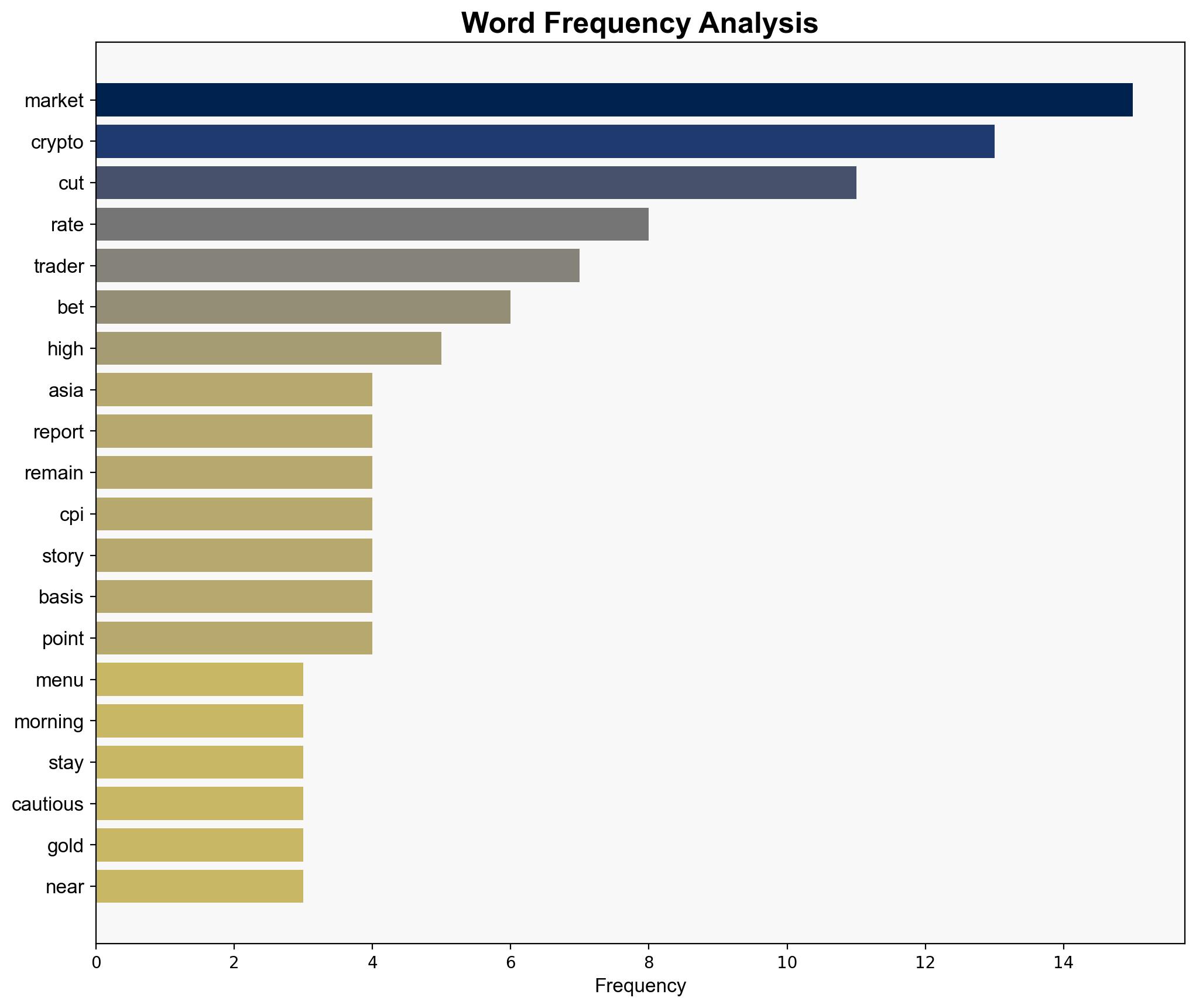

Asia Morning Briefing Equities Rally on Rate-Cut Bets Crypto Stays Cautious – CoinDesk

Published on: 2025-09-09

Intelligence Report: Asia Morning Briefing Equities Rally on Rate-Cut Bets Crypto Stays Cautious – CoinDesk

