Apple to Invest Another 100 Billion In the US to Sidestep Massive Tariffs – PetaPixel

Published on: 2025-08-06

Intelligence Report: Apple to Invest Another 100 Billion In the US to Sidestep Massive Tariffs – PetaPixel

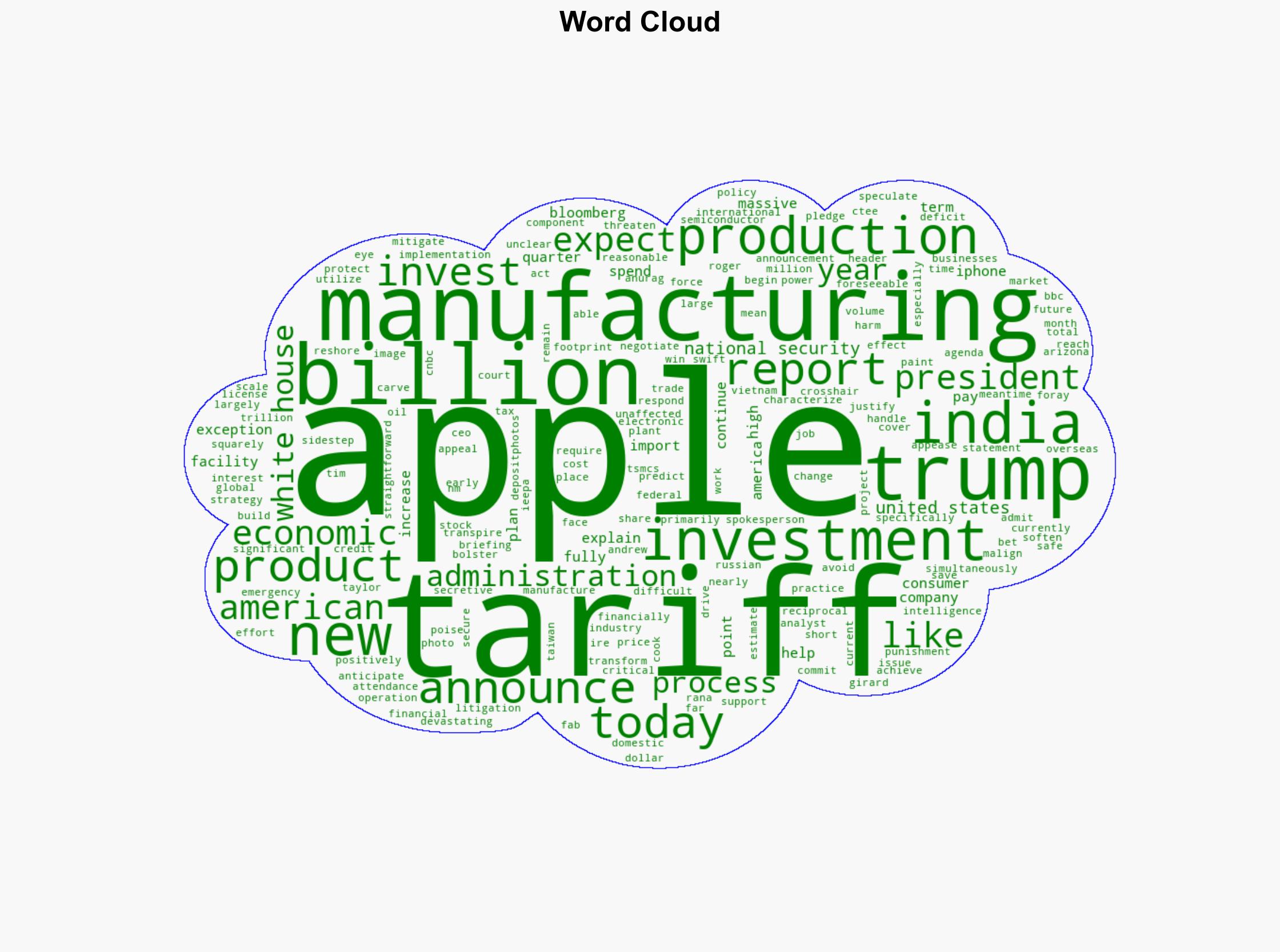

1. BLUF (Bottom Line Up Front)

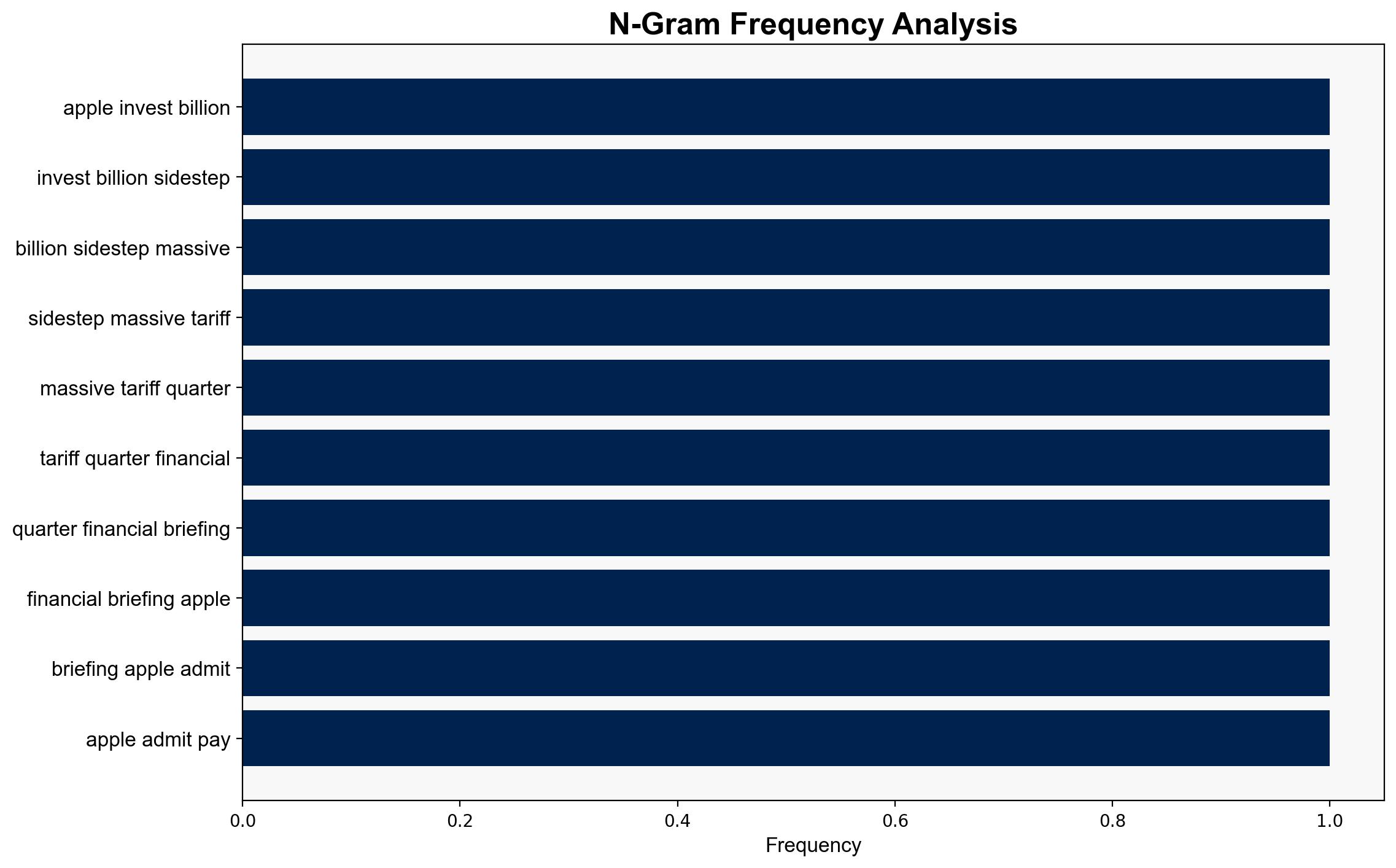

Apple’s decision to invest $100 billion in the US is likely a strategic maneuver to mitigate the impact of tariffs and align with US economic policies. The most supported hypothesis suggests that this investment is primarily to avoid tariffs and secure favorable conditions for future operations. Confidence level: Moderate. Recommended action: Monitor Apple’s negotiations for tariff exceptions and assess the broader impact on US-China trade relations.

2. Competing Hypotheses

Hypothesis 1: Apple’s investment is primarily aimed at avoiding tariffs and securing tariff exceptions, aligning with US economic policies to mitigate financial risks associated with overseas production.

Hypothesis 2: The investment is a strategic move to expand Apple’s manufacturing capabilities in the US, driven by long-term goals of reshoring production and enhancing national security.

Using ACH 2.0, Hypothesis 1 is better supported by the evidence, including the timing of the investment announcement, the focus on tariff avoidance, and the alignment with the Trump administration’s economic agenda.

3. Key Assumptions and Red Flags

Assumptions include the belief that Apple’s investment will lead to significant tariff savings and that the US administration will grant favorable conditions. Red flags involve potential overestimation of the speed and ease of shifting production to the US. There is also a risk of underestimating the complexity and cost of large-scale manufacturing changes.

