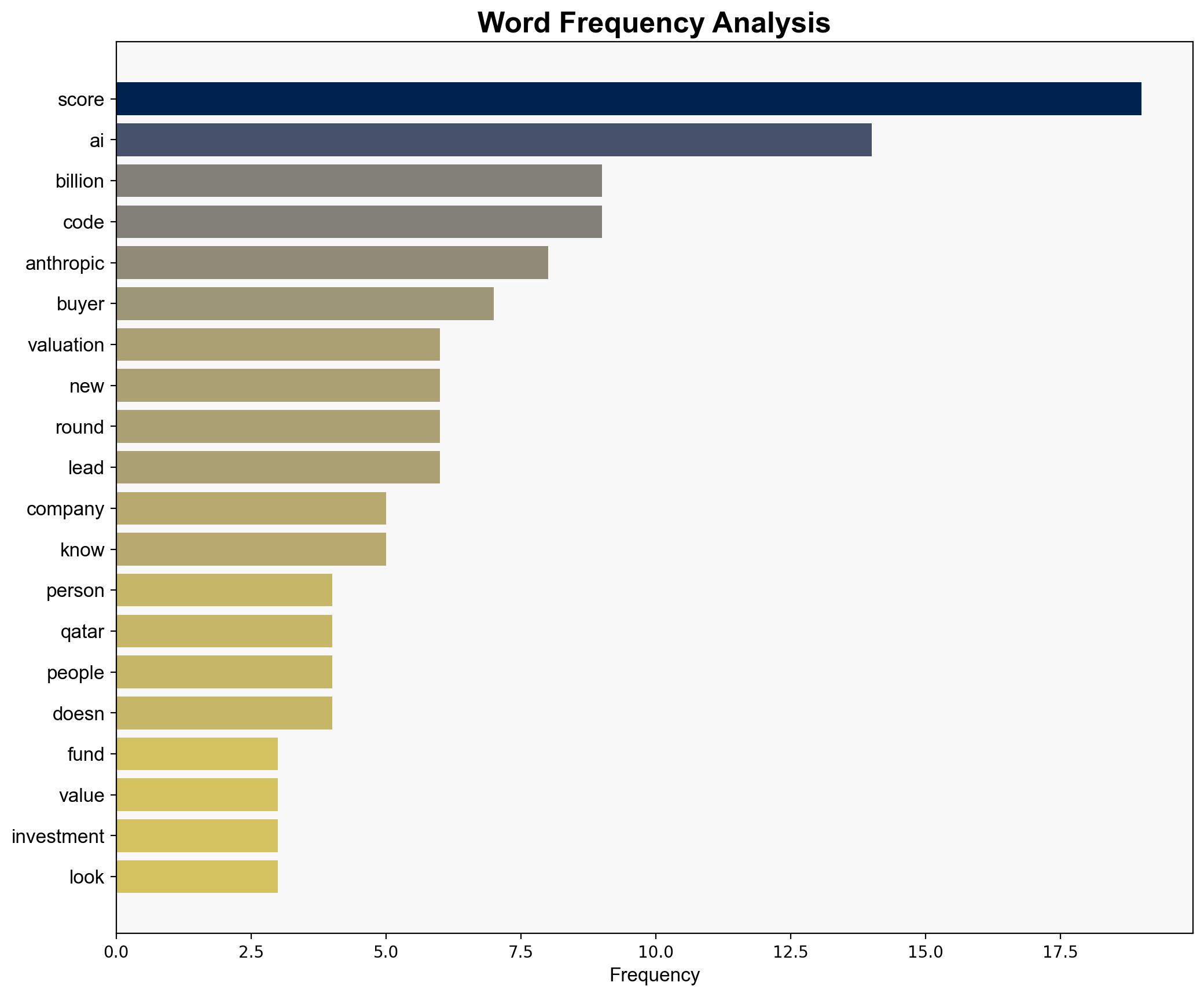

Anthropic Nears Deal To Raise Funding at 170 Billion Valuation – Slashdot.org

Published on: 2025-07-29

Intelligence Report: Anthropic Nears Deal To Raise Funding at 170 Billion Valuation – Slashdot.org

