Android Apps misusing NFC and HCE to steal payment data on the rise – Securityaffairs.com

Published on: 2025-11-03

Intelligence Report: Android Apps misusing NFC and HCE to steal payment data on the rise – Securityaffairs.com

1. BLUF (Bottom Line Up Front)

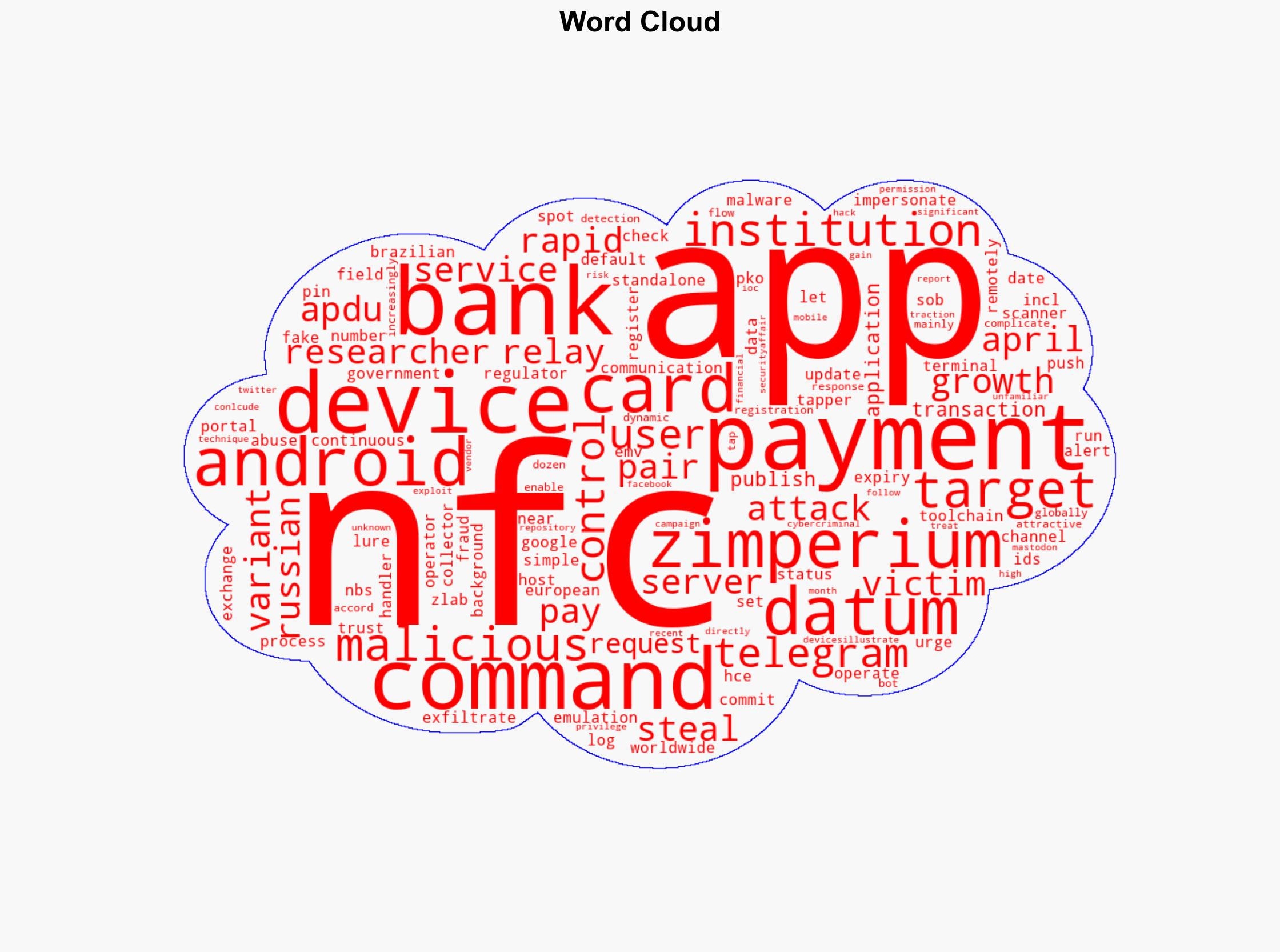