4. Implications and Strategic Risks

The investment could lead to increased US manufacturing jobs and bolster national security by reducing dependency on foreign production. However, it may also escalate trade tensions with China and India, potentially leading to retaliatory measures. Economic risks include potential cost increases for Apple products if manufacturing shifts are not efficiently managed.

5. Recommendations and Outlook

- Monitor Apple’s negotiations for tariff exceptions and assess their impact on the broader trade landscape.

- Scenario-based projections:

- Best Case: Successful tariff negotiations lead to cost savings and increased US jobs.

- Worst Case: Trade tensions escalate, leading to retaliatory tariffs and increased production costs.

- Most Likely: Partial success in tariff negotiations with gradual expansion of US manufacturing.

6. Key Individuals and Entities

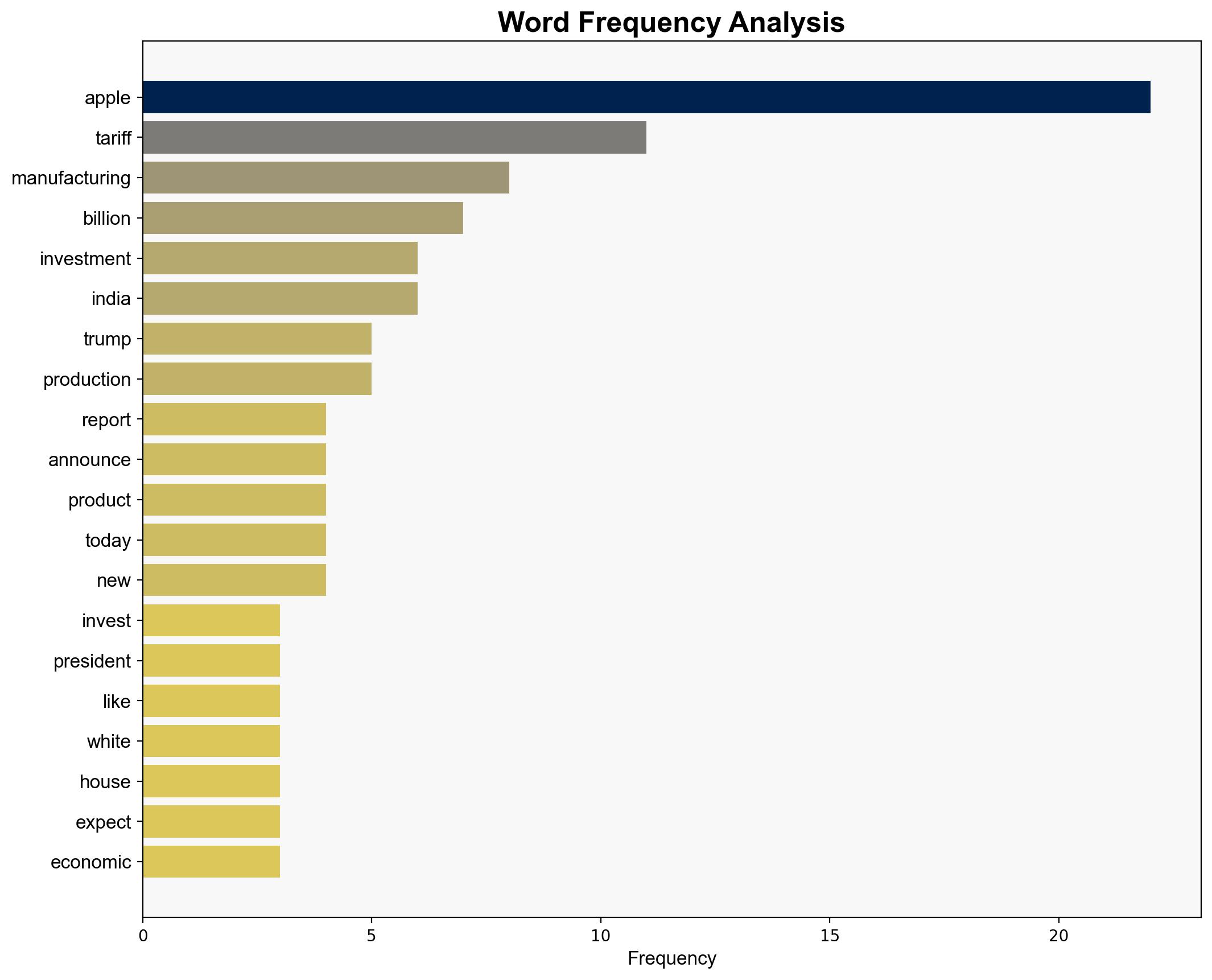

Tim Cook, Taylor Rogers, Anurag Rana, Andrew Girard.

7. Thematic Tags

national security threats, economic strategy, trade relations, manufacturing reshoring