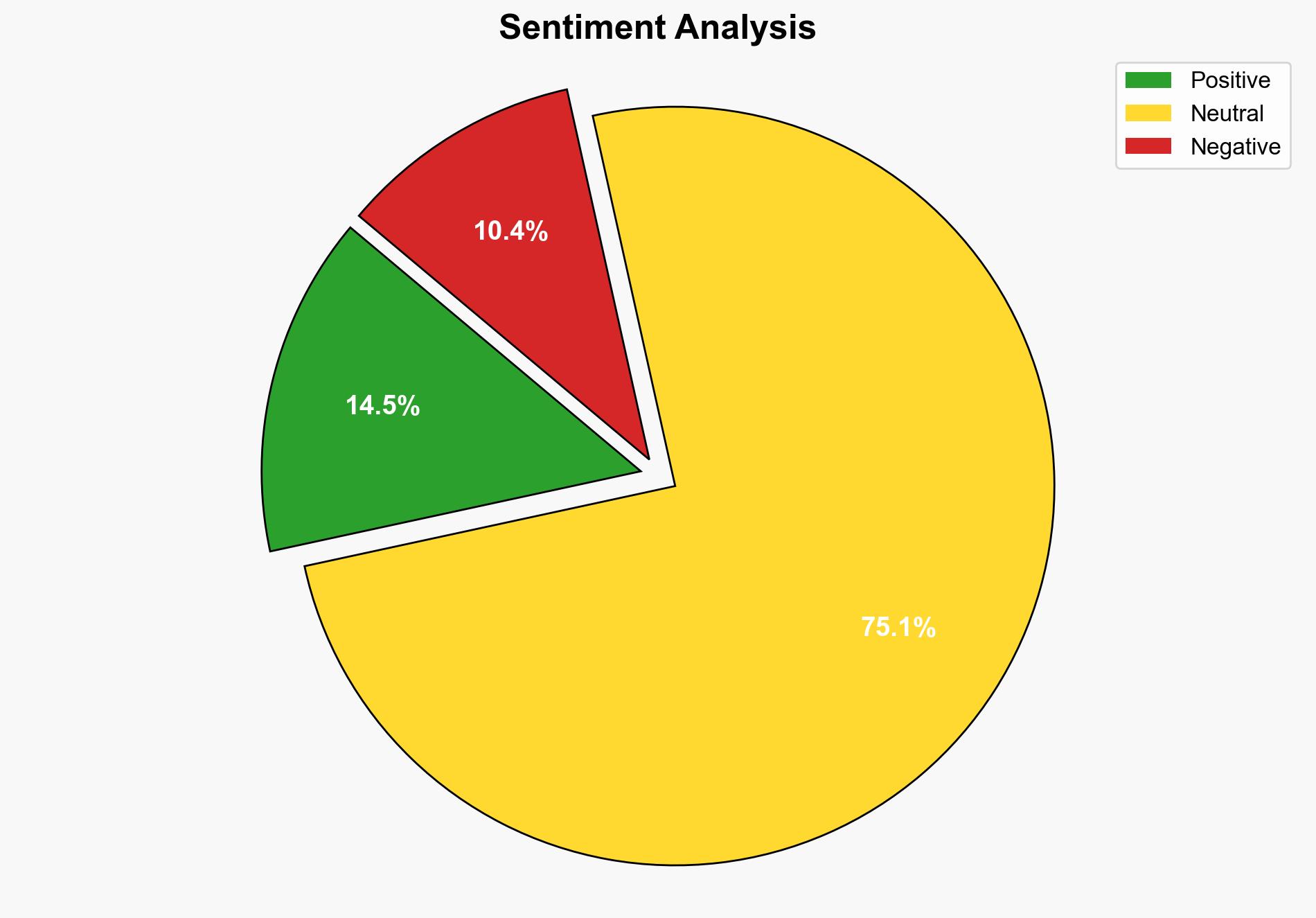

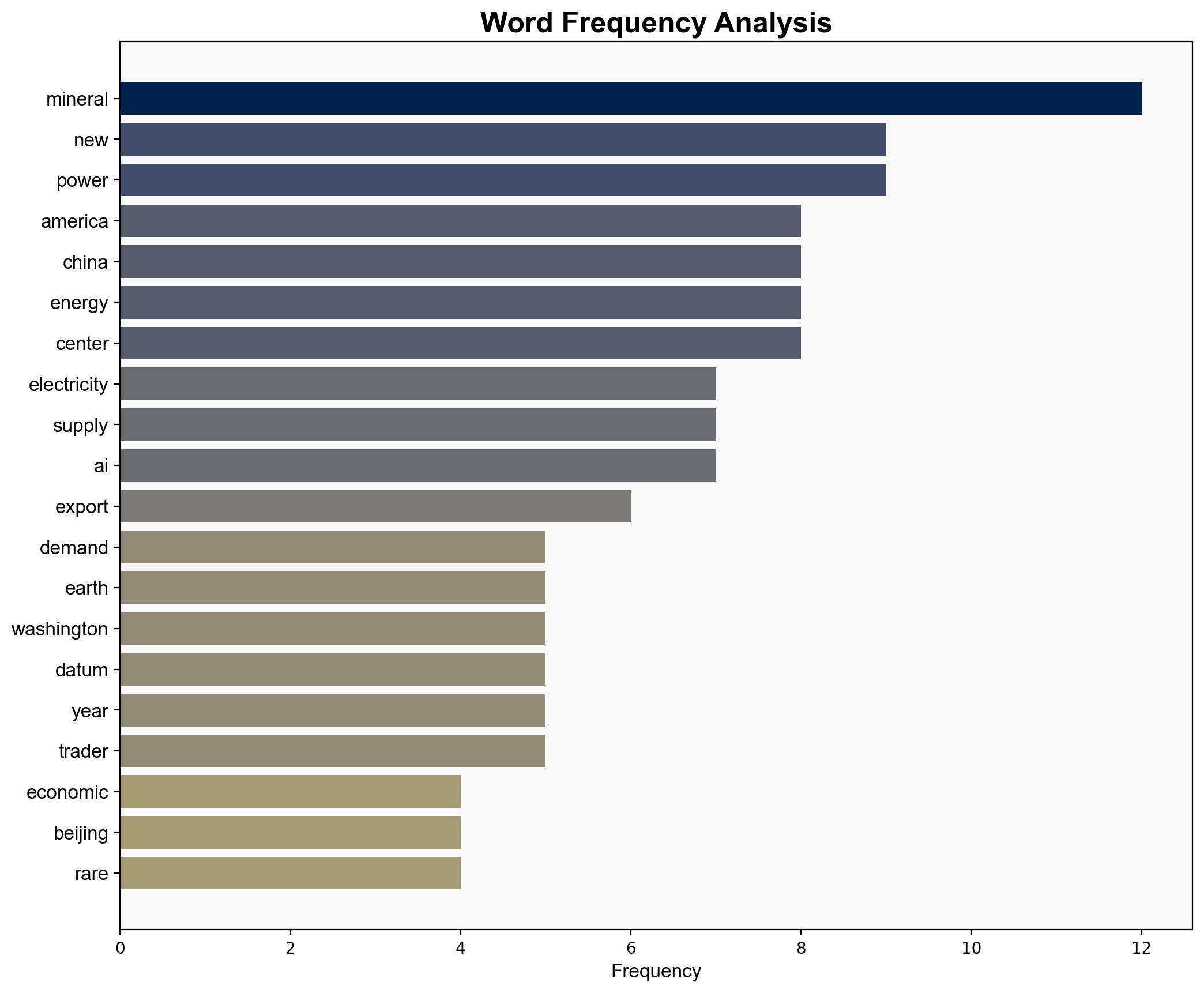

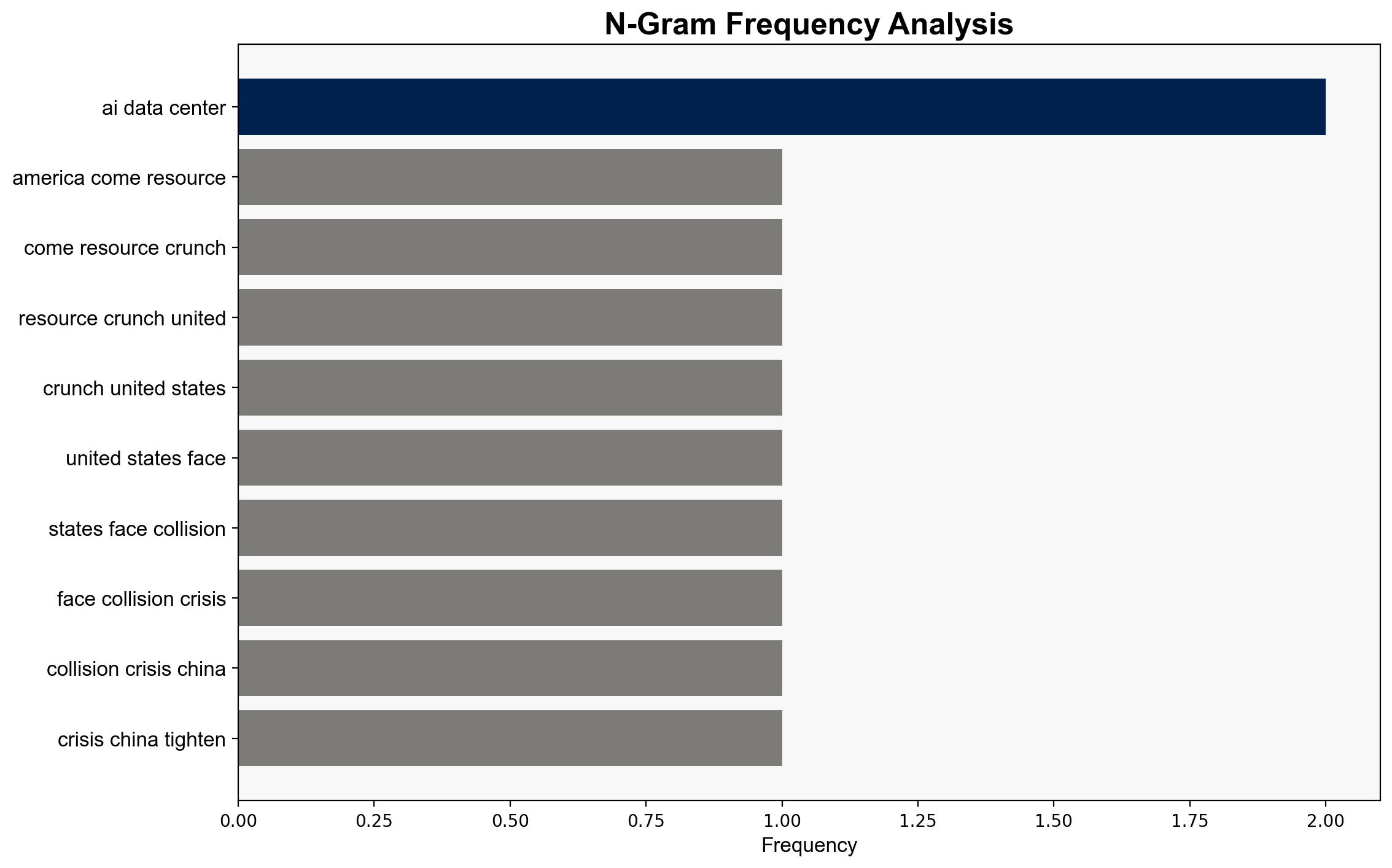

The United States is facing a significant strategic challenge due to China’s control over critical minerals essential for modern technology and the increasing domestic demand for electricity driven by AI advancements. The most supported hypothesis is that China’s export restrictions on rare earth minerals are a strategic maneuver to leverage geopolitical power, which could severely impact U.S. technological and economic resilience. Confidence level: High. Recommended action: Diversify supply chains and increase domestic production capabilities for critical minerals.

2. Competing Hypotheses

1. **Hypothesis A**: China’s export restrictions are primarily a national security measure to protect its own technological advancements and economic interests.

2. **Hypothesis B**: China’s actions are a deliberate geopolitical strategy to exert pressure on the U.S. and other nations by controlling the supply of essential minerals, thereby gaining leverage in international negotiations and conflicts.