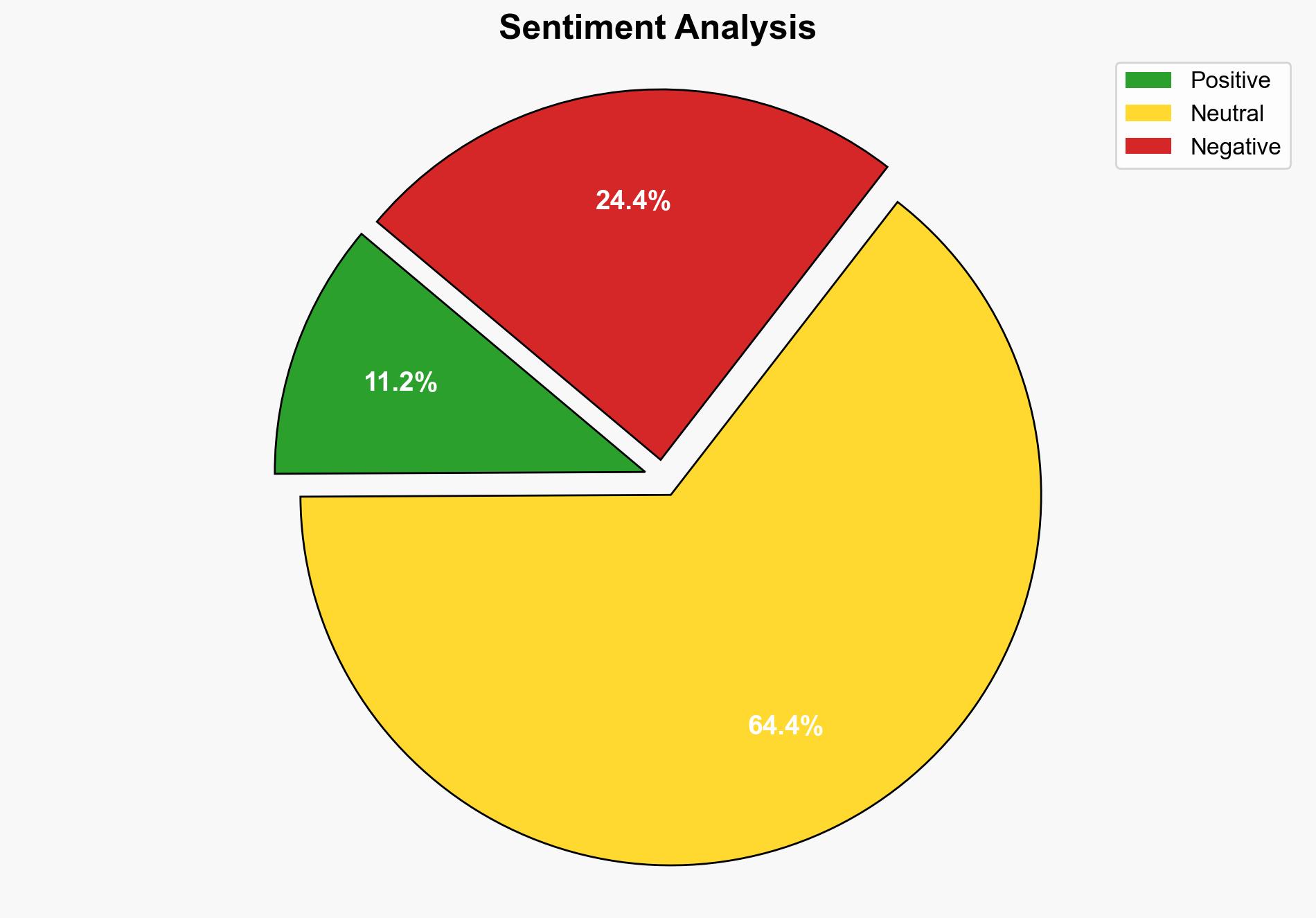

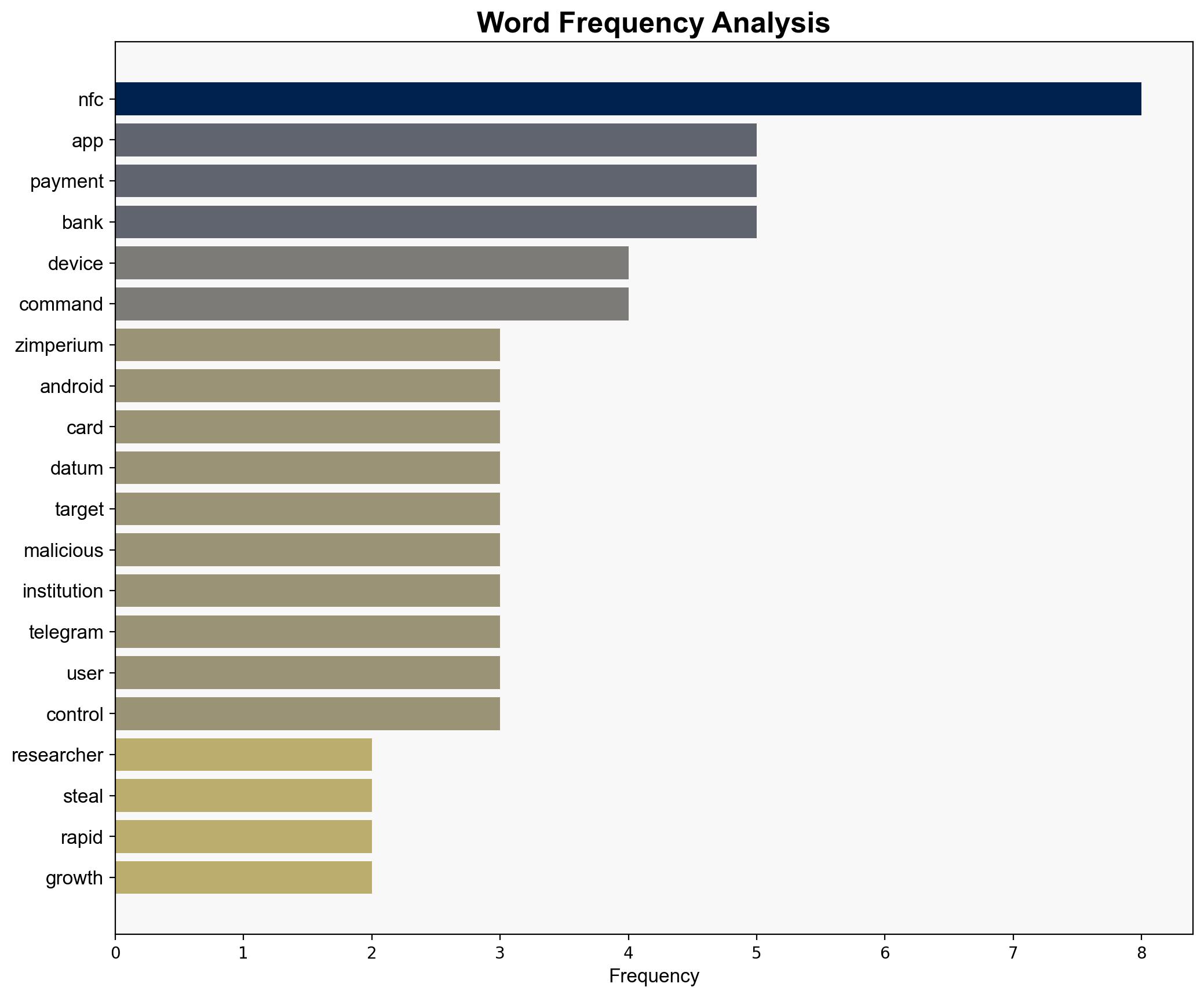

The rapid increase in Android apps exploiting NFC and HCE to steal payment data poses a significant cybersecurity threat, particularly to financial institutions and users globally. The most supported hypothesis is that cybercriminals are increasingly targeting NFC technology due to its widespread adoption and relatively low security awareness among users. Confidence Level: High. Recommended action includes enhancing security protocols for NFC transactions and increasing user awareness about app permissions.