1. BLUF (Bottom Line Up Front)

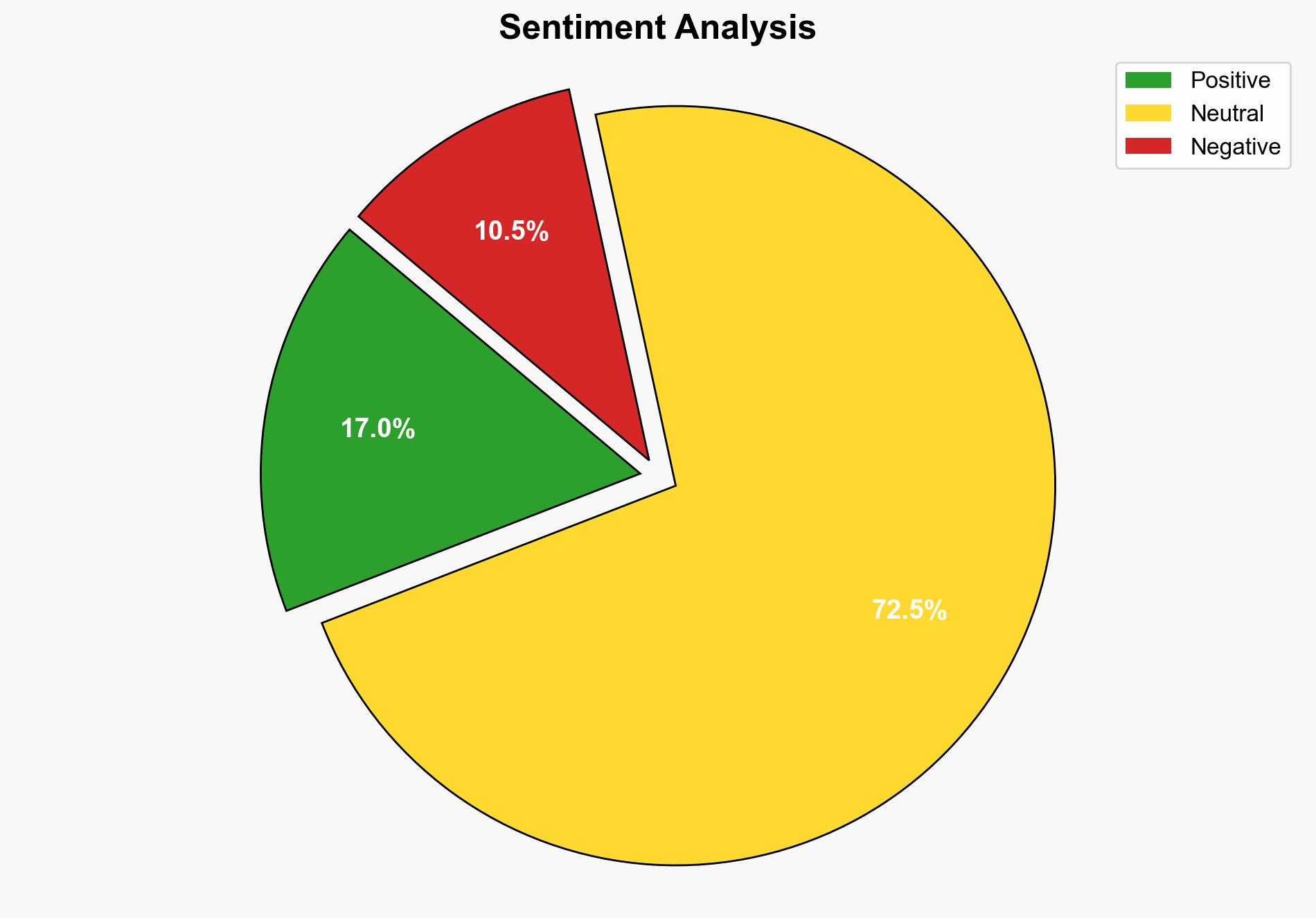

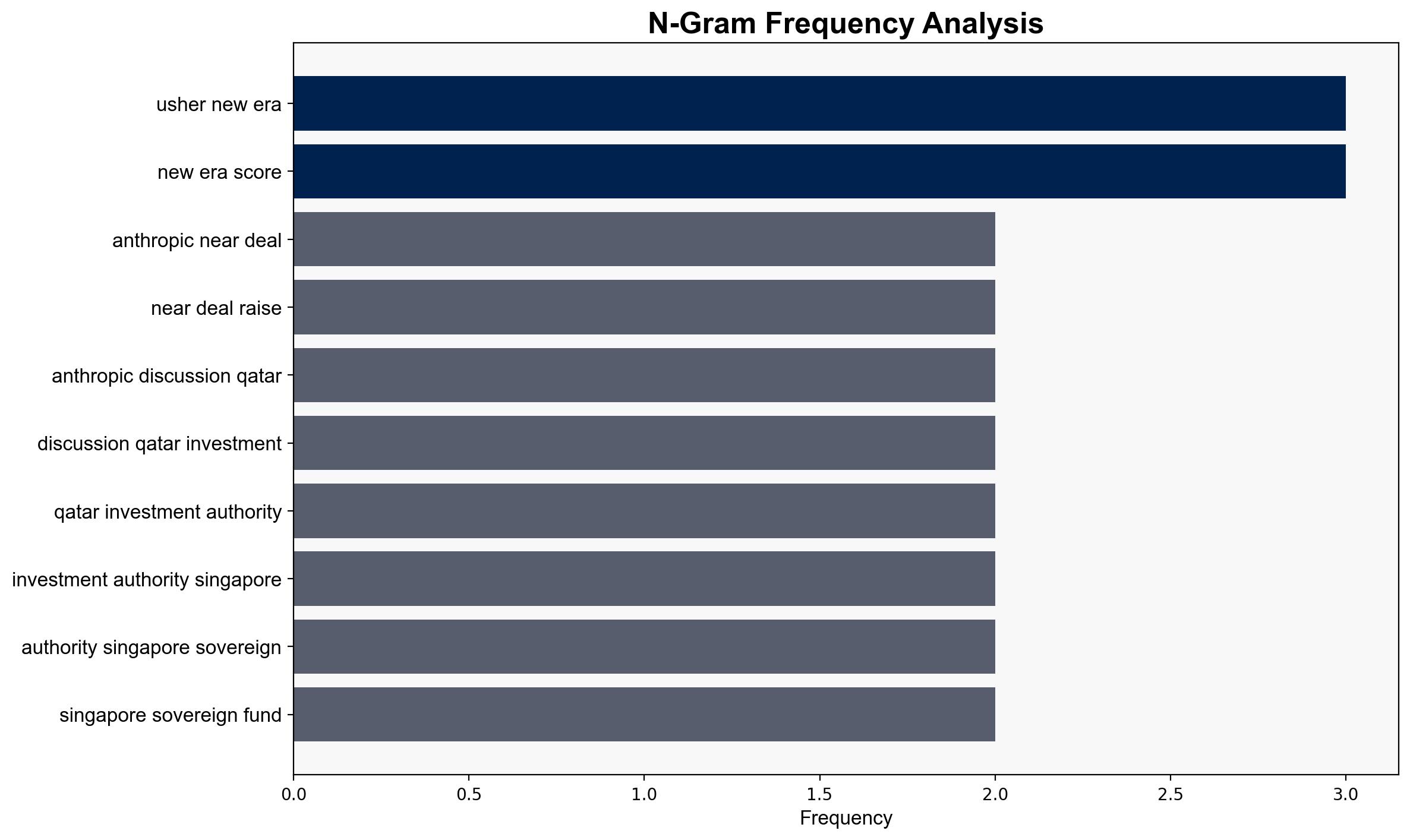

Anthropic is reportedly nearing a significant funding round that could value the AI startup at $170 billion. The most supported hypothesis is that this valuation reflects investor confidence in AI’s transformative potential, despite current market volatility. Confidence level: Moderate. Recommended action: Monitor developments for potential impacts on AI market dynamics and technological advancements.

2. Competing Hypotheses

1. **Hypothesis A**: The high valuation of Anthropic is justified by its technological advancements and strategic partnerships, indicating a robust market position and potential for significant growth.

2. **Hypothesis B**: The valuation is inflated due to speculative investment behavior and market hype around AI, which may not be sustainable in the long term.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported by the involvement of reputable investment firms like Iconiq Capital and participation from sovereign wealth funds, suggesting a strategic interest in Anthropic’s capabilities.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Investors have conducted thorough due diligence on Anthropic’s technology and market potential.

– The AI market will continue to grow at a rapid pace.

– **Red Flags**:

– The report relies on anonymous sources, which could indicate potential misinformation or bias.

– Lack of detailed financial data on Anthropic’s performance and revenue streams.

4. Implications and Strategic Risks

– **Economic**: A successful funding round at this valuation could drive further investment in AI, influencing market trends and valuations of other tech startups.

– **Cyber**: Increased valuation and attention may attract cyber threats targeting Anthropic’s intellectual property.

– **Geopolitical**: Participation by sovereign wealth funds suggests potential geopolitical interests in AI technology, possibly affecting international tech competition.

– **Psychological**: High valuations could lead to inflated expectations and pressure on Anthropic to deliver rapid results, potentially impacting strategic decisions.

5. Recommendations and Outlook

- Monitor Anthropic’s technological developments and partnerships for indicators of sustainable growth.

- Assess the broader AI market for signs of speculative investment behavior and potential corrections.

