AOC Calls Out Suspicious Stock Trades in Congress Amid Tariff Fiasco – The New Republic

Published on: 2025-04-10

Intelligence Report: AOC Calls Out Suspicious Stock Trades in Congress Amid Tariff Fiasco – The New Republic

1. BLUF (Bottom Line Up Front)

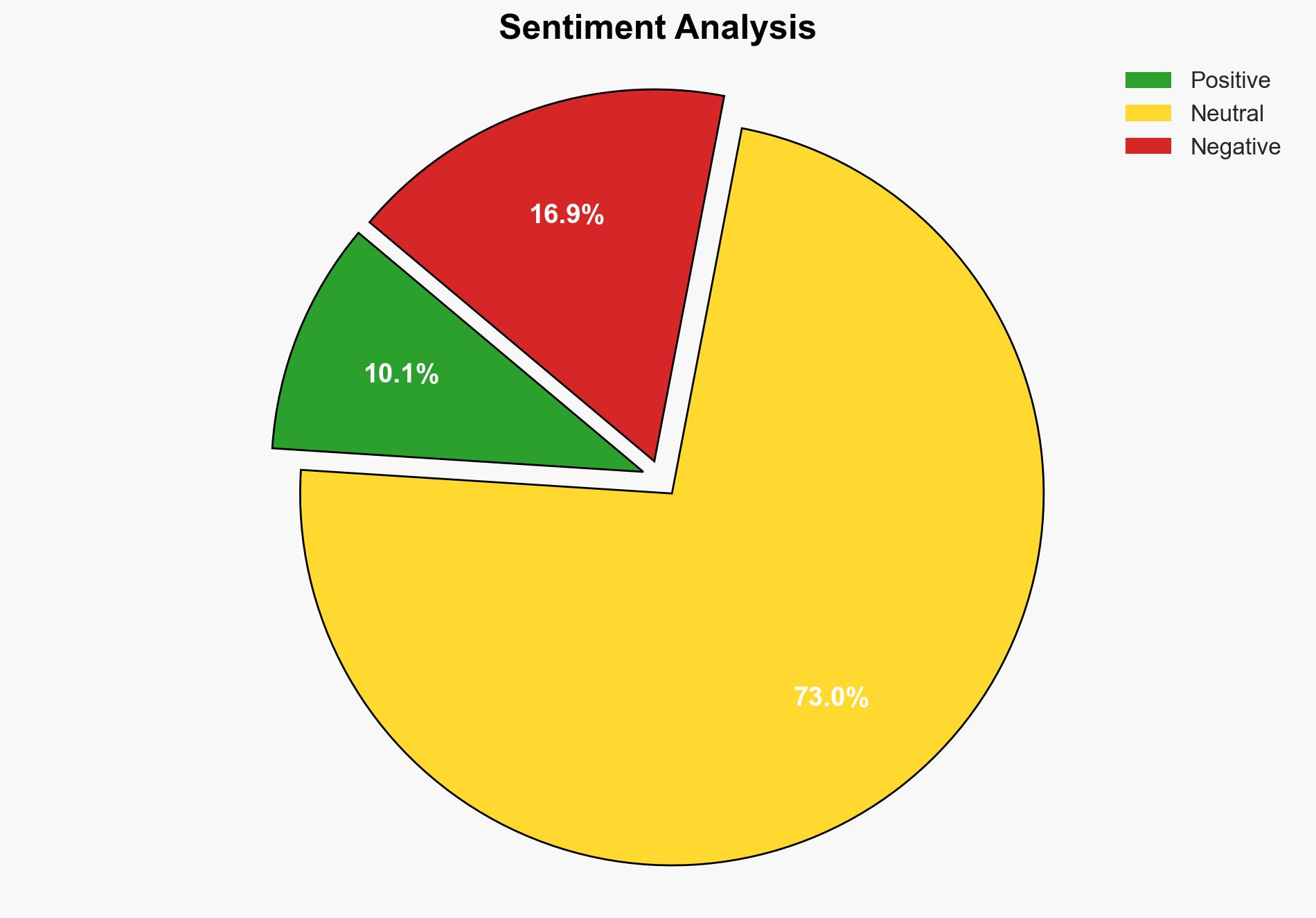

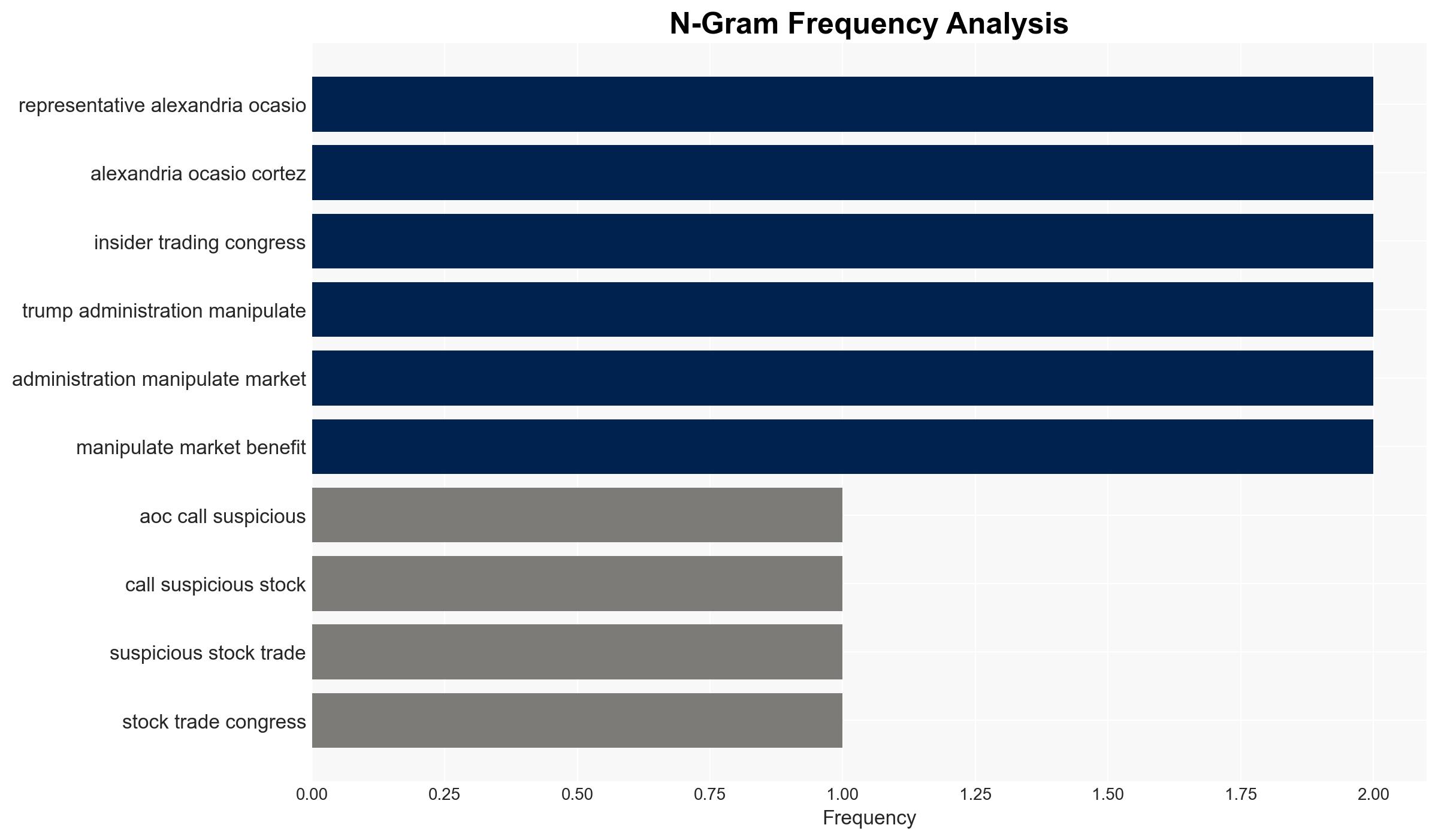

Recent events surrounding the sudden pause of tariffs announced by Donald Trump have raised concerns about potential insider trading within Congress. Alexandria Ocasio-Cortez and other political figures have called for an end to insider trading, citing suspicious stock market activities following the announcement. The situation presents significant implications for market integrity and political accountability. Immediate investigations and regulatory actions are recommended to address these concerns and restore public trust.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