2. Competing Hypotheses

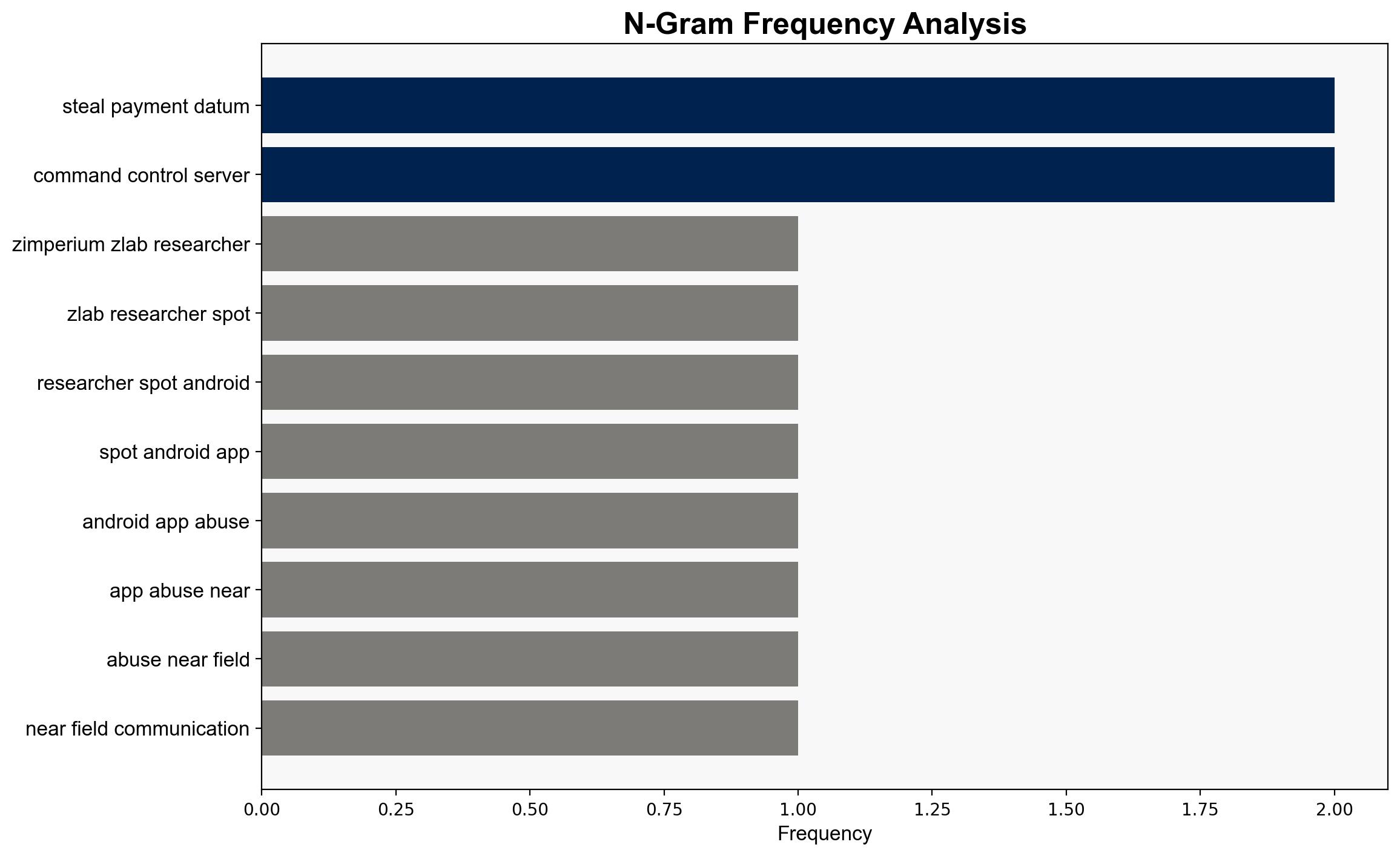

1. **Hypothesis A**: The surge in malicious NFC-enabled apps is primarily driven by organized cybercriminal groups exploiting technological vulnerabilities in NFC and HCE to conduct widespread financial fraud.

2. **Hypothesis B**: The increase in these apps is largely due to individual hackers or small groups capitalizing on the lack of user awareness and inadequate security measures in NFC technology.

Using Bayesian Scenario Modeling, Hypothesis A is better supported due to the organized nature of the attacks, the use of command and control servers, and the targeting of specific financial institutions globally, indicating a level of sophistication typical of organized groups.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the attackers have advanced technical capabilities and access to resources necessary for developing and deploying sophisticated malware.

– **Red Flags**: The rapid growth of these attacks without significant detection suggests potential underreporting or lack of effective monitoring by affected institutions.

– **Blind Spots**: There is limited information on the specific vulnerabilities being exploited in NFC and HCE, which could hinder effective countermeasures.

4. Implications and Strategic Risks

The proliferation of malicious NFC-enabled apps could lead to significant financial losses for individuals and institutions, undermine trust in mobile payment systems, and potentially escalate into broader cyber threats if not addressed. Economically, this could strain financial institutions and impact consumer confidence in digital transactions. Geopolitically, countries with weaker cybersecurity infrastructure may become hotspots for such activities, complicating international efforts to combat cybercrime.

5. Recommendations and Outlook

- Enhance security protocols for NFC transactions, including multi-factor authentication and real-time monitoring of suspicious activities.

- Increase public awareness campaigns about the risks of granting NFC permissions to unfamiliar apps.

- Encourage financial institutions to collaborate on sharing threat intelligence to better detect and mitigate these threats.

- Scenario Projections:

- Best Case: Rapid implementation of security measures curtails the spread of malicious apps.

- Worst Case: Continued proliferation leads to widespread financial disruption and loss of consumer trust.

- Most Likely: Incremental improvements in security reduce but do not eliminate the threat.

6. Key Individuals and Entities

– Zimperium ZLab (Research entity)

– Affected financial institutions (e.g., Russian bank regulator, European bank PKO, Brazilian bank)

– Google Pay (Targeted platform)

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus