Asia Morning Briefing Cautious Calm Returns to BTC Markets as Traders Rebuild Risk – CoinDesk

Published on: 2025-11-03

Intelligence Report: Asia Morning Briefing Cautious Calm Returns to BTC Markets as Traders Rebuild Risk – CoinDesk

1. BLUF (Bottom Line Up Front)

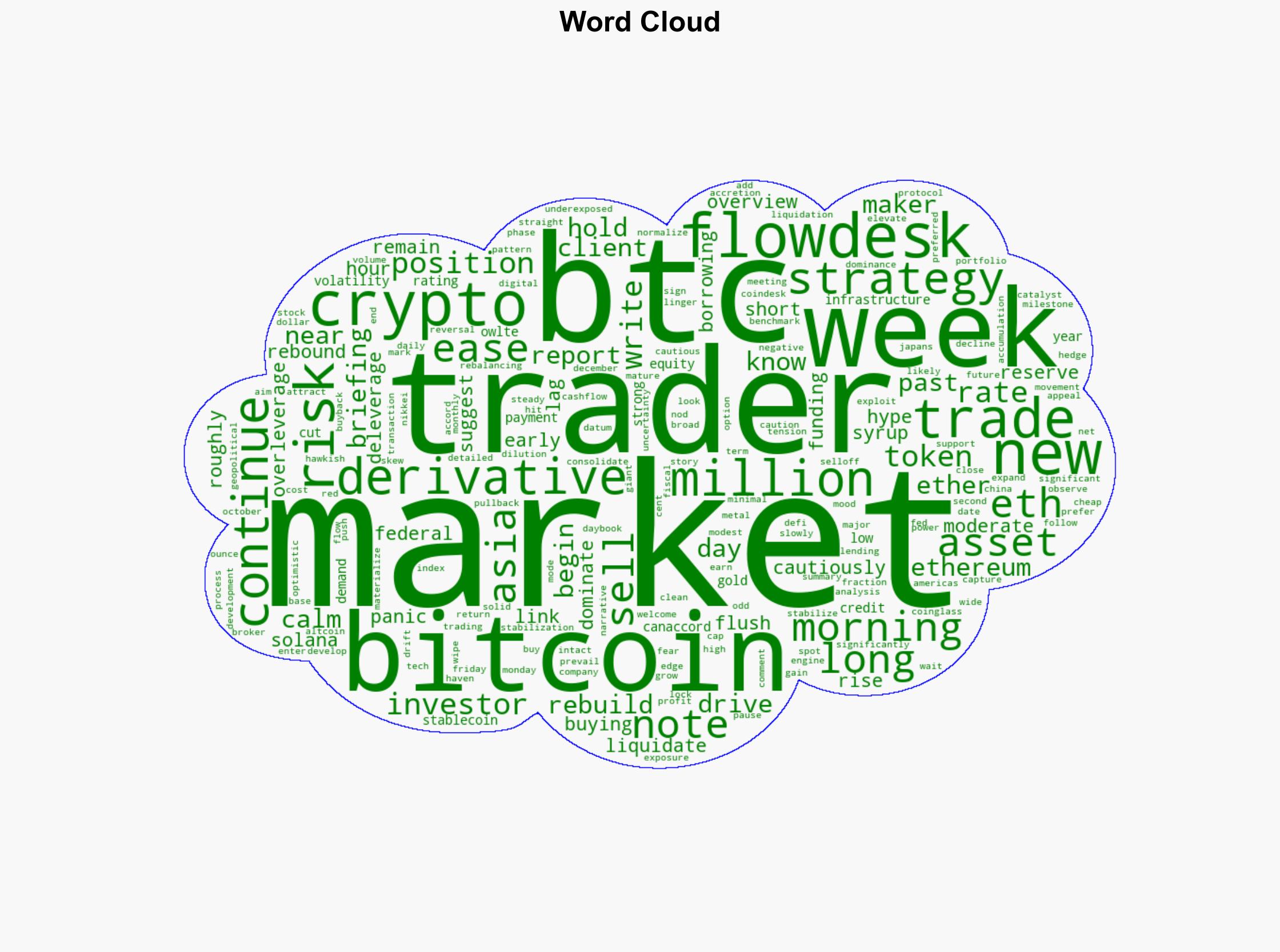

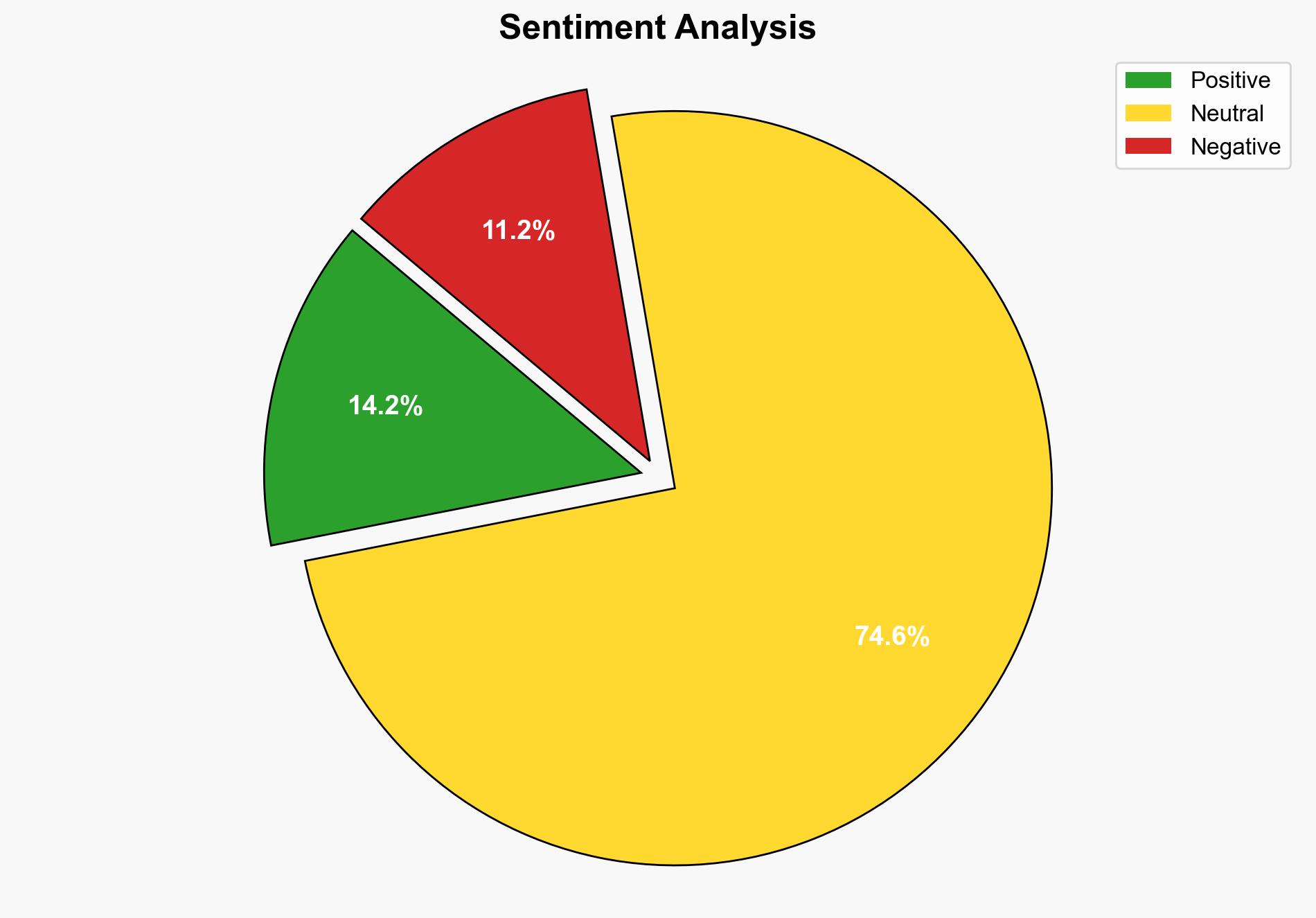

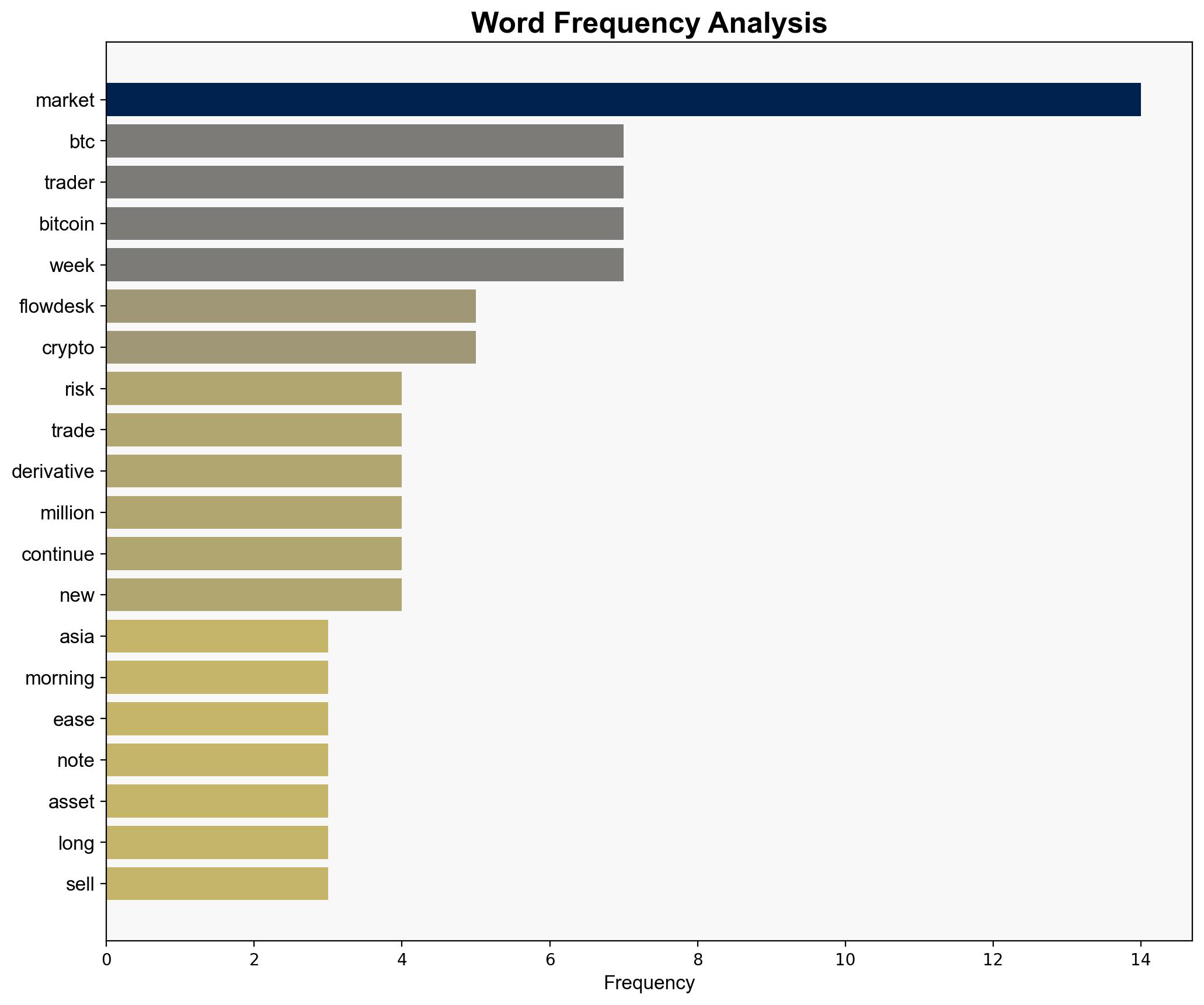

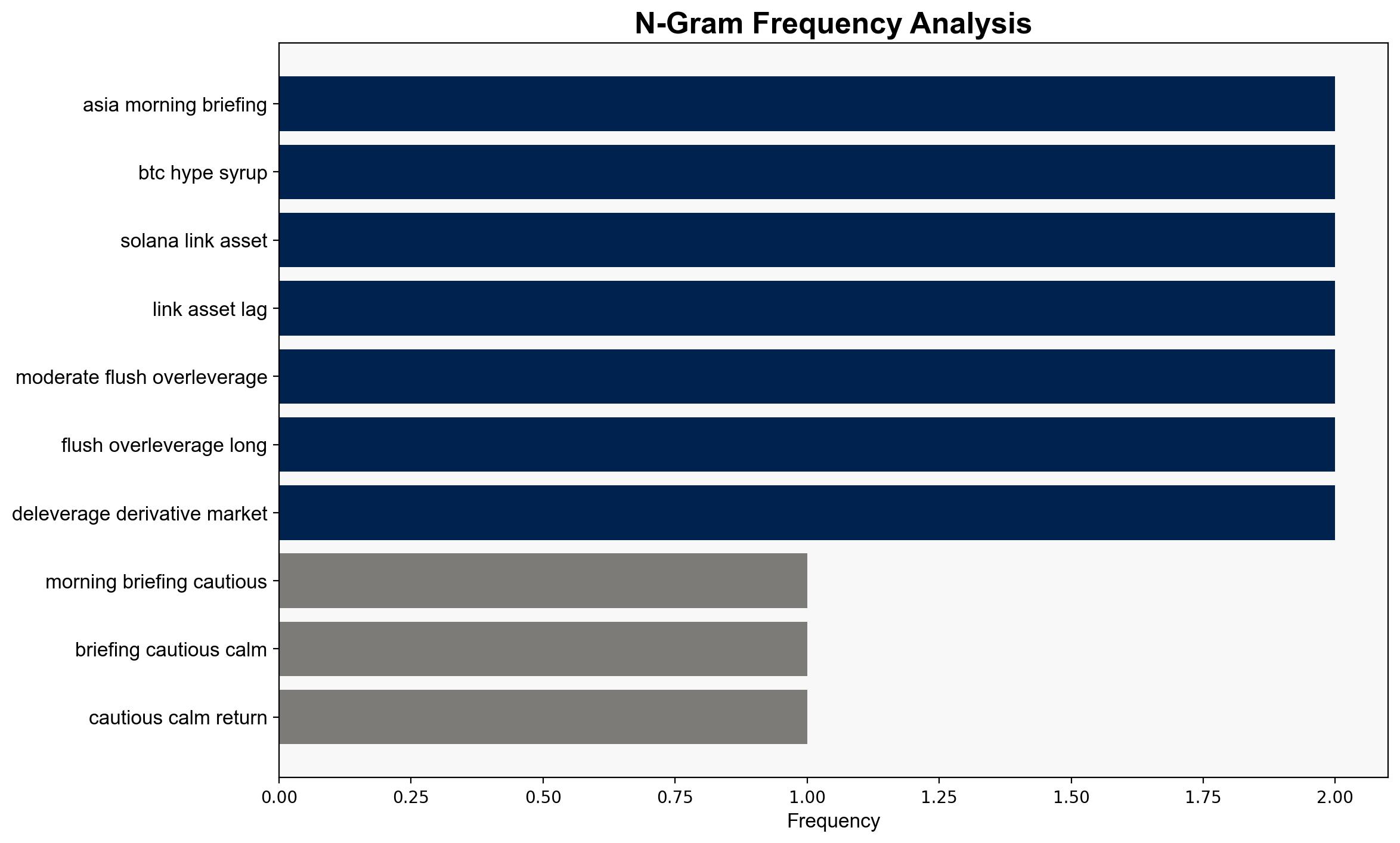

The cryptocurrency market, particularly Bitcoin (BTC) and Ethereum (ETH), is experiencing a cautious stabilization following a period of significant decline. The most supported hypothesis is that traders are cautiously re-entering the market, driven by a strategic rebalancing of portfolios and a response to reduced market volatility. Confidence Level: Moderate. Recommended action is to monitor market sentiment and derivative positions closely, as these could indicate future volatility or stabilization trends.