- Scenario-based projections:

- **Best Case**: Anthropic’s technology leads to breakthroughs, justifying the valuation and driving further innovation.

- **Worst Case**: Market correction exposes overvaluation, leading to financial instability for Anthropic and similar startups.

- **Most Likely**: Gradual adjustment in valuation as market dynamics stabilize and Anthropic’s capabilities are proven.

6. Key Individuals and Entities

– Iconiq Capital

– Qatar Investment Authority

– Singapore Sovereign Fund (GIC)

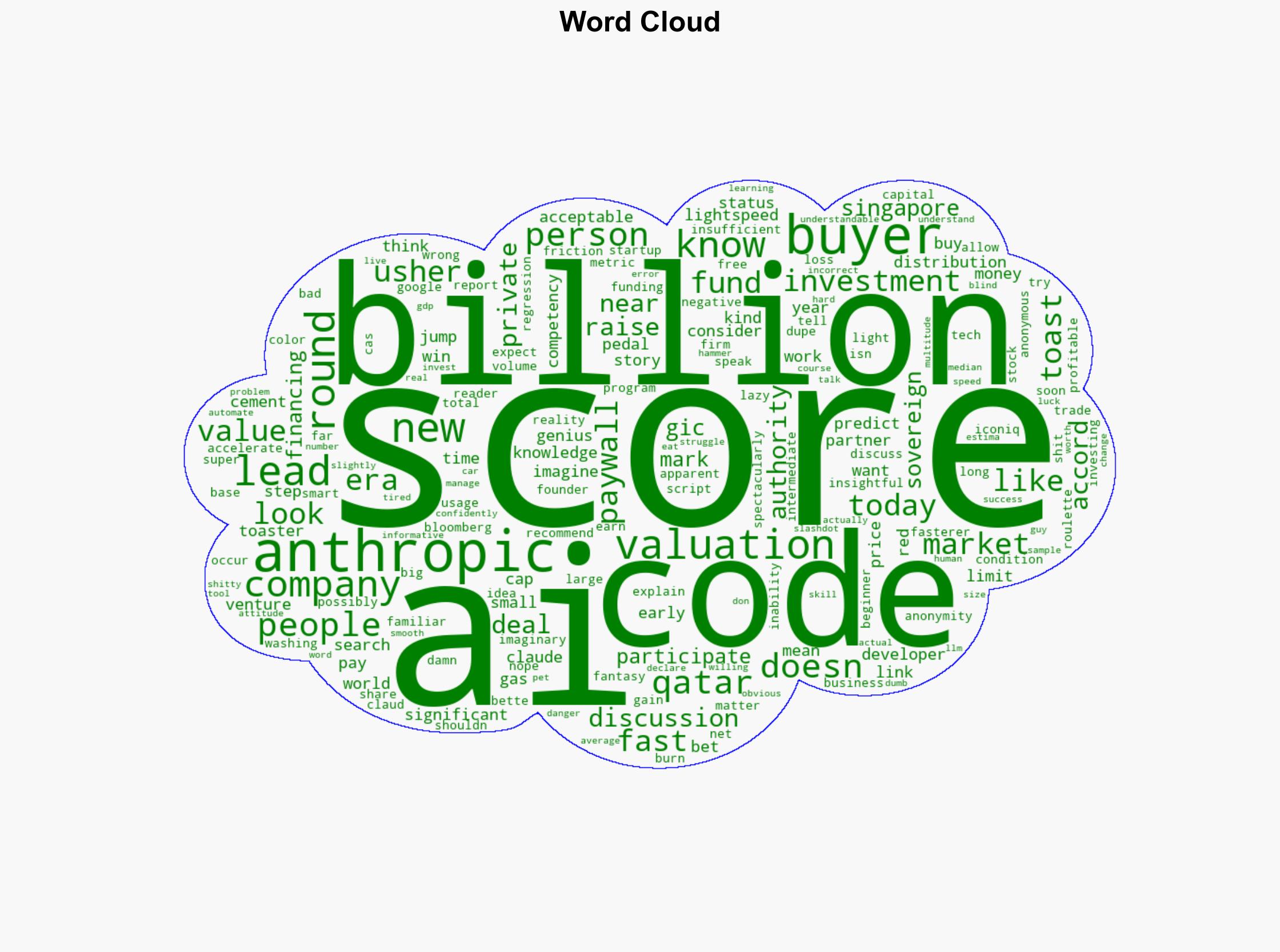

7. Thematic Tags

national security threats, cybersecurity, economic trends, AI market dynamics, investment strategies