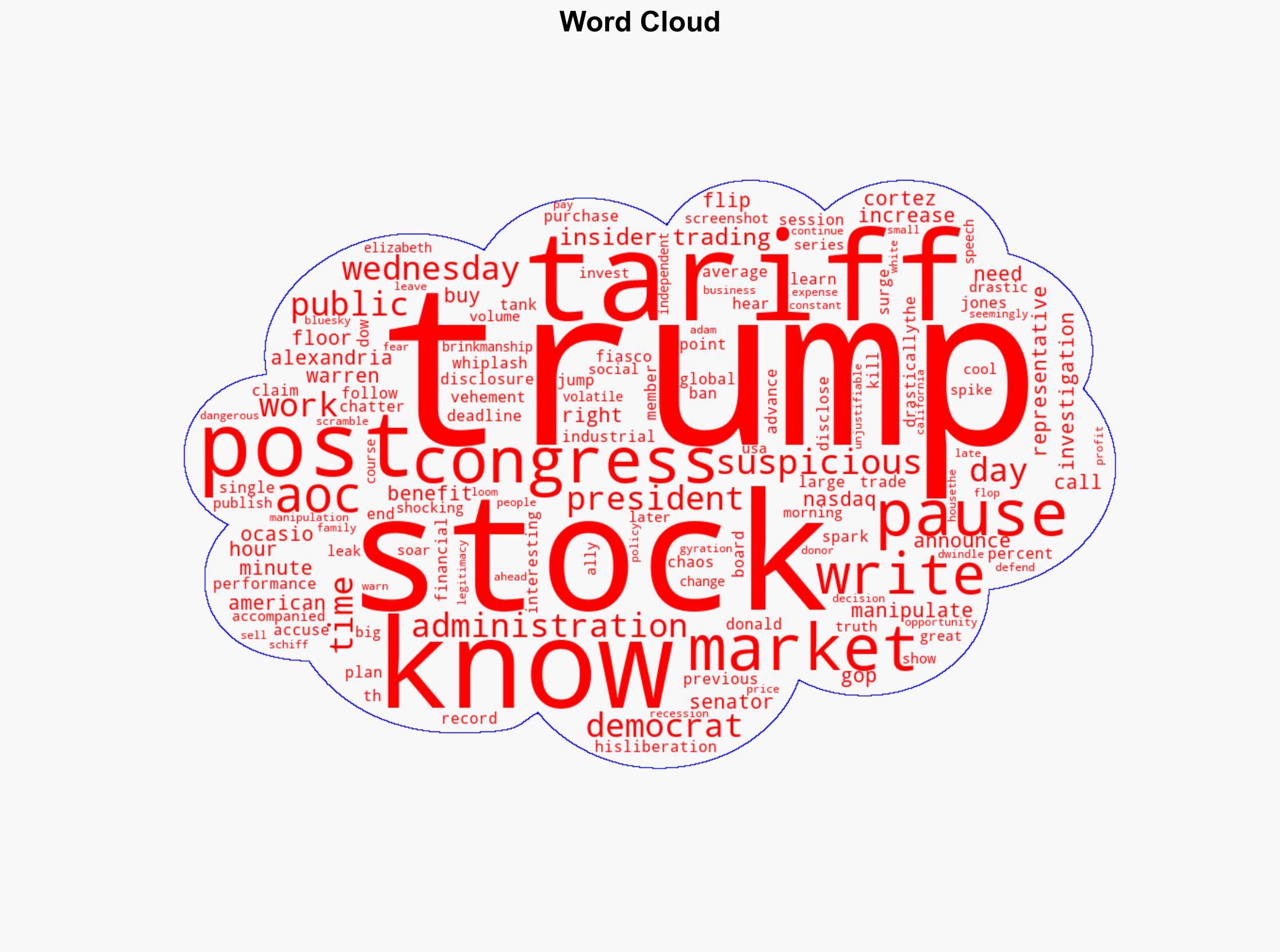

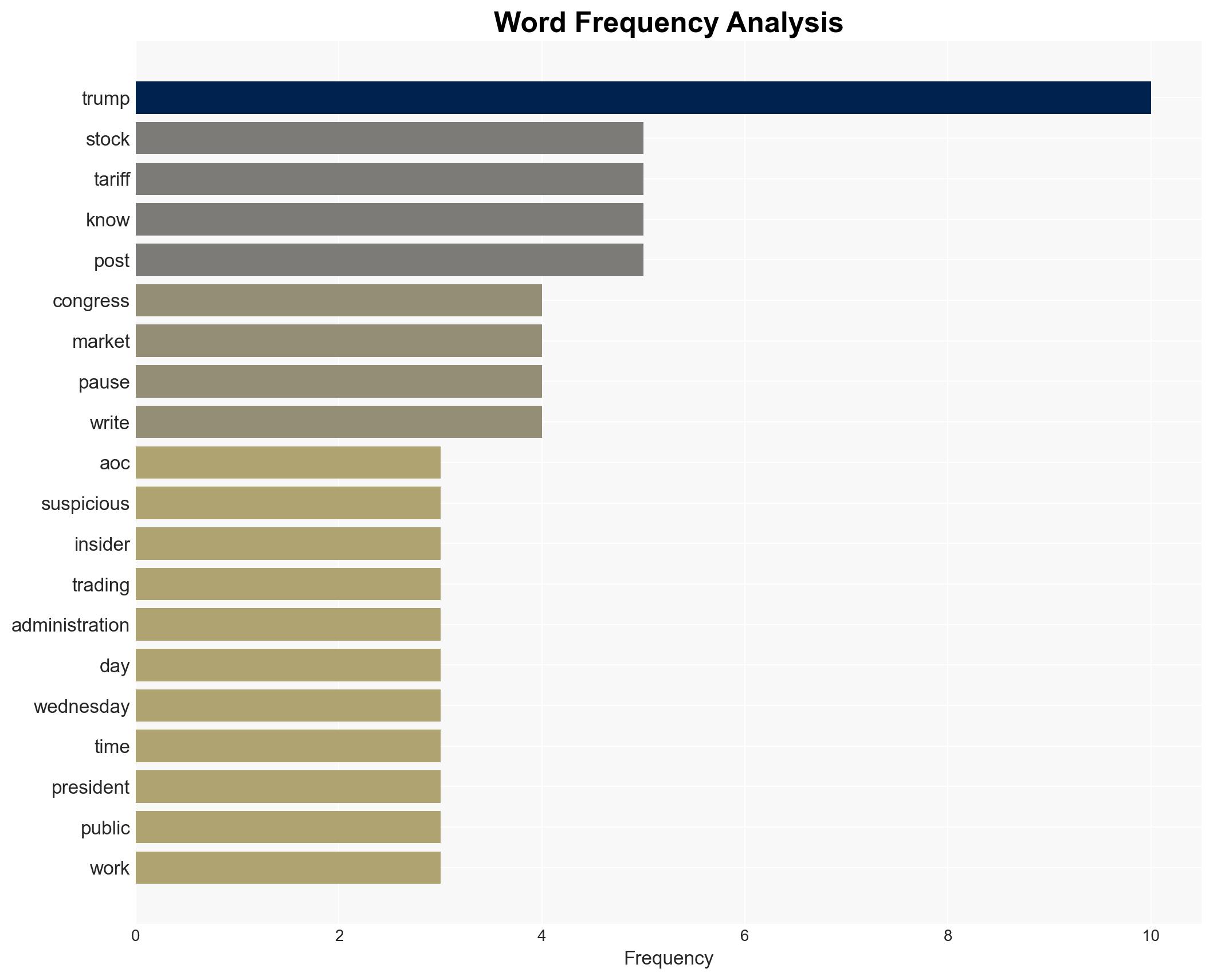

The abrupt change in tariff policy by Donald Trump, followed by a significant surge in stock market indices, suggests potential foreknowledge by certain individuals. Alexandria Ocasio-Cortez highlighted unusual stock trading patterns, particularly in Nasdaq call volumes, prior to the tariff pause announcement. This raises the possibility of insider information being leaked, allowing for substantial financial gains. The situation has prompted calls for transparency and regulatory scrutiny to prevent market manipulation.

3. Implications and Strategic Risks

The potential insider trading incident poses several risks:

- Market Integrity: Undermines investor confidence and market fairness.

- Political Accountability: Questions the ethical conduct of elected officials and their influence on market activities.

- Economic Stability: Creates volatility and uncertainty, impacting both domestic and international economic interests.

- National Security: Potential exploitation of sensitive information for personal gain could compromise national interests.

4. Recommendations and Outlook

Recommendations:

- Initiate an independent investigation into the alleged insider trading activities to ensure accountability and transparency.

- Implement stricter regulations and oversight mechanisms to prevent future occurrences of market manipulation.

- Enhance disclosure requirements for stock trades by government officials to promote transparency.

Outlook:

Best-case scenario: Comprehensive investigations lead to policy reforms, restoring market confidence and political accountability.

Worst-case scenario: Lack of action results in continued market manipulation, eroding public trust and economic stability.

Most likely outcome: Increased regulatory scrutiny and gradual policy changes aimed at mitigating insider trading risks.

5. Key Individuals and Entities

The report mentions significant individuals and organizations:

- Alexandria Ocasio-Cortez

- Donald Trump

- Elizabeth Warren

- Adam Schiff

These individuals have been central to the discourse on the alleged insider trading activities and the subsequent calls for investigation and reform.