2. Competing Hypotheses

1. **Hypothesis A**: Traders are cautiously re-entering the market due to a strategic rebalancing of portfolios and a temporary stabilization in market volatility, suggesting a potential recovery phase.

2. **Hypothesis B**: The current stabilization is a temporary lull before further volatility, driven by underlying economic uncertainties and potential market manipulation.

Using Bayesian Scenario Modeling, Hypothesis A is better supported by the data, as traders are noted to be cautiously buying and rebalancing, and there is a reported easing of liquidation pressures.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that traders’ cautious re-entry indicates confidence in market stabilization. The assumption that the Federal Reserve’s actions are a primary driver of market movements may overlook other geopolitical or economic factors.

– **Red Flags**: The reliance on data from specific market makers and derivative platforms could introduce bias. The potential for market manipulation or misinformation is a concern, given the history of volatility in crypto markets.

4. Implications and Strategic Risks

– **Economic Risks**: Continued volatility could impact broader financial markets, especially if leveraged positions are not managed carefully.

– **Geopolitical Risks**: Global economic policies, particularly from major economies like the U.S. and China, could influence crypto market stability.

– **Psychological Risks**: Market sentiment is fragile; any negative news could trigger another sell-off.

5. Recommendations and Outlook

- **Mitigate Risks**: Encourage diversification of portfolios to manage potential volatility. Monitor derivative positions for signs of over-leverage.

- **Exploit Opportunities**: Consider strategic entry points for investment as market stabilizes.

- **Scenario Projections**:

- **Best Case**: Market stabilization continues, leading to gradual recovery and increased investor confidence.

- **Worst Case**: Renewed volatility due to external economic shocks or market manipulation.

- **Most Likely**: Continued cautious re-entry by traders with periodic volatility spikes.

6. Key Individuals and Entities

– Flowdesk (Market Maker)

– Coinglass (Data Source)

– Canaccord (Brokerage Firm)

7. Thematic Tags

national security threats, cybersecurity, economic stability, market volatility, cryptocurrency trends