Using ACH 2.0, Hypothesis B is better supported due to the timing of the restrictions coinciding with U.S. measures against China, such as chip export bans, and the strategic importance of the minerals involved.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that China’s restrictions are sustainable and that the U.S. lacks immediate alternatives for these minerals.

– **Red Flags**: The potential for underreported domestic mineral reserves in the U.S. and overestimated Chinese control could skew analysis.

– **Blind Spots**: Limited information on other countries’ capacities to supply these minerals.

4. Implications and Strategic Risks

– **Economic Risks**: Disruption in supply chains could lead to increased costs and delays in technology production.

– **Geopolitical Risks**: Heightened tensions between the U.S. and China could escalate into broader economic or military conflicts.

– **Cyber Risks**: Increased vulnerability to cyber-attacks on critical infrastructure as reliance on AI and data centers grows.

– **Psychological Risks**: Public perception of U.S. technological and economic vulnerability could impact national morale and investor confidence.

5. Recommendations and Outlook

- **Mitigation**: Invest in domestic mining and processing capabilities for critical minerals. Explore partnerships with allied nations to secure alternative supply chains.

- **Exploitation**: Leverage the situation to accelerate renewable energy and AI technology development, reducing dependency on foreign resources.

- **Scenario Projections**:

– **Best Case**: Successful diversification of supply chains and increased domestic production lead to reduced dependency on Chinese minerals.

– **Worst Case**: Prolonged shortages and geopolitical tensions result in significant economic downturn and technological stagnation.

– **Most Likely**: Gradual adaptation to new supply chain realities with moderate economic and technological disruptions.

6. Key Individuals and Entities

– Beijing’s Ministry of Commerce

– U.S. Department of Commerce

– Pentagon’s Defense Logistics Agency

7. Thematic Tags

national security threats, economic resilience, geopolitical strategy, supply chain diversification