1. BLUF (Bottom Line Up Front)

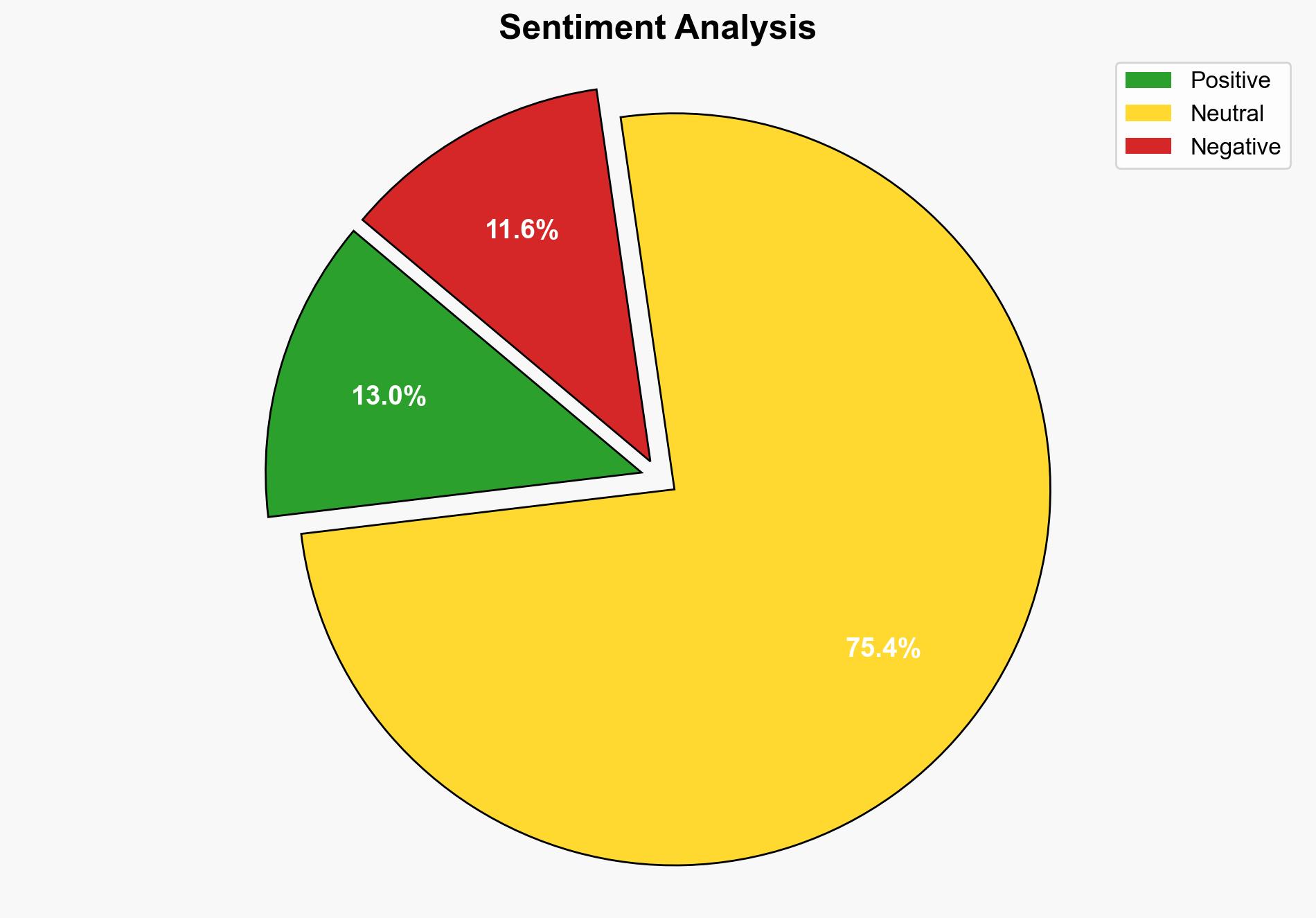

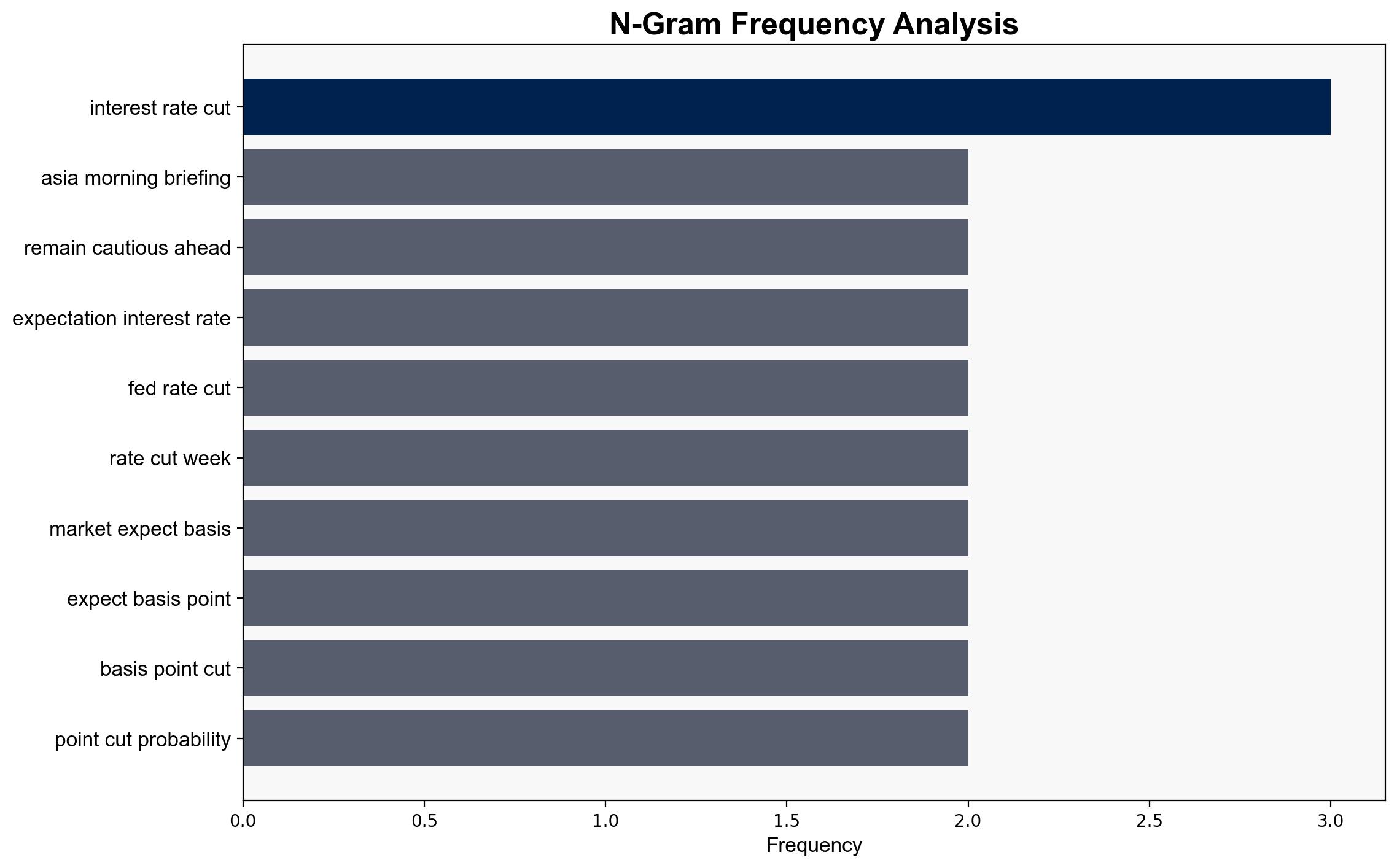

The most supported hypothesis is that the cautious stance of the crypto market, despite the equities rally on rate-cut bets, is primarily due to upcoming economic indicators such as the CPI report and ongoing regulatory developments. Confidence level: Moderate. Recommended action: Monitor regulatory developments and economic indicators closely to anticipate market shifts.

2. Competing Hypotheses

Hypothesis 1: The crypto market’s cautious stance is driven by anticipation of economic indicators, such as the CPI report, which could influence interest rate expectations and market volatility.

Hypothesis 2: The cautious stance is primarily due to regulatory uncertainties and the potential impact of institutional adoption, which could either stabilize or disrupt the market.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes that economic indicators are the primary drivers of market sentiment.

– Hypothesis 2 assumes that regulatory developments have a more significant impact than economic indicators.

Red Flags:

– Lack of specific data on how regulatory changes are perceived by market participants.

– Potential cognitive bias in overemphasizing either economic or regulatory factors without considering their interplay.

4. Implications and Strategic Risks

– Economic indicators like the CPI report could lead to increased volatility if they deviate significantly from expectations, impacting both equities and crypto markets.

– Regulatory developments could either enhance market stability through clearer guidelines or increase uncertainty if perceived as restrictive.

– A divergence in market sentiment between equities and crypto could indicate underlying systemic risks or shifts in investor behavior.

5. Recommendations and Outlook

- Monitor upcoming economic indicators and regulatory announcements for potential market impacts.

- Scenario Projections:

- Best Case: Economic indicators align with expectations, and regulatory clarity enhances market stability, leading to a crypto market rally.

- Worst Case: Unexpected economic data and restrictive regulatory measures lead to increased volatility and market downturn.

- Most Likely: Continued cautious market stance with gradual adjustments based on economic and regulatory developments.

6. Key Individuals and Entities

– Michael Saylor

– Justin Sun

– Coinbase

– Robinhood

7. Thematic Tags

national security threats, cybersecurity, regulatory developments, economic indicators, market volatility